|

市场调查报告书

商品编码

1435898

汽车车载充电器 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Automotive On-board Charger - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

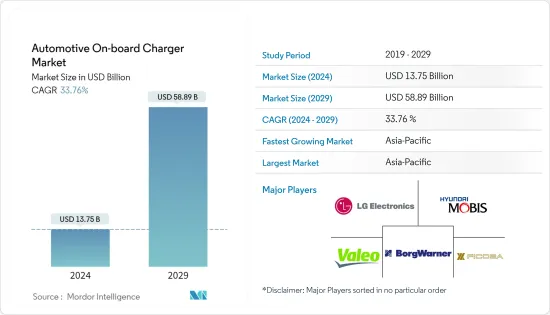

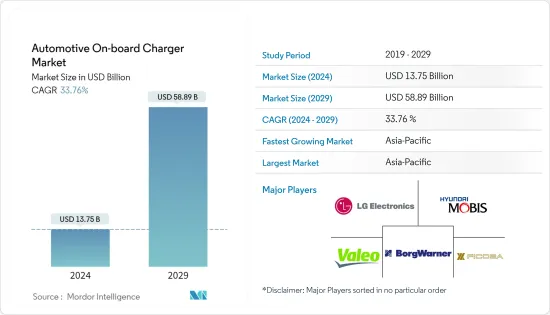

预计2024年汽车车载充电机市场规模为137.5亿美元,预估至2029年将达588.9亿美元,在预测期间(2024-2029年)CAGR为33.76%。

COVID-19 对车载充电器市场的影响是不可避免的,因为它影响了全球几乎所有其他产业。然而,由于纯电动车的采用率逐年迅速上升,电动车(EV)市场正在大幅成长。例如,儘管发生了疫情,中国和欧洲的电动车销量仍大幅成长,显示出预测期内市场活跃成长的迹象。

在中期预测期内,电动车的快速销售、严格的排放法规、电池技术的进步以及充电基础设施的改善预计将刺激对汽车车载充电器的需求。已开发国家市场已经见证了电动乘用车的适应,现在电动车产业的新创公司和主要参与者正计划在未来几年推出新的电动车型。

车载充电器是电动车的重要组成部分,它透过将交流电压转换为直流电压来为车辆电池充电。主要部件包括输入滤波器、功率因数校正器、DC/DC转换器以及能够与车辆上其他设备通讯的控制电路。

电动车电池续航里程正在迅速增加,现在市场上出现的续航里程可达 600 英里的车型。与乘用车相比,卡车和厢型车的车身尺寸更大;它们可以容纳更多电池以实现更远的续航里程。大型电动马达可以产生巨大的扭力来实现牵引和牵引能力。例如,Nikola 的 Badger 皮卡凭藉其燃料电池技术和电池,续航里程可达 600 英里。

中国是电动公车领域的领导者,其电动公车保有量占全球电动公车总数的98%以上。中国拥有超过42.5万辆电动公车。这种高采用率可归因于中国许多省份采用的强大的市政框架。中国已有30多个城市计画在2020年实现100%公共交通电气化,包括珠江三角洲的广州、珠海、东莞、佛山、中山,以及南京、杭州、陕西和山东。

考虑到这些发展,预计在预测期内对车载充电器的需求将保持在较高水准。

车用充电器市场趋势

乘用车引领车用充电机市场

电动乘用车正在全球逐步渗透,目前全球电动乘用车的渗透率达到9%,预计未来几年仍将维持成长轨迹。 2020年欧洲电动乘用车註册量激增,新增电动乘用车註册总量从3.5%大幅成长至11%,占新车註册总量的6%。

电动车在世界各地逐渐成长,因此,货物运输公司也将其现有车队转换为电力推进车辆。 OEM正在重新定义其电动车路线图。例如,

- 2022 年 5 月,Volvo AB 宣布其 2023 年美国产品线全部将是插电式混合动力车。除了 XC90 之外,Volvo还提供 XC60 SUV、S60 和 S90 轿车以及 V60 旅行车的插电式混合动力版本。

