|

市场调查报告书

商品编码

1432854

汽车润滑油:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Automotive Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

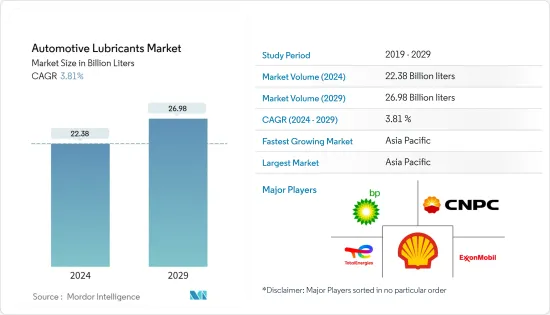

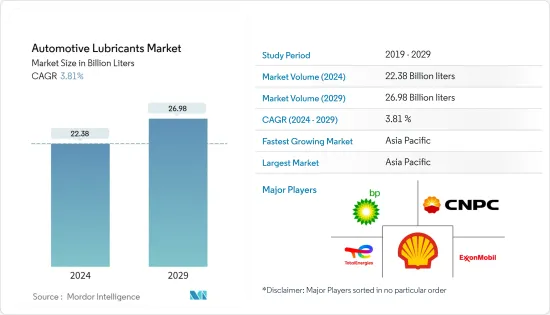

预计2024年汽车润滑油市场规模为223.8亿公升,预计2029年将达到269.8亿公升,在预测期间(2024-2029年)复合年增长率为3.81%。

2020 年,COVID-19 的爆发导致全球范围内的封锁、製造活动和供应链中断以及生产停顿,对市场产生了负面影响。然而,到了2021年,情况开始好转,市场恢復了成长轨迹。

主要亮点

- 短期内,市场预计将受到全球电动车产量增加和汽车零件产业需求扩大的推动。

- 另一方面,由于废油处理方面严格的环境法规,合成润滑油的采用率较低,预计将阻碍市场成长。

- 生物基润滑剂的开发预计将成为所研究市场的市场机会。

- 预计亚太地区将在预测期内主导市场。

车用润滑油市场趋势

增加引擎机油使用量

- 机油广泛用于润滑各类汽车的内燃机。它有多种用途,包括减少磨损、防止腐蚀以及确保引擎内部平稳运行。

- 油在运动部件之间形成一层薄膜,促进热传递并缓解接触过程中的张力。

- 德国汽车製造业是整个欧洲地区汽车生产的最大股东之一。该国是主要汽车製造品牌的所在地,包括大众、梅赛德斯-奔驰、奥迪、宝马和保时捷。该国对研发活动的持续投资和汽车产量的增加可能会支持润滑油市场的成长。

- 儘管该国的整体汽车销量有所下降,但过去几年电动车的註册数量却大幅增加。支撑这一增长的是政府的政策,即到 2040 年普及。

- 截至2022年3月,福斯汽车已核准投资一座新的电动车工厂。新的德国工厂将建在集团历史悠久的沃尔夫斯堡总部旁边,预计将于 2023 年开始建设,并于 2026 年开始生产。

- OICA公布的资料显示,全球汽车产量将从2021年的80,205,102辆增加至2022年的85,016,728辆,带动引擎油需求。

- 所有上述因素预计将推动所研究市场的成长。

亚太地区预计将主导市场

- 亚太地区的快速工业化预计将推动市场成长。该地区汽车工业和其他行业的成长可能会导致润滑油的成长。

- 汽车产业也消耗润滑油用于汽车零件的精加工,预计将推动市场成长。亚太地区预计将占据中国、马来西亚、印度、泰国、印尼和斯里兰卡等新兴国家消费量最高的最大市场占有率。

- 根据OICA的数据,2022年该地区汽车产量达到50,020,793辆,比2021年的46,768,800辆成长7%。到2022年,中国将成为最大的生产国,其次是日本、印度和韩国。

- 此外,由于储蓄、较低的偏好和对个人出行偏好的提高,印度的小客车销售在 2022 年 1 月至 9 月期间保持强劲,说服客户购买新车。受此影响,2022年前第三季印度新车註册量成长约20.2%,达到280万辆。 「Aatma Nirbhar Bharat」和「印度製造」计画等政府改革也支持了印度汽车工业。

- 此外,随着消费者越来越喜欢电池驱动的汽车,印度汽车产业正在见证趋势的转变。

- 此外,中国政府预计2025年电动车普及将达20%。这反映在该国的电动车销售趋势上,2022年电动车销量创下历史新高。根据中国小客车协会的数据,2022年中国电动车和插电式混合动力车销量为567万辆,几乎是2021年销量的两倍。预计该市场对汽车润滑油的需求将会增加,我们准备继续以这种速度进行销售。

- 上述因素和政府法规导致该地区润滑油需求增加。

汽车润滑油产业概况

汽车润滑油市场已部分整合,主要企业之间竞争激烈。这些主要公司包括壳牌公司、中国石化集团公司、英国石油公司、埃克森美孚公司和道达尔能源公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 全球电动车生产需求增加

- 新兴国家汽车零件需求不断扩大

- 其他司机

- 抑制因素

- 关于废油处理的严格环境法规

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔:市场规模(数量)

- 产品类别

- 机油

- 变速箱齿轮油

- 油压

- 润滑脂

- 车辆类型

- 小客车

- 商用车

- 摩托车

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AMSOIL INC.

- Bharat Petroleum Corporation Limited

- BP PLC(Castrol)

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ENEOS

- Exxon Mobil Corporation

- FUCHS

- Gazprom Neft PJSC

- Gulf Oil Lubricants India Ltd(Hinduja Group)

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Ltd

- LUKOIL

- Motul

- Petrobras

- PETRONAS Lubricants International

- Phillips 66 Company

- PT Pertamina Lubricants

- Repsol

- Shell PLC

- SK Lubricants Co. Ltd

- TotalEnergies

- Valvoline Inc.

