|

市场调查报告书

商品编码

1439780

粗钢:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Crude Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

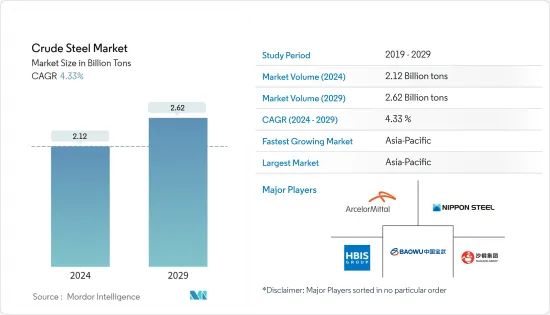

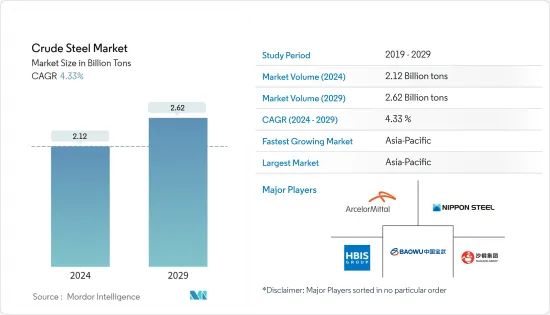

预计2024年粗钢市场规模为21.2亿吨,预计2029年将达26.2亿吨,预测期间(2024-2029年)复合年增长率为4.33%。

COVID-19 对 2020 年市场产生了负面影响。由于 COVID-19 大流行,2020 年全球所有车辆销售量均出现下降。但2021年,市场回暖,各类汽车零件製造的粗钢消耗量增加。 2021年,由于建筑、工具机械、能源、运输等各行业需求增加,石油钢需求增加。

主要亮点

- 从中期来看,建设产业需求的增加以及汽车生产的復苏预计将推动市场成长。

- 另一方面,由于钢铁生产和替代品的供应而导致的自然资源枯竭可能会阻碍研究市场的成长。

- 循环经济的不断发展趋势,据说钢铁透过回收、再利用、再製造和循环利用做出了重大贡献,这可能是研究市场的一个机会。

- 亚太地区预计将主导世界,其中消费量最高的国家来自中国和印度等国家。

粗钢市场走势

建筑和建设产业的需求增加

- 钢及其合金是全球建筑领域最常使用的金属。钢材也用于屋顶和外墙覆层。屋顶、檩条、内墙、天花板、覆层和外墙保温板等产品均由钢製成。

- 根据联合国(UN)统计,全球约有50%的人口居住在都市区,预计2030年将达到60%。经济成长和人口成长的速度必须与商业、住宅和机构建设的需求相符。

- 根据2022年1月发布的中国五年规划,预计2022年中国建设产业将成长6%。中国计划增加装配式建筑的建设,以减少建筑工地的污染和废弃物。预製件,分件或整体製造并运至建筑工地组装,可占全国新建建筑的30%以上。

- 根据美国人口普查局的数据,过去十年该国的建筑总量持续成长。 2021年达到16,264亿美元,比2020金额(14,996亿美元)成长8.5%。

- 根据美国建筑师协会的数据,2022 年美国住宅建筑总量预计将成长 3.1%。预计 2022 年饭店成长 8.8%,办公室成长 0.1%。随后的成长预计将推动预测期内钢铁市场的成长。

- 因此,此类行业趋势预计将同时推动建筑业的钢材需求。

亚太地区主导市场

- 亚太地区粗钢产业成长良好,中国、印度等国消费份额较大。

- 中国是世界上最大的粗钢生产国。根据世界钢铁协会预测,2021年中国产量将占全球产量的50%以上。 2021年粗钢产能为10.328亿吨,比2020年的10.647亿吨下降3%。该国钢铁产量的强劲成长是由于各个最终用户产业的需求不断增加。

- 中国汽车产业的扩张预计将有利于粗钢需求。根据国际汽车工业协会(OICA)的数据,中国是全球最大的汽车生产国,约占全球产量的32.5%。 2021年汽车产量为26,082,220辆,比2020年的25,225,242辆增加3%。

