|

市场调查报告书

商品编码

1437483

元宇宙:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Metaverse - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

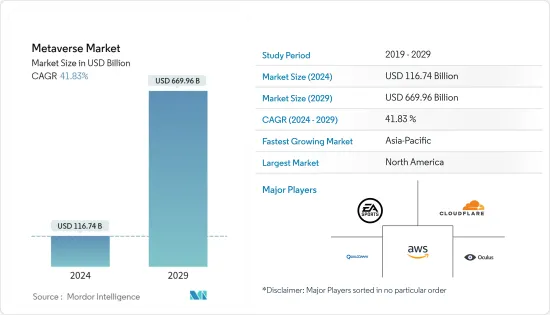

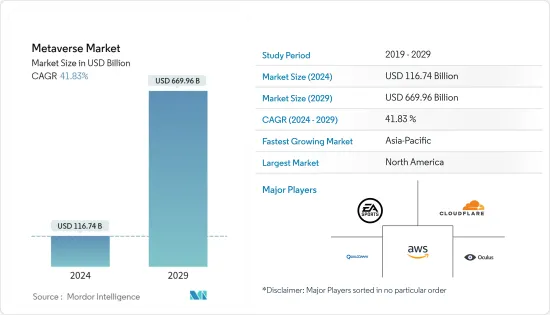

预计2024年元宇宙市场规模为1,167.4亿美元,预估至2029年将达6,699.6亿美元,预测期(2024-2029年)复合年增长率为41.83%。

推动元宇宙市场全球成长的主要原因是全球媒体、娱乐和游戏产业的需求,这主要是由于扩增实境(AR)、虚拟实境(VR)和混合实境( VR)的使用不断增加( MR).是增加。技术。采用这些技术的一个重要原因是VR头戴装置、MR耳机、HUD、HMD、智慧眼镜和智慧头盔等小工具提供了第一人称观点,充当自然的使用者介面并提供6个自由度。可以提供学位。等,创建逼真的虚拟场景,改善最终用户的整体游戏体验。

主要亮点

- 小型、中型、大型企业和个人对先进虚拟实境设备的需求不断增加,市场也不断扩大。此外,对零售和电子商务的投资增加以及在虚拟环境中展示产品的平台的增加使用正在支持该行业的扩张。

- 例如,Decentraland 是元宇宙,于 2022 年 2 月透过替代代币竞标和市场筹集了 120 万美元。普华永道香港公司还斥资 10,000 美元购买了 Sandbox 中的 LAND。

- 此外,由于区块链、混合实境和人工智慧(AI)等各种应用中越来越多地使用先进技术,该市场也在不断增长。元宇宙产业极大受益于混合实境(MR)、扩增实境、人工智慧(AI)和区块链等新技术的使用。 Roblox、Facebook、Oculus、Epic Games、微软、Google、USM 和 NVidia 等公司已经实施或正在实施元宇宙 XR/扩增实境系统和其他新技术。

- 此外,透过元宇宙门户,加密货币经常用于支付从虚拟鞋子到 NFT(不可替代代币)等各种商品。根据 CNBC 的一项调查,十分之一的人投资了虚拟,加密货币通常用于交易各种产品,包括虚拟。加密虚拟交易所的全球可近性使投资者能够利用该资产直接向元宇宙上的客户提供产品,从而改变对他们有利的市场格局。

- 然而,由于许多用户不知道可用的服务和安全替代方案,元宇宙市场的扩张可能会受到限制。同时,针对腾讯控股和Globant等主要企业的网路攻击引发了严重的安全和保密问题。根据2022年SonicWall网路威胁报告资料,2022年上半年发生了28亿次恶意软体攻击,比2021年增加了11%。

- COVID-19感染疾病大大增加了人们对元宇宙概念的兴趣。随着越来越多的人在家工作或在线上上课,需要实用的方法和管道来使线上接触更加真实。这场流行病凸显了其对消费者和企业的重要性。科技公司于 2020 年开始研究这项技术并宣布投资。 2021 年是元宇宙技术投资成功的一年,元宇宙投资额达 10 亿美元。