- 2022 年 3 月,现代汽车公布了加速其电气化雄心的战略路线图,计划在 2030 年推出 17 款新 BEV 车型;现代车型 11 款,Genesis 豪华品牌 6 款

- 2021 年 12 月,丰田汽车公司宣布了一系列纯电动车计划,推出 16 款新 BEV 车型。在 Mega 网路展示会上推出的 16 款新型纯电动车包括五辆丰田「bZ」(超越零)车辆,其中一辆 - bZ4X - 定于 2022 年在全球推出

许多已开发国家和发展中国家的政府都制定了绿色出行计划,其中禁止柴油汽车并向电动汽车购买者提供激励措施,例如,英国正计划禁止销售所有类型的汽油和柴油发动机汽车到2040 年,印度计划到2030 年禁止所有类型的柴油引擎汽车上路。另一方面,挪威遥遥领先,计划到2025 年使每辆新车都成为零排放汽车。乘用电动车销量的增加和充电器数量的增加最终将推动汽车车载充电机市场的成长

考虑到这些发展和因素,预计在预测期内乘用车领域对车载充电器的需求将保持乐观。

亚太地区可望引领汽车车用充电器市场

亚太地区是电动车产业的中心,原材料廉价、劳动力廉价、行业参与者众多、人口众多以及政府参与,预计将引领汽车车载充电机市场。

儘管由于Covid-19大流行导致半导体供应短缺导致全球汽车销量下滑,但随着越来越多的人选择更干净的汽车,中国的电动车销量去年增长了154%。 2021 年,电动车 (EV) 製造商在中国的销量总计 330 万辆,高于 2020 年的 130 万辆和 2019 年的 120 万辆。

自中国电动车(EV)产业诞生以来,包括激励措施在内的政府法规一直促进其发展。然而,鑑于电动车产业的巨大扩张,激励措施给政府带来了沉重的负担。因此,2022年1月,中国财政部宣布,今年中国将削减电动车补助30%,并在年底前取消所有补助。此类措施可能会阻碍市场成长。

印度政府采取了多项措施来促进印度电动车的製造和采用,以减少与国际公约有关的排放,并在快速城市化后发展电动车。在印度,2021 年电动车销量为3,29,190 辆,比上一年的1,22,607 辆增长了168%,其中印度乘用车电动汽车销量在2021 年增长了两倍,达到14,800 辆,并且仍然显示出增长的迹象。

中国汽车製造商的目标是提高其车队的效率,以在地区格局中产生共鸣。例如,2022年8月,中国汽车巨头比亚迪透过改进三款电动车阵容扩大了在欧洲的业务潜力。新设计的架构是围绕着刀片电池构建的,比亚迪称之为八合一电动动力总成。此动力总成架构主要包括整车控制单元、配电单元、电池管理系统、马达控制器、驱动马达、变速箱、DC-DC连接器和车用充电器,整体效率达89%。

考虑到这些发展,预计亚太地区在预测期内对车载充电器的需求将出现高速成长。

车用充电器产业概况

由于新兴新创公司和主要汽车电子製造商的存在,全球汽车车载充电器市场较为分散,有许多活跃参与者。该市场的一些主要参与者包括博格华纳公司、Ficosa 公司和 LG 电子等。一些电动车原始设备製造商自行生产车载充电器,例如比亚迪和特斯拉。随着市场上各种新型电动车型的进入,车载充电器公司正在透过与市场上的其他参与者建立策略联盟并推出新型汽车车载充电器来扩大其影响力。例如,博格华纳采用碳化硅技术,其交流额定功率范围为 7.4 千瓦 (kW)、11 kW 和 22 kW,而其车载充电器则提供 2.3 kW 至 3.6 kW 的 DC-DC 转换器额定功率。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场区隔(市场规模,价值十亿美元)

- 按车型分类

- 搭乘用车

- 商用车

- 按动力总成类型

- 纯电动车

- 插电式混合动力汽车

- 按额定功率类型

- 小于3.3千瓦

- 3.3-11千瓦

- 超过11千瓦

- 按地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太

- 印度

- 中国

- 日本

- 韩国

- 亚太其他地区

- 世界其他地区

- 巴西

- 墨西哥

- 阿拉伯聯合大公国

- 其他国家

- 北美洲

第 6 章:竞争格局

- 供应商市占率

- 公司简介

- BorgWarner Inc.

