|

市场调查报告书

商品编码

1438277

可食用薄膜与涂料:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Edible Films and Coating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

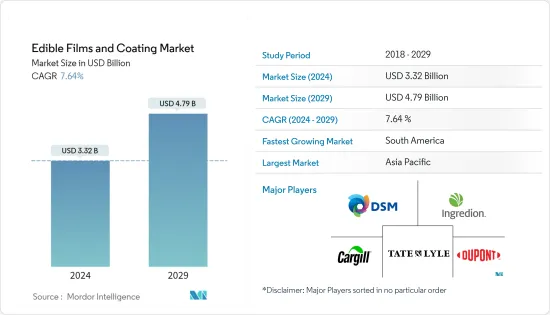

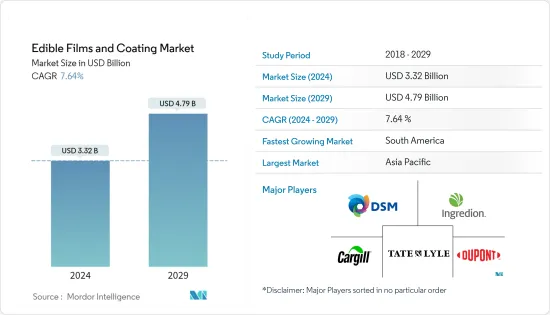

预计2024年可食用薄膜和涂料市场规模为33.2亿美元,预计到2029年将达到47.9亿美元,在预测期内(2024-2029年)增长7.64%,复合年增长率为

主要亮点

- 在食品上使用可食用涂层的优点是它们可以作为二氧化碳、脂质、水分、氧气和香气的屏障。提高食品品质并延长产品保存期限。使用可食用薄膜和涂层的主要优点之一是,一些活性成分可以合併到聚合物基质中并与食品一起服用,从而提高安全性,甚至改善营养和感官特性。可食用涂层可由大豆蛋白、小麦麵筋、乳清、明胶等製成。

- 由于植物来源食品的好处和健康意识,消费者对植物性食品的需求不断增加。食品製造商正在加强延长保质期并改进现有的包装技术,以确保微生物安全并保护食品免受外部因素的影响。技术机构和研究人员正在创新新技术,利用多种成分开发可食用薄膜。

- 例如,2022年9月,印度理工学院古瓦哈蒂开发了一种可食用涂层,可延长水果和蔬菜的保质期。该涂层由微藻类萃取物和多醣的混合物製成。海洋微藻类Dunaliella tertiolecta 以其抗氧化特性而闻名,被用作多种生物活性化合物,如类胡萝卜素、蛋白质和多醣。因此,製造商的新产品创新预计将有助于可食用薄膜和涂料市场的成长。

可食用薄膜和涂料市场趋势

对自然资源可食用包装材料的需求不断增加

- 传统的食品包装材料具有许多缺点,例如环境影响、污染、製造要求和处置。对替代包装材料和形式的需求显着增加。

- 与永续性、道德、食品安全、食品品质和产品成本相关的问题对于现代消费者来说都是购买食品时越来越重要的因素,而食品包装法律规章有助于解决这些问题,其中许多是被迫的。所有这些因素都极大地促进了食品包装行业对可食用薄膜和涂料的需求不断增长。这些可食用薄膜是从天然有机产品中提取的。

- 例如,小麦麵筋、乳清蛋白、玉米醇溶蛋白、蜡、纤维素衍生物、果胶等是利用水果、坚果、谷物和蔬菜生产的可食用薄膜。此外,製造商正在透过使用不同的蛋白质型态在可食用包装领域进行创新。

- 例如,2022 年 6 月,一位名叫 Benedetto Marelli 的科学家推出了一家名为 Mori 的生技Start-Ups,利用丝蛋白。这些蛋白质用于包裹花园蔬菜、嫩牛排、新鲜鸡肉和其他生鲜食品食品和包装食品。

亚太地区继续主导全球市场

- 中国和日本是该地区可食用薄膜和涂料市场的主要消费者。在中国,黄原胶是最常用的食品食用涂料之一,对多醣薄膜和涂料产生了很高的需求。

- 然而,正在进行研究以发现该地区的其他可食用涂层来源,预计这些来源可以延长产品的保质期并保持更长时间的新鲜。此外,印度等国家的意识不断提高,预计将在预测期内带来非常有前景的市场前景。

- 2021年4月,BASF在香港推出Joncryl HPB(高性能阻隔剂)。该公司表示,这种特殊产品是一种水性液体阻隔涂料,在现代包装趋势和自然资源保护中发挥重要作用。这次新推出背后的策略是扩大公司业务。

可食用薄膜和涂料行业概述

可食用薄膜和涂料市场由全球和区域市场公司细分。经营可食用薄膜和涂料市场的主要企业包括杜邦公司、泰莱公司、嘉吉公司、Koninklijke DSM NV 和 Ingredion 公司。可食用薄膜和涂料是包装行业一个不断增长的市场,随着消费者从常规消费品中寻求此类选择,预计需求将会成长。未来几年市场将出现更多创新,产业可能会出现併购。最近出现了新品牌,并因其提供的产品而受到广泛关注。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 成分类型

- 蛋白质

- 多醣

- 脂质

- 复合材料

- 应用

- 乳製品

- 麵包店/糖果零食

- 水果和蔬菜

- 肉类、家禽、鱼贝类

- 其他用途

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 市场占有率分析

- 最采用的策略

- 公司简介

- Tate &Lyle PLC

- DuPont de Nemours Inc.

