|

市场调查报告书

商品编码

1640647

纸包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

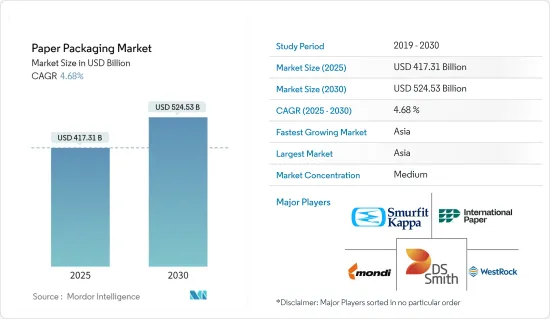

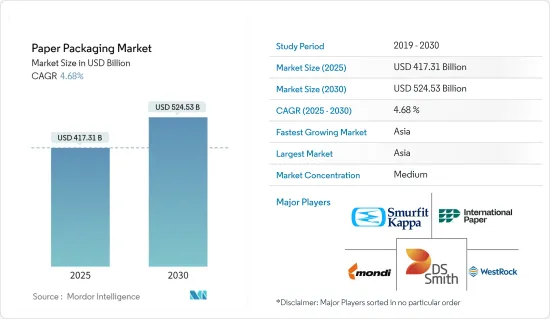

预计 2025 年纸包装市场规模为 4,173.1 亿美元,到 2030 年将达到 5,245.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.68%。

纸质包装是一种多功能且经济有效的保护、保存和运输各种产品的方法。此外,它们还可以进行客製化,以满足您的客户和产品的特定需求。重量轻、生物分解性、可回收等特性是纸包装的优点,使其成为不可或缺的组成部分。

关键亮点

- 全球消费者越来越意识到包装对环境的危害,并将购买习惯转向更环保的选择。消费者、政府和媒体正在向製造商施压,要求他们製造的产品、包装和生产流程更加环保。此外,人们愿意为这种环保包装支付更多金额。由于这些趋势,纸包装行业预计会成长。

- 电子商务销售额的不断增长和对折迭式纸盒包装的需求不断增加正在推动市场的发展。然而,高性能替代品的出现可能会抑制市场的成长。纸板包装是最受欢迎的环保包装选择之一。与体积较大的包装解决方案相比,这种包装形式占用空间小,且可以生产多种尺寸,适用于几乎所有最终用户领域。

- 此外,消费者正在支持循环经济模式并选择更永续包装和运输的产品。透过使用纸板,品牌製造商旨在减少碳足迹和环境污染。电子商务为品牌透过包装实现差异化创造了新的机会。它提供了保护整个供应链中的产品所需的基本实力,并使製造商能够整合增强消费者体验的增值功能。

- 此外,纸板包装广泛应用于零售和电子商务,其中亚马逊等公司处于领先地位,拥有超过 5,000 万用户。随着互联网和智慧型手机的普及和都市化的快速发展,中国和印度等经济体的电子商务市场预计将扩大。据IBEF称,到2026年终,印度电子商务市场规模预计将达到2,000亿美元,高于2017年的385亿美元。

- 纸包装市场面临的挑战是需要用纸来包装重型材料,因此该行业需要与聚合物和金属包装行业保持平衡。此外,森林砍伐导致纸张生产过程中释放戴奥辛,造成环境问题。这些因素可能会阻碍纸包装市场的发展。

纸包装市场趋势

食品和饮料行业预计将占据主要市场占有率

- 纸是食品包装最广泛使用的材料之一。纸张是一种环保的包装材料,是食品包装的理想选择。它主要用于直接包装货物,以便于运输或储存的初级包装。纸和纸板也用于製作微波爆米花袋、烘焙纸和速食容器。预计纸包装市场将受到消费者对包装食品环境问题意识不断增强的推动。

- 此外,纸张是一种随时可用且廉价的资源。它广泛应用于食品和饮料领域。这些材料可以回收利用,製造用于包装应用的模製物品和其他与饮料接触的物品,例如杯子、袋子和液体包装。