- Hyundai Mobis Co., Ltd

- LG Electronics

- Innoelectric AG

- Ficosa Corporation

- Valeo

- Delta Energy Systems

- Toyota Industries Corporation

- BrusaElektronik AG

- VisIC Technologies, Ltd

第 7 章:市场机会与未来趋势

The Automotive On-board Charger Market size is estimated at USD 13.75 billion in 2024, and is expected to reach USD 58.89 billion by 2029, growing at a CAGR of 33.76% during the forecast period (2024-2029).

The impact of COVID-19 on the onboard charger market was inevitable as it affected almost every other industry across the world. However, the electric vehicle (EVs) market is witnessing substantial growth owing to the swiftly escalating year-on-year adoption rate of battery electric vehicles. For instance, there was a dramatic rise in electric vehicle sales in China and Europe despite the pandemic, showing signs of active market growth during the forecast period.

Over the medium-run forecast period, rapid sales of electric vehicles, stringent emission regulations, advancements in battery technology, and improving charging infrastructure are expected to fuel the demand for automotive onboard chargers. The market is already witnessing the adaptation of electric passenger vehicles in developed countries, and now the new start-ups and major players in the EV industry are planning to introduce their new electric models in the coming years.

On-Board Charger is an important component in electric vehicles, It allows the charging of the vehicle's battery by converting AC voltage into DC. The main components include an input filter, power factor corrector, DC/ DC Converter, and a control circuit that enables communication with other devices on the vehicle.

EV battery range is increasing rapidly, now models are coming in the market with up to 600 miles of range. Trucks and van body sizes are bigger as compared to passenger cars; they can accommodate more batteries for a longer range. Big electric motors can create enormous amounts of torque for towing and hauling capacities. For instance, Nikola's Badger pickup truck has a range of 600 miles, due to its fuel cell technology in addition to batteries.

China is the leader in the EV race, its fleet of electric buses accounts for more than 98% of total electric buses running worldwide. China has a fleet of more than 425000 electric buses. This high adoption can be attributed to the strong municipal framework that many provinces in China have adopted. More than 30 Chinese cities had plans to achieve 100% electrified public transit by 2020, including Guangzhou, Zhuhai, Dongguan, Foshan, and Zhongshan in the Pearl River Delta, along with Nanjing, Hangzhou, Shaanxi, and Shandong.

Considering these developments, demand for on-board chargers is expected to remain high during the forecast period.

On Board Charger Market Trends

Passenger vehicles leading the on-board charger market

Electric Passenger cars is gradually penetrating on the global scale, as of now the penetration of electric passenger car stands on 9% globally which is expected to remain in the growth trajectory over the coming years. Europe has witnessed a surge in electric passenger car registration during the year 2020. A significant increase from 3.5% to 11% has been registered in the total new electric passenger car registration, accounting for 6% of total new car registration.

Electric mobility is gradually growing around the world, owing to which, the goods transportation companies are also converting their existing fleets into electric propulsion-based vehicles. OEM is redefining its roadmap for electric vehicles. For instance,

- In May 2022, Volvo AB announced that all its 2023 United States line-up will be plug-in hybrids. In addition to the XC90, Volvo offers plug-in hybrid versions of the XC60 SUV, S60 and S90 sedans, and V60 wagon.