元宇宙市场趋势

游戏产业占最大市场占有率

- 全球 VR 和 AR 游戏玩家大幅增加,市场视野不断拓宽。机器学习、人工智慧、巨量资料分析和 AR/VR 解决方案提供商 NewGenApps 预测,到 2025 年,全球将有 2.16 亿人玩 VR 和 AR 游戏,市场价值达 116 亿美元。预测。

- 此外,显示 VR 技术在游戏领域前景光明的关键因素是客户在 VR 通话和 VR 游戏等场景使用中的舒适度不断提高。根据娱乐软体协会的统计数据,大约有 2.27 亿美国人每週玩电子游戏,其中包括三分之二的成年人和四分之三的 18 岁以下儿童。事实确实如此。电子游戏玩家的平均年龄为31岁,其中55%的男性年龄为45岁。女性参与的百分比。

- 2022年2月,SONY发表了适用于PlayStation 5的VR2和VR2 Sense控制器,为客户提供高品质的虚拟实境体验,让使用者沉浸在游戏世界中,获得丰富的体验。 VR2 增加了更高的视觉保真度并改进了追踪器。

- 此外,Virtex 还宣布打算在 2021 年 7 月推出“Virtex Stadium”,这是一个虚拟实境体育场,球迷可以在球场中央与朋友一起观看比赛。这一推出恰逢电子竞技的日益普及以及消费者 VR 硬体的性能和可访问性的改进。 VentureBeat资料显示,2021 年全球电竞收视人数为 4.74 亿,预计到 2024 年将成长至 5.772 亿。

- 游戏世界正在迅速变化。世界各地的众多游戏开发商正在为 2022 年特定 VR/AR 平台开发各种未来游戏计划。根据游戏开发者大会 2022 年的一项调查,全球 27% 的参与游戏开发者表示他们正在为 Oculus Quest 开发一款游戏。虚拟实境耳机。

北美占据主要市场占有率

- 预计北美地区将是元宇宙解决方案的最大采用率。其主要原因是北美用户和消费者正在以非常快的速度采用新的和复杂的技术。美国人越来越多地透过 VR、MR、AR 和其他新技术尽可能真实地存取和体验元宇宙。美国人也重视元宇宙的体验,并愿意花钱购买能让他们更能体验虚拟世界的小工具。人们对能够改善用户体验的设备日益增长的需求正在推动市场扩张。

- 企业和个人增加对这些先进技术和数位解决方案的投资在整体市场扩张中发挥着至关重要的作用。此外,由于技术的发展和进步,北美在创造用于显示设备的先进技术方面领先于所有其他市场。例如,Unity Simulation Pro 于 2021 年 11 月推出。这使得开发人员能够充分发挥可扩展模拟的潜力。它是唯一从头开始开发的支援分散式渲染的产品,允许多个图形处理单元 (GPU) 在本地或私有云端中同时渲染相同计划。

- 由于AR技术在消费性设备中的广泛应用,北美元宇宙市场正在不断扩大。此外,该地区正在将元宇宙技术应用于医疗保健、消费品、航太和国防以及教育和培训等业务应用。 PTC、Magic Leap、微软和谷歌只是美国提供 AR 设备和解决方案的几家国际公司。此外,推动北美元宇宙市场扩张的主要原因是企业越来越多地接受元宇宙技术以现代方式销售其产品。

- 此外,2021 年 12 月,Meta 推出了名为「Spark AR Go」的简化 AR 创建工具的封闭式版。 Meta 宣布将分发其「Spark 扩增实境 (AR) Go」行动软体作为 iOS 和 Android 智慧型手机的测试版。 Meta 创建了一款与 Spark AR Studio 软体开发套件(SDK) 配合使用的智慧型手机应用程式。这个强大的工具可以在 Facebook 和 Instagram 等社群媒体网站上实现 WebAR 效果和 3D 内容。借助“Spark AR Go”,AR内容创作者可以在Meta的社交媒体平台上创建、测试和发布身临其境型体验,监控用户性能指标并获取用户反馈。

