|

市场调查报告书

商品编码

1408756

ANZ定位服务:市场占有率分析、产业趋势与统计、2024-2029 年成长预测ANZ Location-based Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

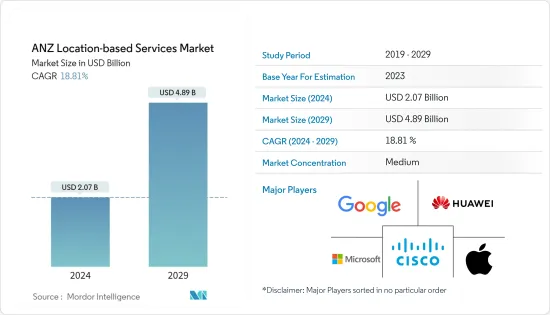

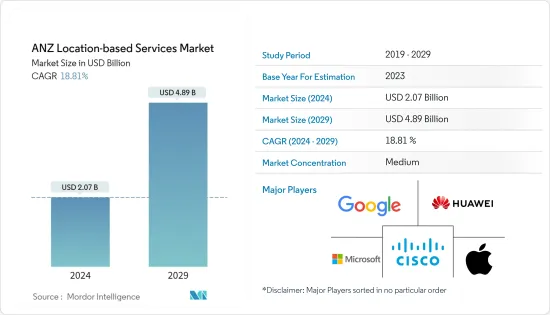

澳新银行定位服务市场规模预计到2024年为20.7亿美元,预计到2029年将达到48.9亿美元,在预测期内(2024-2029年)复合年增长率为18.81%,预计将会成长。

主要亮点

- GPS技术、室内定位系统(IPS)、扩增实境(AR)等技术的不断进步将增强定位服务的准确性和功能性,使其对企业和消费者更具吸引力,并将在未来几年继续成长。预计将有助于市场成长。

- 卫星和定位技术几乎渗透到澳洲人和纽西兰人现代生活的各个领域。更准确的定位技术正在提高空中交通管制和指挥杂货店等领域的企业效率并提高生活品质。

- 由于技术进步、消费行为变化和行业特定需求的融合,ANZ(澳洲和纽西兰)定位服务市场正在经历显着的成长和转型。该市场包括各种基于位置的服务和应用程序,以提供资讯体验、简化业务运营并改善日常生活。

- 澳新银行定位服务市场的关键驱动因素之一是智慧型手机等行动装置的普及。澳洲和纽西兰的智慧型手机普及很高,为资讯位置的应用程式和服务创造了有利的环境。消费者使用这些设备进行导航、本地搜寻和对应位置情报的应用程序,从而为定位服务创建了丰富的用户群。

- 此外,运输和物流行业也从定位服务中受益匪浅。随着该行业的扩张以满足不断增长的需求,对此类服务的需求持续增长。

- 儘管资讯技术正在不断进步,但准确性和可靠性仍然是一个问题,特别是在偏远或人口稠密的地区。不准确的资讯资料会导致使用者体验不佳并降低定位服务的有效性。

- 此外,疫情也加速了非接触式服务和非接触式交易的采用。此外,2020 年 4 月,澳洲推出了 COVIDSafe 应用程序,第一天下载量就达到 100 万次。第一周结束时,该应用程式的下载量约为 400 万用户。澳洲首席医疗官和政府已认识到 COVIDSafe 应用程式是加快接触者追踪、执行封锁限制和帮助澳洲人恢復正常生活的关键工具。此外,随着人们寻求更安全、更便捷的交易方式,行动付款应用程式以及餐厅和商店的非接触式订购等定位服务的使用量也有所增加。

ANZ定位服务市场趋势

网路普及快速提升带动市场成长

- 行动设备,尤其是智慧型手机和平板电脑的兴起,与网路使用量的增加密切相关。这些普及的小工具内建了 GPS 等资讯技术,使其成为提供定位服务的理想平台。存取此类服务的便利性进一步增强了它们的效用,并为依赖即时位置资讯的用户创造了无缝体验。

