|

市场调查报告书

商品编码

1434481

图形薄膜:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Graphic Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

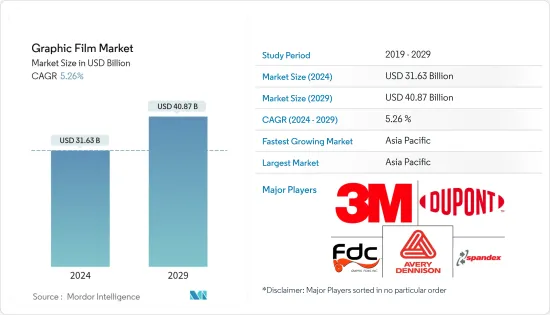

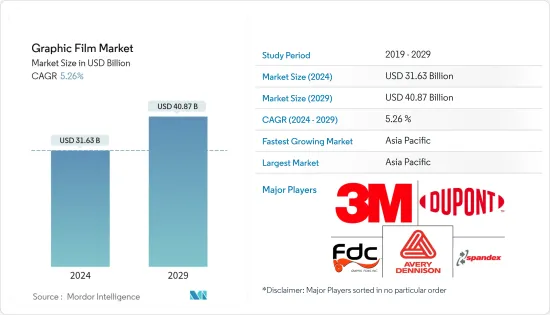

图形薄膜市场规模预计到 2024 年为 316.3 亿美元,预计到 2029 年将达到 408.7 亿美元,预测期内(2024-2029 年)复合年增长率为 5.26%。

COVID-19感染疾病对所研究市场的影响阻碍了预期的整体成长率。然而,应急策略和关键最终用户产业正在逐渐获得动力,长期需求预测显示销售额将大幅成长。随着需求稳步增长以及企业从疫情造成的损失中恢復过来,对受访市场的短期预测预计,汽车行业对图形薄膜包装的配套需求将呈线性增长。此外,根据印度评级和研究私人有限公司 (IND-RA) 的数据,2020 年塑胶薄膜的需求增加了近 9%,但预计到 2023 年将下降至 6-6.5%。

主要亮点

- 现有的几家市场公司生产穿孔窗膜,设计用于玻璃窗和门等平坦、透明的表面。这些薄膜通常具有穿过薄膜的连续孔图案,以提供从一侧可见的图形。

- 窗膜基本上是一种薄层压板,带有粘合剂内衬,可涂在窗户的内部或外部。它们几乎可以切割成任何设计,并应用于门窗,用于各种用途,从企业徽标印刷和行销到完全客製化的墙壁设计。窗膜不仅可以保护隐私和免受紫外线伤害,还有助于调节室内温度,例如公司工作空间。窗膜可以改装到现有窗户上,使其成为经济且快速的选择。

- 墙壁和窗户图形透过室内外设计改变消费者体验。一些办公室使用它来最大化公司品牌、促进新产品和销售、提高职场生产力和士气、娱乐和通知客户以及改善企业环境。我们正在引入图形薄膜。

- 随着大多数企业建筑正在使用这些产品重新设计其工作空间,室内墙饰在市场上越来越受欢迎。这些墙布使用各种图形薄膜将光滑的室内表面转变为艺术品。此外,市场相关人员正在利用这一利润丰厚的机会,提供可印刷薄膜、彩色胶片饰面和其他辅助产品,以提高整体收益。

- 图文膜也用作漆面保护膜,保护车辆外饰件,降低维修成本。已开发经济体和新兴经济体对用于车辆保护和广告的图形薄膜的需求不断增长,可能会加速汽车行业的图形薄膜成长。例如,总部位于美国的 Mactac 为想要在卡车、巴士、货车和其他车辆上宣传其产品和品牌的供应商推出了一种新型黏性车辆包装。

- 该公司表示,一种新的专有黏剂使包装更容易黏贴。这款易剥离黏合剂的背面是一层光亮的白色软质压延 PVC 薄膜,非常适合色彩再现,还有一层聚乙烯涂层衬里,可增加印刷过程中的稳定性。

