|

市场调查报告书

商品编码

1430950

全球汽车润滑油市场:市场占有率分析、产业趋势/统计、成长预测(2021-2026)Global Automotive Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2021 - 2026) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

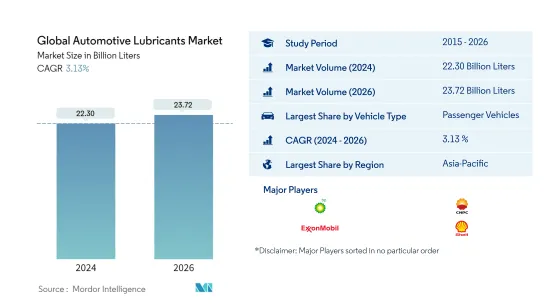

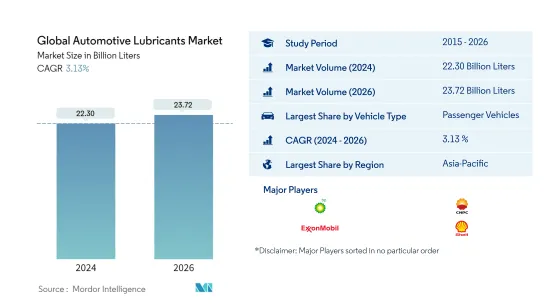

预计2024年全球汽车润滑油市场规模为223亿公升,预估至2026年将达237.2亿公升,预测期间(2024-2026年)复合年增长率为3.13%,预计将成长%。

主要亮点

- 按车型划分最大的细分市场 -小客车:由于世界持有小客车数量众多,该细分市场的润滑油消费量是所有车型中最高的。

- 按车辆类型划分最快的细分市场 - 摩托车:儘管出现了新冠肺炎 (COVID-19) 疫情,但随着一些国家摩托车销量的增长,该细分市场的润滑油消费量预计将继续增长。

- 最大的区域市场-亚太地区:亚太地区是中国、印度和印尼等大型持有的所在地。因此,亚太地区该产业的润滑油消费量最高。

- 快速成长的亚太市场:合成润滑油的普及较低,而印度等国家的汽车保有量预计将保持高成长率,这可能会推动亚太地区的润滑油消费。

车用润滑油市场趋势

按车型划分最大的细分市场:小客车

- 在全球汽车产业中,2020年小客车(PV)细分市场占公路式车辆总数的份额约为55.1%,其次是摩托车(34.7%)和小客车(10.1%)。

- 2020年车用润滑油消费量中,小客车领域占比最高,为53.6%,商用车领域占37.3%。同年,为遏制 COVID-19 而实施的驾驶限制对这些车辆的使用及其润滑油消费量产生了重大影响。

- 2021年至2026年,两轮车细分市场的润滑油消费量预计复合年增长率最高,达5.06%。摩托车销售的增加和与 COVID-19 大流行相关的旅行限制的放鬆可能是推动这一趋势的主要因素。

最大区域:亚太地区

- 汽车润滑油消费主要集中在亚太地区、北美和欧洲。 2020年,亚太地区约占全球汽车润滑油总消费量的43%,其次是北美约占20%,欧洲约占14.8%。

- 2020 年新冠肺炎 (COVID-19) 疫情的爆发对全球汽车润滑油消费产生了重大影响。北美地区受影响最严重,2019 年至 2020 年下降了 17.4%。非洲受影响最小,汽车润滑油消费量下降了 4.7%。

- 从2021年到2026年,亚太地区预计将成为成长最快的润滑油市场,消费量复合年增长率预计为4.89%,其次是非洲,复合年增长率为4.13%,中东地区复合年增长率为3.22 。记录 %。

汽车润滑油产业概况

全球车用润滑油市场适度整合,前5家企业占比40.21%。该市场的主要企业为(按字母顺序排列)英国石油公司(嘉实多)、中国石油天然气集团公司、埃克森美孚公司、荷兰皇家壳牌公司、道达尔能源公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章执行摘要和主要发现

第二章简介

- 研究假设和市场定义

- 调查范围

- 调查方法

第三章 产业主要趋势

- 汽车产业趋势

- 法律规范

- 价值炼和通路分析

第四章市场区隔

- 按车型分类

- 商用车

- 摩托车

- 小客车

- 依产品类型

- 机油

- 润滑脂

- 油压

- 变速箱和齿轮油

- 按地区

- 非洲

- 埃及

- 摩洛哥

- 奈及利亚

- 南非

- 其他非洲

- 亚太地区

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 菲律宾

- 新加坡

- 韩国

- 泰国

- 越南

- 其他亚太地区

- 欧洲

- 保加利亚

- 法国

- 德国

- 义大利

- 挪威

- 波兰

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲国家

- 中东

- 伊朗

- 卡达

- 沙乌地阿拉伯

- 土耳其

- 阿拉伯聯合大公国

- 其他中东地区

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

- 南美洲

- 阿根廷

- 巴西

- 哥伦比亚

- 南美洲其他地区

- 非洲

第五章竞争形势

- 重大策略倡议

- 市场占有率分析

- 公司简介

- BP PLC(Castrol)

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- Exxon Mobil Corporation

- FUCHS

- Idemitsu Kosan Co. Ltd

- Royal Dutch Shell PLC

- TotalEnergies

- Valvoline Inc.

第六章 附录

- 附录1 参考文献

- 附录2 图表清单

第七章 CEO 面临的关键策略问题

简介目录

Product Code: 90298

The Global Automotive Lubricants Market size is estimated at 22.30 Billion Liters in 2024, and is expected to reach 23.72 Billion Liters by 2026, growing at a CAGR of 3.13% during the forecast period (2024-2026).

