|

市场调查报告书

商品编码

1641844

运动穿戴装置:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Wearable Devices In Sports - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

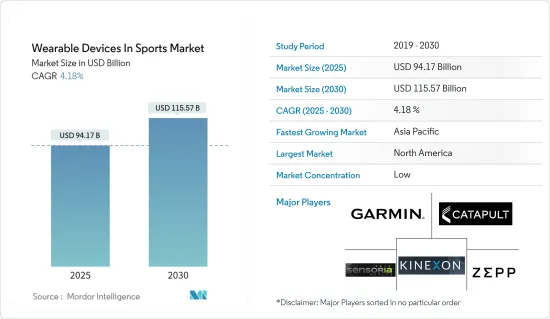

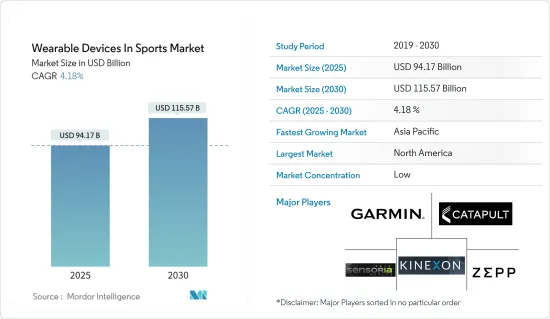

2025年运动穿戴装置市场规模预估为 941.7 亿美元,预计到 2030 年将达到 1,155.7 亿美元,预测期内(2025-2030 年)复合年增长率为 4.18%。

穿戴式科技和设备市场正在快速扩张。随着产业逐渐受到关注,公司除了在设备本身添加新功能外,还优先考虑增强服务。

主要亮点

- 穿戴式装置在体育产业中占有重要地位,提供有关各种参数的重要信息,这些参数旨在支持和控制运动员坚持日常训练。整合分析工具可以更好地评估和分析这些资料,从而提高运动表现和整体个人健身,这体现了体育产业对穿戴式装置的需求。

- 穿戴式装置市场的成长归因于不断增长的需求,以及改进的通讯协定和感测器技术的小型化的普及和相容性。由于体积小巧、整合技术优良,感测器与穿戴式装置可组合成腕饰、服装、鞋子、眼镜等多种配件。

- 影响穿戴式装置在运动市场发展的因素包括大公司的进入、便携性和舒适性、医疗保健意识的增强、生产成本的上升以及技术进步。这些内在因素正在推动穿戴式装置的普及。活动追踪器、智慧型手錶和智慧穿戴等穿戴式装置由于其便携性、最新和先进的技术进步等众多优点,越来越受到消费者的欢迎。

- 线上和线下体育赛事的增加是运动穿戴装置市场发展的主要驱动力。专业比赛、业余锦标赛和主导活动等体育赛事的兴起,带来了对穿戴式装置的需求,这些设备可以增强运动体验、提供即时资料并追踪性能指标。

- 穿戴式电子产品在健身和运动领域有着广泛的应用,用于控制和监测心率、卡路里消耗、睡眠、血压等参数。穿戴式装置允许用户在智慧型穿戴装置上查看健康相关资讯。

- 预测期内,预计限制市场扩张的主要障碍之一是创新穿戴式技术的成本高昂。该领域的大多数公司都发布高级产品产品,但许多用户买不起,这限制了产品实现规模经济。

运动穿戴装置的市场趋势

智慧型穿戴装置类型预计将占据相当大的市场占有率

- 智慧服饰,又称智慧服装、智慧成衣、电子纺织品、智慧纺织品或电子纺织品,能够透过预先定义的控制机製或认知主导的行为感知和回应外部环境。这些安排有助于利用先进的技术监测使用者的身体状况。儘管智慧服饰市场目前还处于起步阶段,但由于健身人口的增加,预计预测期内智慧服装市场将以惊人的速度成长。

- 智慧服饰,包括智慧背心、内衣、智慧鞋、智慧袜子和智慧紧身裤,具有许多潜在应用,包括与其他设备通讯、收集能量并将其转化为其他材料以及保护穿戴者免受环境危害。带来一个重要的应用。

