|

市场调查报告书

商品编码

1408491

日本资料中心冷却:市场占有率分析、产业趋势与统计、2024-2030 年成长预测Japan Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

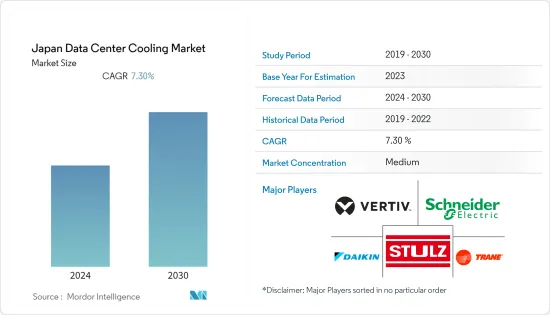

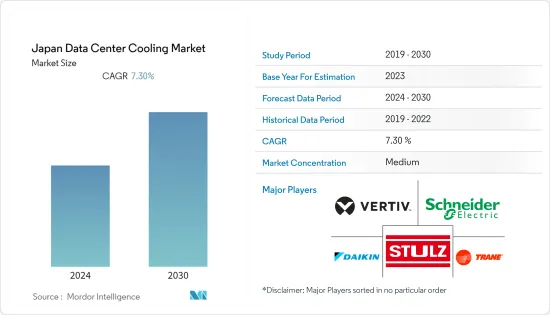

上年度,日本资料中心冷却市场的市场规模达到 6.702 亿美元,预计在预测期内复合年增长率为 7.3%。

主要亮点

- 中小企业对云端运算的需求不断增长、政府有关资料安全的法规以及国内企业投资的增加是推动该国和地区资料中心需求的关键因素。

- 日本资料中心市场未来IT负载容量预计到2029年将达到2,100MW。到 2029 年,日本的占地面积预计将增加到 10,000 平方英尺。

- 预计到 2029 年,日本已安装的机架总数将达到 51.2 万个。到 2029 年,预计机架数量最多的地区将是大阪和东京。全年气温通常在 2°C 至 30°C 之间波动,很少低于 -1°C 或超过 0.5°C。

- 有近32条海底电缆系统连接日本,其中许多正在建设中。

日本资料中心冷却市场趋势

液基冷却正在蓬勃发展

- 技术进步使得液体冷却更易于维护、更具可扩展性且更经济实惠,在热带气候地区减少了 15% 以上的资料冷却消费量,在绿色地区减少了 80% 以上。用于液体冷却的能量可以重新用于加热建筑物和水,先进的人造冷媒可以有效减少空调的碳排放。

- 一些日本公司一年中至少有几个月使用雪作为冷媒。 资料 Dock Co., Ltd. 总部位于日本北部海岸的新舄县,利用融雪剂和室外冷空气冷却其位于长冈市的伺服器。

- 日本资料中心供应商 KDDI 和 NTT DATA 正在探索浸入式技术,以显着减少冷却伺服器硬体的能源浪费。 KDDI 的现场测试表明,与传统风冷系统相比,温度控制期间的功耗惊人地降低了 94%。 KDDI 表示,虽然 IT 设备通常被认为是耗电最多的,但据说资料中心总耗电量的大约一半用于冷却。

- 直接液体冷却 (DLC) 解决方案可达到 1.02 至 1.03 的部分电源使用效率 (PUE) 值,甚至比最先进的空气冷却系统的效率也高出一个位数的差异。然而,值得注意的是,PUE 并不占 DLC 能源效率效益的大部分。在传统伺服器设定中,风扇负责伺服器机架内的电力消耗,且此功耗会计入 PUE 运算的 IT 功耗部分。这些风扇被认为是整个资料中心能耗的一个组成部分。

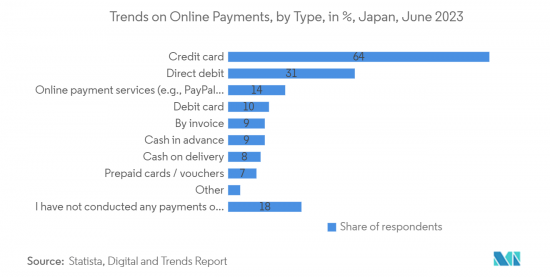

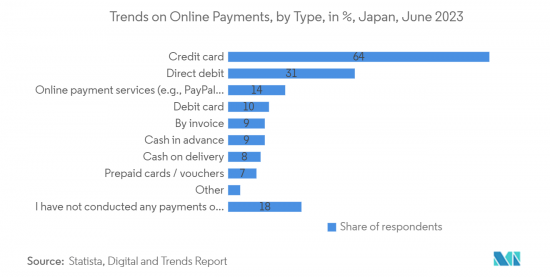

- 日本是三大电子商务市场之一。日本是三大电子商务市场之一,超过英国但落后美国。日本的电子商务市场主要是由高科技网路基础设施支援的高网路普及所推动的。行动商务正在经历显着扩张。预计到 2022 年,行动销售额将超过整个 B2C 电子商务市场。截至2021年,日本行动商务市场规模约4.9兆日圆。过去 10 年增长了一倍多。此类案例解决了对主机代管的主要需求,以及对改善冷却服务不断增长的需求。

