|

市场调查报告书

商品编码

1640346

蓝牙音箱:市场占有率分析、产业趋势与成长预测(2025-2030 年)Bluetooth Speaker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

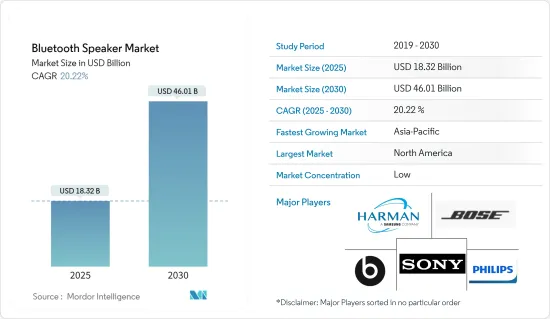

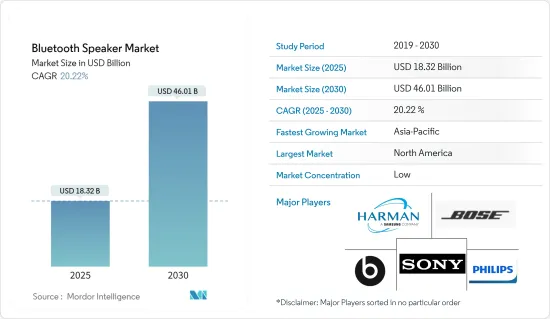

蓝牙音箱市场规模预计在 2025 年为 183.2 亿美元,预计到 2030 年将达到 460.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 20.22%。

近年来,随着消费者偏好的不断变化和技术的快速进步,蓝牙音箱市场发生了巨大的变化。这些扬声器具有无线连接和便携性,已成为现代家庭和商业空间的必备配件。市场受到连接创新、智慧型设备日益增长的趋势以及线上串流媒体服务的激增的影响。因此,这些发展重塑了消费者与音讯设备的互动方式,并导致了市场的显着扩张。

按便携性细分市场

主要亮点

- 可携式与固定扬声器:基于便携性,蓝牙扬声器市场可细分为可携式蓝牙扬声器和固定蓝牙扬声器。由于消费者对音讯设备易用性、体积小、移动性的要求越来越高,可携式扬声器已占据了市场主导地位。另一方面,固定扬声器通常用于家庭娱乐系统和商业环境,这些环境中音质比便携性更重要。

- 消费者对可携式设备的偏好:可携式蓝牙扬声器市场正在快速成长,反映了消费者对无线和行动音讯解决方案的需求。长电池寿命和防水蓝牙扬声器等技术进步意味着该类别继续受到欢迎,尤其是在年轻消费者和户外运动爱好者中。

住宅和商业应用

主要亮点

- 家庭中的普及:在住宅中,蓝牙音箱广泛与智慧型装置和虚拟助理整合。智慧家庭日益增长的趋势使得语音控制和与其他智慧家庭系统的无缝连接成为可能,从而增强了用户体验。这推动了对智慧蓝牙扬声器的需求。

- 商业使用案例:蓝牙扬声器也广泛应用于餐厅、饭店和办公室等商业空间,用于背景音乐、活动、会议等。商业应用的兴起是市场的主要动力,特别是越来越多的企业转向无线扬声器解决方案。

区域市场洞察

主要亮点

- 北美和欧洲引领市场:从历史上看,北美和欧洲一直是蓝牙音箱的强劲市场,这主要是由于智慧型装置的高普及率和精通技术的人口。这些地区受益于早期采用最尖端科技,对高品质音响设备的需求强劲。

- 亚太地区的快速成长:相较之下,由于都市化进程加快、智慧型装置的采用和可支配收入的增加,亚太地区的蓝牙音箱市场正在经历快速成长。随着消费者对价格实惠、高品质的无线音讯产品的需求日益增加,预计中国和印度等国家将推动巨大的需求。

串流服务如何影响消费行为

主要亮点

- 线上串流媒体平台的激增:Spotify、Apple Music 和 YouTube Music 等线上串流平台的流行彻底改变了蓝牙音箱市场。随着消费者寻求能够增强音讯串流体验的设备,对具有环绕声、深沉低音和高级连接等功能的高性能蓝牙扬声器的需求正在激增。

