|

市场调查报告书

商品编码

1641970

缆线连接器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Cable Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

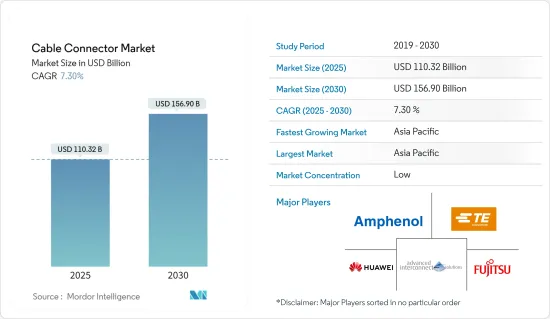

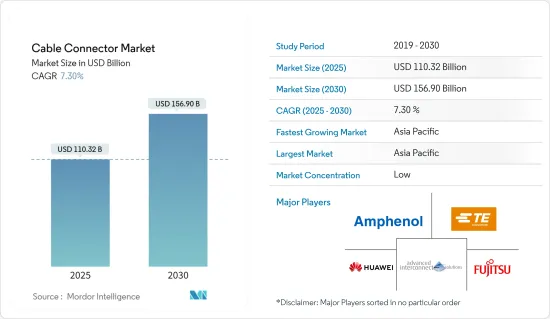

缆线连接器市场规模在 2025 年估计为 1103.2 亿美元,预计到 2030 年将达到 1569 亿美元,在市场估计和预测期(2025-2030 年)内以 7.3% 的复合年增长率增长。

新兴经济体对媒体和娱乐的需求不断增长,以及网路普及率不断提高,导致电视和网路用户数量以及智慧型手机、PDA 和平板电脑用户数量均有所增加。这些因素导致对缆线连接器适配器的需求庞大,没有它们就无法实现有效的连网。

主要亮点

- 全球数位转型正在推动缆线连接器市场的发展。可靠的连接、高效能和效率是推动市场成长的关键因素。高效能网路对于商业、製造、安全和媒体至关重要。此外,USB Type-C 和 HDMI 等电缆越来越受欢迎。

- 多年来固定宽频连线数量的增加推动了所研究市场的成长。根据国际电信联盟的数据,过去五年来全球固定宽频连线数量大幅增加,而这些连接的安装需要连接器,为研究的市场创造了成长机会。根据通讯预测,到2021年全球固定宽频连线数量将成长到约13亿。

- 缆线连接器在小型化应用中的使用正在迅速扩大。几个主要市场正在推动市场成长,包括行动技术、航太和国防以及医疗技术。智慧型手机和其他手持装置也需要更小、更薄的组件,包括能够以超高速资料通讯的微连接器。例如10Gbps基板对基板连接器是标准配置,而一些先进的微型基板对基板连接器可以支援高达20Gbps。因此,消费性电子产品的成长对缆线连接器的需求有直接的影响。

- 此外,大多数资料和电源连接都使用射频连接器和电缆,这一趋势将继续存在于高速资料、企业网路和工业IoT应用中。随着欧洲和亚太地区工业物联网 (IIoT) 的采用不断增加,连接器公司正在转向 USB、CAT 5/6/7、HDMI 和 DisplayPort 等新连接器。例如,2021年7月,伍尔特电子推出了超紧凑高频同轴连接器WR-UMRF(超微型射频同轴连接器)。

- 然而,复杂的故障识别和纠正程序、製造缆线连接器所用原材料价格波动以及蓝牙、无线 HDMI 发射器等无线连接技术的发展等挑战正在挑战所研究市场的成长。

- COVID-19 疫情爆发对研究市场的成长产生了显着影响,因为它迫使中国和其他国家在初期宣布封锁并实施社交疏离措施。这导致许多设备和机械的製造和生产停顿数週。此外,关键原料和工业设备的进出口也受到各种限制,导致供应链严重中断。然而,随着全球几乎所有地区的限制措施都已取消,市场预计将恢復成长动能。

缆线连接器市场趋势

汽车产业可望占据主要市场占有率

- 由于采用音讯控制、ADAS(高级驾驶辅助系统)、诊断系统、巡航控制和资讯娱乐系统等先进的电子系统,预计汽车产业对连接器的需求将会强劲。此外,电动车的日益普及预计将推动市场成长。该领域的主要市场趋势包括技术创新和设计改进以满足设备品质和可靠性标准、对多功能和小型化连接器的需求、RoHS 合规性的普及、UL 认证和IP 额定连接器以及EMI/其中包括具有RFI 抑制功能的智慧型连接器。

