|

市场调查报告书

商品编码

1404500

OSAT:市场占有率分析、产业趋势/统计、成长预测,2024-2029OSAT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

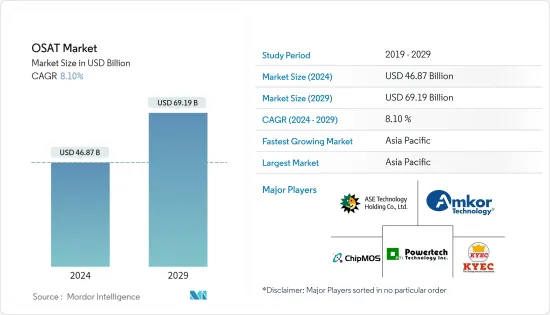

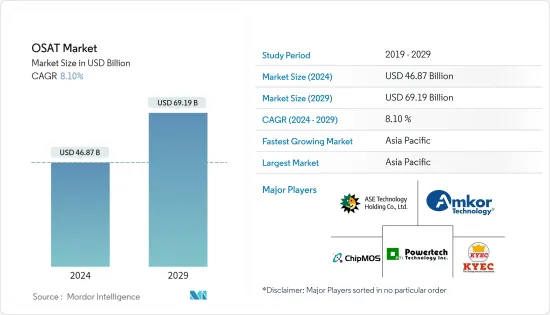

OSAT市场规模预计到2024年为468.7亿美元,预计到2029年将达到691.9亿美元,在预测期内(2024-2029年)复合年增长率为8.10%。

对半导体的需求不断增长以及对新晶片製造、封装、组装和测试设施的投资正在推动所研究市场的成长。

主要亮点

- 外包也是半导体产业的重要组成部分。除了设计之外,半导体产品开发的製造方面还依赖第三方供应商提供的服务。 Fabs(纯晶圆代工厂)和 OSAT 是半导体外包的两个突出例子。 OSAT 半导体公司提供第三方积体电路 (IC) 封装和测试服务,在代工製造的半导体装置出货之前对它们进行封装和测试。这些公司提供创新、经济高效的解决方案,可在电子设备内的较小空间内实现更快的处理速度、更高的效能和功能。

- 许多 OSAT 公司与英特尔、AMD 和 Nvidia 等半导体设计公司签订合约来执行他们的设计。例如,英特尔既是一家晶片设计公司,也是一家代工厂(晶圆供应公司)。英特尔委託晶片封装外包给不同的OSAT,并在将晶片出货给客户之前提供组装和测试服务。

- 半导体产业持续成长,小型化和效率是关键领域,半导体正在成为所有现代技术的基石。该领域的进步和创新对所有下游技术产生直接影响。人工智慧(AI)和云端运算等电子技术的快速发展,伴随着对高速、低功耗和高度整合积体电路(IC)的高需求,导致其销售量庞大。

- 然而,家电需求的大幅下降以及云端服务需求的下降对OSAT市场产生了负面影响,导致2023年上半年许多OSAT工厂的运转率下降。另一方面,先进封装技术的引入以及家用电子电器和汽车领域电子功能不断增加带来的库存调整需求预计将导致未来几个季度OSAT运转率逐步恢復。 。

- 此外,由于製造节点的进步和小型化趋势,半导体封装和测试製程的复杂性不断增加,仍然是研究市场成长的主要挑战。

- 此外,主要半导体製造商垂直整合封装业务是全球OSAT市场面临的重大威胁之一。近年来,代工厂和集成设备製造商 (IDM) 已开始将先进封装产品作为其核心竞争力的一部分。这对 OSAT 供应商具有重大影响。因为他们很多都是大公司,投入巨资,控制前端设备。如果这种趋势持续下去,可能会限制 OSAT 供应商的范围,并对他们的成长产生负面影响。

OSAT市场趋势

汽车应用领域预计将占据主要市场占有率

- 汽车应用是支援 OSAT 市场成长的成长最快的应用领域之一。自动驾驶汽车、电动车和 ADAS(高级驾驶辅助系统)的兴起正在增加汽车晶片的需求和复杂性,导致对半导体晶片的强劲需求,并在所研究的市场中创造商机。

