|

市场调查报告书

商品编码

1438407

碳捕获与储存:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Carbon Capture and Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

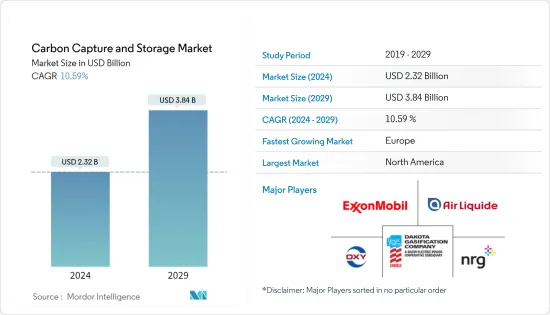

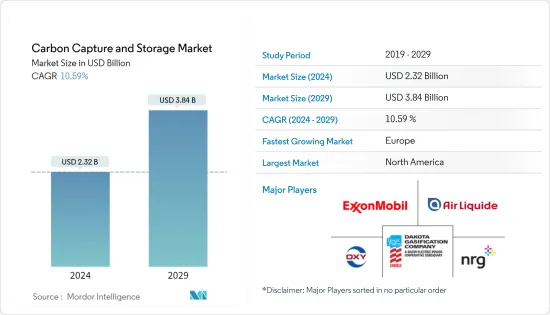

碳捕集与储存市场规模预计到2024年为23.2亿美元,预计到2029年将达到38.4亿美元,在预测期内(2024-2029年)增长10.59%,复合年增长率增长。

由于市场处于新兴和发展阶段,并未受到疫情的严重影响,因此 COVID-19感染疾病对市场的影响不大。

主要亮点

- 推动所研究市场的关键因素是对提高采收率(EOR) 的二氧化碳注入技术的新兴需求以及严格的政府温室气体排放标准。

- 另一方面,庞大的CCS技术实施成本和不断增加的页岩油投资预计将阻碍市场成长。

- 生质能源碳捕获和储存(BECCS)的不断发展可能代表着未来的机会。

- 北美地区可能会主导市场,由于该技术的采用率不断增加(主要是在美国和加拿大),预计在预测期内将保持其主导地位。

碳捕集与储存市场趋势

石油和天然气产业主导市场

- 储存在深层、陆上或海上地质构造的二氧化碳利用石油和天然气产业开发的 CCS 技术来提高石油采收率。

- 二氧化碳广泛应用于石油工业,以提高成熟油田的石油提高采收率(EOR)。当二氧化碳注入油井时,它与原油混合,导致原油膨胀并降低黏度,有助于维持或增加储存内的压力。结合这些过程可以让更多的原油流入生产井。

- 在其他情况下,二氧化碳不溶于油。在这里,二氧化碳的注入增加了储存内的压力,这有助于将石油推向生产井。

- 德克萨斯州(美国)使用二氧化碳为石油回收计划提供动力超过 30 年。 EOR占石油总产量的20%以上,部分油田采收率接近70%。

- 此外,作为永续发展的一部分,石油和天然气产业正在转向碳捕获和封存技术。

- 冠状病毒感染疾病(COVID-19)大流行对石油和天然气生产产生了重大影响。此外,国际能源总署估计,石油和天然气需求仍受到疫情的影响,不太可能赶上感染疾病-19 之前的轨迹。 2020 年石油需求比 2019 年低近 900 万桶/日,预计要到 2023 年才能恢復到这一水准。因此,我们可以看到油气应用增长缓慢。

- 不过,根据BP《2022年世界能源统计回顾》预计,2021年全球石油产量将比2020年成长约1.21%,达到42.214亿吨,并在2022年和2023年进一步成长。此外,市场专家表示,石油产量预计在预测期内将大幅增加,并与疫情前的成长趋势一致。

北美可能主导市场

- 北美地区主导全球市场。由于 EOR 实践中二氧化碳使用量的增加,对干净科技的需求不断增长,这可能会推动美国和加拿大等国家的 CCS 市场。

- 在美国捕获和注入二氧化碳的行业包括化学生产、氢气生产、化肥生产、天然气加工和发电。这些设施可以捕获并注入二氧化碳,将其储存在地下地质构造中,或可用于提高老化油田的石油产量,此过程称为提高石油提高采收率(EOR)。

