|

市场调查报告书

商品编码

1432365

稻米种子处理:市场占有率分析、产业趋势、成长预测(2024-2029)Rice Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

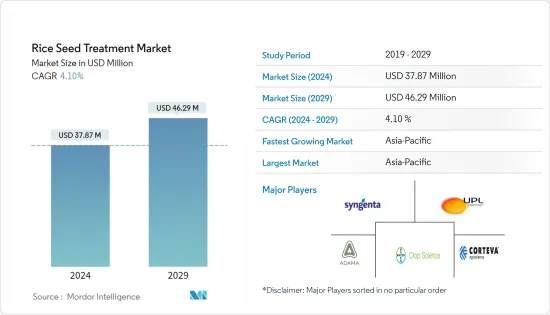

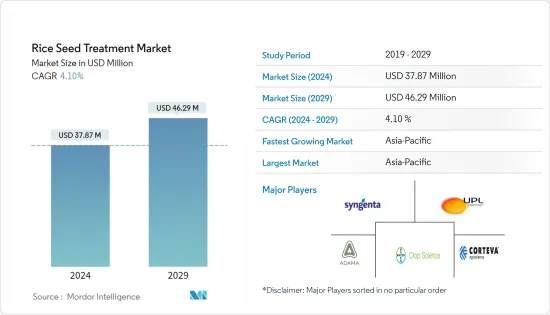

稻米种子处理市场规模预计到 2024 年为 3,787 万美元,预计到 2029 年将达到 4,629 万美元,在预测期内(2024-2029 年)复合年增长率为 4.10%。

疫情爆发之初,农业部门受到了 COVID-19 大流行的部分影响,依赖进口的农药和化肥经历了长期的供应中断。不过,我们已采取预防措施并努力确保供应。

中国是农药的主要生产国,生产中断也将影响北美农作物保护作物的供应,包括种子处理剂。然而,儘管是在海外生产,但农药的活性化学成分是在北美配製的,并生产包括种子处理剂在内的最终产品。据加拿大农产品零售商协会称,大多数产品通常会提前一到两年。因此,加拿大工业在 2020 年生长季的投入供应充足。

种子处理在保护种子和幼苗免受种子和土壤传播的病虫害以及影响作物抽穗和生长的害虫方面发挥着重要作用。对于世界各地的稻农来说,要采用这种方法,重要的是向农民提供适当的化学/生物农药和设备,并提高农民对种子处理、种子后物料输送和种植材料的认识。综合普及策略是必需的。

从应用来看,生物领域预计成长最快。由于环境问题的日益严重和主要市场参与企业推出的产品,生物种子处理预计在预测期内将以更快的速度增长。

从应用技术来看,拌种是 2020 年最大的细分领域。研究表明,种子拌药是最方便且最具成本效益的种子处理技术。例如,该技术已被发现在亚太地区(最大的市场)有效,那里有许多小规模农民和低收入。因此,预计该市场在未来几年将会成长。

作物保护产业新兴市场的开拓、政府支持的增加、需求的增加和优质种子的采用是预测期内推动全球稻米种子加工市场的一些因素。

稻米种子处理市场趋势

优质种子的需求和采用不断增加

农民越来越认识到种子处理是保护他们对优质种子的昂贵投资的一种方式。由于对具有理想农艺性状的优质种子的需求不断增加,种子成本不断上升。企业和农民都愿意在种子处理解决方案上花费额外费用,以保存昂贵的优质种子。

引入基因改造种子为种子带来了很高的付加,但种子的成本很高,有时是非基因改造种子的两倍。此前,由于部分种子腐烂或受到昆虫侵袭,农民预计产量将增加 85%。随着趋势的变化,种子处理变得至关重要,种植者现在期望即使在不利的条件下也能 100% 出苗。新兴市场的主要企业不断致力于透过现代育种技术开发优质种子,导致种子成本不断上升。

非洲国家米产量不足,依赖进口。塞拉利昂就是这样的国家之一。因此,为了实现自给自足,该国政府采取了多项策略。一个有希望的解决方案是普及产量品种,例如非洲新稻(NERICA)。 NERICA因结合了亚洲稻米的遗传特性(产量)和非洲稻米的遗传特性(抗旱、抗病)而被非洲稻农誉为奇蹟作物。然而,目前估计只有 2% 的非洲农民使用 NERICA。这是因为改良品种的成本比常规品种高40-100%,为贫穷农民采用NERICA造成了主要障碍。因此,由于这些混合品种的成本很高,稻农有机会以可负担的成本使用经过处理的种子。预计这将导致未来几年水稻种子加工市场的积极成长。