- 各研究机构也正在投入研究活动,以拓宽智慧服装的应用范围。例如,麻省理工学院开发了可嵌入柔性织物(包括常用于运动服装的聚酯纤维)的轻型感测器,以持续监测体温、心率和呼吸频率等生命征象。此感应器可机洗,并可整合到衣服中,然后可取出并在不同的衣服中重复使用。此感测器可用于医疗行业、体育和太空人生命体征监测。美国国家航太总署 (NASA) 和麻省理工学院 (MIT) 媒体实验室太空探勘计画为麻省理工学院的研究提供了部分资助。

- 将智慧穿戴装置融入服装可能会促进智慧服装或基于物联网 (IoT) 的服装的发展。

- 此外,就智慧服装而言,更重要的功能是被动功能,其中感测器监控运动员的生理测量和身体运动。它可以根据资料进行智慧评估,并提供即时回馈,建议运动员应该在哪些方面更加努力、休息或修改技术。

预计北美将占据较大的市场占有率

- 北美穿戴式装置市场,尤其是体育产业,近年来成长显着。穿戴式装置是一种附着在身体上的电子设备,通常作为配件或衣服,旨在收集和分析与运动和健身活动相关的资料。这些设备配备了各种感测器和技术,以追踪和监测心率、步数、行进距离、燃烧的卡路里等参数,甚至提供即时回馈和指导。

- 美国足球员多年来一直穿着它们比赛。 STATSports 和 Catapult Sports 等全球定位系统 (GPS) 追踪领域的知名公司是这一趋势的最大受益者。

- 对腕戴式和身戴式产品的需求不断增加,推动了北美消费品领域穿戴式装置的成长。此外,美国公司的不断发展和创新为区域市场,尤其是美国市场贡献最大,从而导致穿戴式装置的采用率显着增加。

- 人们对健康和健身的认识和关注度不断提高,导致对有助于追踪和改善身体活动的可穿戴设备的需求激增。此外,各企业也积极合作,进行产品创新。例如,运动和智慧服装公司 Athos 正在与美国金州勇士队合作,使用智慧服装来预防伤害并优化球员表现。产品包括 OMsignal健身运动胸罩和一款美观的生活方式胸罩,可让您即时了解您的心电图、体力活动和呼吸活动。

- 智慧材料正在成为製造新军装的关键组成部分,以改善士兵的健康状况并提高战场洞察力。美国陆军正在与多个政府机构、行业领袖和学术界合作,鼓励和推动智慧服饰解决方案的发展,透过为美国军队提供技术和战术性优势,使美国军队受益。

- 由于健身追踪技术的日益普及和行业的持续技术创新,北美运动穿戴式装置市场有望实现成长。随着科技的不断进步,我们可以预见穿戴式装置将进一步融入运动生态系统,使个人能够监测和提高他们的运动表现。

运动产业穿戴装置概述

运动穿戴装置市场较为分散,主要参与者有 Garmin Ltd.、Zepp US Inc.、Catapult Sports Pty Ltd.、Kinexon GmbH 和 Sensoria Inc.市场参与者正在采取联盟、创新和收购等策略来加强其产品供应并获得永续的竞争优势。

2023 年 5 月,Garmin 在印度推出了其 Edge 540 和 840 系列 GPS 自行车电脑,配备太阳能供电选项,可实现最佳性能和训练。这些新款 Edge 自行车电脑配备了先进的功能,包括动态性能洞察、高级地图和太阳能充电,可帮助骑乘者做出更明智的决定并更有效地训练。

2022年9月,健康科技新兴企业Zepp Health旗下的全球智慧穿戴品牌Amazfit推出了两款旗舰智慧型手錶: Amazfit GTR 4和Amazfit GTS 4。 Amazfit GTR 4 和 Amazfit GTS 4。这些智慧型手錶是 Amazfit 系列中第一款能够透过 Zepp 应用程式将运动和健身资料同步到 Adidas Running 应用程式的产品,但未来可能会进行更新。这项发展是 Amazfit 和 adidas Runtastic 策略合作的结果,将增强运动和健身爱好者的使用者体验。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对市场的影响

第五章 市场洞察

- 市场驱动因素

- 对资料主导决策和业务的需求不断增加

- 线上线下体育赛事的兴起

- 可携式且使用方便

- 市场限制

- 初期投资高且预算受限

第六章 市场细分

- 依设备类型

- 健身和心率监测器

- 智慧穿戴

- GPS 追踪器

- 其他设备(相机等)

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

第七章 竞争格局

- 公司简介

- Garmin Ltd.