- Veedol International Limited

第七章 市场机会及未来趋势

- 生物基润滑剂的开发

- 其他机会

The Automotive Lubricants Market size is estimated at 22.38 Billion liters in 2024, and is expected to reach 26.98 Billion liters by 2029, growing at a CAGR of 3.81% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- In the short term, one of the major factors, like increasing EV production globally and demand from the automotive components industry, is expected to drive the market.

- On the flip side, low adoption rates of synthetic lubricants due to stringent environmental regulations for waste oil disposal are expected to hinder the market's growth.

- The bio-based lubricants development is expected to act as a market opportunity for the market studied.

- Asia-Pacific region is expected to dominate the market studied during the forecast period.

Automotive Lubricants Market Trends

Increasing Usage of Engine Oils

- Engine oils are widely used for lubricating internal combustion engines in different types of automobiles. It is used for various applications such as wear reduction, corrosion protection, and ensuring the smooth operation of the engine internals.

- The oils create a thin film between the moving parts to enhance heat transfer and reduce tension during contact.

- The automobile manufacturing industry in Germany is a prominent shareholder of the overall automotive production in the European region. The country hosts major car-making brands, including Volkswagen, Mercedes-Benz, Audi, BMW, Porsche, etc. The consistent investments in R & D activities and the increasing automotive production in the country are likely to support the lubricants market growth.

- Even though general car sales in the country declined, electric vehicle registrations grew tremendously over the past few years. This growth is supported by the government's push toward all-electric cars by 2040.

- As of March 2022, Volkswagen approved an investment in a new electric car plant. The new German factory construction, which would be built next to the group's historic home in Wolfsburg, would begin in 2023, with production set to begin in 2026.

- According to data published by OICA, global automobile production increased from 80,205,102 in 2021 to 85,016,728 in 2022, boosting engine oil demand.

- All the factors above are expected to propel the market's growth studied.

Asia-Pacific is Expected to Dominate the Market

- Rapid industrialization in the Asia-Pacific region is expected to drive market growth. The growth of industries such as automotive in the region will result in lubricant growth.

- Also, the automotive industry consumes lubricants in automotive parts for finishes which are anticipated to boost the market's growth. Asia-Pacific is anticipated to hold a major market share, with the largest consumption coming from developing and emerging countries such as China, Malaysia, India, Thailand, Indonesia, and Sri Lanka.

- According to OICA, automotive production in the region reached 50,020,793 units in 2022, increasing by 7% from 46,768,800 units produced in 2021. China was the largest producer in 2022, followed by Japan, India, and South Korea.

- Furthermore, in the first nine months of 2022, Indian passenger car sales remained strong due to savings, lower interest rates, and an increasing preference for personal mobility, which convinced customers to buy new cars. As a result, new car registrations in India grew by around 20.2% in the first three quarters of 2022 to reach 2.8 million units. Also, Government reforms such as "Aatma Nirbhar Bharat" and "Make in India" programs supported the automotive industry in the country.

- Further, the automobile industry in India is witnessing switching trends as the consumer inclination toward battery-operated vehicles is on the higher side.

- Moreover, the government of China estimates a 20% penetration rate of electric vehicle production by 2025. It is reflected in the electric vehicle sales trend in the country, which went record-breaking high in 2022. As per the China Passenger Car Association, the country sold 5.67 million EVs and plug-ins in 2022, almost double the sales figures achieved in 2021. The market is anticipated to increase the demand for automotive lubricants in the country, poised to continue sales at this momentum.

- The factors above and supportive government regulations are contributing to the increased demand for lubricants in the region.

Automotive Lubricants Industry Overview

The automotive lubricants market is partially consolidated, with intense competition among the top players. These major companies include Shell PLC, China Petrochemical National Corporation, BP PLC, Exxon Mobil Corporation, and TotalEnergies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from EV Production Worldwide

- 4.1.2 Growing Demand for Automotive Components in Emerging Economies

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regardng Used Oil Disposal

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Engine Oil

- 5.1.2 Transmission and Gear Oils

- 5.1.3 Hydraulic Fluids

- 5.1.4 Greases

- 5.2 Vehicle Type

- 5.2.1 Passenger Vehicles

- 5.2.2 Commercial Vehicles

- 5.2.3 Motorcycles

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMSOIL INC.

- 6.4.2 Bharat Petroleum Corporation Limited

- 6.4.3 BP PLC (Castrol)

- 6.4.4 Chevron Corporation

- 6.4.5 China National Petroleum Corporation

- 6.4.6 China Petroleum & Chemical Corporation

- 6.4.7 ENEOS

- 6.4.8 Exxon Mobil Corporation

- 6.4.9 FUCHS

- 6.4.10 Gazprom Neft PJSC

- 6.4.11 Gulf Oil Lubricants India Ltd (Hinduja Group)

- 6.4.12 Hindustan Petroleum Corporation Limited

- 6.4.13 Indian Oil Corporation Ltd

- 6.4.14 LUKOIL

- 6.4.15 Motul

- 6.4.16 Petrobras

- 6.4.17 PETRONAS Lubricants International

- 6.4.18 Phillips 66 Company

- 6.4.19 PT Pertamina Lubricants

- 6.4.20 Repsol

- 6.4.21 Shell PLC

- 6.4.22 SK Lubricants Co. Ltd

- 6.4.23 TotalEnergies

- 6.4.24 Valvoline Inc.

- 6.4.25 Veedol International Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio Based Lubricants

- 7.2 Other Opportunities