- 此外,国际食品和饮料公司正在响应消费者的需求,目标是使所有包装可回收或生物分解。例如,百加得宣布计划透过发明一种新型纸质饮料瓶,在 2030 年消除塑料,加入全球反对一次性塑料的运动。对循环经济理念的承诺有可能为造纸业带来更大的进步。

- 市场各个参与企业都在不断创新各自的产品,以建立全球框架。 2023 年 5 月,Smurfit Kappa 完成了一项投资计划,以 4,000 万欧元(4,388.6 万美元)大幅扩建其位于 Pruszkw 的包装工厂。此次扩建预计将使 Smurfit Kappa 成为波兰最大的包装厂之一,同时也是欧洲技术最先进、最现代化的包装厂之一。

- 消费者的生活方式越来越忙碌,因此他们不断寻求更容易拿起、处理、食用和携带的食物。各大品牌正努力透过使食品包装便携化来满足这项需求。包装製造商选择使用纸张来包装食品,因为这种包装非常轻且易于运输。此外,近年来食品包装变得更加环保。大公司非常热衷于寻找环保解决方案,他们正在放弃使用一次性塑料,转而使用生物分解性、可回收甚至可重复使用的包装。

- 食品业的成长推动了对折迭纸盒、瓦楞纸箱和液体纸板箱的需求,而这种增长是由对已调理食品、冷冻食品和包装食品的需求不断增长所推动的。例如,根据美国人口普查局的数据,2023年美国食品和饮料零售商的年销售额将达到约9,850亿美元,高于2019年的7,744亿美元。因此,食品和饮料销量的增加将影响纸包装市场的成长。

亚太地区可望占据主要市场占有率

- 预计亚太地区将在所研究的市场中实现显着成长。由于该地区生产设施数量的增加、消费者意识的增强以及直通包装行业的发展,市场正在不断扩大。由于中国和印度等开发中国家对纸浆和纸张的需求不断增加,该地区预计将迅速扩张。

- 在中国,运输包装市场随着消费的成长,带动了对纸包装的需求。城市人口的增加、电子商务行业的发展、纸浆价格的下降以及人们对环保包装意识的增强,预计将推动该地区纸包装市场的发展。

- 据印度造纸工业协会 (IPMA) 称,到 2026-27 年,印度的纸张消费量预计将以每年 6-7% 的速度增长,达到 3000 万吨。预计这一增长主要得益于对教育和识字能力的重视程度提高以及有组织零售业的增长。

- 此外,中国终端用户产业的纸张消费量正在成长,影响了瓦楞纸板等纸製品的生产。根据中国国家统计局的资料,2024年1月和2月,加工纸和纸板的产量随着需求的增加而增加。中国累计纸及纸板产量约 2,242 万吨,高于 2023 年 8 月的 1,225 万吨。

- 日本雀巢公司正在为一系列品牌和产品探索新的包装选择。而且由于公司每天销售约400万件产品,它也积极进行材料研究,以进一步减少对环境的影响。此外,政府限制塑胶废弃物的多项措施也影响了市场成长。因此,消费者意识的不断增强以及食品饮料以及该地区其他领域的成长正在推动市场成长。

纸包装产业概况

纸包装市场由多家参与企业细分,包括国际纸业、Mondi、Smurfit Kappa 和 WestRock 公司。为了保持市场占有率,各家公司正在不断创新并建立策略联盟。公司不断创新和重新设计包装,以提供更好的性能、提高适销性和增强永续性。

- 2024 年 2 月,Mondi Group 将透过其创新的纸本 Eco Wicket Bag 扩大其生产范围,以满足对永续家庭和个人护理 (HPC) 包装日益增长的需求,特别是对一次性尿布和女性用卫生用品的需求。透过扩大其位于匈牙利苏扎达 (Suzáda) 工厂的生态门袋生产,Mondi 将进一步利用集团从自身纸张生产到涂层和加工的一体化价值链。

