|

市场调查报告书

商品编码

1431742

专属式电厂:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Captive Power Plant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

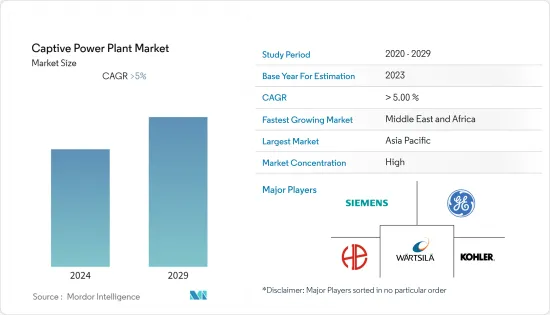

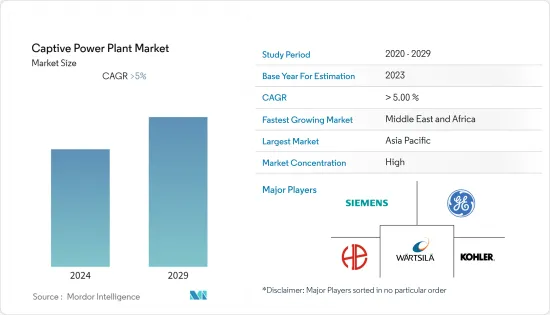

Equal-6.41的专属式电厂市场规模预计将从2024年的2,141.2亿美元成长到2029年的2,921.4亿美元,在预测期间(2024-2029年)复合年增长率为6.41%。

主要亮点

- 从中期来看,大多数国家的发电业已相当成熟,但电力公司每天24小时向工业用户提供优质电力的能力有限,因此工业界将继续发展自备电厂。我别无选择,只能建立它。此外,其中一些行业的地理位置偏远和电力供应不可靠(特别开发中国家和不发达国家)是鼓励安装自备发电厂的因素。

- 另一方面,高昂的资本支出和营运成本限制了全球欠发达地区专属式电厂的成长。

- 儘管如此,尼日利亚、安哥拉和加纳等非洲国家能源密集型产业的扩张预计将在不久的将来为专属式设备製造商和开发商提供重大机会。

- 亚太地区主导专属式电厂市场,大部分需求来自中国、印度和日本。

专属式电厂市场趋势

钢铁业占有较大市场份额

- 在运作大型钢厂时,确保可靠的电源极为重要。由于负载的性质及其大小,钢厂的配电系统与其他工厂的配电系统有所不同。众所周知,大型综合钢厂由各种加工厂、非加工厂、服务和公用设施组成。

- 由于钢厂是连续流程工厂,需要较高的资本支出,因此电网设计必须妥善处理各种突发事件,例如由于电能品质差而停电、电力设备故障以及内部电力系统故障等。批判性观点。设备和配件的选择和尺寸限制可能会因生产损失和经济损失而导致重大资本损失。

- 此外,现代生活的很大一部分是由钢铁製成的。从基础设施、建筑物、机械、电气设备、汽车、烹调器具都需要大量钢材。预计到2050年钢铁需求将增加五倍。

- 世界在现代化过程中建立了庞大的钢铁产能。根据世界钢铁协会统计,2022年钢铁产量约18.85亿吨(MT),较2012年成长约20.6%。

- 在各种政策的推动下,透过扩大製造基地、透过多边合作进程共用专有技术、产品开发和技术转让,促进了国内生产。

- 例如,2022年10月,安赛乐米塔尔公司AMNS India宣布对印度Hazira钢厂投资76.2亿美元。这项投资预计将使该工厂的产能从目前的900万吨增加到1500万吨。此外,这项投资还包括引进新的炼钢技术、安装新时代的机械以及扩大我们的产品范围。

- 2022年7月,印尼Krakatau钢铁公司与韩国POSCO控股公司同意投资35亿美元扩大印尼钢铁产能。该协议将使Krakatoa POSCO的上下游产品产能扩大至每年1,000万吨。 2023 年起的扩建也将包括电动车用汽车钢的生产。

- 考虑到该地区钢铁业的发展和投资,预计在预测期内对容量电厂的需求将大幅增长。

亚太地区主导市场

- 预计亚太地区将在 2022 年主导专属式电厂市场,并有望在未来几年保持其主导地位。人口成长、快速都市化和工业化等因素正在推动该地区的电力需求,为产能扩张创造了重大机会。

