|

市场调查报告书

商品编码

1435978

订阅申请管理:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Subscription Billing Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

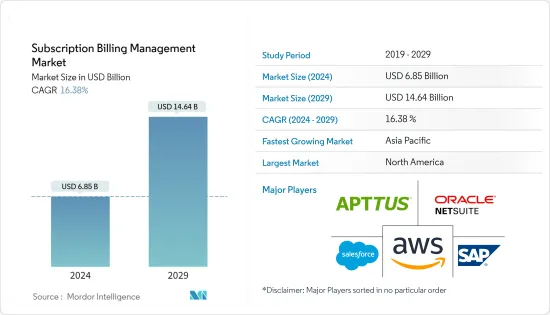

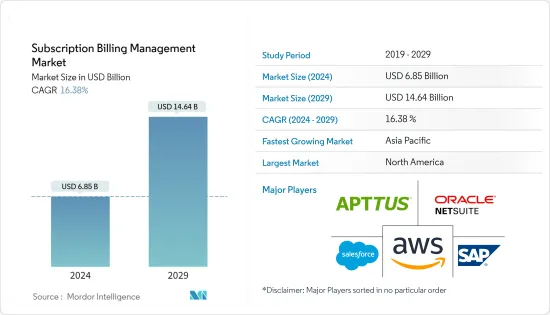

订阅申请管理市场规模预计到 2024 年为 68.5 亿美元,预计到 2029 年将达到 146.4 亿美元,在预测期内(2024-2029 年)增长 16.38%。复合年增长率为

数位化的日益普及和对弹性的需求正在催生各个领域的基于订阅的业务。许多公司越来越多地采用基于订阅的模式,从而提高了客户维繫率。

主要亮点

- 发展庞大的客户群需要申请流程的自动化和统一。此外,公司正在加大努力,透过改善客户体验来最大限度地客户维繫。因此,预计在预测期内会有更多产业采用订阅申请管理系统。

- 基于软体的订阅申请解决方案在企业中越来越受欢迎,因为它们可以最大限度地减少营运费用、简化收益方法并减少申请错误。该解决方案透过结合人工智慧、机器学习和云端运算等多种技术,实现申请和申请流程的自动化。这些可以帮助企业获得改善客户体验和提高客户维繫所需的关键客户洞察。

- 从製造业到金融机构,订阅主导的经营模式在各个领域的使用越来越多,预计将进一步推动市场接受度。

- 由于各行业订阅服务的采用率不同,预计 COVID-19感染疾病对市场扩张的影响很小,但最终证明它对这些市场有利,同时具有颠覆性和破坏性。

订阅申请管理市场的趋势

预计将在媒体和娱乐产业中广泛采用

- 媒体和娱乐产业不断开发新技术和创新方式来製作和分发基于订阅的数位材料,是正在经历快速数位转型的行业的典型例子。广告商、出版商、广播公司和其他机构正在实施订阅制的收入模式,以满足快速成长的需求。

- 媒体和娱乐市场的很大一部分正在转向基于订阅的优惠,企业需要能够根据需要更改促销和折扣,以保持客户附加元件添加附加服务或升级订阅的兴趣。

- 因此,为了将收益流程统一为一种简化的以客户为中心的体验,并获得对整个报价到现金流程的前所未有的洞察力,广播平台、媒体公司和广告公司正在寻求管理订阅申请。我们正在快速部署解决方案。

- 随着人们被迫待在家里,OTT 视讯串流、数位学习、数位新闻和媒体以及通讯软体订阅服务正在加速该行业的扩张。

- 媒体产业包括电子杂誌、电子报纸、日誌、电视、广播、播客、游戏、网站和用于观看影片内容的应用程式。而且,这些公司只有一种固定费率方案。除了选择不同的申请结构之外,价格和结构也会随着时间的推移而改变。订阅申请管理可让您测试申请模型并支援大量货币。

预计北美将主导市场

- 由于 SAP、Salesforce、Oracle、Amazon Web Services、Apttus 和 Recurly 等众多重要行业参与者的存在,北美预计将引领订阅申请管理市场。

- 政府法规、提高客户维繫和减少用户流失的愿望以及其他因素是订阅申请管理市场成长的主要驱动力。

- 随着美国大型组织和小型企业越来越多地使用行动装置和云端基础的解决方案,订阅流程的自动化透过 BYOD 和云端基础的服务迅速普及,推动了该区域市场的成长。我们正在推动。