- 例如,资讯娱乐控制器和 ADAS 等汽车应用在宽动作温度范围内具有严格的关键任务测试要求,需要 OSAT 供应商的参与。先进封装技术和新一代高性能、高可靠、高整合晶片是由封装材料实现的,而封装材料对于先进技术应用的成长至关重要。

- 随着半导体晶片需求的增加,台积电(TSMC)和联华电子(UMC)等供应商正在转移生产以满足大众和丰田等汽车製造商的需求。我们宣布将重点关注这一点。例如,2023年2月,通用汽车与GlobalFoundries签署了一项长期协议,建立美国生产的半导体晶片的生产能力。 WorldFoundries表示,为通用汽车独家生产半导体晶片将扩大这家总部位于纽约的公司的业务。

- 此外,全球千禧世代对自动驾驶汽车的偏好预计将推动对半导体封装和测试的需求。自动驾驶汽车配备了超过2500个晶片。几年前,信誉良好的公司必须应对半导体短缺的问题,因为生产单一半导体需要很长时间。此外,汽车产业的电动趋势预计也将对所研究市场的成长产生重大影响。

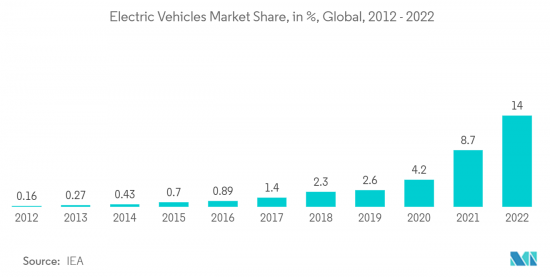

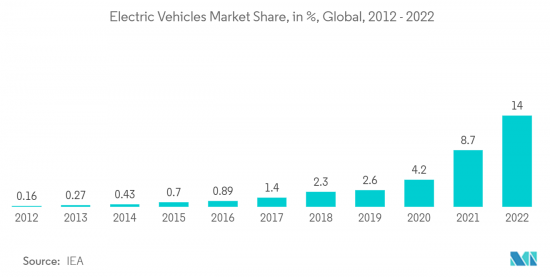

- 例如,根据IEA的预测,2022年电动车在全球小客车销量中的份额将达到约14%,比与前一年同期比较增加约5.3个百分点。自2017年以来,电动车销量一直快速成长,占市场占有率超过1%,尤其是2020年以来成长加速。由于环保意识增强,许多消费者在疫情期间开始寻求更永续的交通途径。这有助于全球电动车市场的扩张。

韩国预计将占据较大市场占有率

- 韩国是全球OSAT厂商最有前景的市场之一。该国也是消费性电子领域着名晶片製造商的所在地,例如三星和SK海力士,使其成为半导体设备创新的有利中心。

- 韩国政府专注于发展智慧製造,计画在2025年将全自动化製造企业数量增加到3万家。政府的目标是透过整合最新的自动化、资料交换和物联网技术来实现这一目标。预计这将成为该国 OSAT 服务的主要动力。

- 此外,由于三星电子系统半导体业务的成长,该国半导体测试产业的规模正在显着扩大。 NEPES Ark、LB Semicon、Tesna 和 Hana Micron 等国内半导体测试公司正在透过大力投资必要的设施和设备来应对系统半导体供应的增加。

- 5G领域的发展也带动了晶片先进封装的成长。根据科学与资讯通讯部的数据,截至 2023 年 2 月,5G用户数为 2,913 万,比 2021 年 2 月的 1,366 万增加了 113%。这种趋势预计将进一步增加对半导体晶片的需求,并在所研究的市场中创造机会。

- 另外,韩国着名汽车公司之一的汽车製造商现代汽车宣布,计划未来五年在 ADAS 系统、电动车、自动驾驶汽车及相关技术领域投资 215.6 亿美元。预计这也将推动汽车半导体的区域需求,并为 OSAT 市场创造机会。

