|

市场调查报告书

商品编码

1644895

日本 POS 终端:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Japan POS Terminals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

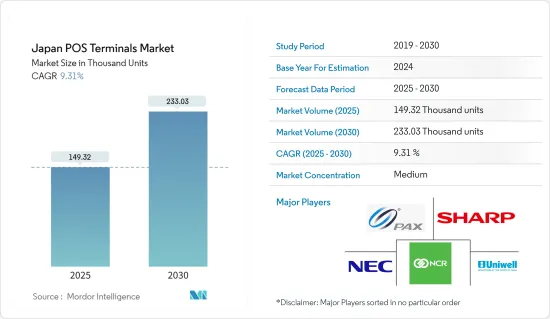

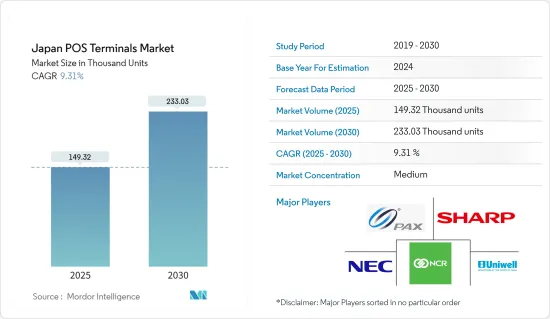

日本 POS 终端市场规模预计在 2025 年为 149,320 台,预计在 2030 年将达到 233,030 台,预测期(2025-2030 年)的复合年增长率为 9.31%。

由于投资收益的提高和访问的便利性,POS 终端市场在过去几年里实现了显着增长。 POS 系统促进了零售、酒店、运输和银行等一系列行业的核心业务交易,多年来,POS 系统对各种规模的企业都具有重要意义。

主要亮点

- 在当前的市场情况下,POS 终端系统已从以交易为导向的设备发展成为支援和整合公司 CRM 和其他金融解决方案的系统。在这种情况下,企业可以使用从 POS 终端收集的交易资料来提供业务洞察。

- 供应商一直支持行动付款的持续发展,尤其是智慧型手机的二维码付款。同样,生态系统的其他领域也取得了进展。无现金计划取得了重大进展,包括政府资助的生物识别基础设施的建立和基于EMV的非接触式付款(在日本称为NFC Pay)的日益普及。预计这一趋势将成为日本 POS 终端普及的主要催化剂。

- 现代 POS 终端随着时间的推移减少了设置、部署、维护和电力消耗成本,从而降低了整体拥有成本。各种供应商都提供模组化 POS 终端,具有触控萤幕显示器和低功耗等功能,有助于降低整体拥有成本。Sharp Corporation电子和 NEC 等公司提供配有触控萤幕显示器和强大处理器的固定 POS 解决方案,以帮助改善业务并减少故障。此外,Aures POS 设备配备无风扇温度控制,减少了终端内部活动部件的数量。

- 经济的日益数位化和 POS 平台在各个领域的日益广泛应用可能会推动 POS 终端市场向前发展。人们对 POS 显示器有效性的认识不断提高、零售连锁店数量的增加以及近距离场通讯系统的使用不断增加,可能会推动市场成长。

- 签帐金融卡、电子钱包和 Pasmo 和 Suica 等智慧付款等数位和电子付款技术的使用正在年轻人群和主要都市区广泛普及。它们为消费者提供了一种方便有效的交易方式,无需实体货币或信用卡。此外,它非常安全并允许用户监控他们的支出。日本交通运输业者推出了 Suica 和 Pasmo IC 卡,可用于交通、自动贩卖机和商店购物。

- 此外,日本政府也积极采取倡议,为日本无现金付款的发展营造支持氛围,实施了“无现金愿景”,旨在到2025年将无现金付款提高到40%,长期内提高到80%。我们也引进了奖励制度,2019 年无现金付款的采用率增加。由于消费者在交易过程中避免接触,疫情也促进了非现金支付的发展。

- 同样,2022年1月,万事达卡宣布与和歌山县建立战略伙伴关係,利用其全球标准付款网络促进旅游业的发展,并加速该县中小企业的无现金交易基础设施和数位转型。

- 此次合作将推动推出整合式IC卡和智慧型手机非接触式付款的全球标准无现金付款系统。此外,两家公司也将利用虚拟卡等技术为该地区的企业提供高效率的付款流程。

日本POS终端市场趋势

行动 POS付款预计将实现市场大幅成长

- 零售、旅游、电子商务等行业对具有发票管理、库存管理、影像扫描器等便利功能的行动POS终端的需求日益增长,预计将推动POS终端市场的发展。此外,随着签帐金融卡和信用卡技术的发展,无需输入密码即可快速完成交易的非接触式付款变得越来越普遍,从而推动了日本POS终端市场的需求。

