|

市场调查报告书

商品编码

1406988

分子机器人:市场占有率分析、产业趋势/统计、成长预测,2024-2029Molecular Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

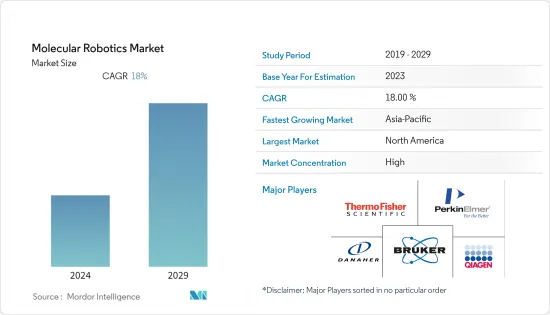

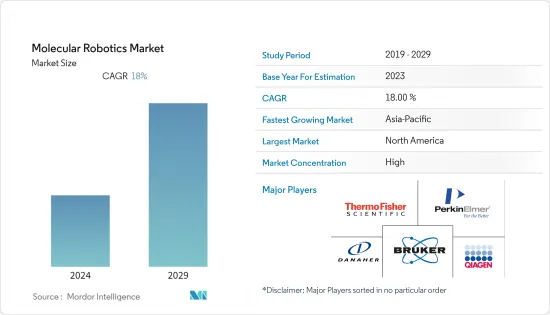

分子机器人市场预计在预测期内复合年增长率为 18%。

COVID-19 爆发后,所有市场都因供应链中断而受到重大影响。然而,寻找 COVID-19 感染潜在治疗方法的研发工作活性化。分子机器人研究和开发的需求量很大,因为改变分子可以提供更快、更聪明的治疗选择。为了找到更好的患者护理和治疗方法,已经进行了许多研究。 2021年8月发表在《英国医学杂誌》上的一篇论文指出,研究人员开发了一种机器人核酸萃取方法,用于高通量检测唾液样本中的SARS-CoV-2 RNA。此外,正在进行进一步的研究以寻找 COVID-19 的治疗方法。这些研究和研究正在创造对分子机器人的需求,并对目标市场产生积极影响。然而,由于活性化,市场目前正在稳步成长,并且预计未来几年将继续保持相同的趋势。

癌症和其他罕见疾病等慢性疾病的高盛行率以及药物开发中利用率的增加是分子机器人市场的主要驱动因素。例如,根据 2021 年乳癌概况介绍,英国每年约有 55,000 名女性和 370 名男性被诊断出罹患乳癌。到 2030 年,这一数字预计将增至 120 万。癌症发生率的增加导致对先进技术的需求增加。对分子机器人技术的需求正在增加,并且可以预测,因为它们可以读取、编辑和修改 DNA 和 RNA,创造新的结构来寻找癌症等疾病的治疗方法。预计在此期间市场将会成长。

如今,研究和开发不断增加,实验室自动化已成为维持平稳工作流程的必要条件。分子机器人采用先进技术设计,可最大程度地减少学习新软体和其他设备的压力,使科学家能够提高实验室的整体效率并加速下一代研究。 2022年7月,调查团队开发出一种新型DNA马达,可以感知和处理化学资讯。随着新研究创造出第一个基于 DNA 的电机,该电机将运算能力与燃烧燃料和朝着有目的的方向移动的能力结合在一起,小分子机器人技术的灵感正在飞速增长。预计这将在预测期内抓住需求并促进所研究市场的成长。

然而,这些分子机器人的市场开拓和设计成本高昂,预计将限制研究预测期内的市场成长。

分子机器人市场趋势

按应用领域分類的药物研发预计将在预测期内实现健康成长

分子奈米技术的快速发展为分子机器人等先进技术打开了大门。这项技术使用分子作为机器人的一部分。由于慢性病和罕见疾病的增加,对药物研发的需求不断增加。由于药物研发需要时间,研究人员现在专注于像机器人一样处理分子,并将分子机器人技术纳入药物研发平台。

