|

市场调查报告书

商品编码

1404338

半导体代工:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Semiconductor Foundry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

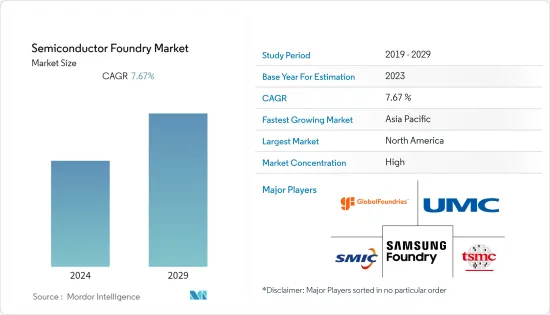

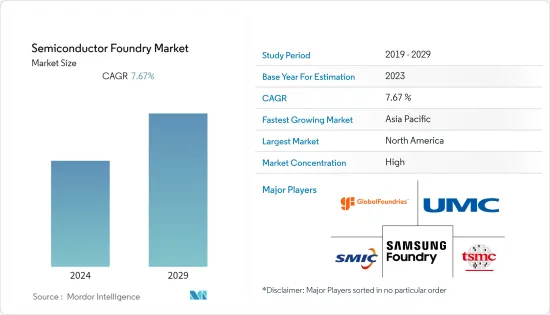

上年度半导体代工市场规模为1,277.9亿美元,预计未来五年将达1,849.4亿美元,复合年增长率为7.67%。

物联网(IoT)、云端运算和人工智慧(AI)等技术变革正在推动晶片产业的长期需求。例如,人工智慧正在为半导体产业创造新的机会,因为许多人工智慧应用都依赖硬体作为创新核心,特别是在逻辑和储存功能方面。与人工智慧快速扩大使用相关的晶片需求预计将对整体行业成长做出重大贡献。

主要亮点

- 密切的跨境政府间合作伙伴关係预计将推动代工市场的成长,特别是在韩国和美国。此外,各国政府鼓励企业在不洩露商业机密的情况下披露半导体生产资讯,以识别瓶颈并防止供应链中断。美国政府要求三星和台积电等公司自愿填写此类资讯细节。

- 如果正确应用,进阶分析可以显着改善营运和报酬率,同时推动成长。然而,包括几家半导体公司在内的许多公司在采用这些策略方面进展缓慢。

- 由于高速连接可用性的不断提高、云端采用的增加以及资料处理和分析的使用的增加,物联网 (IoT) 的采用正在稳步增长。例如,根据爱立信的数据,2022年全球蜂巢式物联网连接数量预计将达到19亿,到2027年将增长到55亿,在此期间复合年增长率为19%。

- 技术创新放缓可能导致采用该技术的新用户减少,从而减少晶片製造商的新开发资金。这可能会形成一个自我强化的循环,稳步降低通用晶片的经济吸引力并减缓技术进步。

- 儘管受到 COVID-19 大流行的影响,全球半导体市场在 2020 年下半年仍保持强劲成长,并持续到 2021 年。该行业一直受到高亏损和需求增加的困扰,导致供应链出现严重缺口,这主要是由于 COVID-19 大流行造成的。由于担心汽车等关键产业对晶片的需求下降,病毒最初的传播导致代工厂关闭并降低了运转率。儘管半导体代工厂最初预测需求增加,但产量下降导致全球半导体短缺。

半导体代工市场趋势

家用电子电器和通讯成为最大的终端用户产业

- 消费性电子是半导体代工市场的关键应用领域之一。笔记型电脑、耳机、穿戴式装置和智慧型手机等家用电子电器的日益普及正在推动该领域的成长。

- 半导体是家用电子电器的重要组成部分,可实现通讯、运算和各种其他应用等关键功能的进步。此外,家用电子电器技术和规模的快速发展也带动了对先进半导体技术的需求。

- 根据美国科技协会(CTA)预测,2021年消费科技产业收益预计将与前一年同期比较%。对智慧型手机、健康设备、汽车技术和串流媒体服务的强劲需求将推动大部分预期收益。