- Android智慧付款POS比传统付款终端具有许多优势,包括易于使用、灵活性和更短的交易时间。它还支援多种付款方式,包括二维码、数位钱包、NFC 和可专门为商家设计和客製化的应用程序,使其成为各种规模企业的理想解决方案。因此,预计预测期内行动 POS付款将占据更大的市场份额。

- 智慧型手机普及率的提高、中小型企业和微企业数量的巨大增长、以及由于各种政府和银行卡受理计划而导致的卡采用率的不断增长,正在推动日本 POS 市场的发展。

- 日本内务部预计,到2022年,约有93.4%的20-29岁人群、94.3%的30-39岁人群和92.2%的40-49岁人群将使用智慧型手机上网。随着智慧型手机的普及,日本的行动网路使用量大幅成长。智慧型手机已成为最受欢迎的网路连线装置。行动互联网连接也用于付款(NFC 技术),推动了日本 POS 终端市场的发展。

- 个人和企业越来越多地采用数位付款方式可能会支持市场成长。此外,近年来,日本政府一直致力于建立无现金社会,以提高金融交易的便利性和效率,并降低处理现金相关的成本。

- 该地区的供应商正在透过推出新的解决方案来扩大其产品供应,从而推动市场成长。例如,2023 年 2 月,Ingenico 宣布在日本推出 Android 智慧 POS 和付款创新。 Android AXIUM DX8000 提供一流的店内数位体验,同时优化安全性、生产力和效能。 DX8000 支援多种付款方式,包括 EMV 晶片和 PIN、磁条、非接触式、二维码扫描器和数位钱包。

零售业可望强劲成长

- 各个地区的零售店数量不断增加,他们透过大幅折扣和其他服务吸引顾客,但客户维繫是市场维持的重大挑战。这种竞争推动了创新经营模式的需要,以避免陷入价格战,并平衡新技术的投资和收益。

- POS 终端机提供的销售报告、库存和财务管理以及客户分析功能可以帮助零售商克服客户维繫问题。因此,客户维繫的需求和日益激烈的行业竞争正在推动 POS 终端的成长。

- 市场上已经出现了本地零售商和供应商之间的多种伙伴关係,以实现更有效的销售并改善数位转型和结帐体验,从而创造了对 POS 系统的需求。例如,2022 年 8 月,ACI Worldwide 宣布与 CARDNET 建立策略合作伙伴关係,以实现日本数位付款的现代化。新的基础设施将使公司能够满足日益增长的需求,并为客户提供覆盖国内和国际市场的更复杂的数位付款解决方案和服务。

- 该国的供应商为基于餐厅的 POS 系统提供了有效的解决方案。例如,2023 年 6 月, Oracle宣布推出 Oracle MICROS Workstation 8 系列。 Workstation 8系列提供多种设定选项。其中包括一个用于低调设置的支架,有助于消除客人和员工之间的障碍,以及一个带有加重底座的垂直支架,用于流线型檯面设计,隐藏电缆,达到整洁的美感。餐厅可以单独部署工作站,也可以利用周边设备扩展模组 (PEM),它提供现金抽屉、秤和扫描器等选项。这将推动餐饮业 POS 终端的成长。

日本POS终端产业概况

日本的 POS 终端市场竞争适中,有相当数量的区域参与者。公司正在利用策略合作倡议和收购来增加市场占有率和盈利。

2023 年 8 月,NCR 公司宣布与领先的企业技术供应商 Autobooks 建立策略合作伙伴关係,将复杂的数位发票、支付接受度和会计功能整合到 NCR 数位银行中。该合作伙伴关係将使金融机构能够向中小型企业提供专门的现金管理解决方案和全面的整合付款套件。

2023 年 3 月,Ingenico 宣布收购领先的纯软体销售点解决方案 (SoftPoS) 供应商 Phos,扩大其透过智慧型手机接受商家支付的服务。 SoftPoS 将平板电脑和智慧型手机变成付款终端,同时遵守最高的付款安全标准。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 日本POS终端市场规模估算

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 行动 POS付款预计将实现显着的市场成长

- 预计 POS 投资增加和付款产业数位化将推动市场成长

- 由于信用卡和签帐金融卡用户的增加,市场预计将大幅成长。

- 市场挑战

- 由于使用重要资讯而产生的安全问题

- 市场机会

- 对无现金经济的期望

- POS终端主要法规及申诉标准

- 关于非接触式付款日益普及及其对产业影响的说明

- 重点案例分析

第六章 市场细分

- 按类型

- 固定POS系统

- 行动/可携式POS 系统

- 按最终用户产业

- 零售

- 饭店业

- 卫生保健

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- NEC Corporation

- NCR Corporation

- Pax Japan

- Sharp Electronics

- Uniwell Corporation

- Fujitsu Japan Limited

- Casio Computer Co. Ltd.