- Zepp US Inc.

- Catapult Sports Pty Ltd.

- Kinexon GmbH

- Sensoria Inc

- ShotTracker Inc.

- STATSports Group

- EXELIO SRL(GPEXE)

- GPSports Systems(Catapult)

- List not Exhaustive

第八章投资分析

第九章 市场机会与未来趋势

The Wearable Devices In Sports Market size is estimated at USD 94.17 billion in 2025, and is expected to reach USD 115.57 billion by 2030, at a CAGR of 4.18% during the forecast period (2025-2030).

The wearable technology and devices market is unfolding at a rapid pace. With the industry going towards a focal point, businesses are prioritizing service enhancement, apart from adding additional new features to the device itself.

Key Highlights

- Wearable devices have remained a significant part of the sports industry, supporting the athlete to stick to daily routines and giving important information on various parameters it is programmed to control. Integration of analytics tools for better evaluating and analyzing this data to improve the performance or handling of overall personal fitness has sustained the need for wearable devices in the sports industry.

- The growth in the wearables market can be attributed to increasing demand coupled with the propagation and suitability of improved communications protocol and miniaturization of sensor technology. Sensors and wearable devices can be combined into multiple accessories such as wristwear, garments, shoes, and eyeglasses because of their compressed or compact size and superior integration technologies.

- The factors influencing wearable devices in the sports market include the entry of big players, portable and comfortable usage, elevated healthcare awareness, the soaring cost of manufacturing, and technological progressions. These essential factors have encouraged the adoption of wearable devices. Wearable devices such as activity trackers, smartwatches, and smart clothing are preferred among customers owing to their numerous advantages, including portable usage and the most modern and advanced technological advancements.

- The increasing number of sports events, both online and offline, has indeed been a significant driver for the wearable devices market in sports. The rise in sports events, including professional competitions, amateur tournaments, and community-driven activities, has created a demand for wearable devices to enhance the sports experience, provide real-time data, and track performance metrics.

- Wearable electronic devices find various applications in fitness and sports for controlling and monitoring parameters such as heart rate, calorie consumption, sleep, and blood pressure. Wearable devices permit a user to check health-related information on their smart wearables.

- One of the main obstacles anticipated to restrain the market's expansion during the forecast period is the high cost of innovative wearable technology. Most firms in this sector are releasing their products under the category of premium products, which are not affordable for many users and restrict the products from reaching economies of scale.

Sports Wearable Devices Market Trends

Smart Clothing Device Type Segment is Expected to Hold Significant Market Share

- Smart fabrics, also known as smart clothing, smart garments, electronic textiles, smart textiles, or E-textiles, can be defined as fabrics that can sense and react to the external environment via a pre-defined control mechanism or cognitive-driven behavior. These arrangements help monitor the user's physical condition by using advanced technologies. At present smart clothing, the market is at its nascent stage and is expected to rise at a notable speed during the forecast period, owing to growing fitness.

- Smart clothing, such as smart vests, undergarments, smart shoes, smart socks, and smart tights, will have various potential applications, such as communicating with other devices, harvesting energy transformed into other materials, and protecting wearers from environmental hazards.

- Various institutes have also been investing in research activities to increase applications for smart clothing. For instance, MIT has created a lightweight sensor that can be embedded into flexible fabrics, including polyesters typically used in athletic wear, to constantly monitor vital signs, including body temperature, heart rate, and respiratory rate. The sensors are machine-washable and can be integrated into clothing that can be removed and reused in different garments. The sensor has potential applications across the health industry, in athletics, and in astronaut vital sign monitoring. National Aeronautics and Space Administration (NASA) and Massachusetts Institute of Technology (MIT) Media Lab Space Exploration Initiative partly funded MIT research.