- 至少自 1997 年起,美国能源局的化石能源和碳管理研究、开发、示范和部署计划 (FECM) 就资助了 CCS 组件的研发 (R&D)。

- 自 2010 财年以来,政府已向 DOE CCS 相关项目提供了 73 亿美元的资金,其中近年来逐年增加。 2021财年,该国向FECM拨款7.5亿美元,其中向CCUS拨款2.283亿美元。

- 根据《基础设施投资和就业法案》(IIJA),美国政府将拨款 121 亿美元用于碳管理技术,其中 25.4 亿美元将专门用于 2022 年至 2025 年的碳捕获和储存(CCS) 示范计划。

- 此外,2020年12月,加拿大政府提案了无污染燃料标准法规。采用 CCS 来最大限度降低石化燃料生命週期碳强度的计划是获得无污染燃料标准合规积分的一种方法。此外,加拿大2021年预算提案对CCUS计划资本支出提供投资税额扣抵,目标是每年减少至少15 Mtpa的二氧化碳排放,预计2022年生效。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 提高石油提高采收率(EOR) 对二氧化碳注入技术的新需求

- 严格的政府温室气体排放标准

- 抑制因素

- 引进CCS技术成本庞大

- 页岩油投资成长

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 科技

- 燃烧前捕获

- 富氧燃烧捕获

- 燃烧后回收

- 最终用户产业

- 油和气

- 燃煤/生质能发电厂

- 钢

- 化学品

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 挪威

- 荷兰

- 其他欧洲国家

- 世界其他地区

- 亚太地区

第六章 竞争形势

- 合併、收购、合资、合作和协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- Air Liquide

- Aker Solutions

- Baker Hughes Company

- Dakota Gasification Company

- Exxon Mobil Corporation

- Fluor Corporation

- General Electric

- Halliburton

- Honeywell International Inc.

- Japan CCS Co., Ltd.

- LanzaTech

- Linde plc

- Mitsubishi Heavy Industries Ltd

- NRG Energy Inc.

- Occidental Petroleum Corporation

- Shell plc.

- Siemens Energy

- SLB

第七章市场机会与未来趋势

- 提升生质能源碳捕获与储存(BECCS)的优势

The Carbon Capture and Storage Market size is estimated at USD 2.32 billion in 2024, and is expected to reach USD 3.84 billion by 2029, growing at a CAGR of 10.59% during the forecast period (2024-2029).

The effect of the Covid-19 pandemic on the market was moderate as the market is in the emerging/developing stage and was not affected severely due to the effect of the pandemic.

Key Highlights

- The major factors driving the market studied are the emerging demand for CO2 injection techniques for enhanced oil recovery (EOR) and strict government norms towards GHG emissions.

- On the flip side, huge CCS technology implementation costs and increases in shale investments are expected to hinder the market's growth.

- Augmenting prominence for bioenergy carbon capture and storage (BECCS) is likely to be an opportunity in the future.

- The North American region is likely to dominate the market and is expected to remain at dominating position over the forecast period owing to increasing implementation of the technology majorly in the United States and Canada.

Carbon Capture and Storage Market Trends

Oil and Gas Segment to Dominate the Market

- Carbon dioxide stored in deep, onshore, or offshore geological formations uses CCS technologies for enhanced oil recovery that have been developed in the oil and gas industry.

- Carbon dioxide is extensively used in the oil industry for enhanced oil recovery (EOR) from mature oilfields. When carbon dioxide is inserted into an oilfield, it can mix with the crude oil, triggering it to swell and drop its viscosity, helping to maintain or raise the pressure in the reservoir. The combination of these processes permits more crude oil to flow to the production wells.

- In other circumstances, the carbon dioxide is not soluble in the oil. Here, the injection of carbon dioxide raises the pressure in the reservoir, helping to sweep the oil toward the production well.

- For more than three decades in Texas (United States), carbon dioxide has been used in enhanced oil recovery projects. EOR constitutes over 20% of total oil production, and some fields achieve recoveries of nearly 70%.

- Moreover as part of sustainable development, the oil and gas industry is moving toward carbon capturing and storage technologies.

