|

市场调查报告书

商品编码

1548903

全球商业印刷市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Commercial Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

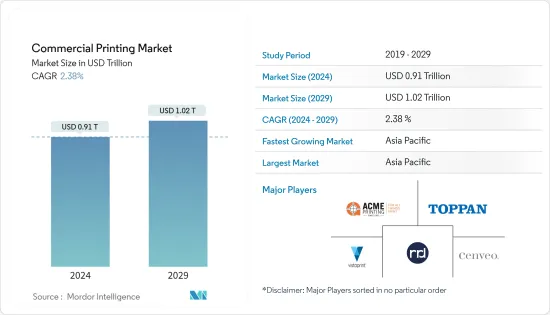

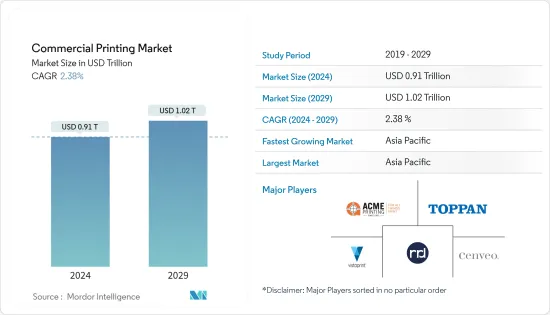

全球商业印刷市场规模预计到2024年为9,100亿美元,预计到2029年将达到1.2兆美元,在预测期内(2024-2029年)复合年增长率为2.38%。

商业印刷产业的变化主要是由于网路和行动连线的快速崛起。这项变革正在重塑企业和个人沟通和存取资讯的方式。因此,公司正专注于生产更有针对性和更频繁的印刷产品,特别是在消费者兴趣浓厚的领域。

印刷广告是商业印刷的基石,对于寻求全面目标市场的企业,尤其是零售企业极为重要。印刷广告有独特的优势。这意味着您的产品可以进行几个月甚至几年的广告,广告的投放时间与出版物本身一样长。这种长寿及其有效性正在推动对印刷广告不断增长的需求。

商业印刷业正在发生重大变化,并逐渐走向永续实践。印刷业越来越重视环境因素,并采取各种环保措施。

此外,随着永续性变得越来越重要,越来越多的公司将注意力转向商务用喷墨产品。这些产品消耗的电力更少,排放的二氧化碳也更少,因此不会排放碳粉粉尘,空气更干净。许多公司正在投资喷墨印表机,以增强其产品供应、个人化包装、帮助客户宣传其品牌并应对季节性需求。

历来依赖劳动力的印刷业正在经历变革。机器设计、数位化和电脑化的进步提高了生产力,并使成长与直接劳动力脱钩。然而,原料成本上涨令许多市场参与者望而却步。这些原料包括纸张、墨水和各种化学物质。

根据 Zenith 的数据,全球广告支出在 2020 年经历了重大挫折,下降了 4%,这主要是由于 COVID-19 的爆发。然而,随着包装、出版和广告等产业在后疫情时代的扩张,广告支出在隔年大幅反弹。据预测,到2024年,该产业将出现復苏,支出成长达到7.6%左右。

商业印刷市场趋势

预计可伸缩安全注射器市场在预测期内将出现显着成长

- 印刷技术的进步彻底改变了包装的方面。当前的包装趋势强调数位印刷的快速采用、智慧技术的整合以及先进印刷技术的利用。这些进步在提高包装的视觉吸引力和功能性以及实现永续性目标方面发挥关键作用,这些目标与行业更广泛的环保意识运动相一致。

- 在技术进步和不断变化的客户偏好的推动下,商业印刷不断发展。广告已显着增长,以创造具有视觉吸引力的设计,因为透过引人注目且资讯丰富的包装来区分品牌已成为在商店中脱颖而出的关键。

- 随着数位资讯传递的增加,商业印刷商正在实施数位技术来提高包装的印刷品质。快速反应(QR)码已成为产品包装上的基本/主流印刷方式,可以用智慧型手机扫描以显示附加资料,例如产品资讯或促销内容。

