|

市场调查报告书

商品编码

1436133

智慧冰箱:全球市场占有率分析、产业趋势与统计、成长预测(2024-2029)Global Smart Refrigerator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

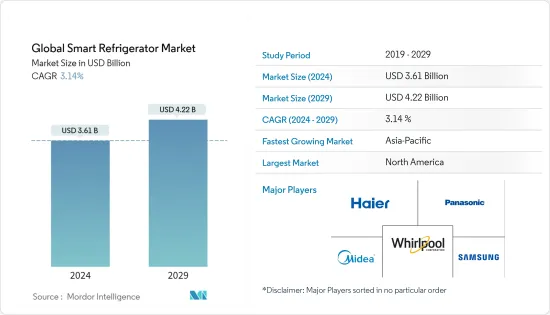

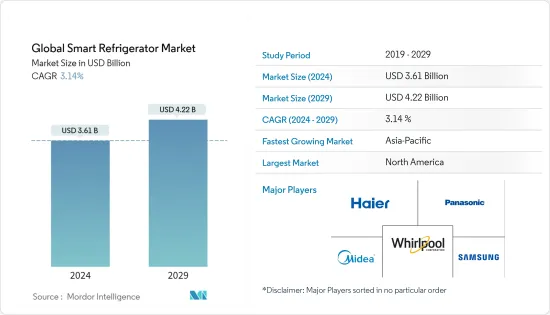

预计2024年全球智慧冰箱市场规模为36.1亿美元,预计到2029年将达到42.2亿美元,在预测期内(2024-2029年)成长3.14%,复合年增长率为

物联网 (IoT) 的日益普及和快速都市化正在推动全球智慧连网型冰箱产业的成长。此外,人们可支配收入的增加和智慧连网型冰箱效率的提高(例如功耗的降低)预计将推动市场成长。智慧冰箱提供与搜寻引擎、智慧扬声器和其他智慧技术的连接,以提高用户的便利性和效率并支持市场趋势。在可支配收入增加的支持下,消费者生活方式的改变以及转向购买先进的智慧家庭产品预计将推动市场需求。新兴国家智慧家电的普及和消费者知识的增加将推动产品需求。此外,新住宅的建筑发展以及对支持美观的智慧产品的需求正在改变市场前景。

智慧冰箱的成长主要是由于企业恢復营运并适应新常态,同时从 COVID-19 的影响中恢復,其中包括社交距离、远端工作和商业设施。限制性遏制措施已经到位,包括关闭造成营运挑战的活动。

随着全球经济(主要是已开发国家)持续都市化,对物联网和智慧型设备的需求不断增加。在印度等国家,工作人口超过了受扶养人口。这将使抚养比降低到50%以下,并增加可支配收入,最终提振智慧冰箱市场。

智慧冰箱市场趋势

对节能冰箱的需求不断增长推动市场发展

智慧冰箱製造商正竞相开发使用更少能源的型号,以减少碳排放并帮助消费者节省能源费用。节能家电的兴起可以追溯到政府对家电的监管和家电的进步。节能电器旨在使用尽可能少的能源来运作。 80多个国家已经颁布了节能家用电器的法规和标籤。

食品零售商正在寻求降低公用事业成本,每一点节省都很重要。价格竞争的加剧意味着营运成本对竞争力和盈利有直接影响。对大多数超级市场来说,除了人事费用之外,能源是最大的负担。在食品零售业,大部分能源都消耗在冷冻上,因此 AKVP电动膨胀阀和高端箱体控制器等高效能新型组件通常是一项不错的投资。

引进物联网智慧家电,智慧家电产业正在重构。近年来,智慧冰箱经历了许多改进,使其永续性。

从零售额来看,2022年亚洲将拥有最大的冰箱电器零售额,其次是北美和欧洲。

亚太地区引领市场

由于智慧连网型冰箱因其相容性和易用性而日益普及,预计亚太地区的市场将在预测期内以最快的速度扩张。此外,都市化的加速和中阶人口的成长也推动了市场扩张。该地区重要市场参与企业的存在也有助于支持创新产品的开发,以扩大客户群。该地区的产品需求预计将受到中国和印度等新兴经济体互联网普及不断提高和技术进步的推动。印度的平均物普及为个位数,而全球平均普及为两位数。这为智慧冷冻产业在亚太地区不断增长的经济体中蓬勃发展创造了巨大的机会。

亚太地区拥有对价格最敏感的客户,企业应利用黑色星期五特价、假期销售和额外线上销售等促销手段来增加智慧冰箱的销售。

智慧冰箱产业概况

这个市场是分散的,许多公司都在争取少数股权。公司正致力于透过产品创新来扩大产品线,以满足不断增长的需求,特别是在发展中经济体。智慧冰箱市场的主要企业包括三星、LG电子、惠而浦公司、海尔集团、罗伯特博世有限公司、西门子公司、通用电气电器、伊莱克斯公司和松下公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 市场限制因素

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 洞察市场创新

- COVID-19 对市场的影响

第五章市场区隔

- 按类型

- 法式门

- 并排门

- 三门

- 双门

- 单门

- 按最终用户

- 住宅

- 商业的

- 按地区

- 北美洲

- 南美洲

- 欧洲

- 亚太地区

- 中东和非洲

第六章 竞争形势

- 市场集中度概况

- 公司简介

- Whirlpool

- Samsung

- Haier

- Electrolux

- LG

- Panasonic

- Robert Bosch GmbH

- Siemens AG

- General Electric Co.

