|

市场调查报告书

商品编码

1432481

全像显示:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Holographic Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

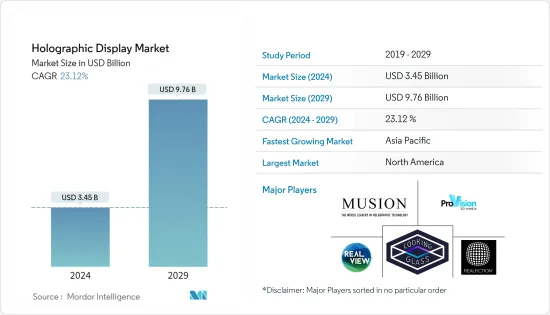

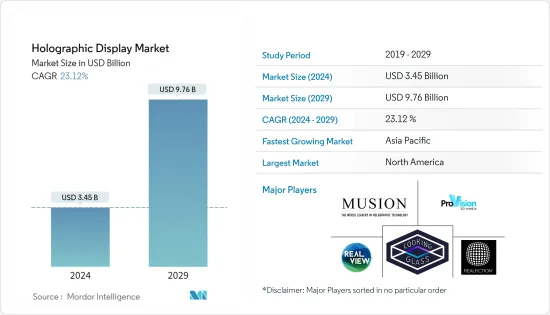

预计 2024 年全像显示市场规模为 34.5 亿美元,预计 2029 年将达到 97.6 亿美元,在预测期内(2024-2029 年)复合年增长率为 23.12%。

全像图主要用于新兴市场的近距离行销,使企业能够与客户互动,并透过定位他们与客户进行更单独的互动来扩大客户群。

在汽车、医疗保健研究和医学影像等广泛的产品应用的支持下,全像显示市场可能在未来几年出现快速增长,特别是在美国等已开发国家。

对全像显示器的需求是由医疗保健、汽车和媒体行业推动的,而媒体和娱乐、教育、住宅(客厅)和军事测绘应用预计将推动所研究的市场。

全像显示器也用于广告看板、资讯亭、销售点终端、数位看板、场馆、活动等。全像显示器在所有这些应用中的普及可能会推动市场扩张。例如,数位指示牌方案广泛应用于零售业,领先企业和新兴企业选择配备人工智慧和机器学习的先进数位指示牌,以最大限度地发挥消费者资料的潜力。

技术的进步对目前市场上提供的创新解决方案产生了重大影响。透过使用 3D全像显示器,现在可以开发利用神经行销学的视觉品牌体验。在商店、展览、公共场所等人潮聚集的场所,看似自由漂浮的全像投影自然能吸引人们的驻足关注。

然而,全像显示设备的製造成本高昂,限制了市场的扩张。新技术必须作为该过程的一部分被创造和製造,这对小型企业来说可能是昂贵的。此外,新兴国家的消费者可能会发现价格过高,限制了市场扩张。

全像显示市场趋势

汽车板块有望大幅成长

车载娱乐萤幕的成长使汽车产业成为显示器技术的主要用户。全像技术正在迅速发展,促使供应商和製造商考虑创造性汽车应用。透过开发适合未来应用的材料,我们准备好帮助多家公司从原型转向生产。例如,显示器安装在前仪表板中,以将智慧型手机介面整合到汽车娱乐系统中。

此外,许多重要汽车中使用的显示区域的市场需求强劲且不断增长。从历史上看,汽车业采用新技术的速度一直很慢。然而,在可预见的未来,预计中低阶汽车将取代豪华汽车成为全像显示器的主要用户。

此外,提案的分级全像显示技术是平视显示应用中 LED/TFT 显示器的有力替代品。例如,路虎探测车在极光中选择了全像HUD,因为它的设计多功能性和低功耗。

使用薄膜技术进行车辆照明有多种好处。全像薄膜使汽车工程师和设计师能够使用光作为设计元素。汽车製造商目前正在考虑采用扩增实境(AR) 技术的新 HUD 设计来克服这些缺点。

