|

市场调查报告书

商品编码

1406066

封装-市场占有率分析、产业趋势与统计、2024 年至 2029 年成长预测Encapsulant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

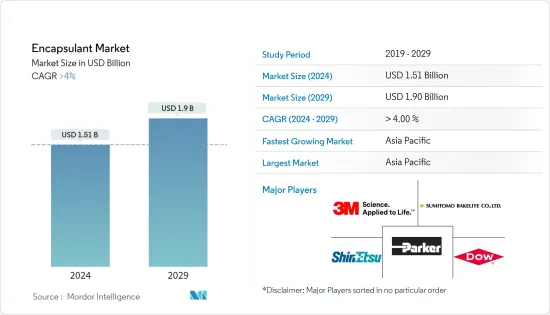

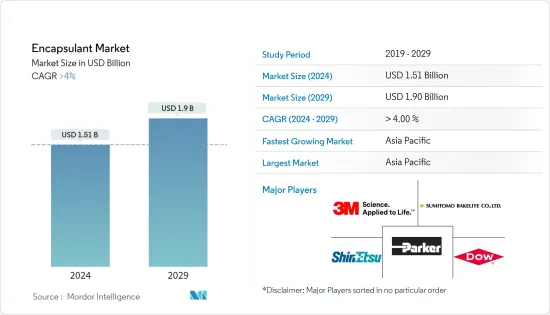

2024年封装市场规模预计为15.1亿美元,预计2029年将达到19亿美元,在预测期内(2024-2029年)复合年增长率预计将超过4%。

由于遏制措施和经济中断,电子/电力和汽车等行业被迫减慢生产,因此 COVID-19大流行减缓了生产和运输,对市场产生了负面影响。目前市场正在从疫情中恢復,预计将持续稳定成长。

主要亮点

- 全球对电子设备和电器产品的需求正在增加,预计将推动市场成长。

- 然而,製造封装所需原料价格的波动预计将阻碍市场扩张。

- 此外,预计更加重视开拓低成本封装将创造未来的市场机会。

- 亚太地区正主导全球市场,中国、印度和日本等国家成为最大的消费国。

封装市场趋势

电气和电子产业的高需求

- 封装用于电子设备中的绝缘目的。电路基板、半导体和其他电子元件具有出色的耐高温、耐化学暴露和其他环境危害的能力。

- 电气和电子行业使用量的增加和应用范围的扩大预计将推动全球整体。

- 例如,根据日本电子情报技术产业协会(JEITA)的数据,2022年全球电子资讯科技产业产值预计为34,368亿美元,而2021年为34,159亿美元, 与前一年同期比较率为1%。此外,预计2023年将达35,266亿美元,与前一年同期比较成长3%。

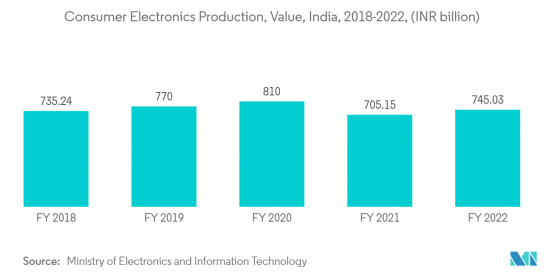

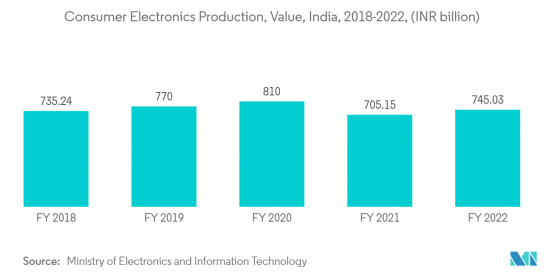

- 此外,根据电子与资讯科技部的数据,22 财年印度消费性电子产品(电视、配件、音讯)的产值超过 7,450 亿印度卢比(94.6 亿美元)。这支持了市场成长。

- 在美国,电子业主要由家用电器的销售所推动。此外,由于美国各地工业活动的增加,工业电子产品在过去十年中获得了发展势头。由于对电视、行动电话电脑和智慧产品等家用电子电器的高需求,市场消费预计将增加。

