|

市场调查报告书

商品编码

1405361

硬质塑胶包装:市场占有率分析、产业趋势/统计、成长预测,2024-2029 年Rigid Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

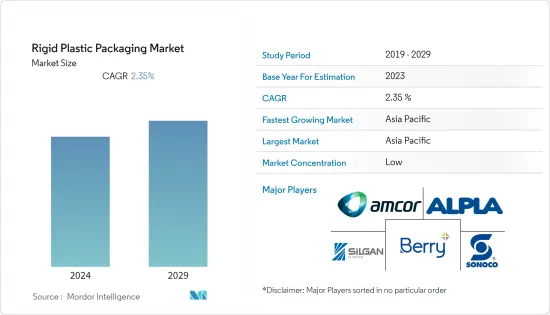

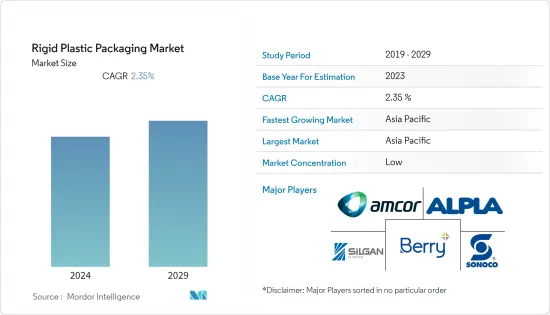

硬质塑胶包装市场规模预计将从2024年的2,533.6亿美元成长到2029年的2,846亿美元,预测期内(2024-2029年)复合年增长率为2.35%。

据塑胶工业协会的硬质塑胶包装小组(RPPG)称,塑胶占全球包装行业的三分之一,其中大部分是刚性的。

主要亮点

- 硬质塑胶包装耐用、价格实惠且环保。硬质塑胶包装的一个关键市场驱动因素是对环保和永续包装解决方案日益增长的需求。这为製造商创造了潜在的成长机会。

- 便利包装产业正在影响硬质塑胶包装市场,因为忙碌的生活需要可以在旅途中消费并减少烹饪时间的物品。新兴国家可支配收入的增加和包装商品消费的增加也推动了对硬包装的需求。

- 对生物分解性硬质塑胶包装的需求不断增长预计将推动未来市场的成长。此外,人们的消费趋势转向饮料和其他家庭护理产品的永续包装解决方案,将对硬质塑胶包装市场产生积极影响。例如,印度的Pepsi Black就采用rPET包装材料包装。此外,快速的都市化也促进了市场的成长。此外,人们可支配收入的增加可能会对未来的市场成长产生正面影响。

- 医疗保健产业对硬质塑胶包装的需求不断增加也是近年来推动市场成长的关键因素之一。硬质塑胶正在帮助医疗保健产业的公司保护药品免受污染。医疗产品包装必须符合国际安全监管标准。因此,硬质塑胶的特性以及耐用性、重量轻、清洁度和透明度使其成为存放医疗产品的理想选择。

- 然而,先进硬质塑胶包装的激烈竞争可能会阻碍市场成长。此外,塑胶产品製造中双酚 A (BPA) 的使用量不断增加,对整个硬质塑胶包装市场构成了重大挑战。原材料波动也是市场拓展的主要障碍。原油是塑胶製品的主要原料,石油价格的波动影响成品的定价。

硬质塑胶包装市场趋势

聚丙烯(PP)在硬质塑胶包装市场中占有很大的市场占有率

- 与聚乙烯、聚对苯二甲酸Terephthalate(PET)和聚苯乙烯(PS)等其他塑胶材料相比,聚丙烯具有优异的阻隔性能、改善的表面光泽、更低的成本和更高的拉伸强度。这些特性使聚丙烯成为各种包装应用的理想材料。聚丙烯不断增长的应用包括药瓶、番茄酱和糖浆瓶以及瓶盖和瓶盖。因此,由于对聚丙烯(PP)材料的需求不断增长,硬质塑胶包装市场在预测期内可能会继续成长。

- 聚丙烯不断增长的用途包括药瓶、瓶盖和瓶盖、番茄酱和糖浆瓶。例如,联合利华(Unilever)以 Magnum 品牌成为冰淇淋行业第一家推出由回收 PP 塑胶包装製成的管冰淇淋的公司。此举是该公司更广泛策略的一部分,该策略的目标是到 2025 年,其 25% 的塑胶包装将由消费后回收材料製成。