OSAT产业概况

半导体组装与测试服务(OSAT) 市场较为分散,主要参与者包括日月光科技控股(ASE Technology Holding)、安靠科技(Amkor Technology Inc.)、力成科技(Powertech Technology Inc.)、景源电子(King Yuan Electronics) 和茂茂科技(ChipMOS Technologies Inc.)。

2023 年 8 月,凯因斯科技与卡纳塔克邦(印度)IT&BT 部签署了一份谅解备忘录,将在迈索尔建立半导体组装和测试设施。藉此,Kaynes Circuits India Pvt. Ltd. 将主导建立一家製造工厂,生产复杂的多层印刷电路基板(PCB)。

2023 年 6 月,Amkor Technology Inc. 宣布,它一直致力于先进的封装创新,以实现未来的汽车。这是由于过去几年汽车体验的巨大发展,以及在当地法律规章和消费者偏好的推动下,朝向 ADAS(高级驾驶辅助系统)和全自动驾驶发展的趋势。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 半导体产业展望

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估宏观趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 半导体在汽车中的应用增加

- 5G 等趋势推动半导体封装的先进发展

- 市场抑制因素

- 垂直整合是 OSAT 厂商最关心的问题之一

第六章市场区隔

- 按服务类型

- 包装

- 测试

- 按包装类型

- 球栅阵列 (BGA) 封装

- 晶片级封装 (CSP)

- 堆迭晶片封装封装

- 多晶片封装

- 四扁平双列直插式封装

- 按申请

- 通讯设备

- 消费性电子产品

- 车

- 运算网路

- 产业

- 其他的

- 按地区

- 美国

- 中国

- 台湾

- 韩国

- 马来西亚

- 新加坡

- 日本

- 其他地区

第七章竞争形势

- 公司简介

- ASE Technology Holding Co. Ltd

- Amkor Technology Inc.

- Powertech Technology Inc.

- ChipMOS Technologies Inc.

- King Yuan Electronics Co. Ltd

- Formosa Advanced Technologies Co. Ltd

- Jiangsu Changjiang Electronics Technology Co. Ltd

- UTAC Holdings Ltd

- Lingsen Precision Industries Ltd

- Tongfu Microelectronics Co.

- Chipbond Technology Corporation

- Hana Micron Inc.

- Integrated Micro-electronics Inc.

- Tianshui Huatian Technology Co. Ltd

- Vendor Share Analysis

第八章投资分析

第九章 市场机会及未来趋势

The OSAT Market size is estimated at USD 46.87 billion in 2024, and is expected to reach USD 69.19 billion by 2029, growing at a CAGR of 8.10% during the forecast period (2024-2029).

The growing semiconductor demand and investments in new chip manufacturing, packaging, assembly, and testing facilities favor the studied market's growth.

Key Highlights

- Outsourcing is also a major factor in the semiconductor industry. More than just design, the manufacturing aspect of semiconductor product development is dependent on the services provided by third-party vendors. Fabs (Pure-Play Foundries) and OSATs are two prominent examples of semiconductor outsourcing. OSAT semiconductor firms provide third-party integrated circuit (IC) packaging and testing services package and test semiconductor devices made by foundries before shipping them to the market. Such companies in the market provide innovative and cost-effective solutions that deliver faster processing speeds, higher performance, and functionality while taking up less space in an electronic device.

- OSAT companies are mostly contracted by semiconductor design companies, such as Intel, AMD, and Nvidia, and execute those companies' designs. For instance, Intel is both a chip designer and a foundry (wafer provider) owing to the fact that they own and operate their fabs or foundries. Intel outsources its chip packaging to different OSATs for assembly and test services before shipping the chips to customers.

- The semiconductor industry has been growing, with miniaturization and efficiency being the focus area and semiconductors emerging as building blocks of all modern technology. The advancements and innovations in this field have been directly impacting all downstream technologies. The rapid development of electronics technology, including artificial intelligence (AI) and cloud computing, is complemented by a high demand for integrated circuits (ICs) with high speed, low power consumption, and high integration, leading to its significant sales.