- 预计推动该地区市场收益成长的另一个因素是越来越多的Start-Ups专注于创建用于该地区商业化的元宇宙平台。该地区游戏和元宇宙公司高度集中,如The Sandbox、Nvidia Corporation、Epic Games, Inc.等,主要致力于将元宇宙融入游戏中,创造市场开拓潜力。例如,Nvidia 公司已宣布与 Blender 和 Adobe 建立合作伙伴关係。这将使世界上第一个协作和模拟平台 NVIDIA Omniverse 能够覆盖数百万更多用户。

元宇宙产业概况

元宇宙市场适度整合。市场上成熟的供应商包括 Qualcomm Technologies Inc.、AWS、Cloudflare 等。这些公司从事各种产品开发、併购、收购、策略合作伙伴关係等,推出新产品,以维持市场竞争力。

- 2022 年 2 月 - Electronic Arts Company 发布 GRID Legends,以促进流畅的动作、组织理想的多人游戏会话并与其他赛车手一起构建故事。这使得用户可以浏览符合自己喜好的实况活动、即时参与活动、使用 Race Creator 开放设计竞赛,并为用户的聚会创建私人大厅。

- 2022 年 1 月 - 微软透露已收购动视暴雪公司。微软相信,此次收购将推动元宇宙产业的发展,并加速微软游戏业务在行动、PC、云端和主机平台上的成长。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业生态系统分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19感染疾病对元宇宙市场的影响

第五章市场动态

- 市场驱动因素

- 游戏和社群媒体平台融合等有利趋势

- 硬体和网路技术进步

- 市场限制因素

- 审核、隐私、可近性和监管挑战

- 元宇宙主要经营模式分析

- NFT 在促进游戏和基于事件的模型中的所有权方面的作用(Play-to-Earn 和 Collect)

第六章市场区隔

- 按类型

- AR 和 VR 硬体

- 社群媒体参与(广告)

- 虚拟现场娱乐 - Epic Games 和 Roblox

- 游戏服务

- 按最终用户产业

- 游戏

- 媒体和娱乐

- 商业的

- 零售

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争形势

- 公司简介 -元宇宙体验解决方案

- Fortnite

- EA Sports

- Hologate

- 公司简介 -元宇宙基础设施

- AWS

- Qualcomm

- Cloudflare

- 公司简介 - Metaverse 最终用户设备

- Oculus

- Vive

- Vuzix

- 公司简介 -元宇宙创经济

- Epic

- Roblox

- Polystream

- 公司简介 - 元界发现平台

- Unity

- Steam

- Itch.io

第八章投资分析

第9章 未来趋势

The Metaverse Market size is estimated at USD 116.74 billion in 2024, and is expected to reach USD 669.96 billion by 2029, growing at a CAGR of 41.83% during the forecast period (2024-2029).

The key reasons propelling the growth of the Metaverse Market globally are rising demand in the worldwide media, entertainment, and gaming industries, primarily due to the increased usage of Augmented Reality (AR), Virtual Reality (VR), and Mixed Reality (MR) technologies. The crucial justifications for adopting these technologies are that the gadgets, such as VR headsets, MR headsets, HUD, HMD, smart glasses, and intelligent helmets, can provide a first-person perspective that acts as natural user interfaces, providing 6-degree freedom, etc., to create virtual scenarios that look realistic and improve the overall gaming experience of end users.

Key Highlights

- Small, medium-sized, and large-scale businesses and individual customers increasingly need advanced VR gadgets, promoting market expansion. Also, the rising investments in retail and e-commerce and increased use of platforms to display products in a virtual environment support industry expansion.

- For instance, Decentraland, a metaverse powered by the Ethereum Blockchain, raised USD 1.2 million in February 2022 through an auction and marketplace for fungible tokens. Price Waterhouse Cooper Hong Kong also paid USD 10,000 for LAND in Sandbox.