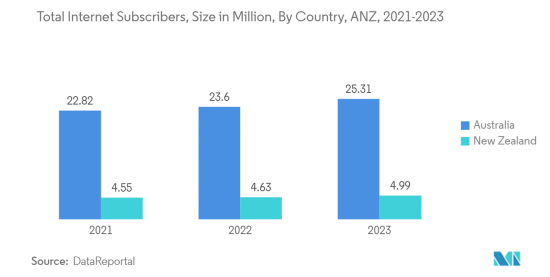

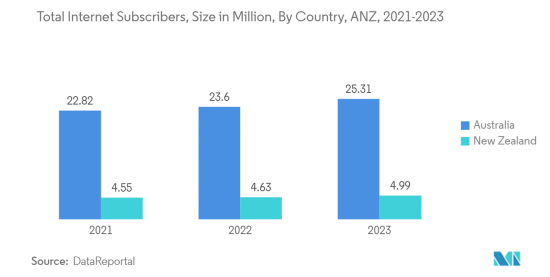

- 此外,根据DataReportal统计,2023年1月,澳洲有2531万网路用户,网路普及约96.2%;纽西兰有499万网路用户,网路普及为95.9%。已经被通报了。这样的互联网普及表明很大一部分人口已连接到互联网,并且可以轻鬆访问基于位置的应用程式和解决方案。

- 在澳新银行,我们看到满足各种需求的行动应用程式爆炸性地成长,从导航到社交网路再到电子商务等。其中许多应用程式自然包含资讯位置的功能,使得定位服务普及。消费者已经习惯了这些应用程式的便利性,它们已经成为他们数位生活中不可或缺的一部分。

- 此外,社群媒体平台也很快融入了资讯位置的功能。用户可以签到特定地点、共用其位置、发现附近的活动和企业等等。这些功能促进用户参与和互动,并展示社交网路和定位服务之间的关係。

- 此外,将定位服务纳入物联网(IoT)生态系统预计将成为利用增强的网路连接来推动定位服务的新趋势。物联网设备依赖互联网连接来通讯和共用资料,而定位服务对于资产追踪、智慧家庭自动化和环境监控等各种物联网应用至关重要。

零售和消费品预计将占据较大市场占有率

- 定位服务使零售商能够向消费者开展高度针对性和个人化的行销宣传活动。透过分析位置资讯,零售商可以向实体店附近或实体店内的客户即时发送优惠、折扣和促销讯息。这种程度的个人化极大地提高了转换的可能性和客户忠诚度。

- 此外,定位服务使零售商能够为客户在购物中心和大型零售店内提供准确的商店搜寻和室内导航协助。这简化了购物体验,帮助客户更有效地找到产品,并提高了整体满意度。

- 定位服务也弥合了实体店和网路购物之间的差距。零售商可以使用这些服务,透过提供「点击取货」选项来促进无缝的全通路购物体验,这些选项允许客户在线订购并在店内取货。Masu。

- 此外,根据澳洲统计局的数据,2023年3月总销售额达到约38.3亿澳元(28.73亿美元),较去年同月成长2.68%。此外,2022 年 11 月的销售额达到 40 亿澳元(30 亿美元),实现了巨大的价值。随着零售和消费品行业的稳定成长和巨大的销量,该行业的公司正在大力推动技术投资,以提高其销售和客户参与度。

- 此外,位置资讯可用于最佳化库存管理。零售商可以追踪商店内产品的流动情况,并在需要的时间和地点进行补充。这有助于最大限度地减少缺货、提高供应链效率并改善客户体验。

ANZ定位服务概览

澳新银行定位服务市场预计将逐步整合,国际和本地公司将在市场占有率中做出巨大贡献。该市场的主要行业参与者是谷歌公司、微软公司、苹果公司、华为技术公司和思科系统公司等知名公司。

2023 年 6 月,DCS Spatial Services 和非营利组织 FrontierSI 宣布建立战略合作伙伴关係,旨在为新南威尔斯 (NSW) 政府降低成本、减轻风险并解决位置资讯挑战。该倡议旨在评估最佳策略并提出建议,以建立新南威尔斯州资讯报告的标准化和高效解决方案,该解决方案在国家层面具有潜力,并且也产生了影响。

2022年11月,全球科技公司GMV将与全球着名科技公司洛克希德马丁公司合作开发南方定位增强网路系统(SouthPAN)。该合作计划得到澳洲和纽西兰政府的支持,旨在建立用于导航和精确定位(PPP)服务的星基增强系统(SBAS)。此外,GMV 还负责监控并确保这些服务在该地区遵守商定的绩效标准。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章 检验方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 定位技术日益受到关注

- 网路普及快速上升

- 市场抑制因素

- 资料隐私和安全问题

- 部分地区限制高速网路存取

第六章市场区隔

- 按地点

- 室内的

- 户外

- 按服务类型

- 专业的

- 管理

- 按最终用户产业

- 运输/物流

- 製造业

- 零售/消费品

- 车

- 卫生保健

- 其他最终用户产业

第七章 竞争形势

- 公司简介

- Google LLC

- Microsoft Corporation

- Apple Inc.

