|

市场调查报告书

商品编码

1431090

精密车床加工产品製造:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Precision Turned Product Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

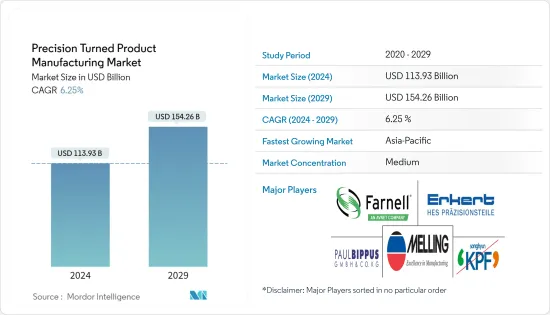

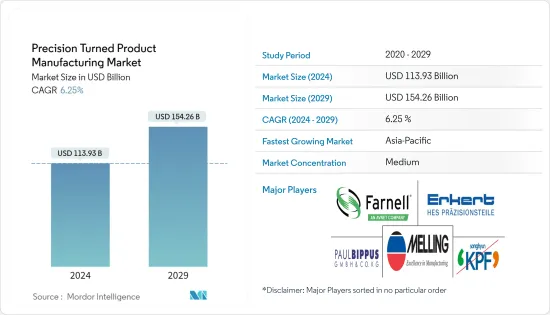

精密车削产品製造市场规模预计到 2024 年为 1,139.3 亿美元,预计到 2029 年将达到 1,542.6 亿美元,在预测期内(2024-2029 年)复合年增长率为 6.25%。

对尖端加工解决方案的需求正在推动销售成长,重点是减少停机时间以提高生产速度、精度和製作流程。工业4.0鼓励製造设备与其他业务功能合作,并利用製造机器和生产精密工程机械创建复杂的自适应自动化系统。因此,随着工业4.0在未来几年的蓬勃发展,该领域存在着许多机会。

航太业,包括民用和国防市场的所有系统、电子和设备的研究、开发和製造,目前正在经历全球成长,并且不太可能经历衰退压力。然而,全球顶级商用航太OEM预测,到2023年或2024年初,全球客运量将恢復到2019年的水准。这可能会导致订单增加,以满足不断增长的积压,从而提高行业收益。这一增长的原因之一可以归因于乌克兰战争爆发后国防预算的增加,这增加了世界对军事装备的需求。

精密工程机械因其电脑控制的精度而变得越来越受欢迎,这提高了製造过程的效率和生产率。技术在进步,精密工程的范围在扩大。精密工程机械可实现流程自动化,减少加工零件所需的时间。

机械师可以将代码输入计算机,机器就可以运行,无需人工干预或控制。事实证明,机器人,也称为工业自动化机器 (IAM),在许多方面对离散製造商和系列製造商都有好处。其中一些好处包括提高效率和更有效率的製造流程。

精密车床产品製造的市场趋势

汽车产业引领市场

汽车行业是精密加工零件的最大用户,因此确保准确和严格的公差非常重要。为了使汽车零件正常工作,它们必须安装到位并且品质指定,如果没有按照适当的规格进行加工,可能会导致燃油经济性降低、引擎故障和事故等问题。这是有性别的。精密车床零件应用于汽车业,如节气门控制轴、低通滤波器、液压阀、阀门壳体、感知器壳体、温度感知器壳体、压力感知器壳体、管接头、感知器金属壳等用于各种目的。我们确保零件准确、耐用且功能正常,帮助您的汽车平稳、安全地运作。

2022 年全球汽车产量将达到约 8,500 万辆。与前一年相比,这一数字增加了约 6%。由于人口增长、都市化和个性化,这一数字预计将继续增长。

随着电子商务的发展,物流运输对轻、中、重型商用卡车的需求大幅增加。物流业不再只是一个服务供应商,而是提供以客户为导向的解决方案。因此,对商用卡车运输的需求呈指数级增长。

工业4.0将彻底改变製造业

工业4.0实现生产现代化并增强西方工业部门的竞争力。它以改进的机器人技术和自动化、新型态的人机互动、大量资料的累积以及增强的连接性为中心。借助物联网和高效自动化机器人技术,製造商可以收集、分析大量资料并采取行动。

