|

市场调查报告书

商品编码

1404316

航空燃油:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

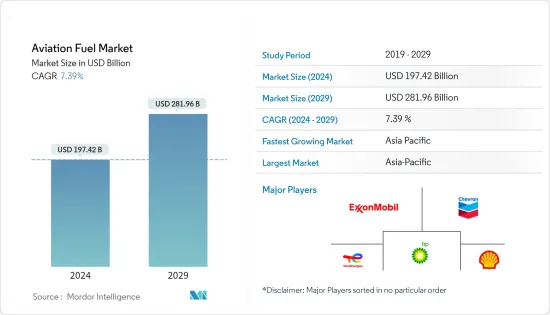

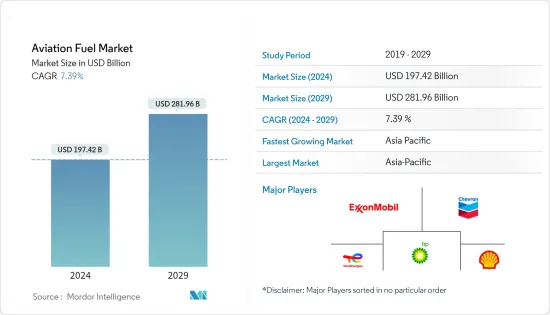

航空燃油市场规模预计到2024年为1974.2亿美元,预计到2029年将达到2819.6亿美元,在预测期内(2024-2029年)复合年增长率为7.39%。

年终,航空燃油市场规模预估为1,838.3亿美元,预估未来五年将达到2,625.6亿美元,预测期内复合年增长率超过7.39%。

主要亮点

- 从中期来看,航空需求的增加和飞机持有的成长预计将在预测期内推动市场。

- 另一方面,对空气污染的环境担忧日益加剧预计将阻碍预测期内的市场成长。

- 然而,永续航空燃油技术的持续进步预计将在航空燃油市场创造重大商机。

- 由于该地区航空旅行和飞机持有的增加,预计亚太地区将成为航空燃油市场的主导地区。

航空燃油市场趋势

航空涡轮燃料可望主导市场

- 航空涡轮燃料(ATF),俗称喷射机燃料,是一种成分类似煤油的石油基燃料。全球有多种等级,包括 Jet A、Jet A-1 和 Jet B,其中 Jet A-1 是最常使用的。 Jet A-1 适用于各种飞机涡轮发动机。最低闪点为摄氏 38 度(100 华氏度),最高冰点为摄氏 -47 度。

- 航空涡轮燃料用于多种飞机,包括商用客机、军用飞机和喷射机。现今使用的大多数飞机,尤其是大型民航机,都依赖喷射机燃料作为其初级能源。喷射机燃料在各种类型的飞机中的广泛使用有助于喷射机燃料在市场上的主导地位。

- 此外,民航机和军用飞机中普及的喷射发动机需要航空涡轮燃料才能有效运作。这些引擎的设计充分利用了喷射机燃料的能量含量和燃烧特性。只要喷射发动机仍然是航空业的主导推进技术,对航空涡轮燃料的需求就会持续很大。

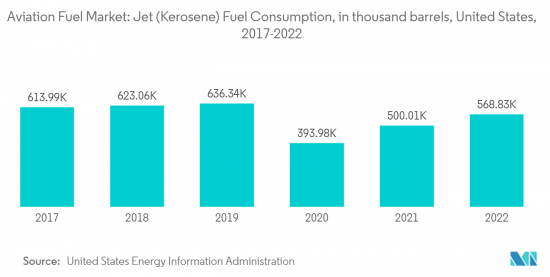

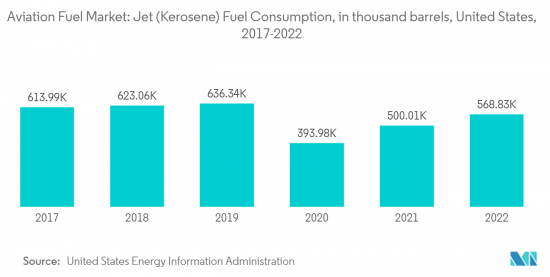

- 例如,根据美国能源资讯署的数据,2022年至2021年间,美国的喷射机燃料消费量增加了约14%,显示飞机运作和燃油消耗量增加。

- 航空涡轮燃料比活塞发动机飞机中使用的其他燃料(例如航空汽油)具有更高的能量密度。这意味着喷射机燃料每单位体积可以提供更多的能量,这对于远距飞行和大型飞机至关重要。航空涡轮燃料的高能量密度使其非常适合为喷射发动机动力来源,使其能够有效且长时间地飞行。

- 2023年1月,印度石油公司(IOC)开始出口航空燃油,以满足小型飞机和无人机(UAV)的需求。此举将使印度能够透过冒险石油出口进入价值约27亿美元的全球市场。贾瓦哈拉尔尼赫鲁港口信託公司 (JNPT) 已协助出货其第委託80 桶航空燃料运往巴布亚纽几内亚。一桶容量为16公升,可运输大量航空气体。