- Huawei Technologies Co. Ltd

- Cisco Systems, Inc.

- Uber Technologies Inc.

- GapMaps Pty Ltd

- HERE Technologies(HERE Global BV)

- Esri Australia Pty Ltd

- TomTom International BV

第八章投资分析

第九章 市场机会及未来趋势

The ANZ Location-based Services Market size is estimated at USD 2.07 billion in 2024, and is expected to reach USD 4.89 billion by 2029, growing at a CAGR of 18.81% during the forecast period (2024-2029).

Key Highlights

- Ongoing advancements like GPS technology, indoor positioning systems (IPS), and augmented reality (AR) are expected to enhance the accuracy and capabilities of location-based services, making them more attractive to businesses and consumers and contributing to market growth in the coming years.

- Satellite and positioning technologies are utilized regularly in almost all areas of modern life for people in Australia and New Zealand. More accurate positioning technology increases the efficiency of companies and improves the quality of life in a variety of areas, including air traffic control and instructions to the grocery.

- The ANZ (Australia and New Zealand) location-based services market is experiencing significant growth and transformation due to a convergence of technological advancements, changing consumer behaviors, and industry-specific demands. This market encompasses a wide range of services and applications leveraging location data to deliver personalized experiences, streamline business operations, and enhance everyday life.

- One of the primary drivers of the ANZ location-based services market is the widespread adoption of smartphones and other mobile devices. With a high smartphone penetration rate in Australia and New Zealand, the region provides a favorable environment for location-based apps and services. Consumers use these devices for navigation, local search, and location-aware applications, creating a substantial user base for location-based offerings.

- In addition, the transport and logistics industry benefits significantly from location-based services for route optimization, fleet management, and real-time tracking. As this sector expands to meet growing demand, the need for such services continues to rise.

- While location technology has improved, accuracy and reliability can still be a concern, especially in remote or densely populated areas. Inaccurate location data can lead to suboptimal user experiences and reduce the effectiveness of location-based services.

- Further, the pandemic accelerated the adoption of contactless services and touchless transactions. Moreover, in April 2020, Australia introduced its COVIDSafe app, which had one million downloads on the first day. At the end of the first week, the app had been downloaded by almost four million users. The Chief Medical Officer of Australia and the government recognized the COVIDSafe app as a crucial tool for accelerating contact tracing, enabling lockdown limitations, and easing the transition for Australians back to normal life. In addition, location-based services, such as mobile payment apps and contactless ordering at restaurants and stores, saw increased usage as people looked for safer, more convenient ways to conduct transactions.

ANZ Location-based Services Market Trends

Rapid Increase in Internet Penetration to Drive the Market Growth

- The rise of mobile devices, especially smartphones and tablets, is closely connected to the increase in internet usage. These widespread gadgets come equipped with built-in location-based technologies like GPS, making them ideal platforms for location-based services. The convenience of accessing such services further enhances their utility, creating a seamless experience for users who rely on real-time location information.

- Moreover, according to DataReportal, in January 2023, Australia was reported to have 25.31 million internet users with around 96.2% internet penetration rate, while in New Zealand, internet users were 4.99 million with a 95.9% penetration rate. Such a significant level of internet adoption indicates a considerable portion of the population is connected and can readily access location-based apps and solutions.

- ANZ has witnessed a proliferation of mobile applications catering to diverse needs, from navigation to social networking, e-commerce, and more. Many of these apps naturally incorporate location-based features, thereby popularizing location-based services. Consumers have grown accustomed to the convenience of these apps, which have become an integral part of their digital lives.

- Moreover, social media platforms have been quick to embrace location-based features as well. Users can check in at specific locations, share their locations, and discover events and businesses in their vicinity. These features promote user engagement and interaction, demonstrating the relationship between social networking and location-based services.