- 对购买决策的影响:串流媒体的转变也影响了消费者的购买决策,许多人选择可携式无线扬声器以方便出行。多设备配对、语音控制和长电池寿命等功能已成为标准期望。

- 提高音讯品质:为了满足对卓越音质的需求,製造商正致力于提高蓝牙扬声器的音讯效能。尤其是随着消费者越来越多地透过串流媒体平台消费高等级音讯。

技术进步推动连接解决方案

主要亮点

- 蓝牙 5.0 及后续技术:技术进步,尤其是蓝牙 5.0 等蓝牙技术的改进,对于市场扩张至关重要。这些技术创新提高了通讯、速度和稳定性,使得蓝牙扬声器成为优于传统有线连接的明显选择。

- 人工智慧与虚拟助理的整合:另一个重要发展是基于人工智慧的虚拟助理的集成,例如 Amazon Alexa 和 Google Assistant。这些智慧蓝牙扬声器使消费者能够透过语音命令控制音乐和智慧家居设备,将娱乐和家庭自动化结合在一起。

- 防水和坚固的设计:防水和坚固设计的引入扩展了蓝牙扬声器的多功能性,使其特别适合户外和探险使用。这些特点吸引了那些过着积极生活方式的消费者,从而进一步促进了销售。

蓝牙音箱市场趋势

可携式蓝牙音箱正在蓬勃发展

- 便携性推动市场成长可携式蓝牙扬声器领域成为成长最快的领域,这得益于消费者对行动音讯解决方案的偏好日益增加。凭藉长电池寿命、防水蓝牙扬声器和智慧控制等特点,可携式产品预计将在未来几年占据市场主导地位。

- 智慧功能增强用户体验:将 Alexa、Google Assistant 和 Siri 等语音助理整合到智慧蓝牙扬声器中是塑造市场的关键趋势。这些功能可实现对连接设备的无缝控制,满足对更智慧、更直觉的音讯解决方案日益增长的需求。

北美占据主要市场占有率

- 北美市场占有率:北美仍然是全球蓝牙音箱市场的主导地区。该地区受益于消费者对先进音响设备和智慧家居技术的强劲需求。美国智慧家居产品的日益普及,加上持续的产品创新,预计将支撑北美的市场占有率。

- 新兴市场推动全球销售:亚太地区和拉丁美洲等新兴市场也为全球销售成长做出了贡献。可支配收入的增加和无线音讯设备的普及正在推动这些地区的需求,使其成为未来成长的关键市场。

蓝牙音箱产业概况

市场结构分散:蓝牙音箱市场高度分散,全球和区域参与者在各个细分市场中竞争。Sony Corporation、LG 电子公司和三星电子(透过哈曼国际)等主要公司凭藉其创新和高级产品引领市场。

创新为核心:主要企业正在大力投资研发,以推出具有更佳连接性、音质和设计的新产品。这些公司专注于透过添加防水蓝牙扬声器、智慧控制和卓越音讯性能等功能来实现其产品的差异化。

具有竞争力的定价以扩大市场范围:为了覆盖更广泛的消费者群体,製造商正在提供具有竞争力价格的蓝牙音箱,同时不影响品质。这项策略使蓝牙音箱更容易被注重预算的消费者所接受,进一步推动了市场成长。

未来的成功策略:在这个竞争激烈的市场中取得成功的关键在于不断创新和回应不断变化的消费者偏好的能力。语音控制、多房间音讯和延长电池寿命等功能对于吸引新客户至关重要。

由于技术进步、消费者对可携式和无线音讯解决方案的需求不断增加以及智慧家居产品的兴起,蓝牙扬声器市场预计将进一步增长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 宏观因素如何影响市场

第五章 市场动态

- 市场驱动因素

- 新兴地区连结性的最新进展和对连网型设备的需求不断增长

- 线上串流服务的需求和使用日益增加

- 市场限制

- 盗版威胁

第六章 市场细分

- 按可移植性

- 可携式的

- 固定

- 按应用

- 住宅

- 业务

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Sony Corporation

- Koninklijke Philips NV

- Samsung Electronics Co. Ltd.(Harman International Industries)

- Bose Corporation

- Beat Electonics

- Panasonic Corporation

- LG Electronics Inc.