- The Covid-19 pandemic servely affected oil and gas production. Moreover, The International Energy Agency estimates that the oil and gas demand is still reeling from the effects of the pandemic, and is unlikely to catch up with its pre-Covid trajectory. In 2020, oil demand was nearly 9 million barrels per day below the level seen in 2019, and it is not expected to return to that level before 2023. Thus, slow growth in oil & gas application can be witnessed.

- However as per the BP Statistical Review of World Energy 2022, the global oil production in the year 2021 observed an increase of around 1.21% as compared to the year 2020 and amounted 4,221.40 million metric tons which is further expected to increase in 2022 and 2023. Further, as per market experts the oil production is expected to see a significant boost over the forecast period and to grow as per pre-pandemic growth trends.

North America is Likely to Dominate the Market

- The North American region dominates the global market. The growing demand for clean technology, accompanied by the growing use of CO2 in EOR practices, is likely to drive the CCS market in countries like the United States and Canada.

- Chemical production, hydrogen production, fertilizer production, natural gas processing, and power generation are among the industries in the United States where CO2 is captured and injected. These facilities capture and inject CO2 to store it underground in geologic formations or to use it to boost oil production from aging oil fields, a process known as enhanced oil recovery (EOR).

- Since at least 1997, the US Department of Energy's Fossil Energy and Carbon Management Research, Development, Demonstration, and Deployment program (FECM) has financed research and development (R&D) in components of CCS.

- The government has funded USD 7.3 billion for DOE CCS-related programs since FY2010, including annual increases in recent years. The country allocated USD 750 million to FECM in FY2021, with USD 228.3 million going to CCUS.

- Under the Infrastructure Investments and Jobs Act (IIJA), the United State's government allocated USD 12.1 billion for carbon management technologies of which USD 2.54 billion is appropriated for carbon capture and storage (CCS) demonstration projects from 2022 to 2025.

- Moreover, In December 2020, the Canadian government proposed regulations for the Clean Fuel Standard. Projects that employ CCS to minimize the lifecycle carbon intensity of fossil fuels are one of the approaches to earn compliance credits for the Clean Fuel Standard. In addition, Canada's Budget 2021 suggested an investment tax credit for capital spent in CCUS projects, with a target of lowering CO2 emissions by at least 15 Mtpa, which would take effect in 2022.

Carbon Capture and Storage Industry Overview

The carbon capture and storage market is consolidated in nature. The major players in the market (not in a particular order) include Occidental Petroleum Corporation, Exxon Mobil Corporation, Dakota Gasification Company, NRG Energy Inc., and Air Liquide, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Emerging Demand for CO2 Injection Technique for Enhanced Oil Recovery (EOR)

- 4.1.2 Strict Government Norms Toward GHG Emissions

- 4.2 Restraints

- 4.2.1 Huge CCS Technology Implementation Costs

- 4.2.2 Growth in Shale Investments

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Technology

- 5.1.1 Pre-combustion Capture

- 5.1.2 Oxy-fuel Combustion Capture

- 5.1.3 Post-combustion Capture

- 5.2 End-user Industry

- 5.2.1 Oil and Gas

- 5.2.2 Coal and Biomass Power Plant

- 5.2.3 Iron and Steel

- 5.2.4 Chemical

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 Australia

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Norway

- 5.3.3.5 Netherlands

- 5.3.3.6 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide

- 6.4.2 Aker Solutions

- 6.4.3 Baker Hughes Company

- 6.4.4 Dakota Gasification Company

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 Fluor Corporation

- 6.4.7 General Electric

- 6.4.8 Halliburton

- 6.4.9 Honeywell International Inc.

- 6.4.10 Japan CCS Co., Ltd.

- 6.4.11 LanzaTech

- 6.4.12 Linde plc

- 6.4.13 Mitsubishi Heavy Industries Ltd

- 6.4.14 NRG Energy Inc.

- 6.4.15 Occidental Petroleum Corporation

- 6.4.16 Shell plc.

- 6.4.17 Siemens Energy

- 6.4.18 SLB

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Augmenting Prominence for Bioenergy Carbon Capture and Storage (BECCS)