根据 2021 年 2 月发表在 Springer Nature 分子机器人杂誌上的一项研究,DNA 奈米技术的进步正在增加对由生物分子製成的分子机器人的需求。同一消息来源还指出,这些分子机器人可以提供具有先进资讯处理能力的药物,也可以用于治疗治疗诊断学(用于治疗和诊断的术语)。因此,研发的扩大以及分子机器人在药物研发中的应用正在增加对分子机器人的需求,并有望支持该领域研究市场的成长。

应用生物分子机器人技术的药物研发发现领域的实验、临床试验和资金筹措的增加目前正在促进研究市场的成长。例如,2022年6月,Insilico Medical宣布完成6,000万美元的D轮资金筹措,投资方为具有生物製药和生命科学产业投资经验的全球投资者企业联合组织。这笔资金筹措的目的是投资推出一个由人工智慧驱动的药物研发机器人实验室,以建构具有所需功能的独特分子结构。

因此,研究机构和主要市场参与者的活动不断增加正在推动药物研发领域的成长。预计这将有助于预测期内研究市场的成长。

北美占据市场主要份额,预计在预测期内将成长

北美在分子机器人市场中占据主导地位,由于先进的机器人技术和製药领域的活性化,预计该地区的市场将成长。北美最近癌症和其他罕见疾病等慢性病的盛行率上升。北美,特别是美国正在进行研究工作,以发现更好、更先进的药物和治疗方法。

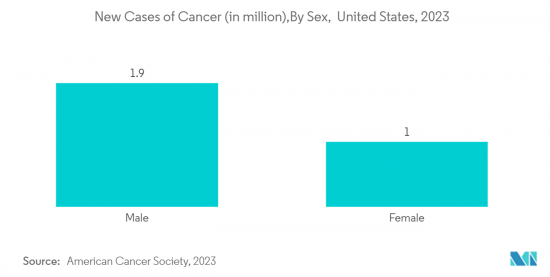

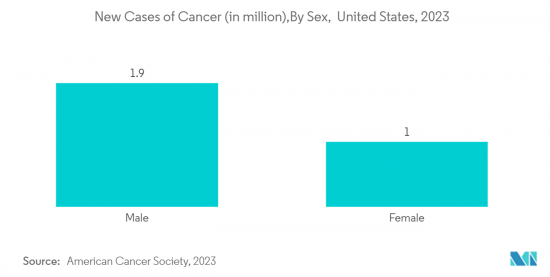

根据美国癌症协会2023年1月发布的《2023年癌症事实与数据》,预计2023年将有190万新癌症患者被诊断出来,其中288,300人被诊断为前列腺癌,其次是肺癌,预计238,340人被诊断为前列腺癌。人们患有乳腺癌,其中 305,590 名女性患有乳腺癌。此外,根据加拿大政府2022年5月发布的统计数据,2022年将有约233,900名加拿大人被诊断出患有癌症,其中前列腺癌预计仍将是最常诊断出的癌症。癌症病例促使美国研究机构与其他北美国家的研究机构合作。这项合作涉及寻找癌症的最佳治疗方法。分子机器人技术是该地区研究最多的癌症药物研发发现研究工具之一。

北美地区市场参与企业高度集中,这些公司推出的新产品也支持该地区的市场成长。大学积极参与药物研发研究和分子机器人技术也支持了研究市场的成长。例如,2021年11月,哈佛大学维斯仿生工程研究所与佛蒙特大学和塔夫茨大学一起宣布,以创造第一个活体机器人而闻名的研究团队宣布发现了一种科学的繁殖型态,为再生医学的发展带来了许多机会。预计该地区的先进研究和开发将在预测期内推动研究市场的成长。

分子机器人产业概述

分子机器人市场的竞争是温和的。目前主导该市场的公司包括丹纳赫公司(医疗器材有限责任公司)、布鲁克、赛默飞世尔科技、Qiagen、珀金埃尔默公司和 Zymergen 公司。这些大公司在产业中占有很大的份额。大多数公司专注于将技术先进的产品推向市场,以获得最大的市场占有率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 研发投入增加,机器人技术进步