- 新的汽车技术改变了汽车的接线方式。关键电气元件必须在认证条件下可靠地传输电力、讯号和资料。混合动力汽车和电动车已将坚固耐用连接器技术的应用范围从赛车扩展到自动驾驶汽车形式的机器人。这导致了缆线连接器以及设计和材料的重大发展。

- 鑑于对能够满足现代车辆要求的连接器的需求不断增长,缆线连接器供应商正致力于开发日益创新的产品。例如,Hirose Electric Co.Ltd于2021年12月开发了新型线对基板连接器GT50系列。此系列间距为1mm,耐热温度达125°C,是一款小型、坚固的产品,非常适合车载使用。

- 汽车产业的最新趋势是电动车迅速取代传统内燃机汽车,这也扩大了连接器的使用范围,因为这些汽车配备了更多的感测器和电子元件。例如,根据国际能源总署的数据,全球使用的电动车数量将从 2016 年的 120 万辆增加到 2021 年的 1,130 万辆。

亚太地区可望创下最快成长

- 亚太地区通讯技术的不断进步和其他终端用户行业的成长是推动缆线连接器市场发展的关键因素之一。此外,IT和通讯对工业应用中自动化流程的支援正在简化製造商的采用。

- 感测器组件、更快的网路、具有高可靠性和安全分层存取的灵活介面以及错误纠正选项有助于提高生产力、持续的品质交货和最小化该地区的製造成本。此外,随着物联网成为开发、生产和物流链(称为智慧工厂自动化)新技术方法的核心,该地区的电缆连接器采用率预计将大幅增加。

- 例如,GSMA 估计到 2025 年,全球整体将有 138 亿个 IIoT 连线。大中华区预计将占约 41 亿个连线数,占全球市场的三分之一。 2021 年 6 月,中国工业与资讯化部 (MIIT) 发布了《工业互联网 2021 年工作计画》,详细列出了进一步扩大国家 5G 网路和工业物联网 (IIoT) 的目标。此外,感测器和光纤电缆等电子元件的日益普及将推动对缆线连接器的需求,这些趋势预计将创造进一步的成长机会。

- 此外,资料中心的激增和对更高频宽的需求不断增长,推动了对电缆和连接器的需求。中国非常注重在资料中心建置方面领先全球,大型企业都在寻求扩大资料中心规模,以确保资讯服务的稳定性和可靠性。例如5G、穿戴式装置、物联网、人工智慧的应用等,对算力的需求不断激增。

- 此外,汽车产业的成长也有望成为亚太地区缆线连接器市场发展的关键因素。例如,根据中国工业协会(CAAM)的数据,预计 2021 年中国纯电动车销量约 290 万辆。

缆线连接器产业概况

缆线连接器市场比较分散。相对较低的初始投资使新参与企业能够快速进入市场。此外,多年来,收购一直是一个主要的市场趋势,较大的参与者利用收购来减少竞争并进一步扩大其市场占有率。主要参与者包括安费诺公司、富士通有限公司、泰科电子有限公司和华为技术有限公司。

- 2022 年 9 月-Amphenol RF 在其 AUTOMATE Type A MiniFAKRA 产品系列中加入了预配置电缆组件。根据该公司介绍,这些组件两端均配备直四埠 miniFAKRA 插孔,专为低损耗 TFC302LL 设计。此外,这些连接器包含封闭式的入口电缆接口,该接口限制了配合部件的尺寸,以防止配合过程中的接触损坏。

- 2022 年 7 月 - 领先的电子元件专业经销商 TTI, Inc. 宣布,他们现已开始储备 TE Connectivity 的工业 Mini-I/O 连接器。 Mini I/O 连接器系列具有出色的抗衝击性、抗振动性、抗衝击性和抗 EMI 性,体积小巧,在恶劣的工业应用中提供可靠的高性能。这项进展扩大了 TE Connectivity 的业务范围,吸引了更多新客户。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 电讯业不断进步,对改善连结性的需求不断增长

- 高频宽的需求不断增加

- 市场挑战

- 原物料价格波动

第六章 市场细分

- 按类型

- PCB 连接器

- 圆形/方形连接器

- 光纤连接器

- 输入输出连接器

- 其他类型

- 按行业

- 资讯科技和电讯

- 汽车/运输

- 消费性电子产品(包括电脑、周边设备和商务设备)

- 工业的

- 其他最终用户(海底、航太、能源/电力、医疗)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Amphenol Corporation

- Molex Inc.(Koch Industries)

- Fujitsu Limited

- Prysmian SpA

- Nexans SA

- TE Connectivity Limited

- 3M Company

- Huawei Technologies Co. Ltd

- Axon Cable SAS

- Alcatel-Lucent SA

- Aptiv PLC

- Yazaki Corporation

- Huber+Suhner AG

第八章投资分析

第九章:市场的未来

The Cable Connector Market size is estimated at USD 110.32 billion in 2025, and is expected to reach USD 156.90 billion by 2030, at a CAGR of 7.3% during the forecast period (2025-2030).