IT/通讯是最大的部分

- 日本是索尼、松下、富士通、NEC 和东芝等主要 ICT 公司的所在地,并且在日本作为主要 ICT 中心的扩张中继续发挥着重要作用。此外,该国众多现代化和扩建计划的有序开拓以及政府为维持品质和先进基础设施而增加的支出也支持了市场成长。

- E-Japan策略的快速发展,重点是开拓地方电子政府计划,包括公民参与、自我评估和线上政府服务回馈,可能会推动日本ICT市场的未来成长。

- 日本政府正在推动加速私营部门数位转型并支持新兴中小企业的措施。 2021年,由日本经济产业省和内务部主导的日本政府发布了促进组织内部数位转型的指导方针,特别是针对中小企业。同样,同年发布了部署人工智慧、网路安全和安全云端服务的指南。

- 2022 年 11 月,数位基础设施供应商 Equinix 宣布将投资 1.15 亿美元建造新资料中心,以扩大其在日本的数位基础设施足迹。这个新资料中心将增强该公司与全球网路和云端服务供应商的连接,从而扩大和加强日本的数位经济。

- 2022年6月,日本政府宣布将在年终前为99%的人口部署无线网路。促进数位化的基本政策和海底电缆计划于年终在日本全国完成。

日本资料中心冷却产业概况

日本资料中心冷却市场竞争适中,并且最近取得了进展。目前,少数大公司在市场上占据主导地位,包括Stulz GmbH、施耐德电气、Vertiv Group Corp.、Daikin Industries Ltd.和Trane Inc.。

2023 年 3 月,总部位于汉堡的空调公司 STULZ 发布了关于其行业领先的 Cyberair 3PRO DX 系列的重要公告。据透露,同系列的某些机组可与全球暖化潜势 (GWP) 较低的冷媒 R513A 相容。这项突破性的发展凸显了该公司对为资料中心提供最永续的空调系统的持续承诺。此外,世图兹正在扩大产品系列,纳入 R513A 冷媒的使用。

2022年2月,技嘉发表了一款基于AMD EPYC和Nvidia A100技术的开创性高效能运算伺服器。这些伺服器配备了 CoolIT 的直接液体冷却系统。新机器配备一或两个 AMD EPYC 7003 系列「Milan」处理器,拥有多达 128 个核心和四个或八个 Nvidia A100 80GB SXM4 模组。 CoolIT 以其独特的直接液冷系统而闻名,可分别冷却 CPU 和 GPU 以优化效能。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 区域内IT基础设施的发展

- 生态资料中心的出现

- 市场抑制因素

- 成本、调适要求、停电

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 影响评估

第五章市场区隔

- 冷却技术

- 风冷

- 液体冷却

- 蒸发冷却

- 最终用户

- 资讯科技/通讯

- BFSI

- 政府机关

- 媒体与娱乐

- 其他最终用户

第六章 竞争形势

- 公司简介

- Vertiv Co.

- Schneider Electric SE

- STULZ GMBH

- Daikin Industries Ltd

- Trane Inc.

- Johnson Controls International PLC

- Mitsubishi Electric Corporation

- RITTAL Electro-Mechanical Technology Co. Ltd(RITTAL GMBH & CO. KG)

- Nortek Air Solutions

- Munters Air Treatment Equipment(Beijing)Co. Ltd

- CoolIT Systems Inc.

- Asetek AS

- Wakefield-Vette Inc.

第七章 投资分析

第八章 市场机会及未来趋势

The Japan data center rack market reached a value of USD 670.2 million in the previous year, and it is further projected to register a CAGR of 7.3% during the forecast period.

Key Highlights

- The increasing demand for cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in the country/region.

- The upcoming IT load capacity of the Japan data center market is expected to reach 2100 MW by 2029. The country's construction of raised floor area is expected to increase to 10K sq. ft by 2029.

- The country's total number of racks to be installed is expected to reach 512K units by 2029. Osaka and Tokyo are expected to house the maximum number of racks by 2029. Throughout the year, temperatures typically fluctuate between 2°C and 30°C, rarely dropping below -1°C or above 0.5°C.

- There are close to 32 submarine cable systems connecting Japan, and many are under construction.

Japan Data Center Cooling Market Trends

Liquid-based Cooling is The Fastest Growing Segment

- Technological advances have made liquid cooling easier to maintain, more scalable, and more affordable, reducing data center liquid consumption by more than 15% in tropical climates and by 80% in greener areas. The energy used for liquid cooling can be recycled to heat buildings and water, and advanced artificial refrigerants can effectively reduce the carbon footprint of air conditioners.

- Some Japanese companies already use snow as a coolant for at least several months of the year. Based in Niigata prefecture on Japan's north coast, DataDock Inc. cools its servers in Nagaoka City with snowmelt and cold outside air.

