|

市场调查报告书

商品编码

1430606

日本国际CEP -市场占有率分析、产业趋势与统计、成长预测(2024-2029)Japan International CEP - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

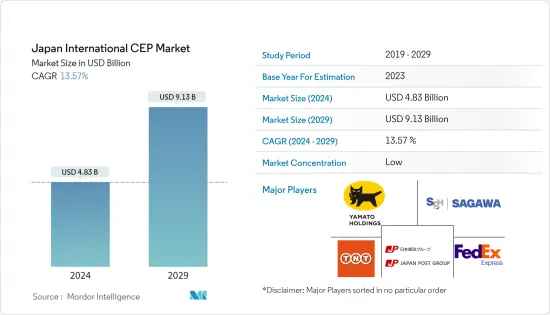

日本国际CEP市场规模预计到2024年为48.3亿美元,预计到2029年将达到91.3亿美元,在预测期内(2024-2029年)复合年增长率为13.57%。

日本是美国的主要贸易和投资伙伴。电子设备和汽车是日本两大出口产品。与其他国家的贸易对日本经济也非常重要。

主要亮点

- 2022年,日本的出口项目为:汽车(886亿美元)、积体电路(360亿美元)、汽车;零件和配件(8701和8705)(334亿美元)、具有单独功能的机械(334亿美元) 220 亿美元)、照相馆设备(185 亿美元)等等。

- 为了促进国际贸易,建立了经济特区 (SEZ) 和自由贸易区 (FTZ),以促进宅配、快递和小包裹公司 (CEP)产生收入。

- 国际CEP市场的主要驱动因素是电子商务领域。日本是全球最大的网路购物市场,日本电商市场以B2B交易为主,越来越重视B2C销售,C2C市场也正在兴起。过去十年,B2C 销售额成长了一倍以上。

- 到2023年初,日本网路普及将达到82.9%,使用网路的人数将达到1.025亿。 2023年1月,日本有9,200万人使用社群媒体,占总人口的74.4%。

- 2022年11月,日本将推出利用太空的宅配服务。总部位于东京的 iSpace Inc. 计划在本月稍后发射月球着陆器,运载大量商业和政府货物,其中包括两辆探测车。

日本国际CEP市场动向

跨境电商成长带动市场

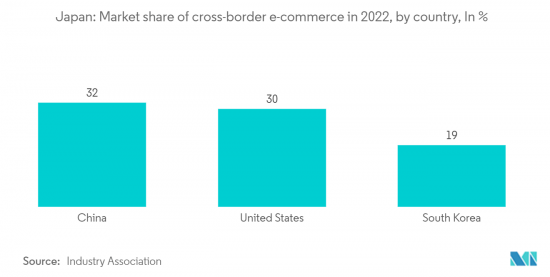

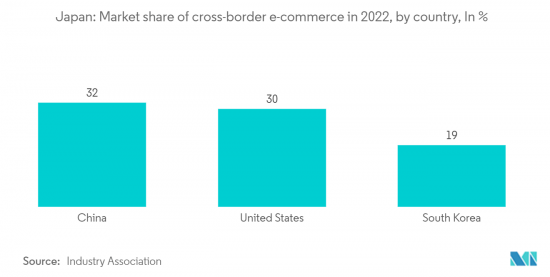

日本的国际电子商务正在兴起,根据 PPRO 研究,中国是日本消费者的首要电子商务目的地。美国排名第二,占全球电商销售额的30%。美国和中国是日本产品的最大市场。据经济产业省称,2021年对中国的网路销售额将达到2.13兆日圆(143.7亿美元),与前一年同期比较增长10%,对美国的网上销售额将增长26%至1.22 兆日元(840 亿美元)。除去20万日圆(1,370.99美元)的网路交易,两国出口总额约占日本年度出口总额的10%。

日本是成长最快的电子商务和行动商务市场之一,精通数位技术的人们越来越多地跨境购物。是跨境电商企业的理想市场。跨境电商公司如果能在地化客户体验,包括真实正确的语言翻译、网站架构、产品清单和卓越的客户服务,就能在这个市场取得成功。