- Samsung Electronics Co. Ltd.

- Ingenico Japan Co. Ltd.

- Vesca Co., Ltd.

- Micros POS Systems(Oracle)

- 主要企业市场占有率

第八章投资分析

第九章:未来市场展望

The Japan POS Terminals Market size is estimated at 149.32 thousand units in 2025, and is expected to reach 233.03 thousand units by 2030, at a CAGR of 9.31% during the forecast period (2025-2030).

The POS terminal market has grown significantly over the past few years, owing to its ability to offer an increased return on investment and ease of access. POS systems that facilitate transactions from the central component of businesses across industries, like retail, hospitality, transportation, and banking, have gained importance in companies of small and big sizes over the years.

Key Highlights

- POS terminal systems have grown from transaction-oriented devices to systems that support and integrate into firms' CRM and other financial solutions in the present market scenario. Companies could use collected transactional data from POS terminals to provide business insight in this case.

- Vendors have supported consistent development in mobile payments, particularly smartphone-enabled QR-code payments. Similarly, progress has been made in other sectors of the ecosystem. Cashless projects are making tremendous progress, with the establishment of a government-funded biometrics infrastructure and a rise in the use of EMV-based contactless payments (or NFC Pay as it is known in Japan). Such trends are expected to act as major catalysts for the increase in the adoption of POS terminals in the country.

- Modern POS terminals reduce the cost of setup, deployment, maintenance, and power consumption over time, leading to the total cost of ownership. Various vendors offer modular POS terminals with attributes such as touchscreen displays and low power consumption, which helps in reducing the overall cost of ownership. Companies such as Sharp Electronics, NEC Corporation, and others offer fixed POS solutions with touchscreen displays and robust processors that help improve operations and reduce failures. In addition, the POS offered by Aures comes with fanless temperature control to reduce the number of moving parts in a terminal.

- The expanding digitization of the economy and the increasing application of POS platforms across sectors will drive the POS Terminals market forward. Growing awareness of the effectiveness of POS displays, an increase in retail chains, and the increasing usage of near-field communication-enabled systems are all likely to help the market's growth.

- The utilization of digital and electronic payment techniques, like debit and credit cards, e-wallets, and smart cards, such as Pasmo and Suica, is extensively growing among younger buyers and in major urban areas. They provide a convenient and effective method for consumers to conduct transactions without requiring physical currency or a credit card. Additionally, they are extremely safe and enable users to monitor their expenditures. Japan's transportation enterprises created Suica and Pasmo smart cards, which can be utilized for transportation, automated vending machines, and in-store acquisitions.

- Moreover, the government of Japan has been taking proactive initiative and striving to establish a supportive atmosphere for the growth of cashless payments in Japan by implementing a "Cashless Vision" with the aim of raising cashless transactions to 40% by 2025 and 80% by the long run. They have also introduced a reward system, which increased cashless payments adoption in 2019. The pandemic also boosted non-cash payments as consumers avoid contact during transactions.

- Similarly, in January 2022, Mastercard announced a strategic partnership with Wakayama Prefecture to leverage its global standard payment network to boost the development of the tourism sector and accelerate the cashless transaction infrastructure and digital transformation for small and medium businesses in the prefecture.

- This partnership will encourage the adoption of global standard cashless payment systems, which involve the integration of contactless payments using IC cards and smartphones. Moreover, both parties will promote effective payment procedures at businesses in the region through the utilization of technologies like virtual cards.

Japan POS Terminals Market Trends

Mobile POS Payments is Expected to Witness Significant Growth in the Market

- The growing need for mobile POS terminals with convenience features like invoice management, inventory management, and image scanners across industry verticals, including retail, tourism, and e-commerce, will push the POS terminal market forward. Furthermore, as debit and credit card technology evolved, contactless payments became popular for completing a rapid transaction without inputting a PIN, driving up demand for the POS terminal market in Japan.

- Android Smart POS offers various advantages over traditional payment terminals, such as user-friendliness, greater flexibility, and faster transaction times. It can also provide access to accept a diverse range of payments such as QR codes, digital wallets, NFC, and apps that can be designed and customized specifically for the merchant, making them the ideal solution for all sizes of businesses. As a result, mobile POS payments are projected to further acquire a portion of the market in the forecasted time period.

- Growth in smartphone penetration, a large base of SMEs and micro-merchants, and an expansion of card user base due to different government and bank card acceptance programs are boosting the Japan POS market.

- According to Japan's Ministry of Internal Affairs and Communications, in 2022, approximately 93.4% of people aged 20 to 29 years old, 94.3% (30 to 39 years old), and 92.2% (40 to 49 years old) used smartphones to access the internet. Because of the adoption of smartphones, mobile internet usage has grown significantly in Japan. Smartphones have become the most popular internet access device. Mobile internet connections are also used for payment(NFC technology), propelling the POS terminal market in Japan forward.

