|

市场调查报告书

商品编码

1432812

智慧型穿戴装置:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Smart Wearable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

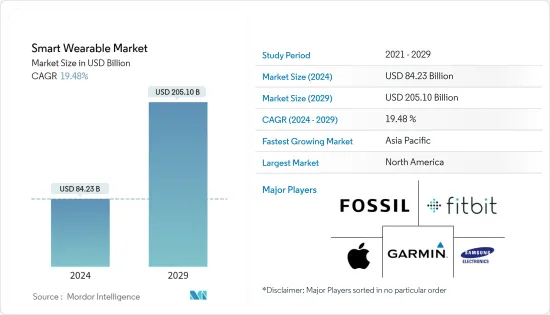

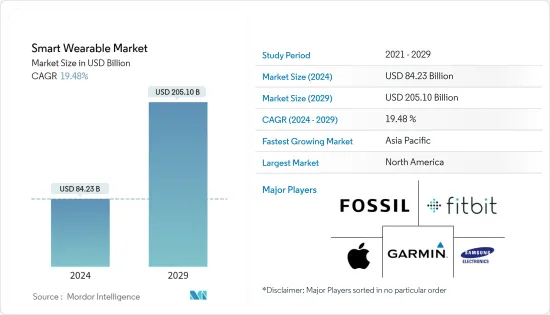

预计2024年智慧穿戴装置市场规模为842.3亿美元,预计2029年将达2,051亿美元,预测期间(2024-2029年)复合年增长率为19.48%。

近年来,研究的进步导致技术创新的增加,推动了穿戴式装置市场的需求。新产品类型也不断涌现,例如智慧织物和耳戴式设备,将高端技术和设计融入日常生活。如今,重点是在设备上提供精美的设计来吸引客户。

主要亮点

- 穿戴式科技是一种新兴趋势,它将电子产品整合到日常活动中,并适应不断变化的生活方式,能够穿着在身体的任何部位。网路连线以及网路和装置之间交换资料的选择等趋势正在推动穿戴式科技的发展趋势。

- 由于消费者健身趋势的蓬勃发展,穿戴式装置正在获得巨大的吸引力。据Cisco称,连网穿戴装置预计将从 2018 年的 5.93 亿台成长到今年的 11.05 亿台。由于适合您日常生活生活方式的品牌等附加功能,智慧型手錶类别正在经历成长。苹果和 Fossil 等强大品牌保持定价与传统手錶价格分布一致,以维持收益。 Google的 WearOS 已将许多豪华手錶引入这一领域,包括 TAG 和 Armani。

- 随着世界各地都市化渗透率的提高,对先进且设计美观、有吸引力的产品的需求不断增加。此外,由于定期追踪工作时间以及奢侈品消费能力的增强,世界各地大量的千禧世代很快就采用了智慧型手錶。

- 随着智慧助理的普及,耳戴式设备越来越受欢迎。 Bragi、谷歌、苹果、Jabra、三星和索尼等公司正积极为该行业的发展做出贡献。

- COVID-19 的爆发和世界各地的封锁法规正在影响世界各地的工业活动。电子业遭受严重打击,供应链和生产设施受到严重影响。 2 月至 3 月,中国大陆和台湾地区停产,影响了全球各OEM。

智慧穿戴市场趋势

头戴式显示器可望带动市场需求

- 头戴式显示器是一种在单目或双眼 HMD 前面具有小型显示光学元件的设备,佩戴在头上或作为头盔的一部分。它们主要用于游戏、航空、工程和医疗等各种用途。抬头显示器不会遮挡使用者的视线,而是将影像迭加到使用者对现实世界的视野上。一种新型态的抬头显示器是视网膜显示器,它将影像直接投影到视网膜的敏感部分。然而,影像显示在使用者理想观看距离的萤幕上。儘管如此,用户面前仍然没有实际的萤幕。头戴式显示器包含特殊的光学组件,例如改良眼镜,可将影像反射到使用者的眼睛中。一些头戴式显示器配备了运动感应器来确定方向和运动,或作为身临其境型虚拟实境应用的介面。