- However, the significant downfall in demand for consumer electronics and declining demand for cloud services has negatively impacted the OSAT market, leading to a decrease in the capacity utilization of many OSAT plants in the first half of 2023. On the contrary, the introduction of advanced packaging technologies owing to the development of sophisticated electronics in both the consumer electronics and automotive sectors, as well as demand for stock adjustment, is expected to provide a moderate recovery of capacity utilization of OSAT in the upcoming quarters.

- Furthermore, the growing complexity in the semiconductor packaging and testing process owing to the advancement in manufacturing nodes and the miniaturization trend continues to remain among the major challenging factors for the growth of the studied market.

- Additionally, vertical integration of key semiconductor manufacturers into packaging operations is one of the significant threats faced by the global OSAT market. In recent years, foundries and integrated device manufacturers (IDMs) have begun to include advanced packaging products as part of their core competencies. This has a significant impact on OSAT vendors, as many of them are large players with high expenditures and control the front-end devices. If this trend continues, it may limit the scope of OSAT vendors and harm their growth.

OSAT Market Trends

Automotive Application Segment is Expected to Hold Significant Market Share

- Automotive applications are one of the fastest-growing application areas supporting the growth of the OSAT market. As the demand and complexity of automotive chips are growing with the advent of autonomous vehicles, electric cars, and advanced driver-assistance system (ADAS) systems, the demand for semiconductor chips has been growing significantly, creating opportunities in the studied market.

- For instance, in-cabin applications such as infotainment controllers and ADAS have stringent mission-critical test requirements over wide operating temperature ranges, necessitating the need for OSAT vendors to step in. Advanced packaging technologies and a new generation of chips with high performance, reliability, and integration are made possible by packaging materials, which are essential to the growth of advanced technology applications.

- Owing to the growing demand for semiconductor chips, the vendors, such as Taiwan Semiconductor Manufacturing Co. (TSMC) and United Microelectronics Corp. (UMC), announced that they have been focusing on relocating their production to meet the demand from automakers, such as Volkswagen and Toyota, among others. For instance, in February 2023, GM signed a long-term agreement with Global Foundries to establish the production capacity of U.S.-produced semiconductor chips. According to GlobalFoundaries, this exclusive production of semiconductor chips for General Motors will be an expansion of the New York-based company's operations.

- Furthermore, the global millennial preference for autonomous vehicles is anticipated to fuel the semiconductor packaging and testing demand. In an automatic car, there are more than 2,500 chips installed. Since it used to take longer to produce a single semiconductor a few years ago, reputable companies had to deal with a shortage of semiconductors. Furthermore, the electrification trend in the automobile industry is also anticipated to have a notable influence on the studied market's growth.

- For instance, according to IEA, Electric vehicles amounted to about 14 percent of global passenger car sales in 2022, a rise of around 5.3 percentage points year-over-year. Electric vehicle sales have rapidly increased since 2017, when they rose above one percent of the market, and have particularly accelerated since 2020. Due to increased environmental consciousness, many consumers started looking for more sustainable transportation methods amid the pandemic. This contributed to the EV market expansion worldwide.

South Korea is Expected to Hold a Significant Market Share

- South Korea is one of the promising markets for global OSAT vendors. The country is also home to some prominent chip makers for the consumer electronics segment, such as Samsung and SK Hynix, making it a lucrative hub for innovation in semiconductor devices.

- The Korean government focuses on smart manufacturing and plans to have 30,000 fully automated manufacturing companies by 2025. The government aims to achieve this by incorporating the latest automation, data exchange, and IoT technologies. This is expected to be a major driver for OSAT services in the country.

- Moreover, the size of the country's semiconductor testing sector has grown significantly with the growth of Samsung Electronics' system semiconductor business. The semiconductor testing companies in the country, such as NEPES Ark, LB Semicon, Tesna, and Hana Micron, have been dealing with increased supplies of system semiconductors by making significant investments in necessary facilities and equipment.

