|

市场调查报告书

商品编码

1406246

橡胶加工油:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Rubber Process Oils - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

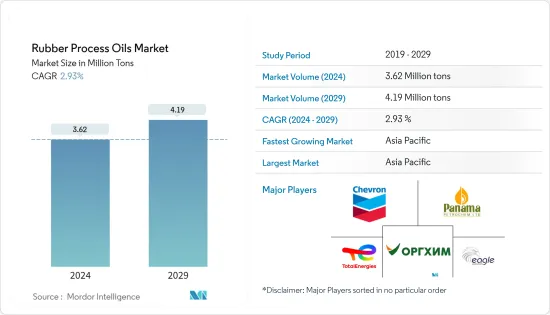

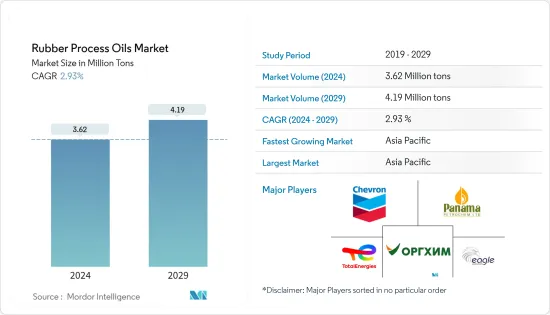

橡胶加工油市场规模预计到2024年为362万吨,预计到2029年将达到419万吨,在预测期内(2024-2029年)复合年增长率为2.93%。

COVID-19 大流行对市场产生了负面影响。这是因为製造设施和工厂因封锁和限製而关闭。供应链和运输中断进一步阻碍了市场。但2021年,产业復苏,市场需求恢復。

主要亮点

- 短期来看,汽车产业对轮胎和汽车零件的需求不断增加是市场成长的主要驱动力之一。

- 另一方面,原材料价格的波动预计将阻碍市场成长。

- 然而,预计对生物基橡胶加工油的需求不断增长将为预测期内的市场成长提供各种机会。

- 亚太地区是最大的市场,由于中国、印度和日本等国家的消费量不断增加,预计亚太地区将成为预测期内成长最快的市场。

橡胶加工油市场趋势

轮胎和汽车零件对橡胶加工油的需求不断增长

- 橡胶加工油用于混合橡胶化合物。这些产品可改善填料的分散性和化合物的流动性。因此,它被认为是橡胶工业最重要的成分。

- 橡胶加工油因其改进的机械性能而用于轮胎和其他汽车零件。此外,该产品煞车效率和燃油效率的提高将进一步有利于其在轮胎和汽车零件中的应用。

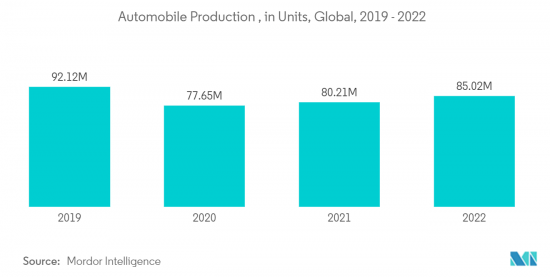

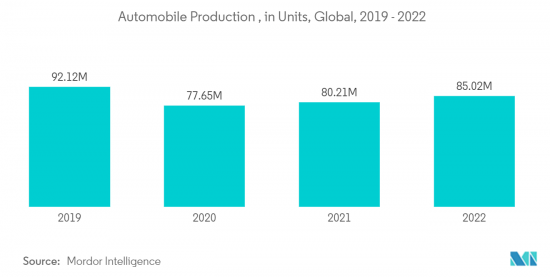

- 橡胶加工油可改善轮胎製造中使用的橡胶的性能。人口成长带来的生活水准提高和消费能力增强是推动全球汽车需求的因素。例如,根据OICA的数据,2022年全球整体小客车产量为6,159万辆,比2021年成长8%,比2020年成长10%。因此,小客车产量的增加预计将在预测期内产生橡胶加工油市场的需求上升。

- 此外,德国汽车工业也受到半导体短缺和原材料供应有限的阻碍。同样,新的世界统一轻型汽车测试程序(WLTP)的实施、美国贸易紧张局势导致全球汽车需求减少,以及新车销售平均二氧化碳排放减少至每公里95克。新的 EU-28排放气体标准要求汽车製造商采取更多措施等因素也对小客车生产产生了负面影响。

- 不过,到了2022年,汽车产量逐渐从半导体短缺中恢復过来。例如,根据 OICA 的数据,2022 年德国小客车产量约为 34,80,357 辆,比 2021 年成长 12%。因此,小客车领域产量的增加预计将为橡胶加工油市场带来需求上升。

