|

市场调查报告书

商品编码

1432421

活动管理软体:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Event Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

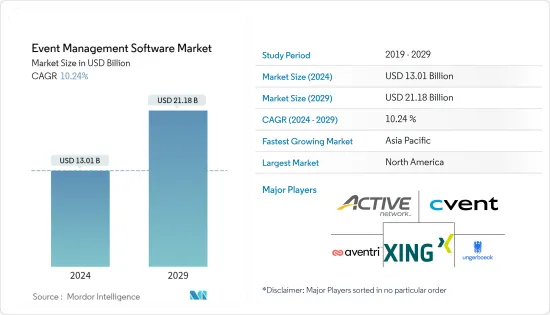

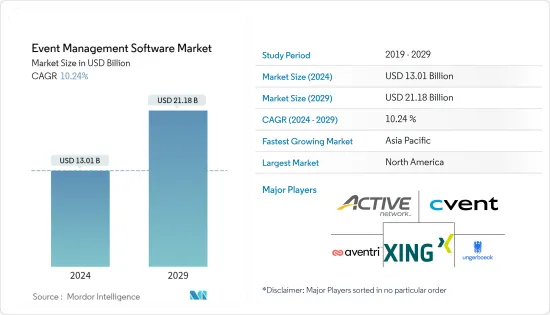

活动管理软体市场规模预计到 2024 年为 130.1 亿美元,到 2029 年将达到 211.8 亿美元,在预测期内(2024-2029 年)复合年增长率为 10.24%。

影响市场成长的关键因素是过去十年体育、游戏和娱乐活动的显着增加,以及基于资料和即时资料从头到尾普及活动的软体的广泛应用。

主要亮点

- 活动管理软体已成为大型和小型策划者的标准。近年来,专业和自由组织者的数量不断增加,基于应用程式的应用程式需求也随之增加。活动管理软体解决方案对于处理全年举办的多个活动和表演的第三方策划者来说非常有利。

- 随着人们生活方式的多样化,活动举办需要创新。因此,企业和联盟开始专注于在有吸引力的目的地举办主题会议和活动,以提升品牌形象。此外,意识提升聚会、社区服务活动和筹款活动等社会活动的组织不断增加,甚至是中小型企业出于行销目的组织的活动,增加了对活动管理软体的需求。

- 考虑到不断增长的需求,领先的市场公司正在提出新的解决方案来维持市场并改进其产品的功能。例如,2022 年 4 月,Cvent CONNECT 推出了新的 Cvent 供应商市场,以推出公司的客户会议。供应商市场直接整合到 Cvent 业界领先的线上场地采购平台 Cvent 供应商网路 (CSN) 中,可让您存取核准的供应商和供应商组成的可信任网络,提供现场服务以及虚拟和混合活动。 。

- 此外,供应商和行销公司越来越多地寻求与活动组织者合作,因为活动被证明是一个很好的行销管道。事实上,根据 Social Tables 的数据,在最近的一项活动行销调查中,52% 的受访者表示事件行销比其他行销管道带来了更多的商业价值。此类统计数据进一步鼓励新公司进入市场,并帮助公司获得可用于实现各种业务目标的可行见解,从而增加对基于行动的事件管理软体解决方案的需求。

- 然而,与事件管理软体相关的价格飙升是阻碍市场成长的主要因素之一。此外,消费者意识下降,特别是在发展中地区,也是受调查市场成长的问题。

- 冠状病毒感染疾病(COVID-19) 在全球范围内的爆发影响了不同国家的数百万人和企业,并对所研究市场的成长产生了显着影响。由于为遏制病毒传播而采取的遏制措施,许多知名和公认的体育赛事被推迟或取消,导致所研究的市场放缓。然而,随着疫情的影响缓解和经济活动开始获得动力,后电晕时期预计将有利于所研究市场的成长。

活动管理软体市场趋势

媒体和娱乐业预计将显着成长

- 第三方策划者全年策划多场音乐会和演出,与内部策划者相比,活动管理软体对第三方策划者极为有利。受欢迎的活动和节日包括经典酵母、圣保罗之旅以及Outside Lands 音乐和艺术节,每年收益数百万美元的收入。