图形膜市场趋势

汽车产业预计将大幅成长

- 在汽车产业,图形薄膜应用包括车辆包装、图形切割和切割。相比之下,在切割乙烯基时,车辆贴膜是一大张黏合乙烯基,本身没有特定的形状。这些包裹物覆盖了车辆的整个面板。出于保护、广告目的以及使车辆看起来更好的需要,汽车上大规模采用图形薄膜和包装材料。根据美国户外广告协会 (OAAA) 的数据,单一车辆包装每天可产生 30,000 到 80,000广告曝光率。此外,根据丰业银行的数据,全球汽车销售量从 2020 年的约 6,380 万辆增至 2021 年的约 6,670 万辆。

- 将图形薄膜贴在汽车上是比其他形式的广告更便宜的广告方式。根据美国户外广告协会的数据,车辆包装的成本为每 1,000 次广告曝光率(CPM) 0.15 美元。相比之下,广告看板每 PCM 的成本为 1.78 美元,广播每 CPM 的成本为 5.92 美元,Prime TV Spot 的每 CPM 的成本为 20.54 美元。因此,广告成本的降低将推动整个汽车产业研究市场的成长。

- 3M、Avery Dennison 和 Lintec 等许多公司正在创新并为市场上的主要汽车製造商供货。例如,Spandex推出了3M Wrap Film Series 2080,这是一种改进的变色车辆包裹材料。一旦应用,薄膜可以轻鬆去除,留下光滑的表面,并确保保护层上的刮痕不会转移到薄膜本身。

- 反光膜的进一步发展可提供额外的安全性、可见度和特殊效果标记,从而提高了相关车队的夜间能见度。因此,此类电影必须符合联邦道路安全准则。同样,反光带作为压感形式被引入市场,采用高品质微棱镜反光材料,增强夜间辨识能力。

- 就车窗贴膜和贴膜而言,它们本质上具有广泛的用途,从个人隐私/安全到车辆广告。例如,3M 汽车窗膜有多种色调可供选择,可限制 95% 的可见光,以确保乘客的隐私。该公司的 Obsidian 系列、FX-Hp 和陶瓷 IR 膜是其为汽车应用提供的一些窗膜。

亚太地区预计将占据最大市场占有率

- 汽车、工业和电子商务等终端用户行业对图形薄膜的需求不断增长,正在积极推动该地区的市场成长。预计中国将在亚太地区占据重要份额。这种成长可归因于先进的技术发展、高可支配收入、卓越的架构和汽车产业场景。

- 中国汽车工业快速发展,中国在全球汽车市场中扮演越来越重要的角色。政府认为汽车工业,包括汽车零件产业,是主导产业之一。

- 此外,中国政府预计2025年汽车产量将达3,500万辆。 IBEF预计,到2026年,印度汽车工业产值预计将达到2,514亿美元至2,828亿美元。因此,由于汽车工业的成长,该地区的市场范围不断扩大。此外,消费者对改变车辆颜色的兴趣日益浓厚,预计将推动该地区对汽车保鲜膜的需求。

- 中国广告业在过去几十年经历了快速发展。外国品牌和广告在当今中国人的生活中司空见惯。此外,中国企业迅速采用国际广告技术和做法,对国内广告市场产生了重大影响。

- 此外,印度是该地区成长最快的建筑市场之一,预计到 2030 年建筑业支出将达到约 13 兆美元。该国人口正在迅速增长,一次性住宅的增加正在创造对重大住宅计划的需求。收入和都市化。在预测期内,上述所有最终用户产业的成长预计将为市场创造机会。

图形胶片产业概述

图形薄膜市场分散,同时竞争激烈。市场主要企业采取的主要策略是产品创新、併购,以扩大影响力并维持市场竞争力。市场主要企业包括3M公司、EI杜邦公司、FDC Graphic Films Inc.、艾利丹尼森公司、Spandex AG等。