- 2024年1月,WestRock宣布计划在威斯康辛州Pleasant Prairie建造新的瓦楞包装工厂,以满足客户日益增长的需求。预计该项投资将提高该公司在五大湖地区的生产能力并增强其成本状况。预计建设成本约1.4亿美元。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 工业供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 阻隔性涂层纸板产品的开发

- 提高消费者对纸包装的认知

- 市场限制

- 森林砍伐对纸包装的影响

- 营运成本增加

第六章 世界再生纸产量统计

- 废纸产量

- 废纸进口额及进口量

- 废纸出口额及数量

- 主要国家废纸产量

第七章 纸板进出口场景

- 箱板纸出口:金额和数量(百万美元,百万吨)

- 箱板纸进口:金额和数量(百万美元,百万吨)

第 8 章市场细分

- 按年级

- 纸板

- 固体漂白硫酸盐 (SBS)

- 未漂白固态硫酸盐 (SUS)

- 折迭式箱板 (FBB)

- 涂布再生纸板 (CRB)

- 无涂布再生纸板 (URB)

- 其他的

- 箱板纸

- 白色牛皮纸

- 其他牛皮卡纸

- 白色顶部测试衬垫

- 其他测试衬垫

- 半化学凹槽

- 回收瓦楞纸

- 纸板

- 按产品

- 折迭式纸盒

- 瓦楞纸箱

- 其他的

- 按最终用户产业

- 食物

- 饮料

- 医疗

- 个人护理

- 家居用品

- 电器

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第九章 竞争格局

- 公司简介

- International Paper Company

- Mondi Group

- Smurfit Kappa Group

- DS Smith PLC

- Eastern Pak Limited

- WestRock Company

- Packaging Corporation of America

- Cascades Inc.

- Nippon Paper Industries Ltd

- Sonoco Products Company

第十章 投资分析

第 11 章 市场的未来

The Paper Packaging Market size is estimated at USD 417.31 billion in 2025, and is expected to reach USD 524.53 billion by 2030, at a CAGR of 4.68% during the forecast period (2025-2030).

Paper packaging is a versatile and cost-efficient method to protect, preserve, and transport a wide range of products. In addition, it can be customized to meet the customers' or product-specific needs. Attributes like lightweight, biodegradability, and recyclability are the advantages of paper packaging, making it an essential component.

Key Highlights

- Consumers globally are becoming more conscious of the environmental hazards of packaging and are moving their purchasing habits to more environment-friendly options. Consumers, the government, and the media are pressuring manufacturers to make their products, packaging, and processes more environmentally friendly. Also, individuals are willing to pay more for these types of conscious packaging. The paper packaging industry is anticipated to grow due to these trends.

- The expansion of e-commerce sales and the rising demand for folded carton packaging drive the market. However, the availability of high-performance substitutes will likely restrain the market's growth. Paperboard packaging is one of the most popular eco-friendly packaging options. Compared to bulkier packaging solutions, this packaging format can be created in various sizes with a small footprint, making it suitable for use in almost all end-user sectors.

- Moreover, consumers support the circular economy model, choosing products packaged and shipped more sustainably. Brand manufacturers aim to reduce their carbon footprint and environmental pollution by using cartonboards. E-commerce has created additional opportunities for brand manufacturers to differentiate themselves through packaging. Manufacturers can provide the essential strength to protect their products throughout the supply chain and integrate value-added features that improve the consumer experience.

- Furthermore, retail and e-commerce rely extensively on paperboard-based packaging, with companies such as Amazon setting the pace with more than 50 million subscribers. In economies such as China and India, the e-commerce market is expected to expand because of rising internet and smartphone penetration and rapid urbanization. According to IBEF, the Indian e-commerce market is anticipated to reach USD 200 billion by the end of 2026, from USD 38.5 billion in 2017.

- The challenge faced by the paper packaging market is the need for paper to package heavy materials, resulting in the industry needing to be more balanced by the polymers and metal packaging industries. Furthermore, deforestation causes the release of dioxins during paper production, causing environmental concerns. Such factors might hinder the paper packaging market.