- 因此,正如所讨论的,航空涡轮燃料市场预计将在预测期内萎缩。

亚太地区预计将主导市场

- 亚太地区正在经历显着的经济成长,其中中国、印度和东南亚国家等国家引领了这一扩张。航空需求随着经济成长而增加,直接导致航空燃油消费量的增加。该地区经济的强劲成长正在增强航空燃油市场的主导地位。

- 亚太地区航空业蓬勃发展,航空公司数量众多,机持有数量不断增加。该地区的航空公司不断扩大业务,增加新航线并增加航班频率。这种扩张需要增加对航空燃料的需求,并有助于占据该地区航空燃料市场的主导地位。

- 此外,亚太地区快速的都市化和不断增长的中产阶级人口导致航空旅行激增。随着该地区越来越多的人使用航空运输,对航空燃料的需求也在增加。都市化的加速和中阶的崛起是推动亚太地区市场主导地位的关键因素。

- 此外,亚太地区正在见证廉价航空公司(LCC) 的出现和发展。这些航空公司提供价格实惠的机票,吸引了更多的人口并刺激了航空旅行的需求。低成本航空企业通常以高负载率运营,导致燃油消费量增加,从而增强其在该地区航空燃油市场的主导地位。

- 此外,亚太地区许多国家正在大力投资机场基础设施。新机场正在建设中,现有机场正在扩建和现代化。这些基础设施投资为增加空中交通和燃油消费量创造了有利条件,进一步增强了该地区在航空燃油市场的主导地位。

- 例如,2023年5月,由于航空公司实现脱碳目标所需的全球供应严重短缺,印度石油公司宣布将采购1.22亿美元的永续航空燃料(SAF)工厂。规划中的工厂将具备每年生产 88,000 吨 SAF 的能力。

- 基于上述情况,预计亚太地区将在预测期内主导市场。

航空燃油产业概况

航空燃油市场较为分散。市场上的主要企业(排名不分先后)包括埃克森美孚公司、雪佛龙公司、壳牌公司、TotalEnergies SE 和 BP Plc。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2028年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 航空需求增加

- 航空材料拓展

- 抑制因素

- 油价不稳定

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 汽油种类

- 空气涡轮燃料

- 喷射机A-1

- 喷射A

- 喷射B

- 生质燃料

- AVGAS

- 空气涡轮燃料

- 最终用户

- 商业的

- 防御

- 通用航空

- 按地区分類的市场分析(到 2028 年的市场规模和需求预测(仅按地区))

- 北美洲

- 美国

- 加拿大

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 埃及

- 南非

- 中东和非洲其他地区

- 北美洲

第六章竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Exxon Mobil Corporation

- Chevron Corporation

- Shell Plc.

- TotalEnergies SE

- BP Plc

- Gazprom Neft'PAO

- Neste Oyj

- Swedish Biofuels AB

- Red Rock Biofuels LLC

- Abu Dhabi National Oil Company

- Bharat Petroleum Corp. Ltd.

- Indian Oil Corporation Ltd.

- Emirates National Oil Company

- Valero Energy Corporation

- Allied Aviation Services Inc.

第七章 市场机会及未来趋势

- 生质燃料和永续替代燃料

简介目录

Product Code: 57160

The Aviation Fuel Market size is estimated at USD 197.42 billion in 2024, and is expected to reach USD 281.96 billion by 2029, growing at a CAGR of 7.39% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, the increasing demand for air travel and an increasing fleet of aircraft is expected to drive the market during the forecasted period.

- On the other hand, the increasing environmental concerns for air pollution are expected to hinder the growth of the market during the forecasted period.

- Nevertheless, the increasing advancements in sustainable aviation fuel technology are expected to create huge opportunities for the aviation fuel market.

- Asia-Pacific is expected to be a dominant aviation fuel market region due to the increasing air travel and aircraft fleets in the region.

Aviation Fuel Market Trends

Aviation Turbine Fuels Expected to Dominate the Market

- Aviation Turbine Fuel (ATF), commonly known as jet fuel, is a petroleum-derived fuel with a composition resembling kerosene. It is available in different grades globally, including Jet A, Jet A-1, and Jet B, with Jet A-1 being the most commonly utilized. Jet A-1 is compatible with a wide range of aircraft turbine engines. It exhibits a minimum flash point of 38 degrees Celsius (100°F) and a maximum freeze point of -47 degrees Celsius.

- Aviation turbine fuels are used in various aircraft, including commercial airliners, military, and business jets. Most aircraft in service today, especially larger commercial aircraft, rely on jet fuel as their primary energy source. The widespread usage of jet fuel in various aircraft types contributes to its dominance in the market.