Key Highlights

- Largest Segment by Vehicle Type - Passenger Vehicles : The large fleet size of passenger vehicles across the globe has resulted in this sector accounting for the highest lubricant consumption among all the different vehicle types.

- Fastest Segment by Vehicle Type - Motorcycles : The sales boost for motorcycles in several countries despite the COVID-19 pandemic is likely to continue and boost the lubricant consumption by the sector in the future.

- Largest Regional Market - Asia-Pacific : Asia-Pacific is home to countries with large vehicle fleets like China, India & Indonesia. As a result, lubricant consumption by this sector was highest in Asia-Pacific.

- Fastest Growing Regional Market - Asia-Pacific : The low penetration of synthetic lubricants and expected high growth rates of vehicle population in countries like India are likely to drive lubricant consumption in APAC.

Automotive Lubricants Market Trends

Largest Segment By Vehicle Type : Passenger Vehicles

- In the global automotive industry, the passenger vehicles (PV) segment accounted for almost 55.1% share in the total number of on-road vehicles during 2020, followed by motorcycles and passenger vehicles with 34.7% and 10.1% shares, respectively.

- The passenger vehicles segment accounted for the highest share of 53.6% in the total automotive lubricant volume consumption in 2020, followed by the commercial vehicles segment that accounted for a share of 37.3%. During the same year, travel restrictions to curb COVID-19 significantly affected the usage of these vehicles and their lubricant consumption.

- During 2021-2026, lubricant consumption by the motorcycles segment is expected to witness the highest CAGR growth, amounting to 5.06%. The growing motorcycle sales combined with the easing down of COVID-19 pandemic-related travel restrictions are likely to be the key factors driving this trend.

Largest Region : Asia-Pacific

- Consumption of automotive lubricants is dominated by Asia-Pacific, North America, and Europe. In 2020, Asia-Pacific accounted for about 43% of the total automotive lubricant consumption globally, while North America and Europe accounted for a share of around 20% and 14.8%, respectively.

- The COVID-19 outbreak in 2020 significantly affected automotive lubricant consumption in many countries worldwide. North America was the most affected, with a 17.4% drop, during 2019-2020. Africa was the least affected, with a 4.7% drop in its automotive lubricant consumption.

- During 2021-2026, Asia-Pacific is likely to be the fastest-growing lubricant market, as the consumption is likely to increase at a CAGR of 4.89%, followed by Africa and the Middle East, which are expected to record a CAGR of 4.13% and 3.22%, respectively.

Automotive Lubricants Industry Overview

The Global Automotive Lubricants Market is moderately consolidated, with the top five companies occupying 40.21%. The major players in this market are BP PLC (Castrol), China National Petroleum Corporation, Exxon Mobil Corporation, Royal Dutch Shell PLC and TotalEnergies (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 Key Industry Trends

- 3.1 Automotive Industry Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 Market Segmentation

- 4.1 By Vehicle Type

- 4.1.1 Commercial Vehicles

- 4.1.2 Motorcycles

- 4.1.3 Passenger Vehicles

- 4.2 By Product Type

- 4.2.1 Engine Oils

- 4.2.2 Greases

- 4.2.3 Hydraulic Fluids

- 4.2.4 Transmission & Gear Oils

- 4.3 By Region

- 4.3.1 Africa

- 4.3.1.1 Egypt

- 4.3.1.2 Morocco

- 4.3.1.3 Nigeria

- 4.3.1.4 South Africa

- 4.3.1.5 Rest of Africa

- 4.3.2 Asia-Pacific

- 4.3.2.1 China

- 4.3.2.2 India

- 4.3.2.3 Indonesia

- 4.3.2.4 Japan

- 4.3.2.5 Malaysia

- 4.3.2.6 Philippines

- 4.3.2.7 Singapore

- 4.3.2.8 South Korea

- 4.3.2.9 Thailand

- 4.3.2.10 Vietnam

- 4.3.2.11 Rest of Asia-Pacific

- 4.3.3 Europe

- 4.3.3.1 Bulgaria

- 4.3.3.2 France

- 4.3.3.3 Germany

- 4.3.3.4 Italy

- 4.3.3.5 Norway

- 4.3.3.6 Poland

- 4.3.3.7 Russia

- 4.3.3.8 Spain

- 4.3.3.9 United Kingdom

- 4.3.3.10 Rest of Europe

- 4.3.4 Middle East

- 4.3.4.1 Iran

- 4.3.4.2 Qatar

- 4.3.4.3 Saudi Arabia

- 4.3.4.4 Turkey

- 4.3.4.5 UAE

- 4.3.4.6 Rest of Middle East

- 4.3.5 North America

- 4.3.5.1 Canada

- 4.3.5.2 Mexico

- 4.3.5.3 United States

- 4.3.5.4 Rest of North America

- 4.3.6 South America

- 4.3.6.1 Argentina

- 4.3.6.2 Brazil

- 4.3.6.3 Colombia

- 4.3.6.4 Rest of South America

- 4.3.1 Africa

5 Competitive Landscape

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Profiles

- 5.3.1 BP PLC (Castrol)

- 5.3.2 Chevron Corporation

- 5.3.3 China National Petroleum Corporation

- 5.3.4 China Petroleum & Chemical Corporation

- 5.3.5 Exxon Mobil Corporation

- 5.3.6 FUCHS

- 5.3.7 Idemitsu Kosan Co. Ltd

- 5.3.8 Royal Dutch Shell PLC

- 5.3.9 TotalEnergies

- 5.3.10 Valvoline Inc.

6 Appendix

- 6.1 Appendix-1 References

- 6.2 Appendix-2 List of Tables & Figures

7 Key Strategic Questions for Lubricants CEOs

02-2729-4219

+886-2-2729-4219