- 2021 年 2 月 - Schweitzer Mauduit International, Inc. 宣布计划收购英国Scapa Group Plc,这是一家面向医疗保健和工业市场的一流创新、设计和製造解决方案供应商。该公司透过提供用于建筑、运输、消费和工业终端市场的强大且盈利的工业图形薄膜胶带来补充其现有业务。

- 2021 年 1 月 - Drytac 推出全新 Polar Choice 系列单体 PVC 薄膜。其中包括 Polar Choice White 下的 6 种产品,包括 Gloss PB(一种永久灰色黏剂)、Matte RB(一种可移除灰色黏剂)和 Gloss P(一种永久透明黏剂)。 Polar Choice Clear 提供 Gloss P(永久透明黏剂)和 Gloss R(可移除透明黏剂),以及 Polar Choice Air White Gloss PB(永久灰色黏剂)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 建筑业的发展与生活水准的提高

- 包装广告的需求成长

- 市场限制因素

- 原物料价格波动

第 6 章 技术概览

- 薄膜类型

- 不透明薄膜

- 透明膜

- 半透明薄膜

- 反光膜

- 印刷技术

- 弹性凸版印刷

- 平版胶印

- 凹版印刷

- 数位的

第七章市场区隔

- 聚合物

- 聚丙烯(PP)

- 聚乙烯(PE)

- 聚氯乙烯(PVC)

- 其他聚合物

- 最终用户产业

- 车

- 促销/广告

- 公共公共设施

- 其他最终用户产业(航空业和电子商务)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第八章 竞争形势

- 公司简介

- 3M Company

- EI Du Pont De Nemours and Company

- FDC Graphic Films Inc.

- Avery Dennison Corporation

- Spandex AG

- Graphic Image Films Ltd

- Hexis SA

- Drytac Corporation

- Orafol Europe GMBH

- Arlon Graphics LLC(FLEXcon Company Inc.)

- Lintec Corporation

- LG Hausys

- Cosmos Films Ltd

- Taghleef Industries Inc.

- Ritrama SpA

- ACCO Brands Corporation

- Innovia Films(CCL Industries Inc.)

- Contravision

- Schweitzer-Mauduit International Inc.

- Ultraflex Systems Inc.

第九章投资分析

第10章市场的未来

The Graphic Film Market size is estimated at USD 31.63 billion in 2024, and is expected to reach USD 40.87 billion by 2029, growing at a CAGR of 5.26% during the forecast period (2024-2029).

The impact of the COVID-19 pandemic on the market studied is hindering the overall anticipated growth rates. However, with contingency strategies and major end-user industries gaining gradual momentum, the long-term demand forecast demonstrates a significant surge in sales. With demand steadily growing and companies recuperating from the losses incurred due to the pandemic, the ancillary demand for graphic film wraps used in the automobile sector is anticipated to rise linearly in the short-term forecast of the market studied. Furthermore, according to Indian Rating and Research Private Limited (IND-RA), the plastic film demand rose close to 9% in 2020 and is expected to fall to 6-6.5% by 2023.

Key Highlights

- Several market incumbents are manufacturing perforated window films that are designed for use on flat, transparent surfaces, such as glass windows or doors. These films are usually equipped with a continuous hole pattern perforated into the film to provide graphics visible from one side.

- Window film is essentially a thin laminate with an adhesive backing that is added to either the inside or outside of a window. It can be cut into almost any design and applied to windows or doors for various purposes - from printing corporate logos and marketing to designing fully customized walls. Window films offer privacy and protection against UV rays and even help manage thermoregulation of interiors, like corporate workspaces. Window films can be retrofitted to existing windows, which makes them an economical and speedy option.

- Wall and window graphics transform consumer experiences with interior and exterior designs. Several offices are incorporating graphic films to maximize their branding, promote new products and sales, improve workplace productivity and morale, entertain and inform customers, and enhance the corporate environment.