The growing demand for media and entertainment and the increasing penetration of the internet across emerging economies led to the increase in the number of television and internet subscribers and users of smartphones, PDAs, and tablets. These factors created an immense demand for cable connector adapters, without which effective networking cannot be established.

Key Highlights

- The market for cable connectors is booming, owing to the global digital transition. Reliable connectivity, high performance, and efficiency are the major factors boosting the market's growth. High-performance networks are essential for business, manufacturing, security, and media. Furthermore, cables, such as USB Type-C and HDMI, are hugely popular.

- The growing number of fixed broadband connections over the years has enabled the growth of the market studied. According to ITU, the number of global fixed broadband subscriptions increased significantly in the last five years, which provides an opportunity for the growth of the market studied, as the installation of these connections requires connectors. According to the International Telecommunication Union, the number of fixed broadband connections globally will increase to about 1.3 billion in 2021.

- The use of cable connectors for miniature applications is rapidly growing. Several key markets, including mobile technology, aerospace and defense, and medical technology, drive the market's growth. Smartphones and other handheld devices also require smaller and lower-profile components, including micro-connectors capable of providing very high data speeds. For example, 10 Gbps board-to-board connectors are standard, and some advanced miniature board-to-board connectors can handle up to 20 Gbps. Therefore, the growth of consumer electronics is having a direct impact on the demand for cable connectors.

- Furthermore, most data and power connections use RF connectors and cables, and these trends will likely continue with high-speed data, enterprise networking, and industrial IoT applications. With the adoption of the Industrial Internet of Things (IIoT) increasing in Europe and APAC, the connector companies are turning to newer connectors, such as USB, CAT 5/6/7, HDMI, and DisplayPort, to name a few. For instance, in July 2021, Wurth Elektronik launched WR-UMRF (Ultra-Miniature RF Coaxial Connector), an extremely compact high-frequency coaxial connector.

- However, the factors such as complex fault identification and correction procedure, fluctuation in raw material prices used to manufacture cable connectors, and the development of wireless connectivity technologies such as Bluetooth, and wireless HDMI transmitters, among others, are challenging the growth of the studied market.

- The outbreak of COVID-19 had a notable impact on the growth of the studied market as it led China, along with other countries, to announce a lockdown and practice social isolation during the initial phase. This factor halted the manufacturing and production of numerous pieces of equipment and machinery for several weeks. Furthermore, various restrictions imposed on importing and exporting critical raw materials and industrial equipment significantly disrupted the supply chain. However, the market is expected to regain momentum with restrictions lifted in almost all parts of the world.

Cable Connector Market Trends

Automotive Sector is Expected to Hold Significant Market Share

- The automotive sector is projected to witness a strong demand for connectors, aided by the adoption of highly advanced electronic systems, such as audio controls, driver assistance systems, diagnostic systems, cruise control, and infotainment systems. Moreover, the increasing popularity of electric vehicles is expected to boost the market's growth. Some of the significant market trends in the segment include innovations and design improvements to meet the quality and reliability standards of devices, demand for versatile miniature connectors, the popularity of RoHS - compliant, UL recognized, and IP -rated connectors, as well as intelligent connectors with EMI/RFI suppression features.

- New automotive technologies have altered the ways cars are wired. The critical electrical components are required to reliably transmit power, signal, and data in certified conditions. The hybrid electric and electric vehicle has expanded the vision for applying robust connector technology from race cars to robotics in the form of autonomous vehicles. This has led to a significant development in design, material, as well as cable connectors.

- Considering the growing demand for connectors that can fulfill the requirements of modern automobiles, the vendors offering cable connectors are increasingly focusing on developing innovative products. For instance, in December 2021, Hirose Electric developed a new wire-to-board connector, the GT50 Series. This small and robust product series has a 1mm pitch and heat resistance up to 125-degree celsius, making it ideal for use in automotive applications.