- 2023 年 1 月,苹果宣布计划开发采用 3 奈米製程製造的 Apple M3 处理器的新款 MacBook Air 和 iMac。根据这些计划,台积电于 2022 年 12 月开始批量生产用于下一代 Mac、iPhone 和其他苹果设备的 3 奈米晶片製程。

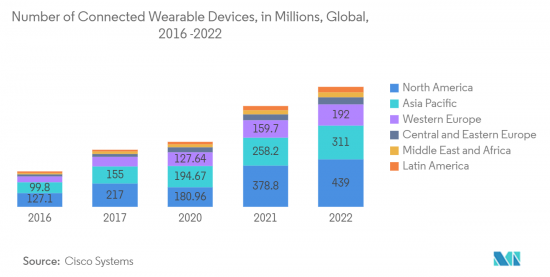

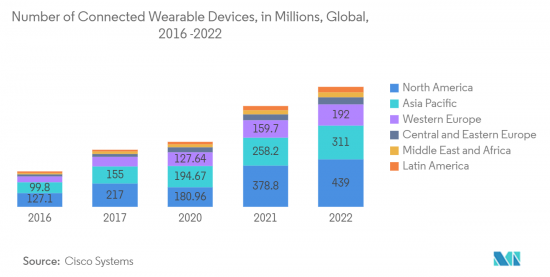

- 此外,穿戴式装置的成长也导致了新的、更小的晶片的采用,推动了大量生产这些晶片的半导体代工厂的成长。据Cisco称,北美连网穿戴装置数量将从 2021 年的 3.788 亿台增至 2022 年的 4.39 亿台。全球整体,连网穿戴装置数量已超过10亿。

北美占有很大的市场占有率

- 由于半导体技术在连网型设备和汽车领域的广泛使用,北美的半导体製造市场正在显着扩大。北美代工市场预计将由美国主导,因为该领域面临国内外竞争的激烈竞争。

- 多年来,美国的地位面临着无数挑战,但由于其韧性和更快行动的能力,它始终能够生存下来。据SIA称,自1990年代以来,美国半导体产业的晶片销售一直领先于全球,占全球市场占有率的近50%。此外,美国半导体企业在研发、设计和製造流程技术方面持续领先或具有高度竞争。

- 根据半导体工业协会 (SIA) 的数据,全球销售的晶片中约 47% 是在美国製造的。这种差异对美国经济和国家安全构成严重威胁,这就是为什么商界相关人员和政界人士最近开始呼吁在该国建立半导体工厂。为此,英特尔、三星、台积电均表示希望在美国投资新晶圆厂、扩大业务,将大大支持美国未来的半导体製造业。

- 例如,英特尔最初宣布打算在 2022 年 1 月投资超过 200 亿美元在俄亥俄州开设两家新的尖端晶片工厂。作为英特尔 IDM 2.0 计画的一部分,这项投资将有助于提高产量,以满足对先进半导体急剧上升的需求,并为该业务的新一代尖端产品提供动力。

- 此外,2022年11月,台积电宣布将于2024年开始在亚利桑那州工厂生产3奈米晶片,目前为苹果供货。台积电亚利桑那州工厂是拜登政府推动该国晶片製造计画的一部分。

- 此外,加拿大因其经济、金融和政治体系、训练有素的劳动力以及对商业的开放性而享有很高的国际声誉,使其成为未来半导体代工领域的一个重要地区。我们处于独特的地位,我们准备好采取必要步骤位于魁北克的 IBM 微电子公司持续封装先进的电脑晶片,并致力于开发 5G 所需的新型光学元件技术。

半导体代工产业概况

随着市场整合,该行业中的代工厂正在激烈竞争,以获得与无晶圆厂供应商的交易,以进一步扩大其影响力和市场占有率。此外,这些参与企业正在增加产能扩张的投资。

现有排名前五名的厂商台积电、三星电子、联华电子、格罗方德、中芯国际的市场渗透率都非常高,每年都在争取高市场占有率。近年来,5G 和物联网已成为其生产设备的一些关键驱动因素,预计这将成为代工厂未来几年的战略重点。创新水平、上市时间和性能是参与企业在市场中脱颖而出的关键条件。由于整合不断增加、技术进步和地缘政治形势,所研究的市场正在经历波动。