亚太地区主导市场

由于大米是主粮和种植最多的作物,据观察,亚太地区是2020年增长最快、份额最大的地区。中国是该地区最大、成长最快的国家,其次是印度和日本。

根据中国农业部介绍,水稻种业正积极探索差异化商品品种和市场定位,以弥补产量、低抗品种(特别是稻瘟病)的缺乏。中国也致力于提高种子的价值。因此,日本的混合水稻品种不断增加。 2018年,混合稻种子产量较2017年成长2.55%。预计这也将对种子处理市场产生正面影响。印度也是全球第二大稻米生产国和全球最大稻米出口国。在印度,水稻的种植海拔和气候条件差异很大。由于有利的气候和做法,印度水稻产量的增加正在推动该国对水稻种子处理的需求。总体而言,由于粮食需求的增加以及向市场推出创新新产品的研发力度的加大,该地区的稻米种子加工市场预计在未来几年将稳定成长。

稻米种子加工业概况

全球稻米种子处理剂市场高度整合,2021年主要企业(前7名)占据主要份额,而其他参与者则占据次要份额。拜耳股份公司、先正达国际股份公司、UPL 有限公司、安道麦农业解决方案有限公司、Corteva Agriscience、Nufarm 有限公司、Croda International PLC (Incotec) 是该市场上的一些知名参与者。这些公司正专注于产品发布,以扩大其在全球的影响力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 目的

- 化学

- 非化学/生物

- 功能

- 种子保护

- 种子富集

- 其他特性

- 应用科技

- 种子披衣

- 种子製丸

- 拌种

- 其他应用技术

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 西班牙

- 英国

- 法国

- 德国

- 俄罗斯

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他地区和非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Adama Agricultural Solutions Ltd

- Advanced Biological Marketing Inc.

- Yara International

- Bayer AG

- Bioworks Inc.

- Indofill Industries Limited

- Dhanuka Agritech Limited

- Corteva Agriscience

- Rallis India Ltd

- Croda International(INCOTEC)

- Crystal Crop Protection limited

- UPL Limited

- Marrone Bio innovations Inc.

- Nufarm Ltd

- GSP Crop Science Pvt. Ltd

- Precision Laboratories LLC

- Syngenta International AG

第七章 市场机会及未来趋势

第 8 章 COVID-19 市场影响评估

The Rice Seed Treatment Market size is estimated at USD 37.87 million in 2024, and is expected to reach USD 46.29 million by 2029, growing at a CAGR of 4.10% during the forecast period (2024-2029).

In the initial days of the outbreak, the agriculture sectors were partially affected by the COVID-19 pandemic, but agricultural chemicals and fertilizers, which are import-dependent, saw supply disruptions for longer. However, preventive measures and initiatives were taken to ensure supply.

China being the major producer of agricultural chemicals, disruptions to production would have a ripple effect on North American supplies of crop protection inputs, including seed treatment. However, although produced overseas, the active chemical ingredients of a pesticide are formulated in North America to produce the end product, including seed treatment. As per the Canadian Association of Agri-Retailers, most products are generally committed in advance in a year or two. Therefore, the Canadian industry was well-supplied with the inputs for the 2020 growing season.

Seed treatment plays an important role in protecting the seeds and seedlings from seed and soil-borne diseases and insect pests affecting crop emergence and growth. The adoption of this practice by rice farmers across the globe requires effective extension strategies to make the appropriate chemical pesticides/bio-pesticides and equipment available to the farmers, besides making them aware of seed treatment, post-treatment handling of seeds, and planting materials.

In application type, the biological segment is anticipated to witness the fastest growth. With the increasing concern for the environment and product launches by major market players, the biological seed treatment is anticipated to grow at a faster rate during the forecast period.

By application technique, seed dressing was the largest segment in 2020. According to the study, seed dressing is found to be the most convenient and cost-effective seed treatment technique. For instance, in Asia-Pacific (the largest market), where most farmers are small-scale farmers with low income, this technique is found to be effective. Hence, the market is projected to grow in the coming years.

The developments in the crop protection industry, increasing government support, and the increasing demand and adoption of high-quality seeds are some of the factors driving the global rice seed treatment market during the forecast period.

