|

市场调查报告书

商品编码

1408741

日本DRAM:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Japan DRAM - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

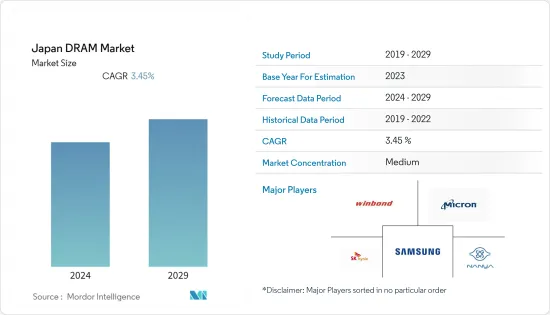

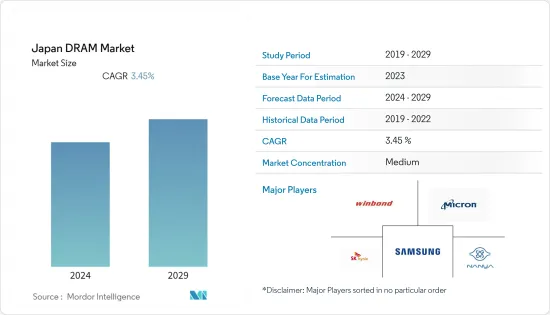

日本DRAM市场规模为33.5亿美元,预计在预测期内将达到39.7亿美元,复合年增长率为3.45%。

主要亮点

- 智慧型手机、个人电脑和笔记型电脑在日本越来越普及,并且正在开发 DRAM 以缩短启动时间并增加记忆体容量以实现高效能。

- 根据日本智慧型手机安全协会(JSSEC)统计,2022年7月国内行动电话出货为142万台,2022年5月为68万台。此外,与前几代相比,支援 5G 的智慧型手机需要更多记忆体。因此,5G实施的推动将有助于市场成长。

- 相机、平板电脑、感测器、工业设备、医疗设备和汽车系统等消费性产品依靠处理器嵌入的 DRAM 快闪记忆体来储存资料和可执行程式码。然而,资料中心使用DRAM闪存,它可以近乎即时地回应读写请求,且资料传输速度很快。随着人工智慧和机器学习应用大规模资料处理需求的增加,DRAM 储存趋势可能会继续发展。

- 技术进步、人口成长、人均收入增加以及高速网路的便利性正在推动智慧型手机和先进家用电器在日本的普及。因此,具有高处理能力和增强储存能力的智慧型手机、平板电脑、笔记型电脑等的产量正在增加,预计将推动日本的动态随机存取记忆体(DRAM)市场。

- 总体而言,资料中心和汽车产业的崛起预计将推动日本动态随机存取记忆体(DRAM)市场的庞大需求。预计消费电子产业的需求在预测期内将保持稳定。

- 随着游戏、汽车、医疗保健、通讯以及更重要的 5G 和人工智慧 (AI) 等驱动因素的记忆体需求不断增加,各公司正在专注于新型创新 DRAM 产品。 2022年6月,美光科技宣布计画在其广岛工厂大量生产先进的DRAM记忆体晶片。该公司将在日本生产「1-β」记忆体晶片。

- 此外,美光宣布将于 2022 年 11 月在广岛工厂开始量产新型高容量、高功率1-β 动态随机存取记忆体(DRAM)晶片。该公司还从日本政府获得了 3.2 亿美元用于製造先进晶片。

日本DRAM市场趋势

汽车业占有较大份额

- 电动车、SUV 和轻型商用车需求的不断增长预计将推动日本动态随机存取记忆体 (DRAM) 市场的需求。日本政府以本田、丰田、SUZUKI、三菱、日产等各种国产品牌为主。