- 与教育和工业等其他行业主办的活动不同,媒体和娱乐活动涉及的收益如此之大,是规划最复杂的活动之一。此外,活动主办过程中的停机可能会对活动的声誉产生重大影响。媒体和娱乐活动通常是出于慈善目的而组织的。因此,规划过程或软体中的偏差可能会损害组织者的声誉。

- 由于大多数媒体和娱乐活动都与高收益变动相关,因此分析工具和活动管理软体对活动组织者极为有利。在当前的市场情况下,此类附加功能已成为许多活动管理软体产品的关键卖点,因为该领域的大部分活动策划都委託给第三方策划者。

- 市场上的主要企业正在与供应商合作,为活动和会议提供视讯解决方案。例如,2022 年 7 月,领先的活动管理公司 ASM Global 宣布致力于云端运算的多年策略蓝图,为现场娱乐产业提供首个完全整合的预订、餐饮、销售和活动管理平台。我们宣布与软体供应商Infor 建立合作关係。该公司还计划在贸易展览、会议和其他企业活动中使用它。

- 随着文化活动需求的增加,市场相关人员也专注于与支持艺术和文化组织的供应商合作。此外,全球范围内举办的公共活动数量不断增加也为所研究市场的成长创造了良好的前景。例如,Live Nation 推广的音乐会和节日数量从 2017 年的 29,592 场增加到 2022 年的 43,644 场。

北美占有很大份额

- 由于在教育运动日、马拉松、电影节和其他私人活动中越来越多地采用活动管理软体,预计北美区域市场在预测期内将占据重要的市场占有率。该地区领先企业、中小企业和新进入者的存在是推动市场成长的一些关键因素。

- 北美地区有多家供应商提供活动管理软体。例如,由 ID.me 提供支援的 Cvent Health Check 是一种易于使用的解决方案,使活动组织者能够透过几个简单的步骤实施安全的方式来检查与会者的健康状况。透过将ID.me 的疫苗、测试和身份验证功能与Cvent 强大的活动行销和管理平台相结合,Cvent 的客户将能够透过对活动参与者的行动装置进行易于使用、保密的健康检查来确保其活动的安全。纳入额外的安全通讯协定。

- 此外,该地区的主要企业还建立了战略合作伙伴关係,以利用最新技术改进其产品。例如,2023 年 4 月,Tripleseat 被 General Atlantic 收购,Tripleseat 是一家总部位于美国的软体平台供应商,为活动管理提供端到端功能,涵盖预订、潜在客户开发、规划、活动执行工作流程、报告和分析。宣布策略性成长投资。透过利用这种合作伙伴关係,该公司计划专注于关键成长领域,包括对产品和技术的进一步投资、扩大市场范围、寻求策略併购以及扩展到其他市场。

- 根据 Billboard 统计,光是美国每年就会举办 800 多个音乐节,吸引了 3,200 万人参加。有效管理此类重要活动的要求预计将增加该地区对活动管理软体的需求。

活动管理软体产业概述

活动管理软体市场竞争适度,由多家区域和全球公司组成。目前,一些重要的公司占据了市场的主导份额。市场占有率突出的大公司正致力于进一步扩大海外基本客群。这些公司利用合作伙伴关係和收购等策略合作倡议来增加市场占有率、盈利并增强产品能力。主要市场参与者包括 Ungerboeck Software International Inc.、Cvent Inc.、Active Network LLC 等。

- 2023 年 5 月:《体育画报》的粉丝优先票务网站 SI Tickets 与 Web3 领导者 ConsenSys 合作建立,推出由 Polygon 区块链技术支持的创新领先票务和自助服务。我们推出了“Box Office by SI Tickets” ,事件管理解决方案。据该公司称,Box Office 是第一个将适用于任何规模活动的完整 NFT 票务解决方案与传统非 NFT 门票的邻近性和可见性相结合的全球平台。

- 2023 年 5 月:Tickets99 在印度推出创新票务应用程式。据该公司称,该平台旨在为用户和活动组织者提供易于使用、安全可靠的免费和付费活动票务解决方案。一个主要好处是即时推播通知,让客人随时了解活动行程的变更和更新。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 越来越注重从事件中获取可行的见解

- 活动管理公司越来越多地采用自动化

- 市场挑战

- 高成本、认知度低

第六章市场区隔

- 透过软体

- 活动企划

- 活动行销

- 场地/门票管理

- 分析和报告

- 其他的

- 按组织规模

- 中小企业

- 大公司

- 依部署类型

- 云

- 本地

- 按行业分类

- 公司

- 政府机关

- 教育机构

- 媒体娱乐

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Cvent Inc.