- 此外,组织正在寻求开发灵活的业务流程并使用有效的申请策略来节省资本成本。无纸化申请可以帮助企业节省纸张、列印和运输成本。透过改善全部区域的财务管理,客户可以更好地组织付款时间表和预算,并避免无意义的逾期罚款。

订阅申请管理产业概述

由于全球范围申请在多个市场参与者,为基于订阅的企业提供创新的申请和申请解决方案,因此订阅计费市场的竞争形势呈现碎片化。此外,新兴企业和老牌公司越来越多地筹集资金来增强和改进其产品,以获得最大的市场吸引力。

- 2023 年 1 月 - Salesforce 宣布了商务创新,使各行业的组织能够简化业务、最大化收益并提高忠诚度。 Salesforce 平台上的这些新的商务创新使製造、医疗保健、技术和消费品等行业的公司能够利用自动化和统一客户资料的力量来嵌入个性化商务。我可以。

- 2022 年 12 月,Amazon Web Services Inc. 与 Slalom LLC (Slalom) 宣布达成策略伙伴协议 (SCA)。两家公司预计将为能源、金融服务、生命科学、公共部门以及媒体和娱乐领域的客户创建基于 AWS 的垂直解决方案和加速器。它还有望提供特定于客户的端到端云端迁移和现代化服务,以加速他们向云端的迁移。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19感染疾病对市场的影响

第五章市场动态

- 市场驱动因素

- 订阅业务的成长

- 专注于减少用户解约率并提高客户维繫

- 随着客户规模的增加,需要减少复杂的收益模型并减少申请错误

- 市场限制因素

- 资料和隐私问题

第六章市场区隔

- 部署方式

- 本地

- 在云端

- 组织规模

- 中小企业

- 大公司

- 最终用户产业

- 零售与电子商务

- BFSI

- 资讯科技和电信

- 媒体和娱乐

- 公共部门和公共产业

- 其他最终用户产业(运输和物流、教育机构)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Salesforce.com Inc.

- SAP SE

- Oracle Corporation(Netsuite)

- Apttus Corporation

- Amazon Web Services Inc.

- Recurly Inc.

- Zoho Corporation Pvt. Ltd

- Zuora Inc.

- Chargebee Inc.

- 2Checkout.com Inc.

- Chargify LLC

- Invoicera

- Stripe Inc.

- Muvi LLC

- Billingplatform.com

第八章投资分析

第九章市场机会与未来趋势

The Subscription Billing Management Market size is estimated at USD 6.85 billion in 2024, and is expected to reach USD 14.64 billion by 2029, growing at a CAGR of 16.38% during the forecast period (2024-2029).

The increasing adoption of digitization and demand for flexibility have given rise to subscription-based businesses across sectors. Numerous businesses' rising adoption of subscription-based models leads to improved customer retention rates.

Key Highlights

- The expansion of the large customer base necessitates the automation and uniformity of the subscription billing procedure. In addition, businesses are putting more effort into maximizing client retention through an improved customer experience. Thus, more industries are anticipated to embrace subscription billing management systems during the projection period.

- Software-based subscription billing solutions are becoming increasingly popular among businesses since they minimize operating expenses, simplify monetization methods, and lessen billing errors. The solutions automate the invoicing and billing process by incorporating numerous technologies, including artificial intelligence, machine learning, and cloud computing. They assist businesses in gaining crucial client insights that are necessary for enhancing the customer experience and boosting customer retention.

- Market acceptance is anticipated to be boosted by the growing use of subscription-driven business models across various sectors, from manufacturing to financial institutions.

- Although the COVID-19 pandemic was predicted to have a minimal impact on market expansion due to the varying rates at which different industries adopted subscription services, it ended up being both beneficial and disruptive to those markets.

Subscription Billing Management Market Trends

Media and Entertainment Industry Expected to Exhibit Significant Adoption

- The media and entertainment sector, which constantly develops new technology and creative methods to produce and deliver subscription-based digital material, is a prime example of an industry undergoing a rapid digital transition. Advertisers, publishers, broadcasters, and others are implementing the subscription-based income model to keep up with the rapidly expanding demand.