随着越来越多的资料被记录、分析和存储,以及智慧型设备数量的增加,连接和通讯可能变得更加重要。企业需要在内部以及与外部合作伙伴进行互通和共用资料,以实现更高级的营运。

使用数位迭加,混合实境设备可以将现场工作人员与具有必要技能的第三方联繫起来,让工作人员能够逐步学习如何进行维修。

过去,试图保持竞争力的製造公司不得不将业务外包给低工资国家。技术进步现在使富裕国家能够参与竞争。

精密车床产品製造业概况

市场上有很多大公司。市场是分散的,因为没有竞争对手控制市场的很大一部分。竞争对手正在製定新的策略来维护自己的主导地位。

Premier Farnell Corp.、HES Prazisionsteile Hermann Erkert GmbH、KPF 和 Melling Tool Co.KG 是一些活跃于该领域的主要企业。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查背景

- 研究假设和市场定义

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 目前的市场状况

- 市场动态

- 市场驱动因素

- 航太的成长推动市场

- 汽车产业引领市场

- 市场限制因素

- 缺乏技术纯熟劳工

- 机会

- 到 2025 年,工业 4.0 将彻底改变製造业

- 市场驱动因素

- 产业吸引力-波特五力分析

- 价值链/供应链分析

- 政府法规和倡议

- 科技趋势

- COVID-19 对市场的影响

第五章市场区隔

- 按操作

- 手动操作

- 数控操作

- 按机器类型

- 自动螺丝机

- 旋转传送机

- 计算机数值控制(CNC)

- 车床或车削中心

- 依材料类型

- 塑胶

- 钢

- 其他材料类型

- 按最终用途

- 车

- 电子产品

- 防御

- 卫生保健

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 孟加拉

- 土耳其

- 韩国

- 澳洲

- 印尼

- 其他亚太地区

- 中东/非洲

- 埃及

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲

- 世界其他地区

- 北美洲

第六章 竞争形势

- 公司简介

- Melling Tool Co.

- Kksp Precision Machining

- E&H Precision

- Greystone of Lincoln

- RW Screw Products

- Zhejiang Ronnie Precision Machine Co. Ltd

- Astro Machine Works

- Cox Manufacturing Company

- EJ Basler Co.

- Hall Industries Incorporated

- Supreme Machined Products Company

- Alpha Grainger Mfg

- C & M Machine Products

- Alger Precision Machining

- Tompkins Products Inc.

第七章 市场的未来

第8章附录

The Precision Turned Product Manufacturing Market size is estimated at USD 113.93 billion in 2024, and is expected to reach USD 154.26 billion by 2029, growing at a CAGR of 6.25% during the forecast period (2024-2029).

The demand for cutting-edge machining solutions is driving sales growth, and the focus on reducing downtime to increase production speed, accuracy, and machining processes is also driving growth. Industry 4.0 encourages manufacturing facilities to link up with other business functions to create complex and adaptive automation systems that use manufacturing and production precision engineering machinery. So, there are lots of opportunities in the sector as Industry 4.0 flourishes in the coming years.

The aerospace industry, which includes R&D and manufacturing of the full range of systems, electronics, and equipment for both civilian and defense markets, is currently experiencing global growth and is unlikely to experience recessionary pressures. However, the world's top commercial aerospace OEMs predict that by 2023 or early 2024, global passenger traffic is expected to return to 2019 levels. This could lead to ramp-ups to address growing backlogs and boost industry revenue. One of the reasons for this increase can be attributed to the increase in defense budgets after the outbreak of war in Ukraine, which led to an increase in global demand for military equipment.

Because of their computerized precision, precision engineering machines are becoming increasingly popular as manufacturing processes become more efficient and productive. Technology is advancing, and the scope of precision engineering is expanding. Precision engineering machines allow for automated processes and, therefore, reduce the time required for component machining.

Once the codes are fed into the computer by the machinist, the machines can run without manual intervention and control. Robots, also known as industrial automated machines (IAMs), have proven to be beneficial for discrete and continuous manufacturers alike in a variety of ways. Some of these benefits include increased efficiency and more efficient manufacturing processes.