- Indoor wall wraps are gaining market traction, as most corporate buildings are redesigning their workspaces with these products. These wall wraps turn smooth indoor surfaces into artworks with a wide array of graphic films. Further, market players are capitalizing on this lucrative opportunity by offering printable films and finishes to colored films and other ancillary products, thus boosting their overall revenues.

- Graphic films are also used as paint protection films to protect the exterior components of vehicles for lowering the maintenance cost. The rising demand for graphic films to safeguard vehicles and for advertising in developed and developing economies may augment graphic films' growth in the automotive sector. For instance, US-based Mactac launched a new adhesive vehicle wrap for vendors looking to advertise their products and brands on trucks, buses, vans, and other vehicles.

- As per the company, the new proprietary adhesive enhances the ease of application of wraps. This easily-removable adhesive backs a gloss white soft calendered PVC film, which is highly suitable for color reproduction, and a poly-coated liner for stability during printing.

Graphic Film Market Trends

Automotive Sector is Expected to Witness Significant Growth

- In the automotive industry, graphic film applications include vehicle wraps, cut graphics, and cut deals. In contrast, to cut vinyl, vehicle wraps are large sheets of self-adhesive vinyl without a particular shape of their own. These wraps cover across entire panels of the vehicle. The large-scale adoption of graphic films or wraps in vehicles has been driven by the need for protective and advertisement purposes and to provide a better look at the vehicles. Also, per the Outdoor Advertising Association of America (OAAA), one vehicle wrap can generate between 30,000 and 80,000 impressions daily. Moreover, according to Scotiabank, worldwide car sales grew to around 66.7 million automobiles in 2021, up from approximately 63.8 million units in 2020.

- Putting graphic film wraps on an automobile is a cheaper means of advertising than other forms of advertisement. According to the Outdoor Advertising Association of America, the vehicle wraps cost USD 0.15 per cost of thousand impressions (CPM). In contrast, the billboards cost USD 1.78 per PCM, radios cost USD 5.92 per CPM, and prime TV spots cost USD 20.54 per CPM. Thus, the lower cost of advertisement drives the growth of the market studied across the automotive sector.

- Many companies, such as 3M, Avery Dennison, and Lintec, among others, are innovating and offering products to the major automotive players in the market. For instance, Spandex launched the 3M Wrap Film Series 2080, an improved color-change vehicle wrap material. The film can be easily removed after the application to reveal a smooth finish, and any scratch on the protective layer will not be transferred to the film itself.

- Further developments in the form of Reflective Films, which provide added safety or visibility and special effect markings, are enhancing the night visibility of the concerned fleet. Such films are therefore required to meet the federal guidelines for road safety. Likewise, Reflective Tapes as pressure-sensitive formats have been launched in the market featuring high-quality, micro-prismatic retroreflective materials for additional night-time recognition.

- As far as window tints or films are concerned, these basically serve a wide range of purposes, from personal privacy/security to fleet advertisements. For instance, 3M Automotive Window Films are available in different tint levels to restrict 95% of visible light for privacy among passengers. Its Obsidian Series, FX-Hp, and Ceramic IR Film are some of the window films offered for automotive applications.

Asia Pacific is Expected to Account for the Largest Market Share

- Growing demand for graphic films across the end-user industries, such as automotive, industrial, and e-commerce, is driving the market growth positively in the region. China is expected to hold a prominent share in Asia-Pacific. The increase may be attributed to high technological development, high disposable income, and good architecture and automotive industrial scenarios.

- The Chinese automotive industry has been growing rapidly, and the country plays an increasingly important role in the global automotive market. The government views its automotive industry, including the auto parts sector, as one of the prominent industries.

- Moreover, the Chinese government predicts that its automobile output may reach 35 million units by 2025. According to the IBEF, the Indian automotive industry is anticipated to reach USD 251.4-282.8 billion by 2026. Hence, growth in the automotive industry is expected to create scope for the market studied in the region. Moreover, rising interest in vehicle color change among consumers is anticipated to propel the demand for automotive wrap films in the region.