- Moreover, jet engines, prevalent in commercial and military aviation, require aviation turbine fuels to operate efficiently. These engines are designed to utilize jet fuel's energy content and combustion properties. As long as jet engines remain the dominant propulsion technology in the aviation industry, the demand for aviation turbine fuels will continue to be significant.

- For instance, according to the United States Energy Information Administration, the consumption of jet fuel in the United States increased by almost 14% between 2022 and 2021, signifying the increasing air ravels and fuel consumption.

- Aviation turbine fuels have a higher energy density than other fuels, such as avgas used in piston-engine aircraft. This means that jet fuel can provide more energy per unit of volume, which is crucial for long-haul flights and larger aircraft. The high energy density of aviation turbine fuels makes them ideal for powering jet engines and allows for efficient and extended flight operations.

- In January 2023, The Indian Oil Corporation (IOC) initiated the export of aviation fuel, catering to the requirements of small aircraft and unmanned aerial vehicles (UAVs). This move allows India to enter the global market, valued at approximately USD 2.7 billion, by venturing into petroleum exports. The Jawaharlal Nehru Port Trust (JNPT) facilitated the shipment of the first consignment comprising 80 barrels of aviation fuel to Papua New Guinea. Each barrel has a capacity of 16 kiloliters, enabling the transport of a significant quantity of aviation gas.

- Therefore as per the points discussed, aviation turbine fuel is expected to diminish the market during the forecasted period.

Asia-Pacific Expected to Dominate the Market

- The Asia-Pacific region is experiencing significant economic growth, with countries like China, India, and Southeast Asian nations driving this expansion. As economies grow, there is a corresponding increase in air travel demand, directly translating to higher aviation fuel consumption. The region's robust economic growth fuels the dominance of the aviation fuel market.

- The Asia-Pacific region has a flourishing airline industry with numerous carriers and a growing fleet of aircraft. Airlines in the region continuously expand their operations, adding new routes and increasing flight frequencies. This expansion necessitates a higher demand for aviation fuel, contributing to the dominance of the market in the region.

- Moreover, rapid urbanization in the Asia-Pacific region and the rise of the middle-class population has led to a surge in air travel. As more people in the region access air transportation, the demand for aviation fuel grows. The increasing urbanization and a burgeoning middle-class population are key factors driving the dominance of the market in the Asia-Pacific region.

- Furthermore, Asia-Pacific region has witnessed the emergence and growth of low-cost carriers (LCCs). These airlines offer affordable airfares, attracting a larger segment of the population and stimulating air travel demand. LCCs typically operate with higher load factors, leading to increased fuel consumption and subsequently driving the aviation fuel market's dominance in the region.

- Additionally, many countries in the Asia-Pacific region are investing heavily in airport infrastructure development. New airports are being built, and existing ones are undergoing expansion and modernization. These infrastructure investments create favorable conditions for increased air traffic and fuel consumption, further contributing to the region's dominance in the aviation fuel market.

- For instance, in May 2023, Indian Oil Corp. intends to construct a sustainable aviation fuel (SAF) plant worth USD 122 million due to the substantial shortfall in global supplies required by airlines to achieve decarbonization targets. The planned facility will have the capability to manufacture 88,000 tons of SAF annually.

- Therefore as per the above-mentioned points the Asia-Pacific region is expected to dominate the market during the forecasted period.

Aviation Fuel Industry Overview

The Aviation fuel market is fragmented. Some of the major players in the market (in no particular order) include ExxonMobil Corporation, Chevron Corporation, Shell Plc., TotalEnergies SE, and BP Plc. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Air Travel Demand

- 4.5.1.2 Expanding Airline Fleet

- 4.5.2 Restraints

- 4.5.2.1 Volatile Crude Oil Prices

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Air Turbine Fuel

- 5.1.1.1 Jet A-1

- 5.1.1.2 Jet A

- 5.1.1.3 Jet B

- 5.1.2 Aviation Biofuel

- 5.1.3 AVGAS

- 5.1.1 Air Turbine Fuel

- 5.2 End-User

- 5.2.1 Commercial

- 5.2.2 Defence

- 5.2.3 General Aviation

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Egypt

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Exxon Mobil Corporation

- 6.3.2 Chevron Corporation

- 6.3.3 Shell Plc.

- 6.3.4 TotalEnergies SE

- 6.3.5 BP Plc

- 6.3.6 Gazprom Neft' PAO

- 6.3.7 Neste Oyj

- 6.3.8 Swedish Biofuels AB

- 6.3.9 Red Rock Biofuels LLC

- 6.3.10 Abu Dhabi National Oil Company

- 6.3.11 Bharat Petroleum Corp. Ltd.

- 6.3.12 Indian Oil Corporation Ltd.

- 6.3.13 Emirates National Oil Company

- 6.3.14 Valero Energy Corporation

- 6.3.15 Allied Aviation Services Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Biofuels and Sustainable Alternatives

02-2729-4219

+886-2-2729-4219