- 此外,美国也是全球第二大汽车销售和生产市场。例如,根据OICA的数据,2022年美国汽车产量为100,60,339辆,较2021年成长10%。因此,由于汽车产量的增加,橡胶加工油市场的需求预计将增加。

- 因此,该地区所有这些有利的趋势和投资预计将在预测期内推动橡胶加工油市场的需求。

亚太地区主导市场

- 预计亚太地区将在预测期内主导橡胶加工油市场。中国、日本和印度等发展中国家的轮胎和汽车零件对橡胶加工油的需求不断增长,预计将推动该地区橡胶加工油的需求。

- 最大的橡胶加工油生产商位于亚太地区。橡胶加工油生产领域的领先公司包括道达尔、雪佛龙知识产权有限责任公司、巴拿马石化有限公司、ORGKHIM Biochemical Holding 和 Eagle Petrochem。

- 随着消费者对电池驱动电动车的偏好增加,中国汽车产业正经历转变。中国汽车工业的扩张预计将有利于橡胶加工油市场。根据国际汽车工业协会(OICA)的数据,中国是世界上最大的汽车生产国,占全球产量的近34%。 2022年汽车产量为2,70,20,615辆,比2021年的2,61,21,712辆增加24%。因此,汽车产量的增加预计将为橡胶加工油市场带来需求上行。

- 在印度,更严格的车辆排放法规、提高的车辆安全性、车辆中ADAS(高级驾驶辅助系统)的引入以及零售和电子商务领域物流的快速增长正在推动对新型和先进轻型商用车的需求。 ( LCV)是需求的主要驱动力。例如,根据OICA的数据,2022年印度轻型商用车产量为6,17,398辆,较2021年成长27%,较2020年恢復60%。

- 此外,印度汽车工业的投资增加和进步预计将增加橡胶加工油市场的消费。例如,塔塔汽车在2022年4月宣布,计画未来5年向小客车业务投资30.8亿美元。这一扩张预计将对该国的橡胶加工油市场产生积极影响。

- 人们对工业和建筑施工期间电气接触、坠落物体、危险化学品和石油洩漏以及移动机械造成的伤害的工人安全意识的提高预计将对橡胶鞋的需求产生积极影响。在橡胶鞋的製造中,橡胶加工油的使用越来越多。因此,胶鞋需求的上升进一步提振了橡胶加工油市场。

- 由于上述因素,亚太地区橡胶加工油市场预计在研究期间将显着成长。

橡胶加工油产业概况

橡胶加工油市场较为分散。该市场的主要企业(排名不分先后)包括TotalEnergies、Chevron Corporation、Panama Petrochem Ltd、ORGKHIM Biochemical Holding、EaglePetrochem等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 轮胎和汽车零件需求增加

- 鞋类需求增加

- 其他的

- 抑制因素

- 原物料价格波动

- 其他阻碍因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 产品类别

- 芳香

- 石蜡基

- 环烷烃

- 目的

- 轮胎/汽车配件

- 鞋类

- 消费品

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太地区其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- APAR Industries

- Chevron Corporation

- CPC Corporation

- EaglePetrochem

- Exxon Mobil Corporation

- HF Sinclair Corporation

- LODHA Petro

- ORGKHIM Biochemical Holding

- Panama Petrochem Ltd

- Repsol

- Sterlite Lubricants

- TotalEnergies

- Witmans Industries Pvt. Ltd

第七章 市场机会及未来趋势

- 生物基橡胶加工油需求增加

- 其他机会

The Rubber Process Oils Market size is estimated at 3.62 Million tons in 2024, and is expected to reach 4.19 Million tons by 2029, growing at a CAGR of 2.93% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, increasing demand for tire and automotive components from the automobile industry is one of the major factors driving the growth of the market studied.

- On the flip side, volatility in raw material prices is expected to hinder the growth of the market.

- However, the increasing demand for bio-based rubber process oil is forecasted to offer various opportunities for the growth of the market over the forecast period.

- Asia-Pacific region represents the largest market and is also expected to be the fastest-growing market over the forecast period owing to the increasing consumption from countries such as China, India, and Japan.

Rubber Process Oil Market Trends

Growing Demand of Rubber Process Oil from Tire and Automobile Components

- Rubber process oils are used while mixing the rubber compounds. These products improve the dispersion of fillers and the flow property of the compound. Hence, it is considered to be the most important ingredient for the rubber-based industry.

- Due to enhanced mechanical properties, rubber process oils are used in the tire and other automotive components. In addition, improved braking efficiency and fuel consumption of the product are likely to further benefit its usage in the tire and automotive components.