2022年12月,台积电宣布将在美国亚利桑那州的投资计画增加两倍以上,从先前的120亿美元增加至400亿美元。亚利桑那州工厂将生产用于 iPhone 处理器的 3nm 和 4nm 晶片。

2022年12月,三星电子有限公司宣布计画在2023年提高韩国最大半导体工厂的晶片产能。

2022 年 10 月,美国参议员帕特里克·莱希(Patrick Leahy) 和GlobalFoundries 获得了3,000 美元的联邦拨款,用于推进格芯佛蒙特州埃塞克斯交界处晶圆厂下一代硅基氮化镓( GaN) 半导体的开发和生产。将获得 1,000,000 美元的资助。这笔 3000 万美元的联邦资金将使 GF 能够购买工具并扩大 200mm GaN 晶圆製造的开发和实施,用于高功率应用晶片的生产,包括电动车、工业马达和能源应用。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 铸造产能利用率趋势

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 透过分析优化半导体工艺

- 汽车、物联网、人工智慧领域驱动市场

- 市场挑战

- 摩尔定律已达到其物理极限

- 主要产业伙伴

- 与半导体产品相关的晶圆代工趋势

第六章市场区隔

- 依技术节点

- 10/7/5nm

- 16/14nm

- 20nm

- 28nm

- 45/40nm

- 65nm

- 其他技术节点

- 按用途

- 家电及通讯

- 车

- 工业的

- HPC

- 其他用途

- 按地区

- 北美洲

- 欧洲、中东/非洲

- 亚太地区

第七章竞争形势

- 公司简介

- TSMC Limited

- Globalfoundries Inc.

- United Microelectronics Corporation(UMC)

- Semiconductor Manufacturing International Corporation(SMIC)

- Samsung Electronics Co. Ltd(Samsung Foundry)

- Dongbu Hitek Co. Ltd

- Intel Corporation

- Hua Hong Semiconductor Limited

- Powerchip Technology Corporation

- STMicroelectronics NV

- Tower Semiconductor Ltd.

- Vanguard International Semiconductor Corporation

- X-FAB Silicon Foundries

- NXP Semiconductors NV

- Renesas Electronics Corporation

- Microchip Technologies Inc.

- Texas Instruments Inc.

第 8 章 研究期间 IDMS 影响半导体(OSD 和 IC)销售和成长的主要趋势和动态

第九章 研究期间IDMS的代工销售情况

第10章 研究期间前5名半导体销售公司的供应商市场占有率以及按类别(OSD和IC)的份额

第 11 章供应商市场占有率分析 - 纯粹的公司

第十二章投资分析

第十三章投资分析市场的未来

The semiconductor foundry market was valued at USD 127.79 billion the previous year and is expected to register a CAGR of 7.67%, reaching USD 184.94 billion by the next five years. Technology inflections such as the Internet of Things (IoT), cloud computing, and artificial intelligence (AI) are driving up the long-term demand for the chip industry. For instance, AI is creating new opportunities for the semiconductor industry as many AI applications rely on hardware as a core enabler of innovation, especially for logic and memory functions. The demand for chips related to the rapidly growing use of AI is expected to contribute significantly to the industry's overall growth.

Key Highlights

- Close partnerships between governments across borders, especially in South Korea and the United States, are anticipated to help the growth of the foundry market. Further, governments are encouraging companies to disclose semiconductor production information without revealing trade secrets to identify bottlenecks and prevent supply chain disruptions. The United States government asked firms like Samsung and Taiwan Semiconductor Manufacturing to voluntarily fill out a form detailing such information.

- Advanced analytics, when applied correctly, can drastically enhance operations and margins while simultaneously spurring growth. Despite this, many companies, including several semiconductor companies, have been slow to adopt these strategies.