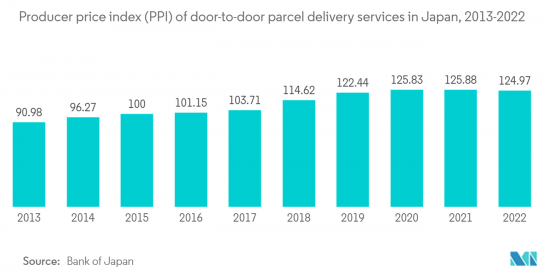

日本宅配出货量增加

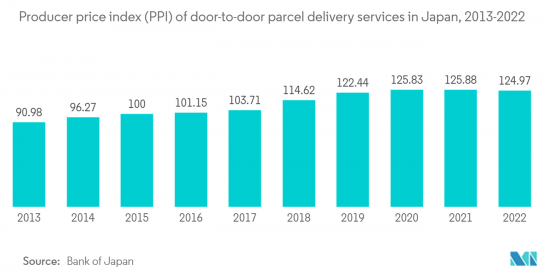

在日本,2022年处理的小包裹和包装货物量达到91亿件,比前一年的92亿件减少1.1%。平均每秒 289 条,即每天 2500 万条。 2022年小包裹产生的总收入为270亿美元,与前一年同期比较增17%,但每个小包裹的收入下降-16%。人均处理宅配数量为73件,每户平均处理宅配数量为173件。到2022年,近一半(48.2%)的日本两人或以上家庭将透过电子商务购买商品和服务,这是过去十年来的最高水准。近年来,使用电子商务的家庭数量稳定增加,休閒相关商品和服务成为最受欢迎的线上购买之一。

日本国际CEP产业概况

日本的国际 CEP 市场较为分散,全球和本土企业云集,竞争激烈。着名的参与者包括大和、佐川急便、TNT Express、日本邮政和联邦快递。全球智慧物流解决方案供应商Geek+将为耐吉在日本实现当日送达,为耐吉在中国的新配送中心提供先进的机器人解决方案,并为该公司的货到货提供服务。我们宣布,我们已经推出了超过「Person」系列的 200 个机器人。这款智慧机器人将把耐吉产品和包裹直接运送给仓库工人,降低成本,提高拣选效率,让仓库工人的日常工作变得更轻鬆。 2022年,日本邮政在小包裹和包装货物方面的市场占有率最高(46%),而大和公司的市占率最低(34%)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 科技趋势

- 政府规章

- 日本物流仓储市场概况

- 日本跨境运输

- 日本货运市场概况

- 日本电商领域注意事项(国内及跨境电商说明)

- COVID-19对CEP市场的影响(对市场和经济的短期和长期影响)

第五章市场动态

- 市场驱动因素

- 电子商务成长推动市场

- 航空货运量增加带动市场復苏

- 市场限制因素

- 宅配业务可视性低

- 市场机会

- 技术进步:先进追踪系统简介

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 供应链/价值链分析

第六章市场区隔

- 按业务

- 企业对企业交易 (B2B)

- 企业对客户 (B2C)

- 客户对客户交易(C2C)

- 按类型

- 电子商务

- 除了电商以外

- 按最终用户

- 服务

- 批发零售

- 卫生保健

- 製造业

- 其他最终用户

第七章 竞争形势

- 公司简介

- YAMATO HOLDINGS CO. LTD

- Sagawa Express Co. Ltd

- TNT Holdings BV

- JAPAN POST Co. Ltd

- FedEx

- DHL

- Seino Transportation Co. Ltd

- United Parcel Service of America Inc.

- DB Schenker

- Nippon Express Co. Ltd

- Takuhai

- Agility

- KERRY LOGISTICS NETWORK LIMITED

- National Air Cargo Inc.*

第八章市场的未来

第九章 附录

The Japan International CEP Market size is estimated at USD 4.83 billion in 2024, and is expected to reach USD 9.13 billion by 2029, growing at a CAGR of 13.57% during the forecast period (2024-2029).

Japan is a major trading and investing partner for the United States. Electronic equipment and cars are two of Japan's biggest exports. Trade with other countries is also very important for Japan's economy.

Key Highlights

- In 2022, Japan's exports are Cars (USD 88.6 billion), Integrated circuits (USD 36 billion), Motor vehicles; parts & accessories (8701 and 8705) (USD 33.4 billion), Machinery having individual functions (USD 22 billion) and Photo lab equipment (USD 18.5 billion) among others.

- To facilitate international commerce, Trade Special Economic Zones (SEZ) and Free Trade Zones (FTZ) are established, which facilitate the revenue generation of the Courier, Express, and Parcel companies (CEP).

- The main driving factor for the International CEP market is the E-commerce Sector. Japan is the world's largest online shopping market, Japan's e-commerce market is dominated by B2B transactions, with a growing emphasis on B2C sales and an emerging C2C market. B2C sales have more than doubled over the past decade.

- Japan's internet penetration rate was 82.9% at the beginning of 2023, with 102.5 million people using the internet. In January 2023, 92.00 million people in Japan were using social media, making up 74.4% of the population.

- In November 2022, Japan is launching a space-based courier service. ISpace Inc. the company, based in Tokyo, is planning to launch a moon lander later this month that will be carrying a bunch of commercial and government stuff, including two rovers.