2022财年第一季印度汽车业平均运转率约73%。这比上一季报告有所改善。

亚太地区正在经历显着成长

亚太地区是全像显示器盈利丰厚的市场。这是因为消费电子领域既有开发中国家,也有已开发国家,如中国、台湾、韩国。

日本和中国在汽车和家电方面具有创新精神。透过匹配供需和回应新技术,这些领域的市场经历了显着成长。

VR/AR在中国的进步与全息技术密切相关。当观看者在固定距离注视 2D 显示器时,VR 给人以 3D 方式观看事物的印象。

显示器製造商正在增强和扩展数位电子看板电视墙技术的功能。 Light Field Labs 等公司正在开发允许企业将 3D全像显示器用于数指示牌的技术。

由于消费性电子产品销售的增加,零售、媒体和广告领域对数位指示牌创新的需求不断增加,以及汽车业对全像显示器的需求不断增加,中国全像显示市场正在不断扩大。此外,日本研究人员还开发了一种具有奈米级像素的全像显示系统,可以从广角观看。

此外,家用电子电器製造能力的扩张,尤其是中国中南部地区的消费性电子製造能力的扩大,导致对东南亚邻国的出口增加,以及4K、LCD、LED和OLED等各种显示技术的平均售价下降。总之,预计这将增加该地区全像显示设备的采用。

全像显示行业概况

由于存在多个参与者,全像显示市场似乎适度集中。主要市场参与者都专注于技术进步。每个参与者都采取了不同的收购、联盟和合资策略,只有主要企业才能获得市场占有率。市场上一些主要的参与者包括 MDH Hologram Ltd.、Looking Glass Factory Inc. 和 Provision Holding Inc.。

2023 年 1 月,Realfiction Holding AB 宣布其 ECHO全像3D 显示器的第一代产品已经完成。该显示器基于该公司正在申请专利的 ECHO 技术,可为多个观看者提供裸眼 3D 体验。从 2023 年 2 月下旬开始,潜在的业务合作伙伴将能够在 Realfiction 位于台湾的开发设施中观看展品。

2023 年 6 月,ARHT Media 宣布西班牙 Newtonlab Space 已选择 ARHT Media 为其多面板全像显示器的全球独家经销商。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估 COVID-19 对产业的影响

- 技术简介

- 接触全像

- 半透明/电子全像

- 活塞全像

- 雷射/全像

第五章市场动态

- 市场驱动因素

- 加大对3D技术的投资

- 无萤幕显示器的进步

- 市场限制因素

- 全像显示设备组装成本高

- 替代显示产品的存在

第六章市场区隔

- 按最终用户

- 家用电器

- 零售

- 媒体/娱乐

- 军事/国防

- 卫生保健

- 车

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争形势

- 公司简介

- Musion Das Hologram Ltd

- Looking Glass Factory Inc.

- Provision Holding Inc.

- Realview Imaging Ltd

- RealFiction Holding AB

- Animmersion UK Ltd

- Kino-mo Limited(HYPERVSN)

- Shenzhen SMX Display Technology Co. Ltd

第八章投资分析

第9章 未来趋势

The Holographic Display Market size is estimated at USD 3.45 billion in 2024, and is expected to reach USD 9.76 billion by 2029, growing at a CAGR of 23.12% during the forecast period (2024-2029).

Holograms are being used in the industry, mainly in the developing field of proximity marketing, which enables businesses to interact and grow their clientele by positioning themselves to engage clients more individually.

The holographic display market may witness a sharp increase over the next few years, especially in developed nations such as the US, with help from various industry players to augment the regional demand subject to the extensive product applications in automotive, healthcare research, and medical imaging.

While the need for holographic displays is driven by the healthcare, automotive, and media industries, applications in media and entertainment, education, residential (living rooms), and military mapping are anticipated to catalyze the market under study.

Holographic displays are also employed in billboards, kiosks, point-of-sale terminals, digital signs, venues, and events. The popularity of holographic displays in all of these uses may fuel market expansion. For instance, digital signage solutions have been widely used in the retail industry, with big and emerging firms choosing advanced digital signage with AI and machine learning to maximize the potential of consumer data.

Technology improvements have had a significant impact on the innovative solutions that are currently being offered in the market. With the use of 3D holographic displays, it is now feasible to develop a visual brand experience that makes use of neuromarketing. In any crowded location, whether in a store, at an expo, or in public areas, the seemingly free-floating holograms can naturally make people stop and pay attention.

However, the prohibitive cost of manufacturing holographic display devices limits market expansion. New technologies must be created and manufactured as part of the process, which could be expensive for smaller businesses. Additionally, consumers in developing countries might find the prices prohibitive, restricting the market's expansion there.