Rice Seed Treatment Market Trends

Increasing Demand for and Adoption of High-quality Seeds

Farmers are increasingly acknowledging seed treatment as a mode to protect high investments made on good quality seeds. Owing to the increasing demand for high-quality seeds with desirable agronomic traits, the cost of seeds is increasing. Both companies and farmers are ready to spend extra on seed treatment solutions to save costly high-quality seeds.

The introduction of GM seeds added high value to seeds, with the cost of seeds being high and sometimes being twice as much as that of non-GM seeds. Earlier, a growth of 85% was expected by farmers as some seeds would rot or be destroyed by insects. With changing trends and 100% seed emergence expectation by growers even in unfavorable conditions, seed treatment has become a necessity. Top players in the market are constantly focusing on developing superior quality seeds through modern breeding techniques, thereby increasing the cost of the seeds.

African countries do not produce enough rice and are reliant on imports. One such country is Sierra Leone. Hence, to become self-sufficient, the country's government is adopting a few strategies. A promising solution is the dissemination of high-yielding rice varieties, such as the New Rice of Africa (NERICA), which have become known as the miracle crop for African rice farmers because they combine the genetic qualities of Asian rice (high yielding) and African rice (high resistance to drought and disease). However, current estimates suggest only 2% of farmers in the country use NERICAs. This is due to the cost of improved varieties that cost 40-100% more than traditional ones, representing a significant barrier to adoption among poor farmers. Hence, due to the high cost of these hybrid varieties, there is an opportunity for paddy farmers to use treated seeds at an affordable cost. This, in turn, is expected to lead to the positive growth of the rice seed treatment market in the coming years.

Asia-Pacific Dominates the Market

As rice is the staple food and most prominent crop grown, the Asia-Pacific region was observed to be the largest and fastest-growing region with the largest share in 2020. In the region, China is the largest and fastest-growing country, followed by India and Japan.

According to the Ministry of Agriculture of China, the rice seed industry is actively seeking differentiated commercial varieties and market positioning to make up for the shortage of high-yield and low-resistance varieties (especially rice blasts). China is also focusing on enhancing the value of seeds. This is leading to an increase in the number of hybrid rice varieties in the country. In 2018, an increase of 2.55% was witnessed in the hybrid rice seed production compared to the value registered in 2017. This is expected to impact the seed treatment market as well positively. Also, India is the second-largest producer and largest exporter of rice across the world. In India, rice is grown under widely varying conditions of altitude and climate. The rising production of rice in India, owing to the favorable climate and practices, is boosting the demand for rice seed treatment chemicals in the country. Overall, the rice seed treatment market in the region is expected to grow steadily in the coming years due to the rising food demand and increasing research and development to introduce new innovative products in the market.

Rice Seed Treatment Industry Overview

The global rice seed treatment market is highly consolidated, with major players (top seven players) holding a major share while others accounted for a minor share in 2021. Bayer AG, Syngenta International AG, UPL Limited, Adama Agricultural Solutions Ltd, Corteva Agriscience, Nufarm Ltd, and Croda International PLC (Incotec) are some of the prominent players operating in the market. These players are focusing on product launches to expand their presence at the global level.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Chemical

- 5.1.2 Non-chemical/Biological

- 5.2 Function

- 5.2.1 Seed Protection

- 5.2.2 Seed Enhancement

- 5.2.3 Other Functions

- 5.3 Application Techniques

- 5.3.1 Seed Coating

- 5.3.2 Seed Pelleting

- 5.3.3 Seed Dressing

- 5.3.4 Other Application Techniques

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Germany

- 5.4.2.5 Russia

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Adama Agricultural Solutions Ltd

- 6.3.2 Advanced Biological Marketing Inc.

- 6.3.3 Yara International

- 6.3.4 Bayer AG

- 6.3.5 Bioworks Inc.

- 6.3.6 Indofill Industries Limited

- 6.3.7 Dhanuka Agritech Limited

- 6.3.8 Corteva Agriscience

- 6.3.9 Rallis India Ltd

- 6.3.10 Croda International (INCOTEC)

- 6.3.11 Crystal Crop Protection limited

- 6.3.12 UPL Limited

- 6.3.13 Marrone Bio innovations Inc.

- 6.3.14 Nufarm Ltd

- 6.3.15 GSP Crop Science Pvt. Ltd

- 6.3.16 Precision Laboratories LLC

- 6.3.17 Syngenta International AG