- 此外,根据 PlastIndia 基金会的报告,印度的聚丙烯 (PP) 製造能力为每年 4,970 千吨 (KTA)。据IBEF称,印度塑胶工业发达,拥有3万个塑胶加工单位,从业人员约400万人。

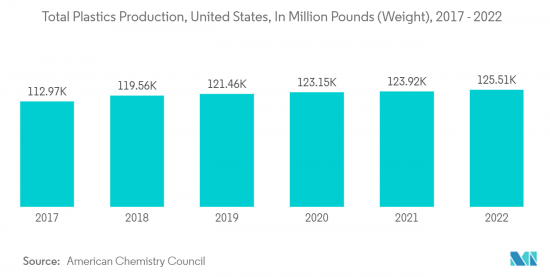

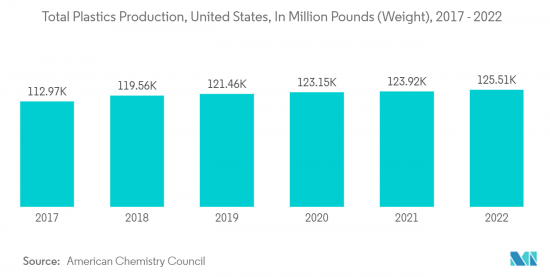

- 根据美国工业理事会的数据,2022 年美国塑胶总产量为 1,255 亿磅,高于 2021 年的 1,239 亿磅。随着原料变得更加容易取得,塑胶产量的快速成长预计将增加对硬质塑胶包装的需求。特别是,广泛用于硬质包装的聚乙烯(PP)产量的增加可以增加聚丙烯树脂的供应,使其更便宜,更容易为包装製造商所用。

亚太地区将在预测期内占据主要市场占有率

- 亚太地区占主要市场占有率。由于经济和经济活动的扩大,预计中国和印度等国家的硬质塑胶包装产业将会增加。此外,这些国家不断增长的人口预计将推动硬质塑胶包装产业的扩张,为快速消费品和耐用消费品提供重要市场。

- 由于工业化、简便食品产业的成长、製造业活动的增加、可支配收入的增加、消费水准的提高以及电子零售的增加等关键因素,在预测期内对硬质塑胶包装的需求正在增长。此外,印度、中国和印尼等国家的成长正在推动亚太地区引领全球美容和个人护理行业的包装需求。

- 近年来,中国软性饮料消费量快速成长,截至2023年2月,中国软性饮料产量估计约2,688万吨。因此,对储存和运输这些饮料的包装材料的需求不断增长。硬质塑胶。

- 製造商正在推出创新的包装格式、尺寸和功能,以满足消费者对便利性的需求。亚太地区也为包装製造商带来了机会和挑战,口腔清洁用品、护肤、男士美容和婴儿护理等利基类别的成长。

硬质塑胶包装产业概况

硬质塑胶包装市场较为分散。由于多家企业的存在,市场竞争非常激烈。本公司专注于提供轻量、高性能的瓦楞纸等级,以降低成本并提高包装性能。市场主要企业包括Amcor Group GmbH、Alpla Werke Alwin Lehner GmbH &Co KG、Silgan Holdings Inc.、Sealed Air Corporation、Plastipak Holding Inc.、Sonoco Products Company、Graham Packaging Company Inc.等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介(塑胶製造流程流程趋势分析)

第五章市场动态

- 市场驱动因素

- 印度和中国等主要亚洲市场的需求不断增长

- 食品饮料包装产业需求旺盛

- 市场抑制因素

- 有关塑胶包装行业的严格法律规章

- 与软质塑胶包装的竞争

第六章市场区隔

- 副产品

- 瓶罐

- 托盘/容器

- 盖子与封口装置

- 其他(泡壳包装、翻盖包装、硬质塑胶胶管)

- 按材质

- 聚乙烯(PE)

- 聚对苯二甲酸Terephthalate(PET)

- 聚丙烯(PP)

- 聚苯乙烯 (PS) 和发泡聚苯乙烯 (EPS)

- 聚氯乙烯(PVC)

- 其他的

- 按最终用户产业

- 食品与饮品

- 卫生保健

- 化妆品/个人护理

- 工业

- 建筑/施工

- 车

- 其他(电气/电子设备)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 北美洲

第七章竞争形势

- 公司简介

- Amcor Group GmbH

- Berry Global Inc.

- Alpla Werke Alwin Lehner GmbH & Co KG

- Silgan Holdings Inc.