- The rubber process oils enhance the rubber properties used in the production of tires. Rising population improved living standards and increased spending power are factors likely to boost the demand for automobiles globally. For instance, according to OICA, in 2022, the total number of passenger cars produced globally was 61.59 million units, which showed an increase of 8% compared to 2021 and 10% compared to 2020. Therefore, an increase in the production of passenger cars is expected to create an upside demand for the rubber process oil market in the forecast period.

- Moreover, in Germany, the automotive industry has been hampered by the shortage of semiconductors and a limited supply of raw materials. Similarly, other factors such as the implementation of the new Worldwide Harmonized Light-Duty Vehicles Test Procedure (WLTP) and US-China trade conflicts which decreased the international automotive demand, EU-28's new emission standard which mandates carmakers to achieve average CO2 emissions of 95 grams per kilometre across newly sold vehicles had negatively affected the production of passenger cars.

- However, in 2022 the automobile production in the country recovered gradually from semiconductor shortages. For instance, according to OICA, around 34,80,357 passenger cars were produced in Germany in 2022, which shows an increase of 12% compared to 2021. Therefore, increase in the production of passeger car segment is expected to create an upside demand for the rubber process oils market.

- Furthermore, the United States is the second-largest market for vehicle sales and production globally. For instance, according to OICA, in 2022, automobile production in the United States amounted to 1,00,60,339 units, which showed an increase of 10% compared to 2021. As a result, an increase in automobile production is expected to create an upside demand for rubber process oils market.

- Therefore, all such favorable trends and investments in the region are expected to drive the demand for rubber process oils market during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for rubber process oil during the forecast period. The rising demand for rubber process oil from tire and automobile components in developing countries like China, Japan, and India is expected to drive the demand for rubber process oil in this region.

- The largest producers of rubber process oil are located in the Asia-Pacific region. Some of the leading companies in the production of rubber process oil are Total, Chevron Intellectual Property LLC, Panama Petrochem Ltd, ORGKHIM Biochemical Holding, and Eagle Petrochem among others.

- The automobile industry in China is experiencing shifting trends as consumer preference for battery-powered electric vehicles rises. The expansion of China's automotive sector is expected to benefit the rubber process oil market. According to the International Organization of Motor Vehicle Manufacturers (OICA), China is the world's largest automobile producer, accounting for nearly 34% of global volume. In 2022, the country produced 2,70,20,615 units of automobiles, registering an increase of 24% compared to 2,61,21,712 units in 2021. Therefore, increasing in the production of automobiles is expected to create an upside demand for the rubber process oil market.

- In India, increasing regulations on vehicle emissions, advancement in vehicle safety, the introduction of driver-assist systems in vehicles, and rapidly growing logistics in the retail and e-commerce sectors, have been significantly driving the demand for new and advanced Light commercial vehicles (LCVs). For instance, accroding to OICA, in 2022, light commercial vehicle production in India amounted to 6,17,398 units, which showen an increase of 27% compared to 2021 and a recovery of 60% compared to 2020.

- Furthermore, increased investments and advancements in the automobile industry in India is expected to increase the consumption of rubber process oil market. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. This expansion is expected to have a positive impact on the rubber process oils market in the country.

- Rising awareness about the worker's safety from injuries due to electrical contacts, falling objects, spilling of harmful chemicals and oils, moving machinery, and others during industrial or construction work is likely to benefit the demand for rubber footwear. Rubber process oil is increasingly used in manufacturing footwear using rubber. Hence, the rising demand for rubber footwear further fuels the rubber process oils market.

- Owing to the above-mentioned factors, the market for rubber process oil in the Asia-Pacific region is projected to grow significantly during the study period.

Rubber Process Oil Industry Overview

The Rubber Process Oil Market is fragmented in nature. The major players in this market (not in a particular order) include TotalEnergies, Chevron Corporation, Panama Petrochem Ltd, ORGKHIM Biochemical Holding, and EaglePetrochem, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Tire and Automotive Components

- 4.1.2 Growing Demand for Footwear

- 4.1.3 Others

- 4.2 Restraints

- 4.2.1 Volatility in Raw Material Price

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Aromatic

- 5.1.2 Paraffinic

- 5.1.3 Naphthenic

- 5.2 Application

- 5.2.1 Tire and Automobile Components

- 5.2.2 Footwear

- 5.2.3 Consumer Goods

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 APAR Industries

- 6.4.2 Chevron Corporation

- 6.4.3 CPC Corporation

- 6.4.4 EaglePetrochem

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 HF Sinclair Corporation

- 6.4.7 LODHA Petro

- 6.4.8 ORGKHIM Biochemical Holding

- 6.4.9 Panama Petrochem Ltd

- 6.4.10 Repsol

- 6.4.11 Sterlite Lubricants

- 6.4.12 TotalEnergies

- 6.4.13 Witmans Industries Pvt. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand of Bio Based Rubber Processing Oil

- 7.2 Other Opportunities