- Owing to the increasing availability of high-speed connectivity, rising cloud adoption, and increasing use of data processing and analytics, the adoption of the Internet of Things (IoT) is growing steadily. For instance, as per Ericsson, there were 1.9 billion cellular IoT connections in the world in 2022, which is expected to grow to 5.5 billion in 2027, registering a CAGR of 19% over the period.

- Slowing innovation may lead to fewer new users adopting the technology, reducing the money chipmakers have for funding new developments. This may create a self-reinforcing cycle that steadily makes the economics of universal chips less attractive, slowing down technical progress.

- Despite the effects of the COVID-19 pandemic, the global semiconductor market observed robust growth in the latter half of 2020, which continued in 2021 as well. The industry was riddled with a high deficit and increasing demand, leading to a significant supply chain gap primarily attributed to the COVID-19 pandemic. The initial spread of the virus led to the shutting down or the reduction of foundry capacity utilization, fearing the decreasing demand for the chips across major sectors, like automotive. The diminished output led to a global shortage of semiconductors as the demand increased despite the initial estimates by semiconductor foundries.

Semiconductor Foundry Market Trends

Consumer Electronics and Communication to be the Largest End-user Industry

- Consumer electronics is one of the prominent application segments for the semiconductor foundry market. The growing adoption of consumer electronics devices, such as laptops, earphones, wearables, and smartphones, has propelled the segment's growth.

- Semiconductors are essential components of consumer electronics, enabling key features, such as advances in different applications like communication, computing, and others. In addition, the rapid development in the technology and size of consumer electronics has also been leading to the demand for advanced semiconductor technology.

- According to the Consumer Technology Association (CTA), in the United States, consumer technology industry revenue is projected to grow by 2.8% from 2021's impressive 9.6% growth over the year before. Strong demand for smartphones, health devices, automotive technologies, and streaming services would help the market to propel much of the projected revenue.

- In January 2023, Apple announced its plan to develop its new MacBook Air and iMac with the Apple M3 processor, built on a 3-nanometer process. In line with these plans, in December 2022, TSMC began mass production of its 3-nanometer chip process for the next generations of Mac, iPhone, and other Apple devices.

- Furthermore, the growth in wearables has also been leading to the adoption of new miniaturized chips, which propels the growth of semiconductor foundries that manufacture such chips in bulk. According to Cisco Systems, the number of connected wearable devices in North America reached 439 million in 2022 from 378.8 million in 2021. Globally, the number of connected wearable devices crossed 1 billion.

North America to Hold Significant Market Share

- The market for semiconductor manufacturing in North America is expanding significantly due to the growing use of semiconductor technology in connected devices and the automotive sector. The North American foundry market is predicted to be dominated by the United States because of the sector's intense competition from international and local competitors.

- Although America's position has faced numerous challenges throughout the years, it has always survived, owing to its resilience and capacity to move more quickly. Since the 1990s, the U.S. semiconductor sector has led the world in chip sales, holding close to 50% of the annual global market share, according to SIA. Additionally, American semiconductor companies continue to lead or be very competitive in research and development, design, and manufacturing process technology.

- Approximately 47% of the chips sold worldwide are created in the United States, according to the Semiconductor Industry Association (SIA). This discrepancy creates severe threats to the economy and national security of the United States, which is why both business insiders and politicians have recently started to demand the construction of semiconductor fabs in the country. Due to this, with capital investments for new fabs, Intel, Samsung, and TSMC have all expressed a willingness to grow their businesses in the United States, which will significantly support the country's future semiconductor manufacturing sector.

- For instance, Intel initially declared intentions to invest more than USD 20 billion in creating two new cutting-edge chip facilities in Ohio in January 2022. As part of Intel's IDM 2.0 plan, the investment will assist increase production in meeting the soaring demand for advanced semiconductors, powering a new generation of cutting-edge products from the business.