- 此外,截至2023年,德国电子业占国内工业产值的10%、GDP的3%,僱用的员工约占德国工业总员工的14%。该国将研发总支出的约24%投资于电子和微技术产业(包括半导体製造)。

- 预计这些积极因素将在预测期内推动电子产业封装市场的发展。

亚太地区主导市场

- 亚太地区是最大的市场,由于中国、印度和日本等国家的消费量不断增加,预计亚太地区将成为预测期内成长最快的市场。

- 中国是全球最大的电子产品生产基地。中国製造商正在建立海外电子产品生产基地,以扩大国际市场。

- 例如,2023年3月,TCL透过在越南、马来西亚、墨西哥和印度设立海外工厂生产电视机、模组和太阳能电池,扩大了在国际市场的影响力。此外,我们也与巴西当地企业合作,共同开发生产设施、供应链和研发基础设施。

- 而且,亚太地区在半导体产业中所占份额最大,预计将成为半导体产量成长最快的地区。这是由于微晶片技术的创新,预计将增加该地区以及所研究市场对积体电路的需求。

- 例如,2023年9月,中国推出一项新的国有投资基金,旨在为其半导体产业资金筹措约400亿美元,以加紧努力追赶美国和其他竞争对手。

- 此外,根据电子情报技术产业协会(JEITA)的预测,2022年日本电子产业国内产值预计为111,243亿日元(约合851.9亿美元),与前一年同期比较。我记录下来了。

- 此外,封装的其他最终用户包括电力和能源来源,例如风力发电和太阳能。中国非常关注可再生能源转型。 2022年,中国将占全球新增陆域风电容量的约47%,其次是美国,占13%。全球能源监测(GEM)资料显示,截至2023年1月,中国风电场总运作容量为278,353MW。

- 预计这些因素将在预测期内进一步增加亚太地区封装市场的需求。

封装产业概况

封装市场因其性质而部分分散。主要公司(排名不分先后)包括 PARKER HANNIFIN CORP、Dow、Sumitomo Bakelite 3M 和工业。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对电气和电子设备的需求增加

- 汽车领域需求增加

- 其他司机

- 抑制因素

- 原物料价格波动

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 类型

- 环氧树脂

- 胺甲酸乙酯

- 硅胶

- 最终用户产业

- 车

- 电力/电子

- 能源/电力

- 其他(建筑、医疗保健等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Aptek Laboratories, Inc.

- Dow

- Dymax

- Henkel AG & Co. KGaA

- KYOCERA AVX Components Corporation

- Nagase America LLC

- Panasonic Industry Co., Ltd.

- PARKER HANNIFIN CORP

- Sanyu Rec Co., Ltd.

- Shin-Etsu Chemical Co., Ltd

- Sumitomo Bakelite Co., Ltd.

第七章 市场机会及未来趋势

- 越来越重视低成本封装的开发

- 其他机会

The Encapsulant Market size is estimated at USD 1.51 billion in 2024, and is expected to reach USD 1.9 billion by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility, as industries such as electronics and electrical, automotive, etc., were forced to delay their production due to containment measures and economic disruptions. Currently, the market has recovered from the pandemic and is expected to grow steadily in the future.

Key Highlights

- The increasing demand for electronics and electrical appliances across the globe is expected to fuel market growth.

- However, volatility in the price of raw materials required for the manufacturing of encapsulant is anticipated to hamper market expansion.

- Furthermore, a rising focus on the development of low-cost encapsulant materials is predicted to generate a market opportunity in the future.

- The Asia-Pacific region dominated the market around the world, with countries like China, India, and Japan being the biggest consumers.

Encapsulants Market Trends

High Demand from Electrical and Electronics Industry

- Encapsulants are used for insulation purposes in electronic devices. In circuit boards, semiconductors, and other electronic components, they provide superior resistance to environmental hazards such as high temperatures, chemical exposure, etc.

- The increasing usage and widening arena of application in the electrical and electronics industry is expected to drive market growth across the globe.