Precision Turned Product Manufacturing Market Trends

Automotive Industry is driving the market

The auto industry is the biggest user of precision machined parts, so it's important to make sure they're accurate and with tight tolerances. Automotive parts need to fit into place and be of good quality to work properly, and if they're not machined to the right specifications, it can lead to problems like lower fuel efficiency, engine failure, and accidents. Precision-turned components are used in the auto industry for a variety of purposes, like throttle control shafts, low pass filters, hydraulic valves, valve housings, sensor housings, temperature sensor housings, pressure sensor housings, pipe joints, sensor metal shells, etc. They make sure the parts are accurate, durable, and work properly, which helps keep your car running smoothly and safely.

There were approximately 85 million motor vehicles produced in the world in 2022. This represents an increase of about 6% compared to the previous year. It is expected that this number will continue to increase in the coming years due to the growing population, urbanization, and personalization.

With the growth of e-commerce, the demand for small, medium, and large commercial trucks in logistics and transportation has increased significantly. The logistics industry is no longer just about providing services but providing customer-oriented solutions. Therefore, the demand for commercial trucks for transportation has increased exponentially.

Industry 4.0 Revolutionizing the Manufacturing Industry

Industry 4.0 involves modernizing production and enhancing the competitiveness of the Western industrial sector. It is centered on improved robotics and automation, new human-machine interaction forms, massive data troves, and increasing connectivity. With the help of IoT and highly effective, automated robotics, manufacturers can gather, analyze, and take action on enormous stockpiles of data.

Connectivity and communication may become more crucial as the amount of data being recorded, analyzed, and stored, along with the number of smart devices, increases. Companies require their data to be interoperable and shared both within an organization and with outside partners to enable higher levels of operations.

Through the use of digital overlays, mixed reality devices can link the person on site with a third party with the necessary skills so they can learn how to make the repairs step-by-step.

In the past, manufacturing companies that wanted to stay competitive had to outsource to low-wage countries. Richer nations are now able to compete because of technological advancements.

Precision Turned Product Manufacturing Industry Overview

There are many major players in the market. Since none of the competitors control a sizable portion of the market, it is fragmented. The rivals are coming up with new strategies to assert their superiority.

Premier Farnell Corp., HES Prazisionsteile Hermann Erkert GmbH, KPF, Melling Tool Co., and Paul Bippus GmbH & Co. KG are a few of the key companies active in the sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Background

- 1.2 Study Assumptions and Market Definition

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Growth of the Aerospace Industry driving the market

- 4.2.1.2 Automotive Industry is driving the market

- 4.2.2 Market Restraints

- 4.2.2.1 Skilled Labor Shortage

- 4.2.3 Opportunities

- 4.2.3.1 Industry 4.0 Revolutionizing the Manufacturing Industry By 2025

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Government Regulations and Initiatives

- 4.6 Technological Trends

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Operation

- 5.1.1 Manual Operation

- 5.1.2 CNC Operation

- 5.2 By Machine Types

- 5.2.1 Automatic Screw Machines

- 5.2.2 Rotary Transfer Machines

- 5.2.3 Computer Numerically Controlled (CNC)

- 5.2.4 Lathes or Turning centers

- 5.3 By Material Type

- 5.3.1 Plastic

- 5.3.2 Steel

- 5.3.3 Other Material Types

- 5.4 By End Use

- 5.4.1 Automobile

- 5.4.2 Electronics

- 5.4.3 Defense

- 5.4.4 Healthcare

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Bangladesh

- 5.5.3.5 Turkey

- 5.5.3.6 South Korea

- 5.5.3.7 Australia

- 5.5.3.8 Indonesia

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 Middle-East and Africa

- 5.5.4.1 Egypt

- 5.5.4.2 South Africa

- 5.5.4.3 Saudi Arabia

- 5.5.4.4 Rest of Middle-East and Africa

- 5.5.5 Rest of the World

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Melling Tool Co.

- 6.2.2 Kksp Precision Machining

- 6.2.3 E&H Precision

- 6.2.4 Greystone of Lincoln

- 6.2.5 R W Screw Products

- 6.2.6 Zhejiang Ronnie Precision Machine Co. Ltd

- 6.2.7 Astro Machine Works

- 6.2.8 Cox Manufacturing Company

- 6.2.9 E. J. Basler Co.

- 6.2.10 Hall Industries Incorporated

- 6.2.11 Supreme Machined Products Company

- 6.2.12 Alpha Grainger Mfg

- 6.2.13 C & M Machine Products

- 6.2.14 Alger Precision Machining

- 6.2.15 Tompkins Products Inc.*