- Midea

第七章市场机会与未来趋势

第 8 章 免责声明与出版商讯息

The Global Smart Refrigerator Market size is estimated at USD 3.61 billion in 2024, and is expected to reach USD 4.22 billion by 2029, growing at a CAGR of 3.14% during the forecast period (2024-2029).

An increase in the use of the Internet of Things (IoT) and rapid urbanization drive the growth of the global smart connected refrigerator industry. Moreover, the rise in disposable income of people and the increase in efficiency of smart connected refrigerators, such as the use of less electricity, were expected to boost market growth. The smart refrigerator offers connectivity with search engines, smart speakers, and other smart technologies, providing enhanced convenience and efficiency to the users and supporting market trends. The changing consumer lifestyles and shift toward purchasing advanced smart home products, supported by increased disposable income, will boost market demand. The easy availability of intelligent appliances and the growing knowledge of consumers in developing countries will support product demand. Moreover, the architectural developments in new residences and the need for intelligent products to support aesthetics are transforming the market outlook.

The growth in Smart Refrigerator Machines is mainly due to the companies resuming their operations and adapting to the new normal while recovering from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges.

With growing urbanization in the world economy, mostly in developed countries, there is an increasing demand for IoT (the Internet of Things) and smart devices. Countries like India, where the working population has grown larger than the dependent population. This reduces the dependency rate to less than 50% and increases disposable income, which ultimately boosts the smart refrigerator market.

Smart Refrigerator Market Trends

Rising Demand For Energy Efficient Refrigerators Driving the Market

Smart refrigerator makers are working quickly to make models that use less energy so they can reduce their carbon footprint and save consumers money on their energy bills.The rise of energy-efficient appliances can be traced to both government rules about electric home appliances and advances in technology.Energy-efficient appliances are made to do their job with the least amount of energy possible.Over 80 countries already have energy-efficient appliance regulations and labeling.

As food retailers look to reduce energy bills, every incremental savings counts. Increasing price competition means operating costs have an immediate impact on competitiveness and profitability-and, after staff, energy is the biggest bill most supermarkets have. In food retail, most of that energy is spent on refrigeration, so efficient new components, like the AKVP electric expansion valve and high-end case controllers, are usually a good investment.

The introduction of smart appliances that utilize IoT is reshaping the smart appliance industry.In the past few years, there have been a number of improvements to smart refrigerators, which have made them better at being sustainable.

In terms of retail value, Asia had the largest retail value of refrigerator appliances in 2022, followed by North America and Europe.

Asia Pacific Region Driving The Market

The Asia-Pacific market is expected to expand at the fastest rate over the forecast period, as smart connected refrigerator machines have gained popularity owing to their compatibility and user-friendliness features. Furthermore, the market expansion is fueled by rising urbanization and an expanding middle-class population. The presence of important market participants in the region also helps to support the development of innovative products to expand the customer base. Product demand in this region is expected to be fueled by rising internet penetration and technological improvements in developing economies such as China and India. In India, the average rate of IoT penetration is in the single digits, whereas the global average rate is in the double digits. This creates a huge opportunity for the smart refrigerator machine industry to flourish in Asia Pacific's growing economies.

The Asia-Pacific region has the most price-sensitive customers, forcing companies to use promotional techniques like Black Friday specials, holiday sales, and additional online deals to boost sales of smart refrigerators.

Smart Refrigerator Industry Overview

This market has many companies fragmented over minor shares. Companies are focusing on expanding their product lines through product innovation, particularly in developing economies, to meet the rising demand. Some of the major players in the smart refrigerator market are Samsung, LG Electronics, Whirlpool Corporation, Haier Group, Robert Bosch GmbH, Siemens AG, GE Appliances, AB Electrolux, Panasonic Corporation, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights of Technology Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 French Doors

- 5.1.2 Side-by-Side Doors

- 5.1.3 Triple Doors

- 5.1.4 Double Doors

- 5.1.5 Single Door

- 5.2 By End-Users

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 South America

- 5.3.3 Europe

- 5.3.4 Asia Pasific

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Whirlpool

- 6.2.2 Samsung

- 6.2.3 Haier

- 6.2.4 Electrolux

- 6.2.5 LG

- 6.2.6 Panasonic

- 6.2.7 Robert Bosch GmbH

- 6.2.8 Siemens AG

- 6.2.9 General Electric Co.

- 6.2.10 Midea*