- In March 2022 Hyundai unveiled a strategic roadmap to accelerate its electrification ambition under which it plans to introduce 17 new BEV models by 2030; 11 for Hyundai models and six for Genesis luxury brand

- In December 2021, Toyota Motor Corporation has announced a line-up of its battery electric vehicle plans, unveiling 16 new BEV models. The 16 new BEVs unveiled at the Mega web showcase included five Toyota 'bZ' (beyond Zero) vehicles, one of which - the bZ4X - is set for a global launch in 2022

Governments of many developed and developing countries have framed their plan for green mobility, in which they are banning diesel vehicles and providing incentives to the EV buyer, For instance, the United Kingdom is planning to ban sales of all types of gasoline and diesel engine cars by 2040, India is planning to ban all type of diesel-engine cars in the roads by 2030. On the other hand, Norway is way ahead of the curve, it plans to make every new car a zero-emission car by 2025. The increase in sales of passenger electric cars and an increase in the number of chargers will ultimately propel the growth of the automotive on-board charger market

Considering these developments and factors, demand for onboard charger is expected to remain positive in the passenger cars segment during the forecast period.

Asia-Pacific Is Expected to Lead the Automotive On-board Charger Market

Asia-Pacific is expected to lead the automotive on-board charger market as it is the hub of the electric vehicle industry owing to the availability of cheap raw materials, cheap manpower, presence of numerous numbers of industry players, large population, and government participation.

Despite a global downturn in auto sales due to a shortage of semiconductor supply caused by the Covid-19 pandemic, electric vehicle sales in China increased by 154 percent last year, as more people chose cleaner vehicles. Electric vehicle (EV) manufacturers sold a total of 3.3 million units in China in 2021, up from 1.3 million in 2020 and 1.2 million in 2019.

Government regulations that include incentives have aided the growth of China's electric vehicle (EV) sector since its inception. However, given the tremendous expansion of the EV sector, the incentives place a significant burden on the government. As a result, in January 2022, the country's Finance Ministry announced that China will reduce EV subsidies by 30% this year and abolish all subsidies by the end of the year. Such measures might hinder market growth.

The government of India has undertaken multiple initiatives to promote the manufacturing and adoption of electric vehicles in India to reduce emissions pertaining to international conventions and develop e-mobility in the wake of rapid urbanization. In India, 3,29,190 electric vehicles were sold in 2021, a 168 percent increase over the 1,22,607 units sold the previous year with passenger EV sales in India tripled in 2021 to 14,800 units and are still showing signs of growth.

Chinese automakers are aiming to bring higher efficiency under their offered fleet to resonate prominence in regional landscape. for instance, in August 2022, Chinese car giant BYD expanded its business potential in Europe with revamping line-up of three electric cars. The newly designed architecture has been built around blade battery which BYD calls as 8-in-1 electric powertrain. That power train architecture basically comprises vehicle control unit, power distribution unit, battery management system, motor controller, drive motor, transmission, DC-DC connector and on-board charger which takes the overall efficiency to 89%.

Considering these developments, demand for on-board charger is expected to witness high growth in the Asia-pacific during forecast period.

On Board Charger Industry Overview

The global automotive on-board charger market is fragmented, has several active players, owing to the presence of new startups and major automotive electronics manufacturers. Some of the major players in the market are BorgWarner Inc., Ficosa Corporation, and LG Electronics amongst others. Some of the electric vehicle OEMs manufacture onboard charger in-house such as BYD and Tesla. As the market is witnessing the entry of various new electric models the on-board charger companies are expanding their presence by forming strategic alliances with other players in the market and launching new automotive on-board chargers. For instance, BorgWarner uses silicon carbide technology and have a range of AC power ratings of 7.4 kilowatts (kW), 11 kW, and 22 kW whereas DC-to-DC converter rating from 2.3 kW to 3.6 kW are offered under its onboard charger.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicle

- 5.2 By Powertrain Type

- 5.2.1 BEV

- 5.2.2 PHEV

- 5.3 By Rated Power Type

- 5.3.1 Less than 3.3 kW

- 5.3.2 3.3-11 kW

- 5.3.3 More than 11 kW

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BorgWarner Inc.

- 6.2.2 Hyundai Mobis Co., Ltd

- 6.2.3 LG Electronics

- 6.2.4 Innoelectric AG

- 6.2.5 Ficosa Corporation

- 6.2.6 Valeo

- 6.2.7 Delta Energy Systems

- 6.2.8 Toyota Industries Corporation

- 6.2.9 BrusaElektronik AG

- 6.2.10 VisIC Technologies, Ltd