- 药品、烟草、酒精饮料等包装和标籤印刷的需求正在迅速增长。这种需求的增长是由于公司需要遵守不断变化的政府法规并打击仿冒品。

- 加工商和零售商之间围绕包装的合作不断加强,从而开发了吸引客户的创新方法。网路购物和创造个人化体验进一步推动了包装领域的商业印刷市场。例如,根据中国商务部 (MOFCOM) 的数据,网路购物市场零售额为 15.3 兆元(2.13 兆美元)。因此,许多包装公司正在投资商业印刷解决方案,推动市场成长。

预计北美将在预测期内占据主要市场占有率

- 亚太地区,特别是中国、印度和东南亚国家,正在经历快速经济成长。例如,根据统计部估计,印度2024财年第三季GDP成长8.4%。这比 2023 财年同季 4.3% 的成长显着成长。财政部公布 2014 财年实际 GDP 成长率为 7.6%。由于住宅需求强劲,建筑业在 2024 财年实现了两位数成长。此外,製造业和服务业第三季也出现成长。

- 这种高成长推动了严重依赖印刷的行业,如零售、广告、教育和製造业。业务的扩展直接推动了商业印刷行业的发展,对行销材料、包装和文件的需求不断增加。

- 这些国家的经济发展导致消费者支出增加,进而推动了对印刷产品的需求。零售商需要更多的包装和标籤,广告商需要更多的促销资料,教育机构需要更多的教科书和学习材料,製造商需要更多的文件和产品标籤。各部门的这种相互关联的成长强调了商业印刷市场在支持经济活动中的重要性。

- 技术创新,特别是数位印刷,推动了印刷业的成长。数位印刷以卓越的品质、效率和客製化而闻名,可实现更快的印刷时间、更快的周转时间和个人化内容。这些功能对各种规模的企业都有吸引力。

- 因此,这种技术转变不仅提高了印刷公司的业务能力,而且随着越来越多的公司寻求这些先进的服务,也扩大了基本客群。许多主要企业正在透过新产品发布、策略合作伙伴关係和区域扩张来扩大其产品组合,进一步提高亚太商业印刷市场的价值。

商业印刷业概况

商业印刷市场被许多全球和地区公司所分散。由于市场产品同质化,许多在同一市场经营的公司面临价格竞争。公司包括 ACME Printing、Cenveo Worldwide Limited、RR Donnelley &Sons Company、Vistaprint (CIMPRESS PLC) 和 Toppan (Toppan Inc.)。

2024 年 3 月 - RR Donnelley & Sons Company 签订最终协议,从 Vericast Corp. 收购数位和印刷行销资产。这些资产包括展示广告、内容定位、联网电视、动态行动服务、数位户外广告、社群媒体行销、电子邮件宣传活动、本地搜寻服务、零方资料撷取和其他数位行销解决方案。 Vericast 的印刷行销部门也将被收购,包括其共享电子邮件服务以及数位和印刷格式的优惠券付款业务。

2024 年 1 月 -Konica Minolta商业解决方案(英国)加强了与 Production Print Direct 的合作伙伴关係,Production Print Direct 是商业印刷市场设备、软体和服务的主要企业。此次扩大的合作关係涵盖Konica Minolta的数位标籤印刷机和包装印刷机。此次合作正值商业印刷公司越来越希望扩大和改善其服务组合之际。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 零售和食品饮料行业对促销材料的需求增加

- 采用环保做法

- 市场限制因素

- 数位化的进步和对原物料价格的依赖增加

- 市场机会

- 引入数位 TIE-INS(二维码、AI、URL 等)

第六章 市场细分

- 按列印类型

- 平张胶印

- 喷墨

- 柔版印刷

- 萤幕

- 凹版印刷

- 其他印刷类型

- 按用途

- 包装

- 广告

- 发布

- 图书

- 杂誌

- 报纸

- 其他出版品

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- ACME Printing

- Cenveo Worldwide Limited

- RR Donnelley & Sons Company

- Vistaprint(CIMPRESS PLC)

- Toppan Co. Ltd(Toppan Inc.)