Paper Packaging Market Trends

The Food and Beverage Segments are Expected to Hold Significant Market Share

- Paper is among the widely used materials for food packaging. Paper is an environment-friendly packaging material, making it an ideal option for food packaging. It is mainly used to package goods directly for transporting and storing primary packages. Paper and paperboard are also used to make microwave popcorn bags, baking paper, and fast-food containers. The market for paper packaging is anticipated to be propelled by high consumer awareness of the environmental concerns of packaged food.

- In addition, paper is one of the readily available, inexpensive resources. It is used extensively in the food and beverage sector. These materials can be recycled to create molded products for packaging applications and other beverage-containing contact items like cups, pouches, and liquid cartons.

- Moreover, international food and beverage businesses have set objectives to make all packaging recyclable or biodegradable in response to consumer demand. For instance, Bacardi stated its intention to eliminate plastic by 2030 by inventing new paper-based beverage bottles, joining the global push against single-use plastics. This dedication to circular economy concepts could result in more significant advancements in the paper industry.

- Various players in the market are constantly innovating products to bolster their foothold globally. In May 2023, Smurfit Kappa completed its investment project, which led to a significant expansion of its packaging plant in Pruszkw with EUR 40 million (USD 43.886 million). This expansion was expected to make Smurfit Kappa one of the largest in Poland and one of Europe's most technologically advanced and modern packaging plants.

- Consumers lead on-the-go lifestyles, and as a result, they continuously seek simpler foods to pick up, handle, eat, or carry. Brands are working harder to make food packaging portable to address this need. Packaging manufacturers depend on paper packaging for food products because these types of packaging are exceptionally lightweight and easy to carry. Moreover, food packaging has become more environmentally friendly in recent years. Big firms abandoned single-use plastics in favor of biodegradable, recyclable, or reusable packaging due to their desire for eco-friendly solutions.

- The growth of the food industry, which, in turn, is driving demand for folding cartons, corrugated boxes, and liquid paperboard boxes, is propelled by the increased need for ready-to-eat, frozen, and packaged goods. For instance, according to the US Census Bureau, in 2023, annual sales of retail food and beverage stores in the United States amounted to ~USD 985 billion, rising from USD 774.4 billion in 2019. Thus, increasing sales of food and beverages impact the growth of the paper packaging market.

Asia-Pacific is Expected to Hold Significant Market Share

- Asia-Pacific is anticipated to record significant growth in the market studied. The market is expanding due to the rising number of production facilities, rising consumerism, and the transit packaging industry in the region. The region is expected to expand quickly due to the increasing need for paper pulp in developing nations like China and India.

- In China, the transportation packaging market is growing along with consumption, fueling the demand for paper packaging. The growing urban population, evolving e-commerce industry, dropping pulp prices, and improving population awareness about environmentally friendly packaging are expected to propel the paper packaging market in the region.

- As per the Indian Paper Manufacturers Association (IPMA), paper consumption in India is expected to witness 6 to 7% annual growth and reach 30 million tonnes by FY 2026-27. This growth is expected to be mainly driven by the growing emphasis on education and literacy, coupled with the increase in organized retail business.

- Furthermore, the growing paper consumption in China throughout the end-user industries is also influencing the production of paper-based products like cardboard. According to data from the National Bureau of Statistics of China, the production of processed paper and cardboard increased simultaneously with their growing demand in January and February 2024. China's cumulative processed paper and cardboard production volume was approximately 22.42 million metric tons, which increased from 12.25 million metric tons in August 2023.

- Nestle, a Japanese company, is looking into new packaging options for various brands and goods. It is also aggressively researching materials to lessen its environmental impact further, as it sells approximately 4 million products daily. Furthermore, several government measures to limit plastic waste influence the market's growth. As a result, increasing consumer awareness and the growth of food, beverage, and other sectors in the region are pushing market's growth.

Paper Packaging Industry Overview

The paper packaging market is fragmented with several players like International Paper, Mondi, Smurfit Kappa, WestRock Company, and more. The companies are innovating and entering into strategic partnerships to retain their market share. Companies constantly innovate with technology and redesign their packaging to get better performance, improve marketability, and enhance sustainability.