- Best IT World Pvt. Ltd(iBall)

- Logitech International

- Yamaha Corporation

- Altec Lansing

- JVC Kenwood Corporation

- AOMAIS(JinWenHua Audio)

- Forcovr(Shenzhen Guiwei Security)

- Anker Innovations Technology

- Onkyo Corporation(Pioneer)

- SoundBot

- Zebronics

第八章投资分析

第九章 市场机会与未来趋势

The Bluetooth Speaker Market size is estimated at USD 18.32 billion in 2025, and is expected to reach USD 46.01 billion by 2030, at a CAGR of 20.22% during the forecast period (2025-2030).

The Bluetooth speaker market has experienced a dramatic transformation in recent years, driven by evolving consumer preferences and rapid technological advancements. These speakers, which offer wireless connectivity and portability, have become essential accessories in modern households and commercial spaces. The market is influenced by innovations in connectivity, the growing trend of smart devices, and the surge in online streaming services. As a result, these developments have reshaped consumer interaction with audio devices, leading to significant market expansion.

Market Segmentation by Portability

Key Highlights

- Portable vs. Fixed Speakers: The Bluetooth speaker market can be categorized based on portability into portable and fixed Bluetooth speakers. Portable speakers dominate the market due to their ease of use, compact size, and growing demand from consumers seeking mobility in their audio devices. On the other hand, fixed speakers, which are often used in home entertainment systems or commercial settings, prioritize audio quality over portability.

- Consumer Preference for Portable Devices: The portable Bluetooth speaker segment has seen rapid growth, reflecting consumer demand for wireless and mobile audio solutions. With technological advancements such as long battery life and waterproof Bluetooth speakers, this segment continues to gain popularity, especially among younger consumers and outdoor enthusiasts.

Residential and Commercial Applications

Key Highlights

- Widespread Adoption in Homes: In residential settings, Bluetooth speakers are widely integrated with smart devices and virtual assistants. The growing trend of smart homes has enhanced the user experience by enabling voice control and seamless connectivity with other smart home systems. This has driven the demand for smart Bluetooth speakers.

- Commercial Use Cases: Bluetooth speakers are also widely adopted in commercial spaces like restaurants, hotels, and offices, where they are used for background music, events, and conferences. This expanding commercial application is a key driver of the market, particularly as more businesses turn to wireless speaker solutions.

Geographical Market Insights

Key Highlights

- North America and Europe Leading the Market: Historically, North America and Europe have been strong markets for Bluetooth speakers, largely due to high penetration rates of smart devices and the tech-savvy nature of the population. These regions benefit from early adoption of cutting-edge technology, which keeps demand for high-quality audio devices strong.

- Rapid Growth in Asia-Pacific: In contrast, the Asia-Pacific Bluetooth speaker market is witnessing rapid growth, driven by increasing urbanization, the proliferation of smart gadgets, and rising disposable incomes. Countries such as China and India are expected to drive significant demand as more consumers seek affordable, high-quality wireless audio products.

Impact of Streaming Services on Consumer Behavior

Key Highlights

- Surge in Online Streaming Platforms: The popularity of online streaming platforms such as Spotify, Apple Music, and YouTube Music has revolutionized the Bluetooth speaker market. With consumers looking for devices that enhance their audio streaming experience, there has been a surge in demand for high-performance Bluetooth speakers that offer features such as surround sound, deep bass, and advanced connectivity.

- Influence on Purchasing Decisions: The shift toward streaming has also influenced consumer purchasing decisions, with many opting for portable, wireless speakers that offer convenience for on-the-go use. Features like multi-device pairing, voice control, and long battery life have become standard expectations.

- Improved Audio Quality: To meet the demand for superior sound, manufacturers are focusing on improving the audio performance of Bluetooth speakers, particularly as consumers increasingly consume high-definition audio via streaming platforms.

Technological Advancements Driving Connectivity Solutions

Key Highlights

- Bluetooth 5.0 and Beyond: Technological advancements, especially improvements in Bluetooth technology like Bluetooth 5.0, have been pivotal in the market's expansion. These innovations offer enhanced range, speed, and stability, making Bluetooth speakers a preferred choice over traditional wired options.