- 越来越多地用于罕见疾病的药物开发

- 市场抑制因素

- 机器人设计与製造成本急剧上升

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 依产品类型

- 软体和耗材

- 装置

- 按用途

- 药物研发

- 基因研究

- 其他的

- 按最终用户

- 研究机构

- 製药和生物技术公司

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东/非洲

- GCC

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 公司概况及竞争形势

- 公司简介

- Bruker

- Danaher Corporation(Medical Devices, LLC.)

- Entos, Inc.

- Hudson Robotics

- Imina Technologies SA

- International Business Machines Corporation(IBM)

- Klocke Nanotechnik GmbH

- Labplan

- Nanorobotics Ltd.

- PerkinElmer Inc.

- Qiagen

- Thermo Fisher Scientific

- Zymergen Inc.

第七章 市场机会及未来趋势

The molecular robotics market is expected to witness a CAGR of 18% over the forecast period.

After the outbreak of COVID-19, all markets were significantly affected due to supply chain disruptions. However, research and development were increased to find potential treatments for the COVID-19 infection. The demand for research and development in molecular robotics has increased because it can enable fast and smart treatment options by changing molecules. Many research studies have been conducted to find better patient care and treatment options. In an article published in the British Medical Journal in August 2021, it was mentioned that researchers developed a robotic nucleic acid extraction method for high-throughput detection of SARS-CoV-2 RNA in saliva samples. More research and studies have also been done to find a cure for COVID-19. These research and studies have created a demand for molecular robots and have had a positive impact on the market under review. However, currently, the market is growing at a stable pace owing to rising research and development activities, and it is expected to witness a similar trend over the coming years.

The high prevalence of chronic diseases such as cancer and other rare diseases and increased use in drug development are the major driving factors for the molecular robotics market. For instance, according to the Breast Cancer Factsheet Now 2021, around 55,000 women and 370 men in the United Kingdom are diagnosed with breast cancer every year. This figure is expected to climb to 1.2 million by 2030. This rising incidence of cancer leads to increased demand for advanced technology. As molecular robots can read, edit, and alter DNA and RNA, which can create new structures to find a cure for cancer-like diseases, the demand for these molecular robots is increasing, which is expected to lead to the growth of the market during the forecast period.

As research and development have been on the rise lately, laboratory automation is becoming a need to maintain a smooth workflow. Molecular robots are designed using advanced technologies to minimize the pressure of learning new software and other equipment, helping scientists increase the overall efficiency of their laboratories and accelerate next-generation research. In July 2022, Researchers created new DNA motors that can sense and process chemical information, allowing them to respond quickly and mimic some fundamental properties of living cells. With new research producing the first DNA-based motors that combine computational power with the ability to burn fuel and move in an intentional direction, the inspiration for miniature molecular robots is rising exponentially. This is expected to gain demand and boost the growth of the studied market during the forecast period.

However, the high cost of development and design of these molecular robots is expected to restrain the growth of the market over the studied forecast period.

Molecular Robotics Market Trends

Drug Discovery by the Application Segment is Expected to Witness a Healthy Growth Over the Forecast Period

The rapid progress of molecular nanotechnology has opened the door to advanced technologies such as molecular robotics. This technique uses molecules as parts of robots. Drug discovery has gained demand due to the increasing incidence of chronic and rare diseases. Because drug discovery takes time, researchers are now focusing on using molecules as robots and introducing molecular robotics into the drug discovery platform.

According to the study published in Springer Nature's Molecular Robotics in February 2021, advances in DNA nanotechnology are increasing the demand for molecular robots made of biomolecules. The same source also stated that these molecular robots can carry drugs with sophisticated information processing capabilities and can also be used for theranostics (a term used for therapy and diagnosis). This growing R&D in drug discovery and the application of molecular robotics in drug discovery are increasing the demand for molecular robots, which is expected to boost the growth of the studied market in this segment.