- Sealed Air Corporation

- Plastipak Holding, Inc.

- Sonoco Products Company

- Graham Packaging Company

- Huhtamaki, Inc.

- Albea Group

第八章投资分析

第九章 市场机会及未来趋势

The Rigid Plastic Packaging Market size is expected to grow from USD 253.36 billion in 2024 to USD 284.6 billion by 2029, registering a CAGR of 2.35% during the forecast period (2024-2029). According to the Plastics Industry Association's Rigid Plastic Packaging Group (RPPG), Plastics account for one-third of the global packaging industry, and much of this plastic packaging is rigid.

Key Highlights

- Packaging made of rigid plastic is durable, affordable, and environmentally friendly. A significant market driver for rigid plastic packaging is the rising need for environmentally friendly and sustainable packaging solutions. Potential growth prospects are being created for manufacturers.

- The convenience packaging industry influences the rigid plastic packaging market since busier lives call for items that can be consumed while on the move and cut down on cooking time. The need for rigid packaging will also be fueled by increased disposable income and expanding packaged goods consumption in emerging nations.

- Augmenting demand for biodegradable rigid plastic packaging is expected to boost the market growth in the future. Also, people's consumption trends shifting towards sustainable packaging solutions for beverages and other household care products positively impact the rigid plastic packaging market. For Instance, Pepsi Black in India is being packaged using rPET packaging materials. Moreover, rapidly increasing urbanization also contributes to market growth. Furthermore, the growing disposable income of the people will positively impact market growth in the coming future.

- The growing demand for rigid plastic packaging from the healthcare industry is also one of the critical factors that has triggered the market's growth in recent years. Rigid plastic helps enterprises in the healthcare industry protect medicines from contamination. The medical product packaging must be compliant with international regulatory standards for safety. Therefore, the properties of rigid plastic, along with its durability, lightweight, cleanliness, and transparency, make it the perfect choice for storing medical products.

- However, high competition for advanced rigid plastic packaging may hinder market growth. Also, increasing the use of BisphenolA (BPA) in manufacturing plastic products poses a significant challenge for the overall rigid plastic packaging market. Raw material volatility is another major stumbling block to the market's expansion. Crude oil is the primary raw material used in plastic-based products, and price fluctuations in crude oil impact the pricing of the finished goods.

Rigid Plastic Packaging Market Trends

Polypropylene (PP) to Account for Significant Market Share in Rigid Plastic Packaging Market

- Compared to other plastic materials like polyethylene, polyethylene terephthalate (PET), polystyrene (PS), and others, polypropylene offers superior barrier qualities, improved surface polish, cheap cost, and high tensile strength. These features make polypropylene an ideal material for a range of packaging applications. Some of the growing applications for polypropylene include medicine bottles, bottles for ketchup and syrups, and bottle caps and closures. The market for rigid plastic packaging will thus continue to increase over the projected period due to the rising demand for polypropylene (PP) material.

- Medicine bottles, bottle caps and closures, and bottles for ketchup and syrups are some of the increasing applications of polypropylene. For instance, under its brand, Magnum, Unilever launched ice creams in tubs made from recycled PP plastic packaging, the first in the ice cream industry. The move was part of the company's broader strategy to ensure that 25% of its plastic packaging will come from post-consumer recycled content by 2025.

- Further, according to a report by the PlastIndia Foundation, India has a manufacturing capacity of 4,970 Kilo Ton per Annum (KTA) for Polypropylene (PP). According to IBEF, India is progressing in plastic industries with 30,000 plastic processing units, and about 4 million people are employed.

- According to the American Chemistry Council, in the United States, the total volume of plastics produced in 2022 was 125.5 billion pounds, a rise from the 123.9 billion pounds produced in 2021. The surge in plastic production is expected to increase the demand for rigid plastic packaging as raw materials become more readily available. In particular, the increased production of polyethylene (PP), widely used in rigid packaging, is expected to increase the supply of polypropylene resin, which may decrease costs and increase availability for packaging manufacturers.

Asia-Pacific to Witness Significant Market Share in the Forecast Period

- The Asia-Pacific region holds a significant market share. Due to their expanding economies and economic activity, the rigid plastic packaging industry is predicted to increase in nations like China and India. In addition, these nations' expanding populations provide a significant market for FMCG goods and consumer durables, which is anticipated to fuel the expansion of the rigid plastic packaging industry.