- In February 2024, Mondi Group expanded the production of its innovative range of paper-based EcoWicketBags as part of the rising need for sustainable home and personal care (HPC) packaging, specifically for diapers and feminine hygiene products. By expanding the production of EcoWicketBags at its Szada (Hungary) plant, Mondi further leverages the Group's integrated value chain, from in-house paper production to coating and converting.

- In January 2024, WestRock announced plans to construct a new corrugated box plant in Pleasant Prairie, Wisconsin, to fulfill customers' growing needs. This investment is expected to position the company to increase production capabilities and enhance its cost profile in Great Lakes. The construction is slated to cost approximately USD 140 million.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Development of Barrier-coated Paperboard Products

- 5.1.2 Growing Consumer Awareness on Paper Packaging

- 5.2 Market Restraints

- 5.2.1 Effects of Deforestation on Paper Packaging

- 5.2.2 Increasing Operational Costs

6 GLOBAL RECOVERED PAPER PRODUCTION STATISTICS

- 6.1 Recovered Paper, Production Quantity

- 6.2 Recovered Paper, Import Value, and Import Quantity

- 6.3 Recovered Paper, Export Value, and Export Quantity

- 6.4 Recovered Paper Production, by Leading Countries

7 CARTONBOARD EXIM SCENARIO

- 7.1 Cartonboard Exports by Value & Volume (USD million, million tonnes)

- 7.2 Cartonboard Imports by Value & Volume (USD million, million tonnes)

8 MARKET SEGMENTATION

- 8.1 By Grade

- 8.1.1 Carton Board

- 8.1.1.1 Solid Bleached Sulphate (SBS)

- 8.1.1.2 Solid Unbleached Sulphate (SUS)

- 8.1.1.3 Folding Boxboard (FBB)

- 8.1.1.4 Coated Recycled Board (CRB)

- 8.1.1.5 Uncoated Recycled Board (URB)

- 8.1.1.6 Othder Graes

- 8.1.2 Containerboard

- 8.1.2.1 White-top Kraftliner

- 8.1.2.2 Other Kraftliners

- 8.1.2.3 White top Testliner

- 8.1.2.4 Other Testliners

- 8.1.2.5 Semi Chemical Fluting

- 8.1.2.6 Recycled Fluting

- 8.1.1 Carton Board

- 8.2 By Product

- 8.2.1 Folding Cartons

- 8.2.2 Corrugated Boxes

- 8.2.3 Other Types

- 8.3 By End User Industry

- 8.3.1 Food

- 8.3.2 Beverage

- 8.3.3 Healthcare

- 8.3.4 Personal Care

- 8.3.5 Household Care

- 8.3.6 Electrical Products

- 8.3.7 Other End User Industries

- 8.4 By Geography

- 8.4.1 North America

- 8.4.1.1 United States

- 8.4.1.2 Canada

- 8.4.2 Europe

- 8.4.2.1 Germany

- 8.4.2.2 United Kingdom

- 8.4.2.3 Italy

- 8.4.2.4 France

- 8.4.3 Asia

- 8.4.3.1 China

- 8.4.3.2 Japan

- 8.4.3.3 India

- 8.4.3.4 Australia and New Zealand

- 8.4.4 Latin America

- 8.4.4.1 Brazil

- 8.4.4.2 Mexico

- 8.4.5 Middle East and Africa

- 8.4.5.1 United Arab Emirates

- 8.4.5.2 Saudi Arabia

- 8.4.5.3 South Africa

- 8.4.1 North America

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 International Paper Company

- 9.1.2 Mondi Group

- 9.1.3 Smurfit Kappa Group

- 9.1.4 DS Smith PLC

- 9.1.5 Eastern Pak Limited

- 9.1.6 WestRock Company

- 9.1.7 Packaging Corporation of America

- 9.1.8 Cascades Inc.

- 9.1.9 Nippon Paper Industries Ltd

- 9.1.10 Sonoco Products Company