- 以GDP计算,中国是世界第二大经济体。 2022年,该国GDP成长约0.8%,达到17.96兆美元。随着人口老化和经济从製造业转向服务业、从外需转向内需、从投资转向消费的再平衡,国家成长逐渐下滑。

- 由于化学、石油和天然气、金属加工和其他行业的显着增长,中国预计将成为专属式电厂最大、成长最快的市场之一。此外,专属式电厂在这些产业中发挥重要作用,因此预计在预测期内也将出现类似的成长。

- 钢铁业是专属式电厂的重要市场。根据世界钢铁协会预测,2022年中国钢铁产量约10.18亿吨,约占全球钢铁产量的54%。

- 此外,石化产业对中国经济贡献显着,也是支撑製造业高品质发展的主要领域。近年来,中国石化产业取得了长足发展。例如,2023年3月,阿美公司与合资伙伴岩金新城工业集团和北方工业集团宣布计画在中国东北地区开始兴建大型精製石化综合厂。该综合设施将包括一座日产30万桶的炼油厂和一座石化厂,每年将生产165万吨乙烯和200万吨对二甲苯。计划获得行政批准后,预计将于 2023 年第二季开工。计划于 2026 年全面运作。

- 韩国也在投资石化产品,专属式电厂的需求预计将增加。 2022年11月,沙乌地阿美公司宣布计画向其韩国子公司位于港口城市蔚山的工厂投资约70亿美元,以生产更高价值的石化产品。该公司表示,Shaheen计划是沙乌地阿拉伯在亚洲国家最大的投资,旨在开发全球最大的精製石化蒸汽裂解装置之一。

- 因此,由于钢铁、石化产业的这些趋势,预计在预测期内对专属式电厂的需求将大幅增加。

专属式电厂产业概况

专属式电厂市场正在整合。该市场的主要企业(排名不分先后)包括科勒公司、通用电气公司、Wartsila Oyj Abp、Bharat Heavy Electricals Limited、西门子股份公司等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2028年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 工业部门对电力的需求不断增加

- 多个行业的位置偏远且供电不可靠

- 抑制因素

- 资本投资和营运成本高

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 燃料来源

- 煤炭

- 气体

- 柴油引擎

- 可再生

- 其他燃料

- 产业

- 水泥

- 钢

- 金属/矿物

- 石油化学

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Kohler Co.

- General Electric Company

- Wartsila Oyj Abp

- Siemens AG

- Bharat Heavy Electricals Limited

- Tata Power Renewable Energy

- AMP Solar Group Inc.

第七章 市场机会及未来趋势

简介目录

Product Code: 47683

The Captive Power Plant Market size in terms of Equal-6.41 is expected to grow from USD 214.12 billion in 2024 to USD 292.14 billion by 2029, at a CAGR of 6.41% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, though the power generation industry is well-established in most countries, the limitations that the utilities have to provide high-quality power round the clock to the industrial users force the industries to establish captive power plants. Moreover, the remote location of some of these industries and the unreliability of the power supply (especially in developing and underdeveloped countries) are the factors promoting the installation of captive power plants.

- On the other hand, high capital and operational expenditures are limiting the growth of captive power plants in underdeveloped regions across the world.

- Nevertheless, the expansion of energy-intensive industries in African countries such as Nigeria, Angola, and Ghana is expected to provide a significant opportunity for captive power plant equipment manufacturers and developers in the near future.

- Asia-Pacific has dominated the captive power plant market, with the majority of the demand coming from China, India, and Japan.

Captive Power Plant Market Trends

Steel Industry to Have Significant Share in the Market

- It is very important to have a reliable power source when operating a large-scale steel plant. The distribution system for power in a steel plant is different from that of any other industrial plant because of the nature of the load and its magnitude. It is common knowledge that large-scale integrated steel plants consist of a variety of processing plants, nonprocessing plants, services, and utilities.

- Since steel plants are continuous process plants requiring high capital expenditure, power network design should be viewed from a criticality perspective to ensure that any eventuality such as grid power failure, power equipment failure and internal power system disturbances due to poor power quality is adequately addressed. A constraint in selection and sizing of equipment and accessories cannot result in a massive capital damage associated with financial loss as a result of lost production, resulting in huge capital damage.

- Further, a large portion of modern life is comprised of steel. Infrastructure, buildings, machinery, electrical equipment, automobiles, and various products, from cookware to furniture, require large amounts of iron and steel. It is estimated that the steel demand will increase by five times by 2050.

- The world has built an enormous capacity for iron and steel during its modernization process. According to World Steel Association, in 2022, the steel production was around 1,885 million tons (MT), with an increase of around 20.6% from 2012.