- The demand for rigid plastic packaging has grown for the forecast period due to significant factors, including industrialization, the growth of the convenience food industry, an increase in manufacturing activities, rising disposable income, rising consumption levels, and rising e-retail sales. Furthermore, the growth of countries like India, China, and Indonesia drives the Asia-Pacific region to lead packaging demand for the global beauty and personal care industry.

- The consumption of soft drinks in China has seen a surge in recent years, as evidenced by the fact that in February of 2023, the volume of manufactured soft drinks in the country was estimated to be around 26.88 million metric tons. This has led to an increase in the need for packaging materials to store and transport these beverages. It is expected that the market for rigid plastic packaging will experience significant growth in the near future, as the durability, lightness, freshness, and recyclability of PET plastic bottles and containers are preferred by soft drink manufacturers.

- Manufacturers are launching innovative pack formats, sizes, and functionality in response to the consumer demand for convenience. Also, with the growth in oral, skincare, and niche categories, such as men's grooming and baby care, Asia-Pacific is both an opportunity and challenging region for packaging manufacturers.

Rigid Plastic Packaging Industry Overview

The rigid plastic packaging market is fragmented. Due to the presence of several players, the market has strong competition. Companies focus on providing lightweight, high-performance, corrugated grades to reduce costs and improve packaging performance. Some of the major players in the market are Amcor Group GmbH, Alpla Werke Alwin Lehner GmbH & Co KG, Silgan Holdings Inc., Sealed Air Corporation, Plastipak Holding Inc., Sonoco Products Company, and Graham Packaging Company Inc., among others.

In August 2023, Berry Global launched a selection of reusable bottles, which are claimed to be made entirely from Post-consumer Recycled Plastic (PCR), for the purpose of providing cleaning services to the Bio-D Society. The bottles are available in 750ml, 1000ml, and 500ml sizes and are intended for a variety of Bio-D's liquid products, including detergents, fabric conditioners, dishwasher rinses, washing-up liquids, and H&G cleaners.

In September 2022, Amcor Rigid Packaging developed ClearCor to produce DairySeal, a novel PET barrier technology for containers of ready-to-drink dairy beverages. The bottles are recyclable and can contain up to 80% recyclable elements in their construction. ARP created a barrier out of PET film to keep dairy beverages tasting fresh. A "concentrated capsulation" created by new technology designed by ClearCor in the preform's core gives the containers additional flexibility and resin possibilities.

In July 2022, Alpla acquired the Polish company Apon, which makes plastic containers for the pharmaceutical market. Apon created bottles, containers with screw closures or snap lids, dose aids for medical equipment, food supplement packaging, and e-liquid packaging. The business is expanding its footprint in Central and Eastern Europe and supplying the Baltic nations and Poland's developing markets with quality goods.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot (Trend Analysis of the Plastic Manufacturing Processes)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand in Major Asian Markets Such as India and China

- 5.1.2 Strong Demand From the Food and Beverage Packaging Industry

- 5.2 Market Restraints

- 5.2.1 Stringent Laws and Regulations Pertaining to Plastic Packaging Industry

- 5.2.2 Competition From Flexible Plastic Packaging

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Bottles and Jars

- 6.1.2 Trays and Containers

- 6.1.3 Caps and Closures

- 6.1.4 Other Product Types (Blister and Clamshell Packs, and Rigid Plastic Tubes)

- 6.2 By Material

- 6.2.1 Polyethylene (PE)

- 6.2.2 Polyethylene Terephthalate (PET)

- 6.2.3 Polypropylene (PP)

- 6.2.4 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 6.2.5 Polyvinyl Chloride (PVC)

- 6.2.6 Other Rigid Plastic Packaging Materials

- 6.3 By End-user Industry

- 6.3.1 Food and Beverage

- 6.3.2 Healthcare

- 6.3.3 Cosmetics and Personal Care

- 6.3.4 Industrial

- 6.3.5 Building and Construction

- 6.3.6 Automotive

- 6.3.7 Other End-user Industries (Electrical and Electronics)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia

- 6.4.3.5 South Korea

- 6.4.3.6 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Berry Global Inc.

- 7.1.3 Alpla Werke Alwin Lehner GmbH & Co KG

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 Sealed Air Corporation

- 7.1.6 Plastipak Holding, Inc.

- 7.1.7 Sonoco Products Company

- 7.1.8 Graham Packaging Company

- 7.1.9 Huhtamaki, Inc.

- 7.1.10 Albea Group