- XING SE

- Active Network LLC

- Aventri Inc.

- Eventbrite

- Ungerboeck Software International Inc.

- Certain Inc.

- SignUpGenius Inc.

- EMS Software LLC

- TryBooking Pty Ltd

- Event Espresso

第八章投资分析

第9章 市场的未来

The Event Management Software Market size is estimated at USD 13.01 billion in 2024, and is expected to reach USD 21.18 billion by 2029, growing at a CAGR of 10.24% during the forecast period (2024-2029).

The major factors influencing the market growth are the significant increase in sports, gaming, and entertainment events over the past decade and the widespread adoption of software that can streamline events from start to end based on historical and real-time data.

Key Highlights

- Event management software has become a standard for both large-scale and small-scale planners. An increasing number of professional and freelance organizers have bolstered the demand for application-based in the past few years. Event management software solutions are highly beneficial for third-party planners compared to in-house planners, as third-party planners handle multiple events or shows that occur at any time of the year.

- With the growing lifestyles of the people, demand for innovations has arisen in hosting events. As a result, companies and consortiums have started to focus on hosting theme-based meetings and events at attractive destinations to increase their brand image. Furthermore, the growing organization of social events, such as awareness gatherings, social service, and fundraising events, even those planned by SMEs for marketing purposes, are boosting the demand for event managing software.

- Considering the growing demand, key market players are coming up with new solutions to sustain the market and increase the capability of their offerings. For instance, in April 2022, Cvent CONNECT launched the new Cvent Vendor Marketplace to kick off the company's customer conference. The Vendor Marketplace, integrated directly into Cvent's industry-leading online venue sourcing platform, Cvent Supplier Network (CSN), provides users with access to a trusted network of approved vendors and suppliers who offer in-person services and virtual and hybrid events.

- Furthermore, as vents are turning out to be great marketing channels, vendors and marketing firms are increasingly looking for collaborations with event organizers. In fact, according to Social Tables, in a recent event marketing survey, 52% of respondents mentioned that event marketing drove more business value to them than other marketing channels. Such statistics further encourage new players' market entry, increasing the demand for mobile-based event management software solutions as they help in gaining actionable insight that can be used by businesses to fulfill various business goals.

- However, a higher price tag associated with event management software is among the major factor challenging the studied market's growth. Additionally, a lower consumer awareness, especially across the developing and less developed regions, also challenges the growth of the studied market.

- The outbreak of COVID-19 across the globe has had a notable impact on the growth of the studied market, as it affected millions of people and businesses across various countries. The containment measures taken to curb the spread of the virus ensured many reputed and recognized sports events were either postponed or canceled, bringing a slowdown in the studied market. However, with the impact of the pandemic reducing and economic activities starting to gain traction, the post covid period is anticipated to favor the studied market's growth.

Event Management Software Market Trends

Media and Entertainment Segment Expected to Register a Significant Growth

- Event management software has become highly beneficial for third-party planners compared to in-house planners, as third-party planners plan more than a single concert or show at any time of the year. Some popular events and festivals include Classic East, Sao Paulo Trip, and Outside Land Music and Art Festival generates revenue millions of dollars each year.

- Such colossal revenue involvement makes media and entertainment events one of the most complicated events to plan, unlike events hosted by several other sectors, such as the educational and industrial ones. Furthermore, downtime in any event organizing process has a terrible effect on the event's reputation. In many cases, many media and entertainment events were hosted for charity purposes; hence, any deviations in the planning process or the software may dent the organizers' reputation.

- As most media and entertainment events are tied up with high revenue movements, analytic tools and event management software are highly beneficial to event organizers. As most of the event planning in the sector is outsourced to third-party planners, such additional features are a key selling point for many event management software products in the current market scenario.

- The Key players in the market are doing partnerships with the vendors offering video solutions in their events and meetings. For instance,in July 2022, ASM Global, a leading event management firm, announced a partnerhsip with Infor, a cloud software provider, for a multi-year strategic blueprint to offer the live-entertainment industry's first fully integrated booking, food and beverage, sales, and event management platform. The company plans to use this for trade shows, conventions, and other corporate events as well.