- The advertising industry in China has witnessed exponential development over the past few decades. Foreign brands and advertisements have become commonplace in the lives of the Chinese population today. Moreover, Chinese companies have been quick to adopt international advertising techniques and practices to create a huge impact on the domestic advertising market.

- Further, India is one of the fastest-growing construction markets in the region, and it is expected to spend around USD 13 trillion on the construction industry by 2030. The country's rapidly expanding population is generating significant housing project demand due to the increase in disposable income and urbanization. Over the forecast period, the growth of all the above end-user industries is expected to create opportunities for the market.

Graphic Film Industry Overview

The Graphic Film Market is fragmented and, at the same time, highly competitive. Key strategies that the major players in the market adopt are product innovation, mergers, and acquisitions to extend their reach and stay competitive in the market. Some of the key players in the market include 3M Company, E.I. Du Pont De Nemours and Company, FDC Graphic Films Inc., Avery Dennison Corporation, and Spandex AG, among others.

- February 2021 - Schweitzer-Mauduit International, Inc. announced its plans to acquire UK-based Scapa Group Plc, best-in-class innovation, design, & manufacturing solutions provider for healthcare & industrial markets. The company will bring a robust and profitable set of industrial, graphic film tapes used in construction, transportation, consumer, and industrial end-markets, complementing existing business.

- January 2021 - Drytac launched a new Polar Choice range of monomeric PVC films. It includes 6 products such as Gloss PB (permanent grey adhesive), Matte RB (removable grey adhesive), and Gloss P (permanent clear adhesive) under Polar Choice White. While under Polar Choice Clear, it offers Gloss P (permanent clear adhesive) and Gloss R (removable clear adhesive), and Polar Choice Air White Gloss PB (permanent grey adhesive).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in the Construction Industry and Improvements in the Standard of Living

- 5.1.2 Growth in Demand for Wrap Advertisement

- 5.2 Market Restraints

- 5.2.1 Fluctuations in Raw Material Prices

6 TECHNOLOGY SNAPSHOT

- 6.1 Film Type

- 6.1.1 Opaque Film

- 6.1.2 Transparent Film

- 6.1.3 Translucent Film

- 6.1.4 Reflective Film

- 6.2 Printing Technology

- 6.2.1 Flexography

- 6.2.2 Offset Lithography

- 6.2.3 Rotogravure

- 6.2.4 Digital

7 MARKET SEGMENTATION

- 7.1 Polymer

- 7.1.1 Polypropylene (PP)

- 7.1.2 Polyethylene (PE)

- 7.1.3 Polyvinyl Chloride (PVC)

- 7.1.4 Other Polymers

- 7.2 End-User Industry

- 7.2.1 Automotive

- 7.2.2 Promotional & Advertisement

- 7.2.3 Institutional

- 7.2.4 Other End-User Industries (Aircraft Industry and E-commerce)

- 7.3 Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia Pacific

- 7.3.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 3M Company

- 8.1.2 E.I. Du Pont De Nemours and Company

- 8.1.3 FDC Graphic Films Inc.

- 8.1.4 Avery Dennison Corporation

- 8.1.5 Spandex AG

- 8.1.6 Graphic Image Films Ltd

- 8.1.7 Hexis S.A.

- 8.1.8 Drytac Corporation

- 8.1.9 Orafol Europe GMBH

- 8.1.10 Arlon Graphics LLC (FLEXcon Company Inc.)

- 8.1.11 Lintec Corporation

- 8.1.12 LG Hausys

- 8.1.13 Cosmos Films Ltd

- 8.1.14 Taghleef Industries Inc.

- 8.1.15 Ritrama SpA

- 8.1.16 ACCO Brands Corporation

- 8.1.17 Innovia Films (CCL Industries Inc.)

- 8.1.18 Contravision

- 8.1.19 Schweitzer-Mauduit International Inc.

- 8.1.20 Ultraflex Systems Inc.