Japan International CEP Market Trends

Growth in Cross Border E-commerce is driving the market

Japan's international e-commerce is on the rise, a study by PPRO found that China was the top e-commerce destination for Japanese shoppers. The US came in second with 30% of the global e-commerce sales. The United States and China are the country's largest markets for Japanese goods. In 2021, online sales to China reached JPY 2.13 trillion (USD 14.37 billion), a 10% increase from the previous year, while online sales to the United States increased by 26% to JPY 1.22 trillion (USD 84 billion), according to the Ministry of Economics, Trade and Industry (METI). The two countries combined accounted for about 10% of Japan's total exports for the year, excluding online transactions of JPY 200,000 (USD 1370.99).

Japan is one of the fastest-growing e-commerce & m-commerce markets with a digitally savvy population that is increasingly buying across borders. It is an ideal market for cross-border e-commerce businesses. Cross-border e-commerce companies will be successful in this market if they localize the customer experience, including genuine and correct language translations, website architecture, product listing, and superior customer service.

Increase in Volume of Parcel Shipments in Japan

In Japan, the volume of parcels and packets generated in 2022 reached 9,1 billion, a decrease of -1,1% compared to the previous year's 9,2 billion parcels. This represents an average of 289 parcels per second, equivalent to 25 million parcels per day. The total revenue generated from parcels in 2022 was USD 27 billion, an increase of 17% year-on-year, however, the revenue per parcel decreased by -16%, largely due to the strong US Dollar-Yen exchange rate in 2022. The average parcel generated per person was 73, while the average parcel generated per household remained at 173. Nearly half of Japanese households (48.2%) with 2 or more people purchased goods or services through e-commerce in 2022, a record high in the last decade. The number of e-commerce-using households has been steadily rising in recent years, and leisure-related products and services are among the most popular online purchases.

Japan International CEP Industry Overview

The Japanese international CEP market is fragmented, with a mix of global and local players, making it highly competitive. Some of the strong players include Yamato, Sagawa Express, TNT Express, Japan Post, and FedEx. Geek+, a global provider of smart logistics solutions, announced that it had powered same-day delivery for Nike in Japan, providing advanced robotics solutions to Nike's new distribution center in China and deploying more than 200 robots from its goods-to-person P series line. The smart robots carry Nike products and packages directly to the warehouse worker, reducing costs, increasing picking efficiency, and making daily work easier on the warehouse operators. In 2022, Japan Post has the highest market share (46%) for parcels and packets, while Yamato has the lowest market share (34%).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Government Regulations

- 4.4 Overview of the Logistics and Warehousing Market in Japan

- 4.5 Spotlight on Cross-Border Transportation in Japan

- 4.6 Brief on Japan Freight Forwarding Market

- 4.7 Spotlight on Japan E-commerce Sector (Commentary on Domestic and Cross-border E-commerce)

- 4.8 Impact of COVID-19 on the CEP Market (Short-term and Long-term Impact on the Market and on the Economy)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in E-commerce is driving the market

- 5.1.2 The market is fueled by the growing number of Air Freights

- 5.2 Market Restraints

- 5.2.1 Poor Visibility on the Courier Delivery Operations

- 5.3 Market Opportunities

- 5.3.1 Advancements in Technology: Introduction of Advanced tracking Systems

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

- 5.5 Supply Chain/Value Chain Analysis

6 MARKET SEGMENTATION

- 6.1 By Business

- 6.1.1 Business-to-Business (B2B)

- 6.1.2 Business-to-Customer (B2C)

- 6.1.3 Customer-to-Customer (C2C)

- 6.2 By Type

- 6.2.1 E-commerce

- 6.2.2 Non-e-commerce

- 6.3 By End User

- 6.3.1 Services

- 6.3.2 Wholesale and Retail Trade

- 6.3.3 Healthcare

- 6.3.4 Industrial Manufacturing

- 6.3.5 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 YAMATO HOLDINGS CO. LTD

- 7.2.2 Sagawa Express Co. Ltd

- 7.2.3 TNT Holdings BV

- 7.2.4 JAPAN POST Co. Ltd

- 7.2.5 FedEx

- 7.2.6 DHL

- 7.2.7 Seino Transportation Co. Ltd

- 7.2.8 United Parcel Service of America Inc.

- 7.2.9 DB Schenker

- 7.2.10 Nippon Express Co. Ltd

- 7.2.11 Takuhai

- 7.2.12 Agility

- 7.2.13 KERRY LOGISTICS NETWORK LIMITED

- 7.2.14 National Air Cargo Inc.*