- The players in the market are also focusing on collaborating with vendors who assist Arts and Culture Organisations because of the increased demand for cultural events. Furthermore, the growing number of public events being organized across the globe also creates a favorable outlook for the studied market's growth. For instance, the number od concerts and festivals promoted by Live Nation had increased from 29,592 in 2017 to 43,644 in 2022.

North America Region to Hold Significant Share

- The North America regional segment is expected to hold a significant market share during the forecast period due to the increased adoption of event management software for athletics events in educational institutions, marathons, film festivals, and other private events. The presence of significant players and small enterprises, and new entrants in the region are some of the important factors bolstering the market growth.

- There are several vendors offering event management software in the North American region. For instance, Cvent Health Check, powered by ID.me, is an easy-to-use solution that enables event organizers to implement a secure method of verifying attendee health status in a few simple steps. Cvent customers can include additional safety protocols at their events with easy-to-use, confidential health checks on event attendees' mobile devices by combining ID.me vaccine, testing, and identity verification capabilities with Cvent's robust event marketing and management platform.

- Furthermore, key players in this region are involved in strategic partnerships to improve their product offerings along with updated technologies. For instance, in April 2023, Tripleseat, a U.S.-based software platform provider for end-to-end functionality for event management, spanning booking, lead generation, planning, event execution workflows, reporting, and analytics, announced a strategic growth investment from General Atlantic. By leveraging this partnership, the company plans to focus on key growth areas, including investing further in its product and technology, expanding market reach, pursuing strategic M&A, and scaling into additional markets.

- According to Billboard, over 800 annual music festivals are hosted in the US alone, attracting 32 million attendees. The requirement for efficient management of such significant events are anticipated to drive the demand for event management softwares in the region.

Event Management Software Industry Overview

The event management software market is moderately competitive and consists of several regional and global players. A few significant players currently hold a dominating share in the market. Major players with prominent shares in the market are focusing on further expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives such as partnerships, acquisitions, etc., to increase their market share, profitability and to strengthen their product capabilities. Some key market players include Ungerboeck Software International Inc, Cvent Inc., and Active Network LLC, among others.

- May 2023 - SI Tickets, the fan-first ticketing site from Sports Illustrated, launched 'Box Office by SI Tickets,' an innovative, primary ticketing and self-service event management solution built in partnership with web3 leader ConsenSys and powered by Polygon's blockchain technology. According to the company, Box Office is the first global platform to combine a complete NFT ticket solution for events of any size with adjacency and visibility to traditional, non-NFT tickets.

- May 2023 - Tickets99 launched its innovative ticketing app in India. According to the company, the platform is designed to provide an easy-to-use, secure, and reliable ticketing solution to users and event organizers from free to paid events. A key benefiting feature is the real-time push notifications that can help guests to stay up-to-date on any changes or updates to the event schedule.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Focus on Gaining Actionable Insights From Events

- 5.1.2 Growing Adoption of Automation by Event Management Companies

- 5.2 Market Challenges

- 5.2.1 High Cost & Lower Awareness

6 MARKET SEGMENTATION

- 6.1 By Software

- 6.1.1 Event Planning

- 6.1.2 Event Marketing

- 6.1.3 Venue & Ticket Management

- 6.1.4 Analytics and Reporting

- 6.1.5 Other Software Types

- 6.2 By Organization Size

- 6.2.1 Small & Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Deployment Type

- 6.3.1 Cloud

- 6.3.2 On-premise

- 6.4 By End-user Vertical

- 6.4.1 Corporate

- 6.4.2 Government

- 6.4.3 Education

- 6.4.4 Media and Entertainment

- 6.4.5 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cvent Inc.

- 7.1.2 XING SE

- 7.1.3 Active Network LLC

- 7.1.4 Aventri Inc.

- 7.1.5 Eventbrite

- 7.1.6 Ungerboeck Software International Inc.

- 7.1.7 Certain Inc.

- 7.1.8 SignUpGenius Inc.

- 7.1.9 EMS Software LLC

- 7.1.10 TryBooking Pty Ltd

- 7.1.11 Event Espresso