- 随着电动车的普及和资讯娱乐系统的快速发展,半导体汽车平台正面临模式转移。高清地图、视讯串流和 3D 游戏等资讯娱乐系统的先进功能,加上 ADAS 需求的激增,将在预测期内推动整个汽车行业对大容量、高性能固态硬碟 (SSD) 的需求…预计将显着推动图形DRAM 的需求。

- 在预测期内,汽车产业对日本动态随机存取记忆体(DRAM)市场的需求很高。推动需求的关键因素之一是人们越来越关注包含 5G 基础设施的自动驾驶技术。例如,特斯拉采用了Nvidia的CPU和GPU解决方案,并推动纳入GDDR5 DRAM产品。

- 此外,汽车产业中物联网 (IoT) 的出现已成为多功能应用的热点。从联网汽车到自动交通系统,物联网在汽车市场中的作用预计将为日本 DRAM 市场带来巨大商机。

- 多家汽车製造商正在扩大其在日本的生产设施,以满足不断增长的需求并击败竞争对手。例如,比亚迪于2023年7月宣布进军日本小客车市场。本公司提供 Atto 3 型号。比亚迪Atto 3计划于2023年1月发布。第二款车型是比亚迪Dolphin,预计2023年中期上市,第三款车型是新款比亚迪Seal,预计将于2023年下半年上市。

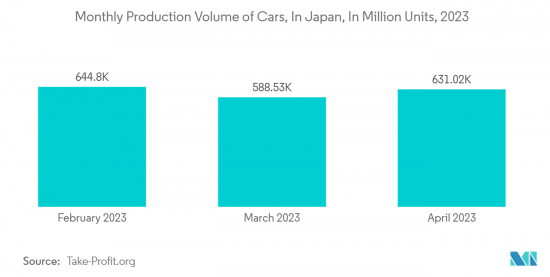

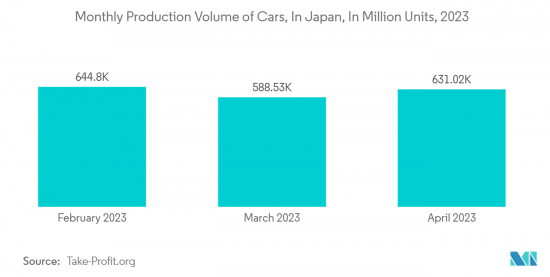

- 另外,根据汽车工业协会公布的资料,2023财年日本汽车产量在2023年2月增加至6,31,022辆。最大值为 9,61,994 单位,最小值为 2,49,772 单位。汽车产量的增加可能会为日本汽车市场带来对 DRAM 的高需求。

资料中心和伺服器的增加推动了市场

- 动态随机存取记忆体 DRAM 是现代企业和资料中心应用程式正常运作的重要元件。随着越来越多的资料中心利用云端运算、虚拟和软体定义伺服器技术,断电和备用发电机启动之间的时间正在缩短。

- 物联网IoT技术和巨量资料预计将增加对资料中心的投资,进一步为日本动态随机存取记忆体(DRAM)市场带来新的成长机会。日本公司在所有行业都经历大量资料生成,包括医疗保健、银行、金融服务和保险 (BFSI)、IT 和通讯以及政府和国防。云端运算的成长、国外云端供应商普及的提高以及国内企业投资的增加是推动市场成长的主要因素。

- 新行动运算设备的激增正在提高各种组织中资料中心的效用。此外,许多供应商正在市场上建立新的资料中心,推动了正在研究的市场。例如,Datadog, Inc.于2023年4月宣布将在东京开设一个新的资料中心。新资料中心将透过在本地处理和储存资料来帮助公司及其客户遵守本地资料隐私和安全法规。

- 同样,2023年1月,Optage Co., Ltd.宣布计划在大阪建造新的资料中心。该物业位于东梅田区,面积2,250平方公尺,共14层。

- 为了满足这些要求,供应商正在发布新产品以保持市场竞争力。例如,2022年5月,三星电子宣布开发基于Compute Express Link的DRAM记忆体技术,以升级资料中心效能。此DDR5设计用于支援CXL介面。 CXL 介面是基于 PCI Express (PCIe) 5.0 介面的开放式产业标准互连,使资料中心能够在处理器、主机、记忆体缓衝区、加速器和输入/输出等设备之间提供高速、低延迟的通讯设备。它的设计目的是。

