|

市场调查报告书

商品编码

1432434

碳预浸料:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Carbon Prepreg - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

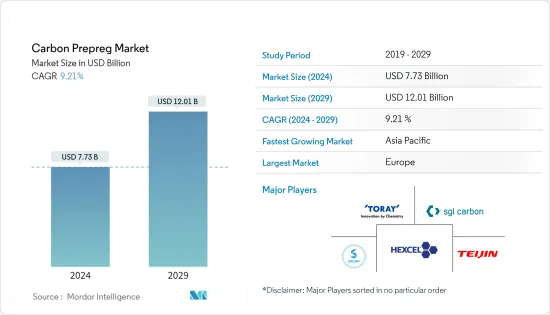

碳预浸料市场规模预计到2024年为77.3亿美元,预计到2029年将达到120.1亿美元,在预测期内(2024-2029年)复合年增长率为9.21%。

COVID-19 的疫情对旅游业产生了负面影响,也影响了航太业。然而,随着封锁的放鬆以及各国取消旅行限制,2021年和2022年旅客人数增加,碳预浸料市场达到了疫情前的水平。

主要亮点

- 对绿色能源来源的重视、对碳纤维复合材料零件的需求不断增长、航太和国防工业不断增长的需求可能成为预测期内的市场驱动因素。

- 然而,环保替代品的可用性可能会阻碍预测期内的市场成长。

- 电子产业中越来越多的应用可能是未来的一个机会。

- 由于国防部门需求的增加,欧洲主导了全球整体市场。

碳预浸料市场趋势

航太和国防工业的需求增加

传统上,航太製造商一直专注于碳复合材料,与铝等传统航太材料相比,碳复合材料可显着减轻重量并节省成本。大多数航太复合材料使用碳预浸料作为原料,高压釜是一种常见的製造流程。航太是民航机、军用喷射机、直升机、航空发动机或太空卫星和火箭碳预浸料的最大消费者。

碳纤维复合材料因其高强度、高刚度、耐热性、耐化学性以及各种其他热和化学性能等特性而被用于航太和国防应用。

根据波音商业展望(2022-2041),全球商业航空服务(包括航班业务、维护和工程、地面业务、车站业务、货运业务等)预计到 2041 年将达到 3.615 兆美元。预计这可能会推动未来几年研究市场的需求。

最近,飞机製造商一直在寻找加快生产的方法,以填补订单订单。例如,波音《商业展望》(2022-2041)预计,到 2041 年,全球新飞机交付总量将达到 41,170 架。此外,报告指出,东南亚航太服务市场规模预计将达2,450亿美元,欧洲将达8.5亿美元。从长远来看,航太的这种情况预计将继续推动碳预浸料市场的成长。

欧洲主导市场

欧洲主导全球碳预浸料市场。德国经济是欧洲第一大经济体,世界第五大经济体。

德国拥有众多飞机内饰件、MRO(维修、修理和大修)、轻量化结构和材料生产基地,其中大部分位于巴伐利亚州、不来梅州、巴登符腾堡州和梅克伦堡-前波莫瑞州。

在欧洲,波音商用飞机展望(2022-2041)预计,到 2041 年,新飞机交付总量将达到 8,550 架,市场服务价值为 8,500 亿美元。因此,未来该地区飞机製造对光学镀膜的需求可能会增加。

此外,根据波音商用公司的《展望(2022-2041)》,到 2041 年,该地区的航空公司持有预计将成长 4.2%。据估计,未来20年将有超过30,000至35,000架新飞机投入使用,以满足日益增长的航空需求。因此,飞机产量的增加预计也将有助于预测期内的市场成长。

2022 年 3000 万欧元,包括欧洲先进雷达技术的研究 (ARTURO) 和生态设计的弹道系统,用于持久和轻型防御平台和个人应用中当前和新兴的威胁 (ECOBALLIFE) 两个新计画价值(约31,614,000美元)已移交给欧洲国防局(EDA)。因此,该地区行业的这种趋势预计将在预测期内推动碳预浸料市场的成长。

碳预浸料产业概况

全球碳预浸料市场整合,主要市场占有率由前五名公司占据。市场主要企业(排名不分先后)包括 TEIJIN LIMITED、Hexcel Corporation、TORAY INDUSTRIES, INC.、SGL Carbon、Solvay 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 重视绿色能源来源

- 对 CFRP 零件的需求增加

- 航太和国防领域的需求不断增长

- 抑制因素

- 环保替代品的可用性

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 树脂型

- 热固性

- 热塑性塑料

- 最终用户产业

- 航太/国防

- 活力

- 车

- 休閒

- 电子产品

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- ACP Composites, Inc.

- Kordsa Teknik Tekstil AS

- Barrday Inc.

- Gurit Services AG, Zurich

- Hexcel Corporation

- Lingol Corporation

- Mitsubishi Chemical Corporation

- PARK AEROSPACE CORP.

- SGL Carbon

- Solvay

- TEIJIN LIMITED

- THE YOKOHAMA RUBBER CO., LTD

- TORAY INDUSTRIES, INC.