Holographic Display Market Trends

Automotive Segment is Expected to Witness Significant Growth

The growth of entertainment screens in cars has made the automobile sector a leading user of display technology. Holographic technology is developing swiftly, encouraging suppliers and producers to consider creative automobile uses. By developing materials for applications of the future, several companies are ready to help in the transition from prototype to production. For instance, displays are being put on the front dashboard to incorporate the smartphone interface into the car entertainment system.

Additionally, there is a strong increase in demand on the market for the display area used by many significant automobiles. In the past, the automobile industry has been slow to adopt new technology. However, it is envisaged that mid-range and lower-range automobiles will replace high-end vehicles as the primary users of holographic displays in the foreseeable future.

Furthermore, the proposed phase-only holographic display technology strongly replaces LED/TFT displays for head-up display applications. For instance, Range Rover used the holographic HUD for the Evoque because of its versatility in design and low power usage.

There are various advantages of using film technology for automobile illumination. Holographic films allow engineers and designers of automobiles to use light as a design element. Automakers are now looking into new designs for HUDs that feature augmented reality (AR) technology to overcome these drawbacks.

The average capacity utilization for the Indian automobile industry during the first quarter of the fiscal year 2022 was about 73 percent. It was an improvement from the prior quarter that had been reported.

Asia Pacific to Witness Significant Growth

A tremendously profitable market for holographic displays is Asia-Pacific. This is because both developing economies and nations with advanced consumer electronics sectors, like China, Taiwan, and South Korea, are present.

In automobiles and consumer electronics, Japan and China have been innovators. The markets in these areas have experienced tremendous growth due to matching supply and demand and staying current with emerging technologies.

The advancement of VR/AR in China is closely tied to hologram technology. While the viewer is staring at a fixed-distance 2D display, VR gives the impression that they are watching something in 3D.

Manufacturers of displays are enhancing and expanding the capabilities of video wall technology for digital signage. Companies such as Light Field Labs are developing technologies that enable companies to use 3D holographic displays for digital signage.

The Chinese holographic display market has expanded due to rising consumer electronics sales, growing demand for digital signage innovations in retail, media, and advertising, and rising demand for head-up holographic displays in the automotive sector. Additionally, researchers in Japan have developed a holographic display system with nano-sized pixels that can be viewed from a wide angle.

Further, the expansion of consumer electronics manufacturing capacities, especially in the South Central region of China, coupled with rising exports to neighboring countries in Southeast Asia and declining average selling prices of various display technologies such as 4K, LCD, LED, and OLED is projected to increase the adoption of holographic display devices in the region.

Holographic Display Industry Overview

The holographic display market appears to be moderately concentrated due to the presence of multiple players. The major market players are focusing on technological advancements. The players are adopting different strategies, namely acquisitions, partnerships, and joint ventures, by which only top players are gaining market share. Some key players in the market are MDH Hologram Ltd, Looking Glass Factory Inc., and Provision Holding Inc., among others.

In January 2023, Realfiction Holding AB announced that the first iteration of the ECHO holographic 3D display had been finished. The display is built on the firm's patent-pending ECHO technology, which offers multiple viewers glasses-free 3D experiences. From late February 2023, prospective business partners were welcome to examine the exhibit at Realfiction's development facilities in Taiwan.

In June 2023, ARHT Media announced that Newtonlab Space, a Spanish Company, has chosen ARHT Media as an exclusive distributor of its multi-panel holographic display globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Technology Snapshot

- 4.5.1 Touchable Holographic

- 4.5.2 Semi-transparent/Electro Holographic

- 4.5.3 Pistons Holographic

- 4.5.4 Laser/Plasma Holographic

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investments in 3D Technology

- 5.1.2 Advancements in Screenless Displays

- 5.2 Market Restraints

- 5.2.1 High Cost of Assembling Holographic Display Devices

- 5.2.2 Presence of Substitute Display Products

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Consumer Electronics

- 6.1.2 Retail

- 6.1.3 Media and Entertainment

- 6.1.4 Military and Defense

- 6.1.5 Healthcare

- 6.1.6 Automotive

- 6.1.7 Other End-user Verticals

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the world

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Musion Das Hologram Ltd

- 7.1.2 Looking Glass Factory Inc.

- 7.1.3 Provision Holding Inc.

- 7.1.4 Realview Imaging Ltd

- 7.1.5 RealFiction Holding AB

- 7.1.6 Animmersion UK Ltd

- 7.1.7 Kino-mo Limited (HYPERVSN)

- 7.1.8 Shenzhen SMX Display Technology Co. Ltd