- 显示器是头戴装置的重要组成部分,一般分为虚拟实境(VR)设备和扩增实境(AR)设备。 AR 装置具有透明显示屏,可将数位资讯迭加到真实物体上。这些 HMD 称为光学头戴式显示器或 OHMD。在VR设备中,显示器不是透明的,只有虚拟资讯和影像呈现在配戴者的眼前。

- 根据功能,处理型 HMD 进一步分为滑盖式 HMD、分离式 HMD 和整合式 HMD。滑动 HMD 是最具成本效益且易于使用的 VR型态,由智慧型手机支架、镜头和一些主要输入组成。 VR 体验是透过将智慧型手机连接到滑动 HMD 并在用户眼睛上方播放整个装置来实现的。透过这种方式,我们利用智慧型手机进行显示、处理和旋转追踪。然而,有些人使用自己的 IMU,而不是依赖智慧型手机。例如,三星的 Gear VR 采用内建 IMU。

- 除了处理之外,分立式 HMD 还具有显示器、镜头、旋转追踪、位置追踪、音讯和进阶输入。因此,需要连接电脑进行处理。儘管它提供了最佳的 VR 体验,但它的可操作性不如滑动式或整合式 HMD。也称为系留 HMD,包括 Oculus Rift、HTC Vive 和 PlayStation VR。

- 整合式 HMD 是最先进、最昂贵的 HMD,也是 OHMD。它是一种独立的运算设备,无需PC或智慧型手机等外部硬体即可提供VR和AR体验。凭藉内建显示器、处理器和相机,它可以显示立体 3D 影像、执行复杂的追踪并利用先进的输入方法。目前,大多数整合HMD都是价格分布AR OHMD,仅针对商务专业人士。最受欢迎的整合 HMD 包括 Microsoft HoloLens、Google Glass 和 Magic Leap。

亚太地区成长最快

- 预计亚太地区在预测期内智慧穿戴装置市场将呈现最高成长。电子产业的成长和可支配收入的快速成长正在推动该地区智慧穿戴装置市场的发展。

- 在中国,穿戴式装置市场正在呈现不同的面貌,部分原因是富裕消费者的购买力不断增强。例如,中国政府智库最近的一份报告称,全球约80%的智慧穿戴装置是在中国这个中国东南部的港口城市和製造地製造的。中国资讯产业发展中心的报告显示,深圳是许多中国高科技巨头的大本营,也是最广泛的智慧穿戴装置研发和生产基地。

- 据印度行动电话协会 (ICEA) 称,今年 3 月,PMP 简化了生产智慧穿戴装置的反向职责结构。在推动行动电话和笔记型电脑/平板电脑的本地製造之后,印度政府启动了一项新的分阶段製造计划(PMP),以生产腕戴式可穿戴设备、听力设备和电子智慧电錶,该计划已经启动。

- 此外,健身意识的提高、技术的进步和高速网路连接的可用性是推动该国智慧穿戴装置市场成长的关键因素。

智慧穿戴产业概况

智慧穿戴市场竞争激烈,近年来已取得竞争优势。此外,透过满足主要千禧世代人口的需求,参与者正在这个快速成长的市场中获得竞争优势。

- 2022 年 9 月 - U&i 宣布推出三款适合积极生活方式的优质穿戴装置。智慧型手錶还配备运动模式,可即时侦测步行、跑步、慢跑等多种身体活动,帮助使用者保持健康活跃。

- 2022 年 5 月 - Vuzix 公司宣布已与法国 mLED(微型发光二极体)显示器解决方案公司 Atomistic SAS 签署协议。该协议规定了自订背板设计、关键 mLED 技术的独家许可,以及在完成各个技术阶段后收购公司的能力。 Atomistic 将在先进节点 300mm 晶圆上提供背板,并提供晶圆的系统级支持,支持基于该公司创新材料科学的未来 mLED 和来自潜在第三方供应商的替代 LED。 mLED将应用于AR眼镜。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场概况

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 不断进步的技术进步有助于市场成长

- 市场限制因素

- 高成本和资料安全问题

第六章市场区隔

- 副产品

- 智慧型手錶

- 头戴式显示器

- 智慧穿戴

- 耳挂式

- 健身追踪器

- 随身携带的相机

- 外骨骼

- 医疗设备

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Ekso Bionics Holdings Inc.

- Cyberdyne Inc.

- Transcend Information Inc.