- ZYVEX TECHNOLOGIES

第七章 市场机会及未来趋势

- 扩大电子领域的应用

- 其他机会

The Carbon Prepreg Market size is estimated at USD 7.73 billion in 2024, and is expected to reach USD 12.01 billion by 2029, growing at a CAGR of 9.21% during the forecast period (2024-2029).

Due to the COVID-19 outbreak tourism sector was affected negatively which affected the aerospace industry. However, the easing of lockdowns and countries lifting travel restrictions led to increased traveling in the years 2021 and 2022 which helped the carbon prepreg market reach pre-pandemic levels.

Key Highlights

- Emphasis on green energy sources, growing demand from CFRP components, and the growing demand from the aerospace and defense industry are likely to act as drivers for the market over the forecast period.

- However, the availability of eco-friendly alternatives is likely to hinder the market growth during the forecast period.

- Increasing application in the electronics industry is likely to act as an opportunity in the future.

- Europe dominated the market across the world due increased demand from the defense sector.

Carbon Prepreg Market Trends

Increasing Demand from the Aerospace and Defence Industry

- Traditionally, manufacturers in aerospace turned to carbon composites for their significant weight reductions and cost savings compared to conventional aerospace materials, such as aluminum. Most aerospace composites use carbon prepregs as raw materials, with autoclave molding as a popular fabrication process. The aerospace industry is the greatest consumer of carbon prepregs for civil aircraft, military jets, helicopters, aero-engines or space satellites, and launchers.

- Carbon fiber composites are used in aerospace and defense applications due to their properties, such as high strength, stiffness, heat and chemical resistivity, and various other thermal and chemical properties.

- According to the Boeing Commercial Outlook 2022-2041, the global forecast for commercial aviation services (which include flight operations, maintenance and engineering, ground, station, and cargo operations, and others) by 2041 is expected to be USD 3,615 billion. It will likely boost the demand for the studied market in the coming years.

- Recently, aircraft manufacturers are looking for ways to accelerate production to fill order backlogs. For instance, according to the Boeing Commercial Outlook 2022-2041, the total global deliveries of new airplanes are estimated to be 41,170 by 2041.

- Further, according to the report, the market size of aerospace services in Southeast Asia is expected to reach USD 245 billion and in Europe USD 850 million.

- This scenario in the aerospace industry is expected to continue driving the growth of the carbon prepreg market in the long term.

Europe to Dominate the Market

- Europe dominated the global carbon prepreg market. The German economy is the largest in Europe and the fifth-largest globally.

- Germany hosts many production bases for aircraft interior components, MRO (maintenance, repair, and overhaul), and lightweight construction and materials, largely in Bavaria, Bremen, Baden-Wurttemberg, and Mecklenburg-Vorpommern.

- In Europe, according to the Boeing Commercial Outlook 2022-2041, the total deliveries of new airplanes are estimated to be 8,550 units by 2041, with a market service value of USD 850 billion. Thereby, the demand for optical coatings from aircraft manufacturing will likely rise in the region in the future.

- Further, according to the Boeing Commercial Outlook 2022-2041, the airline fleet in the region is expected to grow by 4.2% by 2041.

- Over 30 to 35 thousand new aircraft are estimated to be operational by the next 20 years to meet the rising aviation demand. Thus, the increase in aircraft production is also expected to contribute to the market growth during the forecast period.

- Further, in the year 2022, two new projects, which include Advanced Radar Technology in Europe (ARTURO) and Research in eco-designed ballistic systems for durable, lightweight protection against current and new threats in the platform and personal applications (ECOBALLIFE), were handed to the European Defense Agency (EDA) which are worth EUR 30 million (~USD 31.614 million).

- Hence, such trends in the industry in the region are expected to drive the market growth for carbon prepreg during the forecast period.

Carbon Prepreg Industry Overview

The global carbon prepreg market is consolidated, with the top five players accounting for a major market share studied. Major players in the market (not in any particular order) include TEIJIN LIMITED, Hexcel Corporation, TORAY INDUSTRIES, INC., SGL Carbon, and Solvay, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Emphasis on Green Energy Sources

- 4.1.2 Growing Demand for CFRP Components

- 4.1.3 Growing Demand from the Aerospace and Defense Sector

- 4.2 Restraints

- 4.2.1 Availability of Eco-Friendly Alternatives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Thermoset

- 5.1.2 Thermoplastic

- 5.2 End-user Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Energy

- 5.2.3 Automotive

- 5.2.4 Leisure

- 5.2.5 Electronics

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACP Composites, Inc.

- 6.4.2 Kordsa Teknik Tekstil A.S.

- 6.4.3 Barrday Inc.

- 6.4.4 Gurit Services AG, Zurich

- 6.4.5 Hexcel Corporation

- 6.4.6 Lingol Corporation

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 PARK AEROSPACE CORP.

- 6.4.9 SGL Carbon

- 6.4.10 Solvay

- 6.4.11 TEIJIN LIMITED

- 6.4.12 THE YOKOHAMA RUBBER CO., LTD

- 6.4.13 TORAY INDUSTRIES, INC.

- 6.4.14 ZYVEX TECHNOLOGIES

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications in Electronics

- 7.2 Other Opportunities

![BMI 预浸料市场趋势:趋势、机会、竞争分析 [2024-2030]](/sample/img/cover/42/1496957.png)