- The recent shift in the automotive industry's trend wherein electric vehicles are fast replacing the traditional ICE vehicles is also expected to support the growth of the studied market as these vehicles contain more sensors and electronic components, expanding the use cases for connectors. For instance, according to the International Energy Agency, the global number of battery electric vehicles in use has increased from 1.2 million in 2016 to 11.3 million in 2021.

Asia-Pacific Expected to Witness the Fastest Growth Rate

- The continuous advancements in communication technologies and the growth of other end-user industries in the Asia Pacific region are among the significant factors boosting the development of the cable connectors market. Moreover, the support by IT and communications for automated processes in industrial applications have facilitated easier adoption among manufacturers.

- Sensor components, faster networks, flexible interfaces with high levels of reliability and secured hierarchical access, and error-correction options added to productivity, continued quality deliveries and minimized manufacturing costs in the region. Furthermore, with IoT at the center of new technological approaches for the development, production, and the entire logistics chain (otherwise known as intelligent factory automation), the adoption of cable connectors is expected to increase significantly in the region.

- For instance, according to the GSMA estimates, there will be 13.8 billion IIoT connections globally by 2025. Greater China is expected to account for around 4.1 billion connections or a third of the global market. In June 2021, the Chinese Ministry of Industry and Information Technology (MIIT) released its Industrial Internet 2021 Work Plan, detailing its goal to expand further the country's 5G network and the Industrial Internet of Things (IIoT). Such trends are also expected to create further growth opportunities as increased deployment of electronic components such as sensors and optic fiber cables will drive the demand for cable connectors.

- Furthermore, the growing number of data centers and rising demand for higher bandwidth drive the need for cables and connectors. China is highly focused on taking the lead over global peers in data center construction, with larger enterprises looking to scale up their data centers to ensure stability and reliability of data services, such as the application of 5G, wearable devices, the internet of things, and artificial intelligence spurs a burgeoning demand for computing power.

- The growth of the automotive sector is also expected to be a vital contributor to the development of the cable connectors market in the Asia Pacific region. For instance, according to the China Association of Automobile Manufacturers (CAAM), about 2.9 million battery electric vehicles will be sold in China in 2021.

Cable Connector Industry Overview

The Cable Connector Market is fragmented. The relatively lower initial investment requirement enables new players to enter the market quickly. Moreover, acquisitions have been a critical trend in the market over the years as the bigger players are using this to reduce competition and further expand their market presence. Some key players include Amphenol Corporation, Fujitsu Limited, TE Connectivity Limited, and Huawei Technologies Co. Ltd.

- September 2022 - Amphenol RF expanded its AUTOMATE Type A MiniFAKRA product series with pre-configured cable assemblies. According to the company, these assemblies feature a straight quad port miniFAKRA jack on both ends and are designed for low-loss TFC302LL. Furthermore, these connectors are constructed with a closed entry cable interface which limits the size of mating parts to prevent contact damage during mating.

- July 2022 - TTI, Inc., a leading specialty distributor of electronic components, announced that it is stocking the Industrial Mini-I/O connectors from TE Connectivity. The Mini I/O range of connectors provides excellent shock, vibration, shock, and EMI resistance, in a compact size and delivers reliable high performance in rugged industrial applications. The development will expand the reach of TE Connectivity to new customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Advancements In The Telecom Sector Coupled With Greater Demand for Improved Connectivity

- 5.1.2 Increasing Demand for High Bandwidth

- 5.2 Market Challenges

- 5.2.1 Volatile Prices of Raw Material

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 PCB Connectors

- 6.1.2 Circular/Rectangular Connectors

- 6.1.3 Fiber Optic Connectors

- 6.1.4 IO Connectors

- 6.1.5 Other Types

- 6.2 By End-user Vertical

- 6.2.1 IT and Telecom

- 6.2.2 Automotive/Transportation

- 6.2.3 Consumer Electronics (Including Computer, Peripherals, and Business Equipment)

- 6.2.4 Industrial

- 6.2.5 Other End -user Verticals (Submarine, Aerospace, Energy and Power, and Medical)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amphenol Corporation

- 7.1.2 Molex Inc. (Koch Industries)

- 7.1.3 Fujitsu Limited

- 7.1.4 Prysmian SpA

- 7.1.5 Nexans SA

- 7.1.6 TE Connectivity Limited

- 7.1.7 3M Company

- 7.1.8 Huawei Technologies Co. Ltd

- 7.1.9 Axon Cable SAS

- 7.1.10 Alcatel-Lucent SA

- 7.1.11 Aptiv PLC

- 7.1.12 Yazaki Corporation

- 7.1.13 Huber+Suhner AG