- GoPro Inc.

- Sensoria Inc.

- AIQ Smart Clothing Inc.

- Medtronic PLC

- Withings

- Huami Corporation

- Omron Healthcare Inc.

- Nuheara Limited

- Bragi GmbH

- Microsoft Corporation

- Sony Corporation

- Huawei Technologies Co. Ltd

- Fitbit Inc.

- Fossil Group Inc.

- Garmin Ltd

- Samsung Electronics Co. Ltd

- Apple Inc.

第八章投资分析

第9章市场的未来

The Smart Wearable Market size is estimated at USD 84.23 billion in 2024, and is expected to reach USD 205.10 billion by 2029, growing at a CAGR of 19.48% during the forecast period (2024-2029).

Research advancements have led to increased innovation in recent years and are instrumental in driving the demand for the wearable market. It also led to new product categories like smart fabrics and hearables, which incorporate high-end technology and design in daily living. Lately, the focus is to provide an aesthetic design to devices to attract customers.

Key Highlights

- Wearable technology, an emerging trend, integrates electronics into daily activities and addresses the changing lifestyles with the ability to wear on any body part. Factors such as the ability to connect to the internet and data exchange options between a network and a device are leading to the wearable technology trend.

- Wearables have gained significant traction owing to the boom in the fitness trend across consumers. According to Cisco Systems, connected wearable devices are expected to increase from 593 million in 2018 to 1,105 million this year. The smartwatch category is experiencing a rise, owing to additional features, like the brand that suits the everyday lifestyle. Strong brands, such as Apple and Fossil, are keeping the pricing consistent with the price bands of traditional watches to maintain their revenues. With Google's WearOS, many other premium watchmakers, such as TAG and Armani, have entered the segment.

- The rising penetration rates of urbanization in various parts of the world have driven the demand for advanced, aesthetically appealing products to better serve consumers' requirements, such as multiple features in one device and time schedules. Moreover, the vast millennial population across the globe was quick to adopt smartwatches, owing to the increased spending ability on their regular work hours tracking and luxury standards.

- Hearables are gaining traction with the increasing acceptance of smart assistants. Companies like Bragi, Google, Apple, Jabra, Samsung, and Sony have been actively contributing to the growth of this segment.

- The COVID-19 outbreak and the lockdown restrictions across the world have affected industrial activities around the globe. The electronics industry is hit severely with a significant influence on its supply chain and production facilities. Production reached a standstill in China and Taiwan during February and March, influencing various OEMs worldwide.

Smart Wearables Market Trends

Head-Mounted Displays is Expected to Drive the Market Demand

- A head-mounted display is a device with a small display optic in front of one (monocular HMD) or each eye (binocular HMD) and worn on the head or as part of a helmet. These are primarily used for various purposes, including gaming, aviation, engineering, and medicine. Heads-up displays do not block the user's vision but superimpose the image on the user's view of the real world. An emerging form of a heads-up display is a retinal display that projects a picture directly on the sensitive part of the retina. However, the image appears on a screen at the user's ideal viewing distance. Still, there is no actual screen in front of the user. It includes special optics, such as modified eyeglasses that reflect the image into the user's eye. Some Head-mounted displays have motion sensors to determine direction and movement or as the interface to an immersive virtual reality application.

- The display is an integral part of the HMDs and generally is categorized into Virtual Reality (VR) and Augmented Reality (AR) devices. AR devices have a transparent display and digital information superimposed onto real-life objects. These HMDs are known as Optical head-mounted displays or OHMDs. In a VR device, the display is not transparent, and only virtual information and images are present in front of the wearer's eyes.

- Based on the functionality, processing HMDs are further categorized into Slide-on HMD, Discrete HMD, and Integrated HMD. The Slide-on HMD is the most cost-effective and accessible form of VR and consists of a smartphone holder, lenses, and some primary input. A smartphone is placed into the slide-on HMD, and the entire device is played upon the user's eyes to create the VR experience. Thus, it utilizes the smartphone for display, processing, and rotational tracking. However, some use their own IMUs instead of relying on smartphones. For instance, Samsung Gear VR utilizes its built-in IMUs.