- DOHler Group Se

- Koninklijke DSM NV

- Cargill, Incorporated

- Ingredion Incorporated

- RPM International, Inc.(Mantrose-Haeuser Co. Inc.)

- Nagase &Co Ltd

- Sumitomo Chemical Co. Ltd

- Sufresca

- Pace International, LLC

- AgroFresh Solutions, Inc.

- Akorn Technology, Inc.

第七章市场机会与未来趋势

The Edible Films and Coating Market size is estimated at USD 3.32 billion in 2024, and is expected to reach USD 4.79 billion by 2029, growing at a CAGR of 7.64% during the forecast period (2024-2029).

Key Highlights

- The benefit of using edible coating on food products is that it acts as a barrier for carbon dioxide, lipids, moisture, oxygen, and aromas. It improves food quality and extends the shelf life of products. One major advantage of using edible films and coatings is that several active ingredients can be incorporated into the polymer matrix and consumed with food, thus, enhancing safety or even nutritional and sensory attributes. The edible coatings can be made from soybean protein, wheat gluten, whey, gelatin, and many more.

- Demand for plant-based food products is increasing among consumers because of their benefits and health consciousness. The food product manufacturers have increased their efforts to increase the shelf life and improve the existing packaging technology, ensuring the microbial safety and preservation of food from the influence of external factors. Technological institutes and researchers are innovating new technologies to develop edible films with the use of different components.

- For instance, in September 2022, the Indian Institute of Technology, Guwahati, developed an edible coating to extend the shelf life of fruits and vegetables. The coating is made from a mix of microalgae extract and polysaccharides. The marine microalgae Dunaliella tertiolecta, known for its antioxidant properties, is used for its various bioactive compounds such as carotenoids, proteins, and polysaccharides. Thus, new product innovations from manufacturers are expected to contribute to the market growth of the edible films and coatings market.

Edible Films & Coatings Market Trends

Increasing Demand for Edible Packaging from Natural Resources

- Traditional food packaging materials have many shortcomings like environmental effects, pollution, manufacturing requirements, and wastage. The need for alternative packaging materials and packaging formats has increased at a significant level.

- Issues about sustainability, ethics, food safety, food quality, and product costs are all becoming increasingly important factors for modern-day consumers at the time of purchasing food products, and food packaging legislative regulations enforce a number of these issues. All these factors have largely contributed to the rising demand for edible films and coatings in the food packaging industry. These edible films are extracted from natural and organic products.

- For instance, wheat gluten, whey protein, corn zein, waxes, cellulose derivatives, and pectins are some edible films manufactured using fruits, nuts, grains, and vegetables. Additionally, manufacturers are innovating in the edible packaging space by using various protein forms.

- For instance, in June 2022, a scientist named Benedetto Marelli launched a biotech startup called Mori to use silk proteins. These proteins are used to coat garden vegetables, tenderized steaks, fresh poultry, and other perishable and packaged foods.

Asia-Pacific Continues to Dominate the Global Market

- China and Japan are the major consumers of the region's edible films and coatings market. In China, xanthan gum is one of the most commonly used edible coatings in food products, giving rise to the high demand for polysaccharide-based films and coatings.

- However, research to discover other sources of edible coatings is being conducted in the region, which is expected to extend the shelf life and prolong the freshness of products. Moreover, the rising awareness in countries like India is projected to lead to a very promising market scenario in the forecast period.

- In April 2021, BASF launched Joncryl HPB (High-Performance Barrier) in Hong Kong. According to the firm, this specific product is a water-based liquid barrier coating that plays an important role in the latest packaging trends and the conservation of natural resources. The strategy behind this new launch was to expand the company's business.

Edible Films & Coatings Industry Overview

The edible films and coating market is fragmented with global and regional market players. The major players operating in the edible films and coatings market include DuPont de Nemours Inc, Tate & Lyle, Cargill, Incorporated, Koninklijke DSM N.V., and Ingredion Incorporated. Edible film and coatings are a growing market within the packaging segment, where the demand is expected to upscale as consumers seek such options from their regular consumables. The market is poised to witness more innovations over the coming years, and the industry may expect mergers and acquisitions. New brands have emerged recently and have gained significant traction based on their offerings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Ingredient Type

- 5.1.1 Protein

- 5.1.2 Polysaccharides

- 5.1.3 Lipids

- 5.1.4 Composites

- 5.2 Application

- 5.2.1 Dairy products

- 5.2.2 Bakery and Confectionery

- 5.2.3 Fruits and Vegetables

- 5.2.4 Meat, Poultry, and Seafood

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Adopted Strategies

- 6.3 Company Profiles

- 6.3.1 Tate & Lyle PLC

- 6.3.2 DuPont de Nemours Inc.

- 6.3.3 DOHler Group Se

- 6.3.4 Koninklijke DSM N.V.

- 6.3.5 Cargill, Incorporated

- 6.3.6 Ingredion Incorporated

- 6.3.7 RPM International, Inc. (Mantrose-Haeuser Co. Inc.)

- 6.3.8 Nagase & Co Ltd

- 6.3.9 Sumitomo Chemical Co. Ltd

- 6.3.10 Sufresca

- 6.3.11 Pace International, LLC

- 6.3.12 AgroFresh Solutions, Inc.

- 6.3.13 Akorn Technology, Inc.