- For instance, according to the Japan Electronics and Information Technology Industries Association (JEITA), the production by the global electronics and IT industry was estimated at USD 3,436.8 billion in 2022, registering a growth rate of 1% year on year, compared to USD 3,415.9 billion in 2021. Moreover, the industry is expected to reach USD 3,526.6 billion, with a growth rate of 3% year on year in 2023.

- Moreover, according to the Ministry of Electronics and Information Technology, the production value of consumer electronics (TV, accessories, and audio) across India was above INR 745 billion (USD 9.46 billion) in fiscal year 2022. Thus supporting the growth of the market.

- The sales of consumer electronics primarily drive the electronics industry in the United States. Moreover, industrial electronics have gained momentum in the past decade owing to the rise in industrial operations across the United States. High demand for consumer electronics, including television, mobile phones, laptops, and smart gadgets, is expected to increase market consumption.

- Further, As of 2023, in Germany, the electronics sector is responsible for 10% of domestic industrial output, 3% of GDP, and employs about 14% of total employees in the German industry. The country invests about 24% of the total R&D expenditure in the electronics and microtechnology industry (including semiconductor fabrication).

- Such positive factors are expected to drive the encapsulant market in the electronics industry through the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region represents the largest market and is also expected to be the fastest-growing market over the forecast period, owing to the increasing consumption from countries such as China, India, and Japan.

- China has the world's largest electronics production base. Chinese manufacturers are setting up overseas electronics production bases in order to expand in the international markets.

- For instance, In March 2023, TCL broadened its presence in international markets by establishing factories abroad, producing televisions, modules, and photovoltaic cells in Vietnam, Malaysia, Mexico, and India. In addition, it has formed partnerships with local companies in Brazil to collaboratively develop production facilities, supply chains, and an R&D infrastructure.

- Additionally, the Asia-Pacific semiconductor industry accounts for the largest share and is expected to be the fastest-growing region in semiconductors production, owing to innovations in microchip technologies, which are expected to boost demand for integrated circuits in the region, which, in turn, is likely to boost the demand for the market studied.

- For instance, in September 2023, China announced to launch of a new state-backed investment fund that aims to raise about USD 40 billion for its semiconductor sector as the country ramps up its efforts to catch up with the U.S. and other rivals.

- Further, as per the Japan Electronics and Information Technology Industries Association (JEITA), the domestic production by the Japanese electronics industry was estimated at JPY 11,124.3 billion (~USD 85.19 billion) in 2022, witnessing a growth rate of 2% compared to the previous year.

- Moreover, other end-users of encapsulant include power and energy sources such as wind and solar energy. China is highly focused on the renewable energy transition. In 2022, China accounted for approximately 47% of the world's newly installed onshore wind power capacity, followed by the United States at 13 percent. China's total wind farm operational capacity was 278,353 MW as of January 2023, according to data from Global Energy Monitor (GEM).

- Such factors are expected to further drive the demand for the encapsulant market over the forecast period in the Asia-Pacific region.

Encapsulants Industry Overview

The encapsulant market is partially fragmented in nature. The major players (not in any particular order) include, PARKER HANNIFIN CORP, Dow, Sumitomo Bakelite Co., Ltd. 3M, and Shin-Etsu Chemical Co., Ltd. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Electrical and Electronic Appliances

- 4.1.2 Rising Demand from Automotive Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Volatility in Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Epoxy

- 5.1.2 Urethane

- 5.1.3 Silicone

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Electricals and Electronics

- 5.2.3 Energy and Power

- 5.2.4 Others (Construction, Healthcare, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Aptek Laboratories, Inc.

- 6.4.3 Dow

- 6.4.4 Dymax

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 KYOCERA AVX Components Corporation

- 6.4.7 Nagase America LLC

- 6.4.8 Panasonic Industry Co., Ltd.

- 6.4.9 PARKER HANNIFIN CORP

- 6.4.10 Sanyu Rec Co., Ltd.

- 6.4.11 Shin-Etsu Chemical Co., Ltd

- 6.4.12 Sumitomo Bakelite Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Focus on Development of Low-Cost Encapsulant Materials

- 7.2 Other Opportunities