- 此外,中国航空公司计划在未来20年购买约7,690架新飞机(约1.2兆美元),预计将进一步推动粗钢市场的需求。

- 印度汽车工业商协会(SIAM)的报告显示,2021年印度小客车和轻型车产量为4,399,112辆。此外,「Aatma Nirbhar Bharat」和「印度製造」计画等政府改革预计将推动汽车产业的发展。

- 根据IATA(国际航空运输协会)的报告,预计到预测期结束时,印度将成为世界第三大航空市场。预计未来20年该国将需要2,100架飞机,销售额预计将超过2,900亿美元。受这些因素影响,未来航太领域对粗钢的需求预计将增加。

- 因此,所有上述因素都可能对未来几年所研究市场的需求产生重大影响。

粗钢业概况

研究的市场较为分散,市场公司之间为增加份额而展开的竞争较为激烈。市场主要企业(排名不分先后)包括中国宝武钢铁集团有限公司、安赛乐米塔尔、新日铁、河钢集团、沙钢集团等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建筑和建设产业的需求增加

- 汽车生产恢復

- 抑制因素

- 自然资源枯竭和替代品的可用性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 构成比

- 全静钢

- 半静钢

- 製造过程

- 转炉(BOF)

- 电弧炉(EAF)

- 最终用户产业

- 建筑/施工

- 运输

- 工具和机器

- 活力

- 消费品

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- ArcelorMittal

- China Ansteel Group Corporation Limited

- China BaoWu Steel Group Corporation Limited

- China Steel Corporation(CSC)

- Fangda Special Steel Technology Co. Ltd

- HBIS GROUP

- Hyundai Steel

- JFE Steel Corporation

- JSW

- NIPPON STEEL CORPORATION

- NLMK(Novelipetsk Steel)

- Nucor Corporation

- POSCO

- RIZHAO STEEL HOLDING GROUP CO. LTD

- Steel Authority of India Limited(SAIL)

- SHAGANG GROUP Inc.

- Tata Steel Limited

- United States Steel Corporation

- Techint Group

- Hunan Valin Iron And Steel Group Co. Ltd

第七章 市场机会及未来趋势

- 循环经济趋势不断发展

The Crude Steel Market size is estimated at 2.12 Billion tons in 2024, and is expected to reach 2.62 Billion tons by 2029, growing at a CAGR of 4.33% during the forecast period (2024-2029).

COVID-19 negatively impacted the market in 2020. Owing to the COVID-19 pandemic, the global sales of all vehicles in 2020 declined. Still, the market recovered in 2021, thereby enhancing crude steel consumption in the manufacturing of different automotive parts. In 2021, the demand for oil steel increased due to an increase in demand in various industries such as construction, tools and machinery, energy, transportation, and others.

Key Highlights

- Over the medium term, increasing demand from the building and construction industry and recovering automotive production will likely drive the market's growth.

- On the flip side, the depletion of natural resources due to the production of steel and the availability of substitutes will likely hinder the studied market's growth.

- The growing trend of a circular economy, where steel is touted to make a significant contribution through its recovery, reuse, remanufacturing, and recycling, is likely to act as an opportunity for the studied market.

- The Asia-Pacific region is expected to dominate the world, with the most significant consumption from countries such as China and India.

Crude Steel Market Trends

Increasing Demand from the Building and Construction Industry

- Steel and its alloys are among the most common metals used worldwide in the construction sector. Steel is also used on roofs and as cladding for exterior walls. Products, such as roofing, purlins, internal walls, ceilings, cladding, and insulating panels for exterior walls, are made of steel.

- According to the United Nations (UN), around 50% of the global population resides in urban cities, which is projected to touch 60% by 2030. The pace of economic and demographic growth must be in harmony with the demand for commercial, residential, and institutional construction activities.

- According to China's Five-Year Plan unveiled in January 2022, the construction industry in the country is estimated to register a growth rate of 6% in 2022. China plans to increase the construction of prefabricated buildings to reduce pollution and waste from construction sites. The prefabricated parts, either partially or wholly manufactured and then transported to the construction sites for assembly, may account for over 30% of the new construction in the country.