- 此外,政府主导的倡议在日本变得更加活跃,日本对动态随机存取记忆体 (DRAM) 的需求也以类似的速度成长。例如,2022年8月,日本政府宣布计划分散和多样化海底电缆登陆点,并在全国范围内建造多个新的资料中心。政府的目标是缩小都市区差距,提高抵御自然灾害和潜在破坏的能力。

日本DRAM产业概况

日本动态随机存取记忆体(DRAM)市场的特点是整合缓慢,众多主要企业争夺市场占有率。三星电子、SK 海力士和华邦电子等知名企业在塑造该行业方面发挥关键作用。我们致力于持续创新,并以大量研发投资为后盾,帮助我们获得相对于同业的竞争优势。

2023 年 1 月,SK 海力士推出了 LPDDR5TDRAM,比现有 LPDDR5X 技术取得了重大进展。这种创新的LPDDR5T技术适用于人工智慧、智慧型手机、虚拟实境、增强智慧和机器学习等多种应用。

2022 年 12 月,三星电子宣布推出 16 Gigabit DDR5 DRAM。这种尖端 DRAM 采用业界首创的 12 奈米级製程技术製造,特别适合提高资料中心、下一代运算和人工智慧驱动系统等营运的永续性。

2022年5月,知名记忆体和数位储存产品製造商创见资讯(Transcend)宣布推出专为商用和个人电脑设计的新一代DDR5 DRAM模组。 Transcend 的 DDR5 记忆体模组在速度、容量和可靠性方面超过了 JEDEC 标准,为元宇宙、高效能运算 (HPC) 和虚拟经济等应用提供了突破性的效能。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 宏观经济走势对市场的影响

第五章市场动态

- 市场驱动因素

- 高阶智慧型手机和消费性电子产品的普及

- 市场挑战

- 原物料和生产价格上涨

第六章市场区隔

- 依架构

- DDR3

- DDR4

- DDR5

- DDR2/其他架构

- 按申请

- 智慧型手机/平板电脑

- 个人电脑/笔记型电脑

- 资料中心

- 图形

- 消费性产品

- 车

- 其他应用

第七章 竞争形势

- 公司简介

- Samsung Electronics Co. Ltd.

- Micron Technology Inc.

- SK Hynix

- Nanya Technology Corporation

- Winbond Electronics Corporation

- Transcend Information

- Kingston Technology

- Infineon Technologies AG

- ATP Electronics

- Elpida Memory Inc.

第八章投资分析

第9章市场的未来

The Japan dynamic random access memory (DRAM) market was valued at USD 3.35 billion in the current year and is expected to register a CAGR of 3.45%, reaching USD 3.97 billion over the forecast period.

Key Highlights

- The growing adoption of smartphones, PCs, and laptops in the country has increased the development of DRAM, which could reduce the boot-up time and enhance the memory space to offer higher performance.

- According to the Japan Smartphone Security Association (JSSEC), the monthly domestic shipment volume of mobile phones in the country was 1.42 million units in July 2022, which was 0.68 million units in May 2022. Further, 5G-enabled smartphones need more memory compared to previous generations. Thus, the increasing implementation of 5G contributes to market growth.

- Consumer products, such as cameras and tablets, sensors and industrial equipment, medical devices, and automotive systems, rely on DRAM flash memory embedded alongside processors to store data and the code they execute. However, data centers use DRAM flash memory for its near real-time response to read/write requests and high data transfer speed. DRAM storage trends are likely to continue to evolve as demand increases for large-scale data processing for artificial intelligence and machine learning applications.