- The increasing number of individuals and businesses embracing digital payment options will support market growth. Furthermore, in recent years, the government of Japan has also taken initiatives to push toward a cashless society to improve the convenience and efficiency of financial transactions and reduce the costs linked with handling cash.

- The vendors in this region are expanding their product line by launching new solutions and promoting market growth. For instance, in February 2023, Ingenico announced the introduction of Android Smart POS and payment innovation in Japan. Android AXIUM DX8000 offers a best-in-class digital experience in-store while optimizing security, productivity, and performance. The DX8000 is equipped with EMV Chip & PIN, magstripe, contactless, QR-code scanner, and digital wallets to accept various payment methods.

The Retail Segment is Expected to Grow Significantly

- The increasing number of retail stores across regions attract customers due to large discounts and other services; however, customer retention becomes the major challenge for them to sustain in the market. This competition increases the need to reinvent their business models to keep away from the competition concerning price and find the balance between investing in new technologies and revenue.

- The sales reporting, inventory and financial management, and customer analytics features that POS terminals provide assist retailers in overcoming the issues related to customer retention. Hence, the need for customer retention and competition growth in the industry promotes the growth of POS terminals.

- The market is witnessing several partnerships between retail stores and vendors in the region to deliver more effective sales and improve digital transformation and the checkout experience, which creates the demand for POS systems. For instance, in August 2022, ACI Worldwide announced a strategic partnership with CARDNET to modernize digital payments in Japan. The new infrastructure will allow the company to fulfill increasing demand and provide its customers with more sophisticated digital payment solutions and services covering both Japan's domestic and international markets.

- The vendors in this country are providing effective solutions for Restaurant-based POS systems. For instance, in June 2023, Oracle announced the launch of the Oracle MICROS Workstation 8 series. The Workstation 8 Series features multiple configuration options. This includes a mount for a low-profile setup that helps remove any barriers between guests and staff or a vertical stand with a weighted base for a streamlined countertop design that conceals cabling for a clean aesthetic. Restaurants can implement a workstation on its own or leverage the Peripheral Expansion Module (PEM), which provides options for a cash drawer, scale, or scanner. This promotes the growth of the POS terminals in the Restaurant division.

Japan POS Terminals Industry Overview

The Japan POS Terminal Market is moderately competitive, with a considerable number of regional players. The companies are leveraging strategic collaborative initiatives and acquisitions to increase market share and profitability.

In August 2023, NCR Corporation announced a strategic partnership with Autobooks, a leading enterprise technology provider, to integrate sophisticated digital invoicing, payment acceptance, and accounting features into NCR Digital Banking. The partnership will allow financial institutions to provide cash management solutions and a comprehensive, integrated payment suite built specifically for small businesses.

In March 2023, Ingenico announced the acquisition of Phos, a leading provider of software-only Point of Sale Solutions (SoftPoS), to extend its offer for merchant payment acceptance via smartphone. SoftPoS will allow tablets or smartphones to become payment terminals while adhering to the highest payment security standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Sizing and Estimates of Japan POS Terminals Market

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Mobile POS Payments is Expected to Witness Significant Growth in the Market

- 5.1.2 Growing Investments in POS and Digitalization in the Payment Industry are Expected to Boost the Market Growth

- 5.1.3 Increase in Credit & Debit Card Users Expects Significant Growth in the Market

- 5.2 Market Challenges

- 5.2.1 Security Concerns Owing to the Use of Critical Information

- 5.3 Market Opportunities

- 5.3.1 Anticipating a Cashless Economy

- 5.4 Key Regulations and Complaince Standards of PoS Terminals

- 5.5 Commentary on the rising use of contactless payment and its impact on the industry

- 5.6 Analysis of Major Case Studies

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Fixed Point-of-sale Systems

- 6.1.2 Mobile/Portable Point-of-sale Systems

- 6.2 By End-User Industry

- 6.2.1 Retail

- 6.2.2 Hospitality

- 6.2.3 Healthcare

- 6.2.4 Other End-User Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NEC Corporation

- 7.1.2 NCR Corporation

- 7.1.3 Pax Japan

- 7.1.4 Sharp Electronics

- 7.1.5 Uniwell Corporation

- 7.1.6 Fujitsu Japan Limited

- 7.1.7 Casio Computer Co. Ltd.

- 7.1.8 Samsung Electronics Co. Ltd.

- 7.1.9 Ingenico Japan Co. Ltd.

- 7.1.10 Vesca Co., Ltd.

- 7.1.11 Micros POS Systems (Oracle)

- 7.2 Market Share of Key Players