- According to the United States Census Bureau, the total value of construction put in place in the country has been increasing consecutively for the past decade. In 2021, the deal reached USD 1,626.4 billion, registering an 8.5% hike from the value (USD 1,499.6 billion) reached in 2020.

- According to the American Institute of Architects, the overall non-residential building construction in the United States is expected to grow to 3.1% in 2022. The structure of hotels is expected to rise by 8.8% in 2022 and of office spaces by 0.1%. The subsequent increase is expected to enhance the growth of the steel market during the forecast period.

- Therefore, such industry trends are expected to simultaneously drive the demand for steel in the building and construction sector.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region has experienced favorable growth in the crude steel industry, with countries like China and India holding significant consumption shares.

- China is the largest producer of crude steel globally. According to the World Steel Association, in 2021, China accounted for more than 50% of the global production. In 2021, the country's annual crude steel production capacity stood at 1,032.8 million tons, declining by 3% compared to 1064.7 million tons produced in 2020. The strong growth of steel production in the country was due to the growing demand from various end-user industries.

- The expansion of the automotive segment in China is anticipated to benefit the demand for crude steel. According to the International Organization of Motor Vehicle Manufacturers (OICA), China is the largest producer of automobiles, accounting for about 32.5% of the global volume. The country alone produced 2,60,82,220-unit vehicles in 2021, registering an increase of 3% compared to 25,225,242 units in 2020.

- Moreover, the Chinese airline companies are planning to purchase about 7,690 new aircraft in the next 20 years, valued at approximately USD 1.2 trillion, further expected to raise the market demand for crude steel.

- As per the reports by the Society of Indian Automobile Manufacturers, SIAM, India produced 4,399,112 units of passenger cars and light vehicles in 2021. Moreover, the government's reforms, such as "Aatma Nirbhar Bharat" and "Make in India" programs, are expected to boost the automotive industry.

- According to the IATA (International Air Transport Association) report, India is poised to become the third-largest global aviation market by the end of the forecast period. The country is projected to have a demand for 2,100 aircraft over the next two decades, accounting for over USD 290 billion in sales. Due to these factors, the demand for crude steel from the aerospace sector is expected to rise in the future.

- Therefore, all the above mentioned factors are likely to significantly impact the demand in the market studied in the years to come.

Crude Steel Industry Overview

The market studied is fragmented, with moderately high competition among the market players to increase their shares. Some of the key companies in the market (in no particular order) include China BaoWu Steel Group Corporation Limited, ArcelorMittal, Nippon Steel Corporation, HBIS GROUP, and Shagang Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Building and Construction Industry

- 4.1.2 Recovering Automotive Production

- 4.2 Restraints

- 4.2.1 Depleting Natural Resources and Availability of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Composition

- 5.1.1 Killed Steel

- 5.1.2 Semi-killed Steel

- 5.2 Manufacturing Process

- 5.2.1 Basic Oxygen Furnace (BOF)

- 5.2.2 Electric Arc Furnace (EAF)

- 5.3 End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Transportation

- 5.3.3 Tools and Machinery

- 5.3.4 Energy

- 5.3.5 Consumer Goods

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 China Ansteel Group Corporation Limited

- 6.4.3 China BaoWu Steel Group Corporation Limited

- 6.4.4 China Steel Corporation (CSC)

- 6.4.5 Fangda Special Steel Technology Co. Ltd

- 6.4.6 HBIS GROUP

- 6.4.7 Hyundai Steel

- 6.4.8 JFE Steel Corporation

- 6.4.9 JSW

- 6.4.10 NIPPON STEEL CORPORATION

- 6.4.11 NLMK (Novelipetsk Steel)

- 6.4.12 Nucor Corporation

- 6.4.13 POSCO

- 6.4.14 RIZHAO STEEL HOLDING GROUP CO. LTD

- 6.4.15 Steel Authority of India Limited (SAIL)

- 6.4.16 SHAGANG GROUP Inc.

- 6.4.17 Tata Steel Limited

- 6.4.18 United States Steel Corporation

- 6.4.19 Techint Group

- 6.4.20 Hunan Valin Iron And Steel Group Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Trends of Circular Economy