The increasing number of experiments, clinical trials, and fundraisers in the field of drug discovery for the application of biomolecular robots is currently increasing the growth of the studied market. For instance, in June 2022, Insilico Medical announced the completion of a USD 60 million Series D fundraising from a syndicate of global investors with experience investing in the biopharmaceutical and life sciences industries. The funding aims to invest in the launch of an AI-powered drug discovery robotics laboratory and construct unique molecular structures with desired features.

Therefore, the increasing activities by the research organizations and the major market players are driving the growth of the drug discovery segment. This is expected to contribute to the studied market's growth over the forecast period.

North America Holds Significant Share in the Market and Expected to Grow in Forecast Period

North America is expected to dominate the molecular robotics market, and the market is expected to grow in the region due to advanced robotics technologies and increased research and developments in the pharmaceutical sector. The prevalence of chronic diseases, such as cancer and other rare diseases, has recently been increasing in North America. In North America, especially in the United States, research and studies are leaning toward finding better and more advanced drug and treatment options.

According to Cancer Facts and Figures 2023, published in January 2023 by the American Cancer Society, an estimated 1.9 million new cancer cases will be diagnosed in 2023, among which prostate cancer is estimated to be among 288,300, followed by 238.340 cases of lung cancer and 300,590 cases of female breast cancer. Furthermore, according to statistics published by the Government of Canada and released in May 2022, about 233,900 Canadians were diagnosed with cancer in 2022, and prostate cancer is expected to remain the most commonly diagnosed cancer. Cancer cases motivate research institutes in the United States to collaborate with research institutes in other North American countries. This collaboration is involved in finding the best cure for cancer. Molecular robots are one of the most studied tools for cancer drug discovery research in the region.

The presence of a high concentration of market players in the North American region and new product launches by these players are also driving the growth of the market in the region. Active participation of universities in drug research and molecular robotics is also supporting the growth of the studied market. For instance, in November 2021, Harvard University's Wyss Institute for Biologically Inspired Engineering, along with the University of Vermont and Tufts University, announced that a team of researchers known to have built the first living robot, the Xenobot, had discovered an entirely new form of biological reproduction of this living robot, which promises numerous opportunities for regenerative medicine development. The advanced research and developments in the region are anticipated to spur the growth of the studied market over the forecast period.

Molecular Robotics Industry Overview

The molecular robotics market is moderately competitive. Some of the companies currently dominating the market are Danaher Corporation (Medical Devices LLC), Bruker, Thermo Fisher Scientific, Qiagen, PerkinElmer Inc., and Zymergen Inc., among others. These major players hold a significant share in the industry. Most of the players focus on bringing technologically advanced products into the market to acquire the maximum market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing R&D Investment and Advancements in Robotics Technology

- 4.2.2 Increased Use in Drug Development for Rare Diseases

- 4.3 Market Restraints

- 4.3.1 High Cost of Moecular Robots Designing and Production

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - in USD Million)

- 5.1 By Product Type

- 5.1.1 Software and Consumables

- 5.1.2 Devices

- 5.2 By Application

- 5.2.1 Drug Discovery

- 5.2.2 Genetic Research

- 5.2.3 Others

- 5.3 By End-User

- 5.3.1 Research Laboratories

- 5.3.2 Pharma and Biotech Companies

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPANY PROFILES AND COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Bruker

- 6.1.2 Danaher Corporation (Medical Devices, LLC.)

- 6.1.3 Entos, Inc.

- 6.1.4 Hudson Robotics

- 6.1.5 Imina Technologies SA

- 6.1.6 International Business Machines Corporation (IBM)

- 6.1.7 Klocke Nanotechnik GmbH

- 6.1.8 Labplan

- 6.1.9 Nanorobotics Ltd.

- 6.1.10 PerkinElmer Inc.

- 6.1.11 Qiagen

- 6.1.12 Thermo Fisher Scientific

- 6.1.13 Zymergen Inc.