- In addition, incorporating location-based services into the Internet of Things (IoT) ecosystem is expected to be an emerging trend in driving location-based services by utilizing enhanced network connectivity. IoT devices rely on internet connectivity to communicate and share data, and location-based services are integral to various IoT applications, including asset tracking, smart home automation, and environmental monitoring.

Retail and Consumer Goods Segment is Expected to Hold a Significant Market Share

- Location-based services empower retailers to deliver highly targeted and personalized marketing campaigns to consumers. By analyzing location data, retailers can send real-time offers, discounts, and promotions to customers near or inside a physical store. This level of personalization significantly enhances the chances of conversion and customer loyalty.

- In addition, location-based services enable retailers to provide customers with accurate store locators and indoor navigation assistance within shopping malls or large retail outlets. This simplifies the shopping experience, helping customers find products more efficiently and enhancing overall satisfaction.

- Also, location-based services bridge the gap between physical and online shopping. Retailers can use these services to offer click-and-collect options, where customers can order online and pick up products in-store, promoting a seamless omnichannel shopping experience.

- Moreover, according to the Australian Bureau of Statistics, in March 2023, the turnover in terms of total sales was recorded to reach around AUD 3.83 billion (USD 2.873 billion), a 2.68% growth from the same month in the previous year. Moreover, the turnover achieved significant value in November 2022, reaching AUD 4 billion (USD 3 billion). With the Retail and Consumer Goods sector experiencing steady growth and considerable turnover, there is a strong push for businesses in this industry to invest in technologies that can strengthen their sales and customer engagement efforts.

- Further, location data can be used to optimize inventory management. Retailers can track the movement of products within their stores, ensuring items are restocked when and where needed. This minimizes stockouts, improves supply chain efficiency, and enhances the customer experience.

ANZ Location-based Services Industry Overview

The ANZ location-based services market is anticipated to witness moderate consolidation due to the presence of both international and local firms making substantial contributions to market share. Key industry players in this market comprise renowned companies such as Google LLC, Microsoft Corporation, Apple Inc., Huawei Technologies Co. Ltd, Cisco Systems, Inc., and others.

In June 2023, DCS Spatial Services and FrontierSI, a non-profit organization, unveiled a strategic partnership aimed at reducing costs, mitigating risks, and addressing challenges associated with location-based reporting within the New South Wales (NSW) Government. This initiative seeks to assess an optimal strategy and offer recommendations for establishing a standardized and efficient solution for location-based reports across NSW, with potential implications at a national level.

In November 2022, global technology company GMV, in collaboration with Lockheed Martin Corporation, a prominent global technology firm, is set to develop the Southern Positioning Augmentation Network system (SouthPAN). This cooperative project, supported by the Australian and New Zealand governments, has the objective of establishing a satellite-based augmentation system (SBAS) for navigation and precise point positioning (PPP) services. Additionally, GMV will be responsible for monitoring and ensuring compliance with agreed-upon performance standards for both of these services in the region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Focus on Positioning Technologies

- 5.1.2 Rapid Increase in Internet Penetration

- 5.2 Market Restraints

- 5.2.1 Concerns about Data Privacy and Security

- 5.2.2 Limited Access to high-speed internet in Some Regions

6 MARKET SEGMENTATION

- 6.1 By Location

- 6.1.1 Indoor

- 6.1.2 Outdoor

- 6.2 By Service Type

- 6.2.1 Professional

- 6.2.2 Managed

- 6.3 By End-user Industry

- 6.3.1 Transportation and Logistics

- 6.3.2 Manufacturing

- 6.3.3 Retail and Consumer Goods

- 6.3.4 Automotive

- 6.3.5 Healthcare

- 6.3.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Google LLC

- 7.1.2 Microsoft Corporation

- 7.1.3 Apple Inc.

- 7.1.4 Huawei Technologies Co. Ltd

- 7.1.5 Cisco Systems, Inc.

- 7.1.6 Uber Technologies Inc.

- 7.1.7 GapMaps Pty Ltd

- 7.1.8 HERE Technologies (HERE Global B.V)

- 7.1.9 Esri Australia Pty Ltd

- 7.1.10 TomTom International BV