- By integrating smart wearables into clothing, smart clothes or Internet of Things (IoT)-based garments may be developed.

- Further, with smart clothing, the more significant function is the passive function, where sensors monitor an athlete's physiological measurements or physical movements. It can make smart evaluations based on the data and deliver real-time feedback suggesting that athletes work harder, rest, correct their technique, etc.

North America is Expected to Hold Significant Market Share

- The wearable devices market in North America, specifically the sports industry, has grown significantly in recent years. Wearable devices are electronic devices worn on the body, typically in accessories or clothing, and are designed to collect and analyze data related to sports and fitness activities. These devices are equipped with various sensors and technologies that track and monitor parameters such as heart rate, steps taken, distance covered, and calories burned, and even provide real-time feedback and coaching.

- The US soccer athletes have been wearing them while playing for many years. Companies like STATSports and Catapult Sports, which are popular in the global positioning system (GPS) tracking space, have greatly benefitted from these trends.

- The increasing demand for wristwear and bodywear products has led to the growth of wearable devices in North America's consumer products sector. Additionally, US-based companies' increasing developments and innovations have contributed most significantly to the region's market and, specifically, in the United States, resulting in a significant increase in the usage of wearable devices.

- The growing awareness and focus on health and fitness among individuals have led to a surge in demand for wearable devices that can help track and improve their physical activities. In addition, companies are also collaborating actively to innovate their products. For instance, Athos, an athletic & smart clothing player, works with the US-based Golden State Warriors to use smart clothing to prevent injury and optimize player performance. The product includes an OMsignal fitness sports bra and an attractive lifestyle bra that can capture real-time ECG, physical, and respiratory activities.

- The smart fabric has become a significant component in creating new military uniforms to improve soldiers' health while giving added battlefield insight. The military has a partnership with several government agencies, industry leaders, and academia to encourage and advance the growth of smart clothing solutions that would be useful to the US military by providing them with a technological and tactical edge over its opponent.

- The wearable devices market in North American sports is poised for growth with the increasing adoption of fitness-tracking technologies and continuous innovation in the industry. As technology continues to advance, we can expect further integration of wearables into the sports ecosystem, empowering individuals to monitor and improve their athletic

Sports Wearable Devices Industry Overview

The wearable devices in sports market is fragmented with the presence of major players like Garmin Ltd., Zepp US Inc., Catapult Sports Pty Ltd., Kinexon GmbH, and Sensoria Inc. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In May 2023, Garmin launched the Edge 540 and 840 series GPS cycling computers with solar power options in India for optimal performance and training. These new Edge cycling computers come with sophisticated features such as dynamic performance insights, advanced mapping, solar charging, and more, enabling riders to make smarter decisions and train more effectively.

In September 2022, Amazfit, a global smart wearables brand owned by health technology startup Zepp Health, introduced two flagship smartwatches: the Amazfit GTR 4 and Amazfit GTS 4. These smartwatches are the first in the Amazfit lineup to offer syncing of sports and fitness data to the Adidas Running app through the Zepp App, following a future update. This development is a result of the strategic relationship between Amazfit and Adidas Runtastic, enhancing the user experience for sports and fitness enthusiasts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defnition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET INSIGHTS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Data-Driven Decisions and Operations

- 5.1.2 Increasing Sports Events, Online and Offline

- 5.1.3 Portable and Convenient Usage

- 5.2 Market Restraints

- 5.2.1 High Initial Investment and Budget Constraints

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Fitness & Heart Rate Monitors

- 6.1.2 Smart Clothing

- 6.1.3 GPS Trackers

- 6.1.4 Other Devices (Cameras, etc)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Garmin Ltd.

- 7.1.2 Zepp US Inc.

- 7.1.3 Catapult Sports Pty Ltd.

- 7.1.4 Kinexon GmbH

- 7.1.5 Sensoria Inc

- 7.1.6 ShotTracker Inc.

- 7.1.7 STATSports Group

- 7.1.8 EXELIO SRL(GPEXE)

- 7.1.9 GPSports Systems(Catapult)

- 7.1.10 List not Exhaustive