- Transcontinental Inc.

- LSC Communications US LLC

第八章投资分析

第九章市场展望

第 10 章 科技对商业印刷生态系的影响

The Commercial Printing Market size is estimated at USD 0.91 trillion in 2024, and is expected to reach USD 1.02 trillion by 2029, growing at a CAGR of 2.38% during the forecast period (2024-2029).

The commercial printing industry is transforming, primarily driven by the rapid rise of the internet and mobile connectivity. This shift is reshaping how businesses and individuals communicate and access information. Consequently, companies are focusing on producing more targeted and frequent print materials, especially in sectors where consumers are highly engaged.

Print advertising, a cornerstone of commercial printing, is pivotal for businesses, especially in the retail sector, looking to engage their target markets comprehensively. Print ads offer a unique advantage: they stay in circulation as long as the publication does, potentially promoting a product for months or even years. This longevity, coupled with its effectiveness, is fueling a rising demand for print-based advertising.

The commercial printing sector is witnessing a significant shift, gradually transitioning toward sustainable practices. Printing industries are increasingly prioritizing environmental concerns, leading to the adoption of various eco-friendly initiatives.

Moreover, with a growing emphasis on sustainability, businesses are increasingly turning to commercial inkjet products. These products consume less power and emit less carbon dioxide, resulting in cleaner air due to the absence of toner dust emissions. Many companies are investing in inkjet printers to enhance their offerings and personalize packaging, assist clients in brand promotion, and cater to the seasonality of demand.

The printing industry, historically reliant on labor, has witnessed a shift. Advancements in machinery design, digitalization, and computerization have boosted productivity, decoupling growth from direct labor. However, escalating raw material costs are constraining many market players. These materials encompass paper, inks, and various chemicals.

According to Zenith, global advertising spending experienced a significant setback in 2020, with a 4% decline, primarily attributed to the COVID-19 pandemic. However, as industries like packaging, publishing, and advertising expanded in the post-pandemic era, ad spending rebounded notably in the subsequent year. Projections suggest that by 2024, the industry is poised to witness a resurgence, with expenditure growth expected to reach approximately 7.6%.

Commercial Printing Market Trends

Retractable Safety Syringes Segment Expected to Witness Significant Growth During the Forecast Period

- Technological advancements in printing have revolutionized both the aesthetic and practical aspects of packaging. Current trends in packaging underscore a rapid embrace of digital printing, integration of smart technologies, and the utilization of advanced printing techniques. These advancements enhance the visual appeal and functionality of packaging and play a key role in achieving sustainability objectives, which align with the industry's broader push for eco-friendliness.

- Commercial printing is continuously evolving and driven by technological advancements and changing customer preferences. As brand differentiation with eye-catching and informative packaging becomes essential for brands to stand out on store shelves, commercials have significantly grown to create visually appealing designs.

- With a rise in digital information delivery, commercial printers have been imbibing digital technologies to enhance packaging print quality. Quick response (QR) codes have become a basic/mainstream print on product packaging that can be scanned with a smartphone for additional data display, such as product info and promotional content, to name a few.

- The demand for printing on packaging and labels for pharmaceuticals, tobacco, and alcoholic beverages is rapidly surging. This rise is driven by the need for companies to adhere to continuously evolving government regulations and combat counterfeiting.

- Increased cooperation among the convertors and retailers surrounding packaging has led to the development of innovative ways of enticing customers. Online shopping and curating personalized experiences have further aided the market for commercial printing in the packaging domain. For instance, according to MOFCOM China, the retail sales volume of the online shopping market was CNY 15.3 trillion (USD 2.13 trillion). Owing to this, many packaging companies are investing in commercial printing solutions, thus boosting the market's growth.