- In addition, TSMC declared in November 2022 that it will start producing 3-nanometer chips at its Arizona factory, where it now supplies Apple, in 2024. The Arizona factory of TSMC is a component of the Biden administration's plan to promote chip manufacturing in the country.

- Moreover, Canada is in a unique position, with economic, financial, and political systems, a highly-trained workforce, and a significant reputation internationally as a country that is open for business and is poised to take essential steps to emerge as a prominent region in the future semiconductor foundry landscape. IBM Microelectronics in Quebec still packages advanced computer chips and is now taking on new optical component technologies required for 5G.

Semiconductor Foundry Industry Overview

Owing to the consolidated nature of the market, foundries in the industry are competing intensely to gain access to fabless vendor deals to expand their presence and market share further. In addition, these players are increasingly investing in increasing their production capabilities.

The levels of market penetration for the existing top 5 vendors, TSMC, Samsung Electronics, UMC, GlobalFoundries, and SMIC, are significantly high, and these vendors are competing to gain a higher market share each year. In recent times, 5G and IoT have emerged as some of the significant drivers for units to be produced, and this is expected to be a strategic focus for foundries over the coming years. The level of innovation, time-to-market, and performance are the key terms by which the players differentiate themselves in the market. With growing consolidation, technological advancement, and geopolitical scenarios, the market studied is witnessing fluctuations.

In December 2022, Taiwan Semiconductor Manufacturing Co (TSMC) announced that it would more than triple its planned investment in Arizona, United States, to USD 40 billion from a previously announced USD 12 billion. The Arizona plants would produce 3-nm and 4-nm chips used for iPhone processors.

In December 2022, Samsung Electronics Ltd. announced plans to step up chip production capacity at its largest semiconductor fabrication plant in South Korea in 2023.

In October 2022, US Senator Patrick Leahy and GlobalFoundries announced the award of USD 30 million in federal funding to advance the development and production of next-generation gallium nitride (GaN) on silicon semiconductors at GF's Fab facility in Essex Junction, Vermont. The USD 30 million federal funding will enable GF to purchase tools and extend the development and implementation of 200 mm GaN wafer manufacturing in making chips for high-power applications, including electric vehicles, industrial motors, and energy applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Foundry Capacity Utilization Trends

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Optimization of Semiconductor Processes through Analytics

- 5.1.2 Automotive, IoT, and AI Sectors are Driving the Market

- 5.2 Market Challenges

- 5.2.1 Moores Law is about Reaching its Physical Limitation

- 5.3 Major Industry Partnerships

- 5.4 Foundry Trends Related to Semiconductor Products

6 MARKET SEGMENTATION

- 6.1 By Technology Node

- 6.1.1 10/7/5 nm

- 6.1.2 16/14 nm

- 6.1.3 20 nm

- 6.1.4 28 nm

- 6.1.5 45/40 nm

- 6.1.6 65 nm

- 6.1.7 Other Technology Nodes

- 6.2 By Application

- 6.2.1 Consumer Electronics and Communication

- 6.2.2 Automotive

- 6.2.3 Industrial

- 6.2.4 HPC

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe, Middle East and Africa

- 6.3.3 Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 TSMC Limited

- 7.1.2 Globalfoundries Inc.

- 7.1.3 United Microelectronics Corporation (UMC)

- 7.1.4 Semiconductor Manufacturing International Corporation (SMIC)

- 7.1.5 Samsung Electronics Co. Ltd (Samsung Foundry)

- 7.1.6 Dongbu Hitek Co. Ltd

- 7.1.7 Intel Corporation

- 7.1.8 Hua Hong Semiconductor Limited

- 7.1.9 Powerchip Technology Corporation

- 7.1.10 STMicroelectronics NV

- 7.1.11 Tower Semiconductor Ltd.

- 7.1.12 Vanguard International Semiconductor Corporation

- 7.1.13 X-FAB Silicon Foundries

- 7.1.14 NXP Semiconductors NV

- 7.1.15 Renesas Electronics Corporation

- 7.1.16 Microchip Technologies Inc.

- 7.1.17 Texas Instruments Inc.