- Japanese data center providers KDDI and NTT DATA are researching immersion technology to significantly reduce energy waste in cooling server hardware. In KDDI's field test, we achieved an astounding result of reducing power consumption during temperature control by 94% compared to conventional air cooling systems. KDDI said IT equipment is often thought of as the biggest consumer of power, but about half of the total power consumption in data centers is used for cooling.

- Direct liquid cooling (DLC) solutions can achieve partial power usage effectiveness (PUE) values ranging from 1.02 to 1.03, surpassing the efficiency of even the most advanced air cooling systems by a low single-digit margin. It is important to note, however, that PUE does not account for a significant portion of the energy efficiency improvements attributed to DLC. In traditional server setups, fans are responsible for power consumption within the server rack, and this power usage is factored into the IT power section of the PUE calculation. These fans are considered an integral part of the data center's overall energy consumption.

- Japan is one of the three largest markets for e-commerce. It is placed ahead of the United Kingdom but behind the United States. The e-commerce market in Japan is primarily driven by high internet penetration, secured by the Hi-tech network infrastructure. M-commerce is experiencing significant expansions. Mobile sales were projected to outpace the overall B2C e-commerce market until 2022. The mobile commerce market size in Japan stood at around JPY 4.9 trillion as of 2021. It has more than doubled over the last decade. Such instances cater to the major demand for colocation with the increasing demand for improved cooling services.

IT & Telecommunication is the Largest Segment

- Japan is home to major ICT organizations such as Sony, Panasonic, Fujitsu, NEC, and Toshiba, which continue to play a key role in the country's expansion as a major center for ICT. In addition, the orderly development of numerous modernization and expansion projects in the country, along with increasing government spending on maintaining high-quality and advanced infrastructure, are also driving the growth of the market.

- The rapid growth of the E-Japan strategy, which focuses on the development of local e-government projects involving citizen participation, self-evaluation, and feedback on online government services, will drive future growth of the Japanese ICT market.

- The Japanese government is making efforts to accelerate the digital transformation of the private sector and support emerging SMEs. In 2021, the Japanese government, led by the Ministry of Economy, Trade and Industry and the Ministry of Internal Affairs and Communications, published guidelines for promoting digital transformation within organizations, especially targeting small and medium-sized enterprises. Similarly, guidelines on implementing AI, cybersecurity, and secure cloud services were also published in the same year.

- In November 2022, digital infrastructure provider Equinix announced it would expand its digital infrastructure footprint in Japan with a USD 115 million investment in new data centers. The new data center will enhance corporate connectivity with global networks and cloud service providers, enabling them to scale and strengthen Japan's growing digital economy.

- In June 2022, the Japanese government announced that it would deploy wireless networks to 99% of the population by the end of 2030. Its basic policy to promote digitalization and submarine cables is scheduled to be completed throughout Japan by the end of 2025.

Japan Data Center Cooling Industry Overview

The Japan data center cooling market is moderately competitive and has recently gained a competitive edge. Currently, a few major players, including Stulz GmbH, Schneider Electric SE, Vertiv Group Corp., Daikin Industries Ltd, and Trane Inc., hold a dominant position in the market.

In March 2023, STULZ, a Hamburg-based mission-critical air conditioning company, made a significant announcement regarding its industry-leading CyberAir 3PRO DX series. They revealed that some units within this series are now compatible with the low global warming potential (GWP) refrigerant R513A. This groundbreaking development underscores the company's ongoing commitment to delivering the most sustainable air conditioning systems for data centers. Additionally, STULZ has expanded its product portfolio to incorporate the use of R513A refrigerant.

In February 2022, Gigabyte introduced pioneering high-performance computing servers based on AMD EPYC and Nvidia A100 technology. These servers are equipped with CoolIT's direct liquid cooling system. The new machines feature 1 or 2 AMD EPYC 7003 series 'Milan' processors, boasting up to 128 cores, as well as 4 or 8 Nvidia A100 80GB SXM4 modules. CoolIT, known for its unique direct liquid cooling system, ensures separate cooling for the CPU and GPU, optimizing performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Development of IT Infrastructure in the Region

- 4.2.2 Emergence of Green Data Centers

- 4.3 Market Restraints

- 4.3.1 Costs, Adaptability Requirements, and Power Outages

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 Cooling Technology

- 5.1.1 Air-based Cooling

- 5.1.2 Liquid-based Cooling

- 5.1.3 Evaporative Cooling

- 5.2 End-User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Vertiv Co.

- 6.1.2 Schneider Electric SE

- 6.1.3 STULZ GMBH

- 6.1.4 Daikin Industries Ltd

- 6.1.5 Trane Inc.

- 6.1.6 Johnson Controls International PLC

- 6.1.7 Mitsubishi Electric Corporation

- 6.1.8 RITTAL Electro-Mechanical Technology Co. Ltd (RITTAL GMBH & CO. KG)

- 6.1.9 Nortek Air Solutions

- 6.1.10 Munters Air Treatment Equipment (Beijing) Co. Ltd

- 6.1.11 CoolIT Systems Inc.

- 6.1.12 Asetek AS

- 6.1.13 Wakefield-Vette Inc.