North America Expected to Hold Significant Market Share During the Forecast Period

- The Asia-Pacific region, notably countries like China, India, and several Southeast Asian nations, has experienced rapid economic growth; for instance, according to estimates from the Statistics Ministry, India's GDP expanded by 8.4% in the third quarter of FY24. This represents a substantial increase from the 4.3% growth recorded in the same quarter of FY23. The Ministry of Finance reported a 7.6% growth in real GDP for FY24. Strong residential demand drove the construction sector to double-digit growth in FY24. Additionally, the manufacturing and service sectors also experienced growth in Q3.

- This upsurge has propelled industries heavily reliant on printed materials, such as retail, advertising, education, and manufacturing. Expanding businesses come with heightened marketing collateral, packaging, and documentation needs, directly boosting the commercial printing sector.

- The economic development in these countries has led to increased consumer spending, which in turn drives demand for printed products. Retailers require more packaging and labels, advertisers need more promotional materials, educational institutions demand more textbooks and learning aids, and manufacturers need more documentation and product labels. This interconnected growth across various sectors underscores the importance of the commercial printing market in supporting economic activities.

- Technological innovation, especially in digital printing, has driven growth in the printing industry. Digital printing, known for its superior quality, efficiency, and customization, allows for shorter print runs, faster turnarounds, and personalized content. These features appeal to businesses of all sizes.

- Consequently, this technological shift not only enhances the operational capabilities of printing companies but also expands their customer base as more businesses seek these advanced services. Many key players are launching new products and forming strategic partnerships and regional expansions to broaden their portfolios, further adding value to the commercial printing market in the Asia-Pacific region.

Commercial Printing Industry Overview

The commercial printing market is fragmented due to the presence of many global and regional players. Considering the homogenous nature of market products, many firms operating in the market are further being driven to compete on price. Some of the players are ACME Printing, Cenveo Worldwide Limited, R.R. Donnelley & Sons Company, Vistaprint (CIMPRESS PLC), and Toppan Co. Ltd (Toppan Inc.).

March 2024 - R.R. Donnelley & Sons Company finalized an agreement to acquire digital and print marketing assets from Vericast Corp. These assets include digital marketing solutions such as display advertising, contextual targeting, connected TV, dynamic mobile services, digital out-of-home advertising, social media marketing, email campaigns, local search services, and zero-party data capture. The acquisition also covers Vericast's print marketing division, featuring shared mail services and a coupon-clearing business in both digital and print formats.

January 2024 - Konica Minolta Business Solutions (UK) bolstered its collaboration with Production Print Direct, a key player in equipment, software, and services for the commercial print market. This expanded partnership now encompasses Konica Minolta's digital label and packaging presses. The move comes as commercial printers increasingly seek to broaden and elevate their service portfolios.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Promotional Materials from the Retail, Food, and Beverage Industries

- 5.1.2 Introduction of Eco-friendly Practices

- 5.2 Market Restraints

- 5.2.1 Increase in Digitization and Rising Dependence on Feedstock Prices

- 5.3 Market Opportunities

- 5.3.1 Incorporation of Digital TIE-INS (such as QR Code. AI, URL)

6 MARKET SEGMENTATION

- 6.1 By Printing Type

- 6.1.1 Offset Lithography

- 6.1.2 Inkjet

- 6.1.3 Flexographic

- 6.1.4 Screen

- 6.1.5 Gravure

- 6.1.6 Other Printing Types

- 6.2 By Application

- 6.2.1 Packaging

- 6.2.2 Advertising

- 6.2.3 Publishing

- 6.2.3.1 Books

- 6.2.3.2 Magazines

- 6.2.3.3 Newspapers

- 6.2.3.4 Other Publishing

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ACME Printing

- 7.1.2 Cenveo Worldwide Limited

- 7.1.3 R.R. Donnelley & Sons Company

- 7.1.4 Vistaprint (CIMPRESS PLC)

- 7.1.5 Toppan Co. Ltd (Toppan Inc.)

- 7.1.6 Transcontinental Inc.

- 7.1.7 LSC Communications US LLC