- The advances in technology, increasing population, rise in per capita income, and easy availability of high-speed internet have increased the adoption of smartphones and advanced consumer electronics in the country. Therefore, the growing production of smartphones, tablets, laptops, and others with high processing and enhanced memory capabilities is expected to propel the Japanese dynamic random access memory (DRAM) market.

- Overall, the rising data centers and automotive sectors are expected to create massive demand for the Japanese dynamic random access memory (DRAM) market. The demand from the consumer electronics sector is expected to be constant during the forecast.

- With the increased memory requirements in gaming, automotive, healthcare, telecommunication, and, more importantly, with growth drivers like 5G and artificial intelligence (AI), the companies have been focusing on new and innovative DRAM products. In June 2022, Micron Technology announced its plan to mass-produce advanced DRAM memory chips at its Hiroshima plant. The company would be manufacturing its '1-Beta' Memory Chips in Japan.

- Moreover, in November 2022, Micron announced to start of mass production of its new high-capacity, power 1-beta dynamic random access memory (DRAM) chips at its plant in Hiroshima, Japan. The company has also received USD 320 million from the Japanese government to make advanced chips.

Japan DRAM Market Trends

Automotive Sector Holds Significant Market Share

- The country's growing demand for electric vehicles, SUVs, and light commercial vehicles will boost the demand for Japan's dynamic random access memory (DRAM) market. The government is dominated by various domestic brands such as Honda, Toyota, Suzuki, Mitsubishi, and Nissan.

- The proliferation of electric vehicles and the rapid advancement of infotainment systems are causing the semiconductor automotive platform to face a paradigm shift. Advanced features in infotainment systems like high-definition maps, video streaming, and 3D gaming, coupled with soaring demand for ADAS, are expected to significantly drive the demand for high-capacity, high-performance solid-state drivers (SSDs), and graphics DRAM throughout the automotive industry during the forecast period.

- The Japan dynamic random access memory (DRAM) market has witnessed high demand from the automotive industry during the forecast period. One of the major factors driving the demand is the growing emphasis on autonomous driving technologies with built-in 5G infrastructure. For example, Tesla has adopted Nvidia's CPU and GPU solutions, which drove them to incorporate GDDR5 DRAM products.

- Furthermore, the advent of the Internet of Things (IoT) in the automotive industry has become a prominent hotspot for multi-purpose applications. From connected vehicles to automated transport systems, the role of IoT is expected to open up significant opportunities for the Japan DRAM market in the automotive market.

- Several automobile manufacturers are expanding their production facilities in Japan to meet the growing demand and stay ahead of the competition. For instance, in July 2023, BYD announced it to expand its footprint in Japan's passenger vehicle market. The company will offer the Atto 3 model. BYD Atto 3 is expected to go on sale in January 2023. The second model is the BYD Dolphin, scheduled to be released in mid-2023, and the third model is the all-new BYD Seal, expected to be released in late 2023.

- Moreover, according to data published by the Automobile Manufacturers Association, in FY 2023, in Japan, car Production increased to 6,31,022 Units in February 2023. The maximum volume was 9,61,994 Units, and the minimum was 2,49,772 Units. Such a rise in automobiles is likely to bring the high demand for DRAM in the Japanese automobile market.

Growing Number of Data Centers and Servers Will Boost the Market

- Dynamic random access memory DRAM is an essential component for the proper functioning of modern enterprise and data center applications; the growing data centers in Japan have significantly fueled the demand for the market. An increasing number of data centers utilize cloud computing, virtualization, and software-defined server technology, so the time between power failure and startup of the backup generator has shortened.

- The Internet of Things IoT technology and big data will increase investment in the data center, further creating new growth opportunities for Japan's dynamic random access memory (DRAM) Market. Japanese companies are experiencing massive data generation across all industries, including healthcare, banking, financial services, and insurance (BFSI), IT and telecom, and government & defense. The growth of cloud computing, increased penetration by foreign cloud providers, and increased investments by domestic players are some of the major factors driving the market growth.