- As a result of various policy, indigenous manufacturing will be encouraged by widening the manufacturing base, sharing know-how, product development, and technological transfer through a multilateral collaboration process.

- For instance, in October 2022, AMNS India, an arm of ArcelorMittal, announced an investment of USD 7.62 billion in its Hazira steel plant in India. This investment is expected to increase the plant's capacity to 15 million tons, which is currently 9 million tons. Additionally, the investment will include the installation of new steel-making technologies, the setting up of new-age machinery, and the expansion of product offerings.

- In July 2022, Indonesia's Krakatau Steel and South Korea's POSCO Holdings agreed to invest USD 3.5 billion in expanding their steel production capacity in Indonesia. KRAKATAU POSCO's production capacity for upstream and downstream products will be increased to 10 million tonnes per year under the agreement. Starting in 2023, the expansion includes manufacturing automotive steel for electric vehicles.

- Considering the developments and investments in the steel and iron industry in the region, the demand for capative power plants is expected to witness significant growth during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominat the captive power plant market in 2022, and is expected to continue its dominance in the coming years as well. Factors such as growing population, rapid urbanization, and industrialization are driving the power demand in the region, creating significant opportunities for capacity expansion.

- In terms of GDP, China is the second-largest economy in the world. In 2022, the country's GDP grew by about 0.8%, reaching USD 17.96 trillion. The growth in the country is gradually diminishing as the aging population, manufacturing to services, and external to internal demand, and the economy is rebalancing from investment to consumption.

- China is expected to be one of the largest and fastest-growing markets for captive power plants, owing to the significant growth in its chemical, oil & gas, metals processing, and other sectors. Further, it is expected to continue to witness similar growth during the forecast period, as captive power plants play a crucial role in these industries.

- The iron and Steel industry is a significant market for captive power plants. According to World Steel Association, in 2022, the steel production in China was approximately 1,018 million tons, around 54% of the global steel production.

- Further, the petrochemical industry is a significant contributor to China's economy and a key field for supporting the high-quality development of the manufacturing sector. Recently, China is witnessing developments in the petrochemical sector. For instance, in March 2023, Aramco and joint venture partners Panjin Xincheng Industrial Group and NORINCO Group announced plans to start the construction of a significant integrated refinery and petrochemical complex in northeast China. The complex is going to have combination of a 300,000 barrels per day refinery and a petrochemical plant with an annual production capacity of 1.65 million tons of ethylene and 2 million metric tons of paraxylene. Construction is expected to start in the second quarter of 2023 after the project has secured administrative approvals. It is expected to be fully operational by 2026.

- South Korea is also investing in its petrochemical business which is anticipated to create a rising demand for captive power plants. In November 2022, Saudi Aramco announced investment plans for about USD 7 billion at a South Korean affiliate's factory in the port city of Ulsan to produce more high-value petrochemical products. According to the company, the Shaheen project is Saudi's biggest investment in the Asian nation to develop one of the world's largest refinery-integrated petrochemical steam crackers.

- Hence, with these trends from the steel, and petrochemical industries, the demand for captive power plants is anticipated to increase significantly during the forecast period.

Captive Power Plant Industry Overview

The captive power plant market is consolidated. Some of key players in this market (not in particular order) include Kohler Co., General Electric Company, Wartsila Oyj Abp, Bharat Heavy Electricals Limited, and Siemens AG., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Power Demand across Industrial Sector

- 4.5.1.2 Remote Location of Several Industries and the Unreliability of the Power Supply

- 4.5.2 Restraints

- 4.5.2.1 High Capital and Operational Expenditures

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Source

- 5.1.1 Coal

- 5.1.2 Gas

- 5.1.3 Diesel

- 5.1.4 Renewable

- 5.1.5 Other Fuel Sources

- 5.2 Industry

- 5.2.1 Cement

- 5.2.2 Steel

- 5.2.3 Metal & Minerals

- 5.2.4 Petrochemicals

- 5.2.5 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Kohler Co.

- 6.3.2 General Electric Company

- 6.3.3 Wartsila Oyj Abp

- 6.3.4 Siemens AG

- 6.3.5 Bharat Heavy Electricals Limited

- 6.3.6 Tata Power Renewable Energy

- 6.3.7 AMP Solar Group Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion of Energy Intensive Industries in African Countries such as Nigeria, Angola, And Ghana

02-2729-4219

+886-2-2729-4219