- The developments in the 5G space also led to the growth of advanced packaging of chips. According to the Ministry of Science and ICT, as of February 2023, the country had 29.13 million 5G Subscribers, an increase of 113% compared to 13.66 million 5G subscribers in February 2021. Such trends are anticipated to drive the demand for semiconductor chips further, creating opportunities in the studied market.

- Apart from this, the automotive maker Hyundai, one of the prominent automobile companies in South Korea, announced that it is planning to invest USD 21.56 billion over the next five years in ADAS systems, electric cars, autonomous vehicles, and related technology, as its aim to push itself to catch up in this critical emerging technology. This is also expected to fuel the regional demand for automotive semiconductors, creating opportunities in the OSAT market as well.

OSAT Industry Overview

The outsourced semiconductor assembly and test services (OSAT) Market is fragmented, with the presence of major players like ASE Technology Holding Co. Ltd, Amkor Technology Inc., Powertech Technology Inc., King Yuan Electronics Co. Ltd., ChipMOS Technologies Inc., and Players in the market are adopting strategies such as innovations, partnerships, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In August 2023, Kaynes Technology and the Karnataka (India) IT&BT Department signed an MoU for setting up a semiconductor assembly and testing facility in Mysuru. Through this, Kaynes Circuits India Pvt. Ltd. is planning to spearhead the establishment of a manufacturing plant for producing complex multi-layered Printed Circuit boards (PCB).

In June 2023, Amkor Technology Inc. announced that it has been working toward innovating advanced packaging to enable the car of the future. This is done owing to the dramatic evolution of the enhanced automotive experience over the past few years and the move toward advanced driver assistance systems (ADAS) and full autonomy, motivated by regional legislation and consumer preference.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Semiconductor Industry Outlook

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Assessment of the Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Applications of Semiconductors in Automotive

- 5.1.2 Advancement in Semiconductor Packaging Due to Trends like 5G

- 5.2 Market Restraints

- 5.2.1 Vertical Integration is one of the Significant Concerns of OSAT Players

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Packaging

- 6.1.2 Testing

- 6.2 By Type of Packaging

- 6.2.1 Ball Grid Array (BGA) Packaging

- 6.2.2 Chip Scale Packaging (CSP)

- 6.2.3 Stacked Die Packaging

- 6.2.4 Multi Chip Packaging

- 6.2.5 Quad Flat and Dual-inline Packaging

- 6.3 By Application

- 6.3.1 Communication

- 6.3.2 Consumer Electronics

- 6.3.3 Automotive

- 6.3.4 Computing and Networking

- 6.3.5 Industrial

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 United States

- 6.4.2 China

- 6.4.3 Taiwan

- 6.4.4 South Korea

- 6.4.5 Malaysia

- 6.4.6 Singapore

- 6.4.7 Japan

- 6.4.8 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ASE Technology Holding Co. Ltd

- 7.1.2 Amkor Technology Inc.

- 7.1.3 Powertech Technology Inc.

- 7.1.4 ChipMOS Technologies Inc.

- 7.1.5 King Yuan Electronics Co. Ltd

- 7.1.6 Formosa Advanced Technologies Co. Ltd

- 7.1.7 Jiangsu Changjiang Electronics Technology Co. Ltd

- 7.1.8 UTAC Holdings Ltd

- 7.1.9 Lingsen Precision Industries Ltd

- 7.1.10 Tongfu Microelectronics Co.

- 7.1.11 Chipbond Technology Corporation

- 7.1.12 Hana Micron Inc.

- 7.1.13 Integrated Micro-electronics Inc.

- 7.1.14 Tianshui Huatian Technology Co. Ltd

- 7.2 Vendor Share Analysis

![工业电子 OSAT 市场:趋势、机遇、竞争分析 [2023-2028]](/sample/img/cover/42/1272753.png)

![消费电子 OSAT 市场:趋势、机遇、竞争分析 [2023-2028]](/sample/img/cover/42/1272751.png)

![计算机和网络 OSAT 市场:趋势、机遇和竞争分析 [2023-2028]](/sample/img/cover/42/1272752.png)