- The increase in new mobile computing devices has led to the rise in the utility of data centers among various organizations. Further, many vendors in the market are establishing new data centers, driving the studied market. For instance, In April 2023, Datadog, Inc. announced to launch of its new data center in Tokyo, Japan. This new data center in Japan will help the company and its customers comply with local data privacy and security regulations by processing and storing data locally.

- Similarly, in January 2023, Optage Inc. announced plans to construct a new data center in Osaka, Japan. The facility is located in the Higashi-Umeda district, covers an area of 2,250 square meters, and has 14 floors.

- In order to cater to such requirements, vendors are releasing new products to remain competitive in the market. For instance, in May 2022, Samsung Electronics announced the development of DRAM memory technology based on the Compute Express Link to upgrade the performance of the data centers. The DDR5 is designed to support the CXL interface, which is an open industry-standard interconnect based on the PCI Express (PCIe) 5.0 interface that is designed to enable the data centers with high-speed and low latency communications between the processor, host, and the devices such as memory buffers, accelerators, input and output devices.

- Moreover, with the growing government initiative in the country, the demand for Japanese dynamic random access memory (DRAM) has also been increasing at a similar rate. For instance, in August 2022, the Japanese Government announced plans to build several new data centers across the country along with decentralizing landing bases for submarine cables to diversify landing points. Through this, the Government aims to reduce the disparity between rural and urban areas and provide greater resilience against natural disasters or potential sabotage.

Japan DRAM Industry Overview

The dynamic random access memory (DRAM) market in Japan is characterized by moderate consolidation, with numerous key players vying for an increased market share. Prominent companies such as Samsung Electronics, SK Hynix, and Winbond, among others, play a pivotal role in shaping the industry. Their commitment to incessant innovation, underpinned by substantial investments in research and development, has facilitated their attainment of a competitive edge over their peers.

In January 2023, SK Hynix unveiled its LPDDR5TDRAM, representing a noteworthy advancement over the existing LPDDR5X technology. This innovative LPDDR5T technology is well-suited for diverse applications, including artificial intelligence, smartphones, virtual and augmented reality, and machine learning.

In December 2022, Samsung Electronics Co., Ltd. introduced its 16-gigabit (Gb) DDR5 DRAM. This cutting-edge DRAM is crafted utilizing the industry's first 12nm class process technology, making it highly suitable for enhancing sustainability in operations, especially in data centers, next-generation computing, and AI-driven systems.

In May 2022, Transcend Information, Inc. (Transcend), a renowned manufacturer of memory and digital storage products, announced the availability of its next-generation DDR5 DRAM modules, specifically designed for both business and personal computers. These DDR5 memory modules from Transcend surpass JEDEC standards in terms of speed, capacity, and reliability, ushering in groundbreaking performance in applications such as the metaverse, high-performance computing (HPC), and the virtual economy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of High-End Smartphones and Consumer Electronics

- 5.2 Market Challenges

- 5.2.1 Rising Raw Material and Production Prices

6 MARKET SEGMENTATION

- 6.1 By Architecture

- 6.1.1 DDR3

- 6.1.2 DDR4

- 6.1.3 DDR5

- 6.1.4 DDR2/Other Architecture

- 6.2 By Application

- 6.2.1 Smartphones/Tablets

- 6.2.2 PC/Laptop

- 6.2.3 Datacenter

- 6.2.4 Graphics

- 6.2.5 Consumer Products

- 6.2.6 Automotive

- 6.2.7 Other Applications

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd.

- 7.1.2 Micron Technology Inc.

- 7.1.3 SK Hynix

- 7.1.4 Nanya Technology Corporation

- 7.1.5 Winbond Electronics Corporation

- 7.1.6 Transcend Information

- 7.1.7 Kingston Technology

- 7.1.8 Infineon Technologies AG

- 7.1.9 ATP Electronics

- 7.1.10 Elpida Memory Inc.