- Additionally, the market is growing due to the increased use of advanced technologies in various applications, including blockchain, mixed reality, and artificial intelligence (AI). The metaverse industry greatly benefits from the growing usage of new technologies, including mixed reality (MR), extended reality, artificial intelligence (AI), and blockchain. Companies, including Roblox, Facebook, Oculus, Epic Games, Microsoft, Google, USM, NVidia, etc., have already implemented or are implementing Metaverse XR/extended reality systems and other new technologies.

- Moreover, through metaverse portals, cryptocurrency is frequently used to pay for everything, from avatar shoes to NFT (Non-fungible tokens). According to a CNBC survey, one in ten people invests in cryptocurrencies, which are commonly used in trading various commodities, including NFTs. The global accessibility of cryptocurrency exchange allows investors to use this asset to offer products directly to customers on the Metaverse, thus favorably altering the market patterns.

- However, since many users are unaware of the service and security alternatives available, the expansion of the metaverse market may be constrained. Also, on the other hand, cyberattacks against key players like Tencent Holdings, Globant, and others have raised serious security and sensitivity issues. As per the 2022 SonicWall Cyber Threat Report data, the first half of 2022 saw 2.8 billion malware attacks, an 11% rise over 2021.

- The COVID-19 pandemic significantly boosted interest in the concept of the Metaverse. There is a need for practical methods or channels to make online contact more realistic as more people started working from home and attending classes online. Its importance to both consumers and businesses increased because of the pandemic. Tech companies began working on this technology in 2020 and publicized their investments. The year 2021 was successful for investments in Metaverse technology due to the billion dollars spent on Metaverse.

Metaverse Market Trends

Gaming Segment Accounted for the Largest Market Share

- There has been significant growth in VR and AR gamers globally, broadening the market horizon. A provider of machine learning, artificial intelligence, big data analytics, and AR/VR solutions, NewGenApps predicts that by 2025, there will be 216 million people worldwide playing VR and AR games, with a market value of USD 11.6 billion.

- Additionally, a crucial factor that points to a promising future for VR technology in gaming is the rising comfort levels of customers in situational uses, such as VR calls and VR gaming. According to the Entertainment Software Association's statistics, around 227 million Americans play video games weekly, including two-thirds of adults and three-quarters of children under 18. The average age of video game players is 31 years, with 55% of men and 45% of women participating.

- In February 2022, Sony released the VR2 and VR2 Sense Controllers for the PlayStation 5 to provide customers with a high-quality virtual reality experience that enables users to lose themselves in the gaming world with a broad spectrum of experiences. High visual fidelity and improved trackers are added in VR2.

- Moreover, in July 2021, Virtex declared that it intends to introduce a virtual reality stadium, "Virtex Stadium," allowing fans to watch games with their friends from the center of the field. The introduction coincides with the rise in e-sports' popularity and the growing improvement in consumer VR hardware's performance and accessibility. According to VentureBeat data, the worldwide eSports audience was 474 million in 2021 and will increase to 577.2 million by 2024.

- The gaming world is changing at a rapid pace. A broad range of game developers worldwide is working on various futuristic game projects for select VR/AR platforms in 2022. According to a 2022 survey by Game Developers Conference, 27% of participating game developers globally said they were working on titles for the Oculus Quest virtual reality headset.

North America Holds Significant Market Share

- North America is predicted to have the most significant adoption of the metaverse solution. It is mainly because North American users and consumers adopt new and sophisticated technologies at a very rapid pace. Americans are progressively accessing and experiencing the metaverse as realistically possible through VR, MR, AR, and other new technologies. Americans also appreciate their metaverse experience, which motivates them to spend money on gadgets that would experience it even better. The rising desire for devices that improve users' experiences encourages market expansion.

- The growing investments businesses and individuals make in these advanced technologies, and digital solutions play a very significant role in the market's overall expansion. Additionally, due to its technological development and advancement, North America leads all other markets in the creation of advanced technology for use in display devices. For Instance, in November 2021, Unity Simulation Pro was introduced, which enables the developers to unleash the full potential of scalable simulations. It is the only product developed from the ground up to help with distributed rendering, enabling multiple Graphics Processing Units (GPUs) to render the same project simultaneously, either locally or in the private cloud.