- Integration of AI and Virtual Assistants: Another significant development is the integration of AI-based virtual assistants such as Amazon Alexa and Google Assistant. These smart Bluetooth speakers allow consumers to control their music and smart home devices with voice commands, blending entertainment with home automation.

- Waterproof and Rugged Designs: The introduction of waterproof and rugged designs has also expanded the versatility of Bluetooth speakers, particularly for outdoor and adventure use. These features appeal to consumers with active lifestyles, further driving sales.

Bluetooth Speaker Market Trends

Portable Bluetooth Speaker Segment to Witness Fastest Growth

- Portability Driving Market Growth: The portable Bluetooth speaker segment stands out as the fastest-growing sector, driven by the growing consumer preference for mobile audio solutions. With features like long-lasting batteries, waterproof Bluetooth speakers, and smart controls, the portable segment is expected to dominate the market in the coming years.

- Smart Features Enhancing User Experience: The integration of voice assistants such as Alexa, Google Assistant, and Siri in smart Bluetooth speakers is a key trend shaping the market. These features allow for seamless control of connected devices, catering to the rising demand for smarter and more intuitive audio solutions.

North America to Hold a Significant Market Share

- North America's Market Share: North America remains a dominant region in the global Bluetooth speaker market. The region benefits from high consumer demand for advanced audio devices and smart home technology. The growing adoption of smart home products in the U.S., coupled with continuous product innovation, is expected to maintain North America's significant market share.

- Emerging Markets Boosting Global Sales: Emerging markets such as Asia-Pacific and Latin America are also contributing to global sales growth. Rising disposable incomes, coupled with the increasing popularity of wireless audio devices, are driving demand in these regions, positioning them as key markets for future growth.

Bluetooth Speaker Industry Overview

Fragmented Market Structure: The Bluetooth speaker market is highly fragmented, with both global and regional players competing in various segments. Major corporations like Sony Corporation, LG Electronics Inc., and Samsung Electronics Co. Ltd. (through Harman International) lead the market with their innovation and premium product offerings.

Innovation at the Core: Leading companies invest heavily in research and development to introduce new products with enhanced connectivity, sound quality, and design. These players are focusing on differentiating their products by incorporating features such as waterproof Bluetooth speakers, smart controls, and superior audio performance.

Competitive Pricing Expanding Market Reach: To attract a broader consumer base, manufacturers are offering competitively priced Bluetooth speakers without compromising on quality. This strategy has made Bluetooth speakers more accessible to budget-conscious consumers, further driving market growth.

Future Strategies for Success: The key to success in this competitive market lies in continuous innovation and the ability to meet evolving consumer preferences. Features like voice control, multi-room audio, and longer battery life will be critical in attracting new customers.

The Bluetooth speaker market is poised for further growth, driven by technological advancements, increasing consumer demand for portable and wireless audio solutions, and the expansion of smart home products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Impact of Macro Factors on The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Recent Advancements in Connectivity and Growing Demand for Connected Devices in Emerging Regions

- 5.1.2 Increased Demand and Access to Online Streaming Services

- 5.2 Market Restraints

- 5.2.1 Threats of Piracy

6 MARKET SEGMENTATION

- 6.1 By Portability

- 6.1.1 Portable

- 6.1.2 Fixed

- 6.2 By Application

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sony Corporation

- 7.1.2 Koninklijke Philips NV

- 7.1.3 Samsung Electronics Co. Ltd. (Harman International Industries)

- 7.1.4 Bose Corporation

- 7.1.5 Beat Electonics

- 7.1.6 Panasonic Corporation

- 7.1.7 LG Electronics Inc.

- 7.1.8 Best IT World Pvt. Ltd (iBall)

- 7.1.9 Logitech International

- 7.1.10 Yamaha Corporation

- 7.1.11 Altec Lansing

- 7.1.12 JVC Kenwood Corporation

- 7.1.13 AOMAIS (JinWenHua Audio)

- 7.1.14 Forcovr (Shenzhen Guiwei Security)

- 7.1.15 Anker Innovations Technology

- 7.1.16 Onkyo Corporation (Pioneer)

- 7.1.17 SoundBot

- 7.1.18 Zebronics