- The majority of the media and entertainment market is transitioning to subscription-based offers, and businesses need to be able to change their promotions and discounts as needed to keep customers interested in adding add-ons or subscription upgrades.

- So, in order to integrate revenue processes into one simplified customer-focused experience and gain unprecedented insight into the entire quote-to-cash process, broadcast platforms, media businesses, and advertising firms are introducing subscription billing management solutions quickly.

- The expansion of the industry is being accelerated by subscription services, including OTT video streaming, e-learning, digital news and media, and communications software, as the population is being compelled to stay at home.

- The media industry encompasses e-magazines, e-papers, journals, TV, radio, podcasts, gaming, websites, and apps for watching video content. Furthermore, these companies employ only one fixed billing plan. In addition to choosing different billing structures, they also improvise prices and structural changes throughout time. Subscription Billing management enables the testing of billing models and supports numerous currencies.

North America Expected to Dominate the Market

- Due to the presence of numerous significant industry participants, including SAP, Salesforce, Oracle, Amazon Web Services, Apttus, Recurly, and many more, North America is predicted to lead the subscription billing management market.

- Government regulations, the desire to increase customer retention and decrease subscriber churn, and other factors are the main drivers of the growth of the subscription and billing management market.

- The rapid adoption of automation of the subscription process has been made possible by BYOD and cloud-based services, and the US's growing use of mobile devices and cloud-based solutions by large organizations and SMEs is what is driving the growth of the regional market.

- Furthermore, organizations are considering using effective billing strategies to develop flexible business procedures and save capital costs. Due to paperless billing methods, businesses are saving money on paper, printing, and shipping. Improving financial management across the region assists clients in better organizing their payment schedules and budgets and avoiding pointless late penalties.

Subscription Billing Management Industry Overview

The competitive landscape of the subscription billing market is fragmented due to the presence of several market players globally offering innovative billing and invoicing solutions for subscription-based businesses. Furthermore, new and emerging, and existing companies are increasingly raising funds to enhance and improve their offerings to gain maximum market traction.

- January 2023 - Salesforce unveiled Commerce Innovations to Help Organizations Across Industries Streamline Operations, Maximize Revenue, and Drive Loyalty. With these new commerce innovations on the Salesforce platform, companies across industries as diverse as manufacturing, healthcare, tech, and consumer goods can harness the power of automation and unified customer data to embed personalized commerce.

- In December 2022, Amazon Web Services Inc. and Slalom LLC (Slalom) announced a Strategic Partnership Agreement (SCA). The two businesses were expected to create AWS-based vertical solutions and accelerators for clients in the energy, financial services, life sciences, public sector, and media and entertainment sectors. They were also expected to provide clients with specialized end-to-end cloud migration and modernization services to hasten their cloud migrations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Subscription Based Businesses

- 5.1.2 Increasing Focus of Businesses on Increasing Customer Retention by Reducing the Subscriber Churn Rate

- 5.1.3 The Need for Reduction in Complex Monetization Models and Reducing Billing Errors Due to the Increase in Size of Customers

- 5.2 Market Restraints

- 5.2.1 Data and Privacy Concerns

6 MARKET SEGMENTATION

- 6.1 Deployment Mode

- 6.1.1 On-Premise

- 6.1.2 On-Cloud

- 6.2 Size of the Organization

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 End-user Industry

- 6.3.1 Retail and E-commerce

- 6.3.2 BFSI

- 6.3.3 IT and Telecom

- 6.3.4 Media and Entertainment

- 6.3.5 Public Sector and Utilities

- 6.3.6 Other End-user Industries (Transportation and Logistics, Educational Institutions)

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Salesforce.com Inc.

- 7.1.2 SAP SE

- 7.1.3 Oracle Corporation (Netsuite)

- 7.1.4 Apttus Corporation

- 7.1.5 Amazon Web Services Inc.

- 7.1.6 Recurly Inc.

- 7.1.7 Zoho Corporation Pvt. Ltd

- 7.1.8 Zuora Inc.

- 7.1.9 Chargebee Inc.

- 7.1.10 2Checkout.com Inc.

- 7.1.11 Chargify LLC

- 7.1.12 Invoicera

- 7.1.13 Stripe Inc.

- 7.1.14 Muvi LLC

- 7.1.15 Billingplatform.com