- The Metaverse market in North America is expanding due to the wide application of AR technology in consumer devices. Additionally, the region has adapted metaverse technologies in healthcare, consumer products, aerospace and defense, and business applications for education and training. PTC, Magic Leap, Microsoft, and Google are just a few of the international firms in the US that offer AR devices and solutions. In addition, the main reason propelling the expansion of the metaverse market in North America has been the rising acceptance of metaverse technologies by businesses to sell their products in a modern way.

- Furthermore, in December 2021, Meta introduced a closed beta for a streamlined AR creation tool called 'Spark AR Go.' Meta declared the distribution of its 'Spark Augmented Reality (AR) Go' mobile software as a beta version for iOS and Android smartphones. Meta created the smartphone app to go along with its spark AR Studio Software Development Kit (SDK). This potent tool enables webAR effects and 3D content on its social media sites, including Facebook and Instagram. With the help of "Spark AR Go," AR content producers can create, test, and post immersive experiences on Meta's social media platforms, monitor user performance metrics and get user feedback.

- Another factor anticipated to boost the regional market's revenue growth is the rising number of start-ups concentrating on creating metaverse platforms for commercialization in the region. The region's significant concentration of gaming and metaverse companies like The Sandbox, Nvidia Corporation, and Epic Games, Inc., which primarily focus on merging metaverse into games, generate market development potential. For Instance, Nvidia Corporation declared partnerships with Blender and Adobe that will allow NVIDIA Omniverse, the first collaboration and simulation platform in the world, to reach millions more users.

Metaverse Industry Overview

The Metaverse Market is moderately consolidated. Some of the established vendors in the market include Qualcomm Technologies Inc., AWS, and Cloudflare, among others. These companies are implementing various product development, mergers, acquisitions, strategic partnerships, etc., to launch new products to remain competitive in the market.

- February 2022 - Electronic Arts Company released GRID Legends to facilitate smooth action, organize the ideal multiplayer session, and build stories with other racers. It allows users to browse for live events that meet their preferences, enter events in real-time, open design races using the Race Creator, or create a private lobby for users' parties.

- January 2022 - Microsoft disclosed that it had acquired Activision Blizzard, Inc. Microsoft believes that this acquisition will foster the metaverse industry's development and accelerate Microsoft's gaming business growth across mobile, PC, cloud, and console platforms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness-Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Metaverse Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Favorable trends such as convergence of games and social media platforms

- 5.1.2 Technological advancements in hardware and networking

- 5.2 Market Restraints

- 5.2.1 Moderation, Privacy, accessibility & regulatory challenges

- 5.3 Analysis of key business models for Metaverse

- 5.4 Role of NFTs in furthering ownership of gaming and event-based models (Play-to-Earn & Collect)

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 AR & VR Hardware

- 6.1.2 Social Media Engagement (Ads)

- 6.1.3 Virtual Live Entertainment - Epic Games and Roblox

- 6.1.4 Gaming Services

- 6.2 By End-User Industry

- 6.2.1 Gaming

- 6.2.2 Media & Entertainment

- 6.2.3 Commercial

- 6.2.4 Retail

- 6.2.5 Others

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles - Metaverse Experiential Solutions

- 7.1.1 Fortnite

- 7.1.2 EA Sports

- 7.1.3 Hologate

- 7.2 Company Profiles - Metaverse Infrastructure

- 7.2.1 AWS

- 7.2.2 Qualcomm

- 7.2.3 Cloudflare

- 7.3 Company Profiles - Metaverse End-user devices

- 7.3.1 Oculus

- 7.3.2 Vive

- 7.3.3 Vuzix

- 7.4 Company Profiles - Metaverse Created Economy

- 7.4.1 Epic

- 7.4.2 Roblox

- 7.4.3 Polystream

- 7.5 Company Profiles - Metaverse Discovery Platforms

- 7.5.1 Facebook

- 7.5.2 Unity

- 7.5.3 Steam

- 7.5.4 Itch.io