- Discrete HMDs have a display, lenses, rotational tracking, positional tracking, audio, and advanced input, aside from processing. Thus, it requires connections to personal computers for processing. It delivers the best VR experience but is less mobile than slide-on and integrated HMD. It is also known as Tethered HMD, and some of them are Oculus Rift, HTC Vive, PlayStation VR, etc.

- Integrated HMD is the most advanced and expensive HMD and OHMD. It is an independent computing device that delivers VR or AR experiences without external hardware, such as a PC or smartphone. It contains a display, processors, and a camera and can display stereoscopic 3D images, perform complex tracking, and utilize advanced input methods. Currently, most integrated HMDs are AR OHMDs with high price points and target only business professionals. The most popular integrated HMD are Microsoft HoloLens, Google Glass, Magic Leap, etc.

Asia-Pacific to Witness the Fastest Growth Rate

- The Asia-Pacific region is expected to witness the highest growth in the smart wearable market during the forecast period. The growing electronics industry and a rapid rise in disposable income in the region are driving the smart wearable market.

- In China, the wearables market had taken a different shape, fuelled partly by the purchases of growing affluent consumers. For instance, a recent report by a government think tank in China stated approximately 80% of the smart wearable devices in the world are manufactured in the southeastern Chinese port city and manufacturing hub. According to the China Center for Information Industry Development report, Shenzhen, the base camp of many Chinese tech giants, is the most extensive R&D (research and development) and production center for smart wearables.

- In March this year, According to the Indian Cellular and Electronics Association (ICEA), the PMP rationalized the inverted duty structure to produce smart wearables. After boosting local manufacturing of mobile phones and laptop/tablet computers, the Indian government launched a new Phased Manufacturing Programme(PMP) to create wrist wearable gadgets, hearable devices, and electronic smart meters.

- Moreover, increasing awareness regarding fitness, technological advancements, and the availability of high-speed Internet connectivity are the major factors propelling smart wearable market growth in the country.

Smart Wearables Industry Overview

The smart wearable market is highly competitive and gained a competitive edge in recent years. Additionally, the players have gained a competitive advantage in this fast-growing market, mainly catering to the demand of the millennial generation population.

- September 2022 - U&i announced the launch of three premium wearables for an active lifestyle. In real-time, the smartwatch also features Sports Modes that can sense multiple body activities, such as walking, running, jogging, etc., to help users stay fit and active.

- May 2022 - Vuzix Corporation announced signing an agreement with Atomistic SAS (Atomistic), an mLED(micro-Light Emitting Diode) display solutions enterprise based in France. The agreement provides for the custom backplane design, an exclusive license of key mLEDtechnology, and the ability to acquire the enterprise, which depends upon achieving various technical phases. The Atomistic company will deliver a backplane on advanced node 300mm wafers, along with system-level support from Vuzix, intended to support upcoming mLEDs based upon its innovative material science and alternative LEDs from potential third-party suppliers. The mLEDswill be provided for AR glasses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Incremental Technological Advancements Aiding the Market Growth

- 5.2 Market Restraints

- 5.2.1 High Cost and Data Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Smartwatches

- 6.1.2 Head-mounted Displays

- 6.1.3 Smart Clothing

- 6.1.4 Ear Worn

- 6.1.5 Fitness Trackers

- 6.1.6 Body-worn Camera

- 6.1.7 Exoskeleton

- 6.1.8 Medical Devices

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 South Korea

- 6.2.3.5 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ekso Bionics Holdings Inc.

- 7.1.2 Cyberdyne Inc.

- 7.1.3 Transcend Information Inc.

- 7.1.4 GoPro Inc.

- 7.1.5 Sensoria Inc.

- 7.1.6 AIQ Smart Clothing Inc.

- 7.1.7 Medtronic PLC

- 7.1.8 Withings

- 7.1.9 Huami Corporation

- 7.1.10 Omron Healthcare Inc.

- 7.1.11 Nuheara Limited

- 7.1.12 Bragi GmbH

- 7.1.13 Microsoft Corporation

- 7.1.14 Sony Corporation

- 7.1.15 Huawei Technologies Co. Ltd

- 7.1.16 Fitbit Inc.

- 7.1.17 Fossil Group Inc.

- 7.1.18 Garmin Ltd

- 7.1.19 Samsung Electronics Co. Ltd

- 7.1.20 Apple Inc.