|

市场调查报告书

商品编码

1439798

聚合物涂层 NPK:市场占有率分析、行业趋势和统计、成长预测(2024-2029 年)Polymer Coated NPK - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

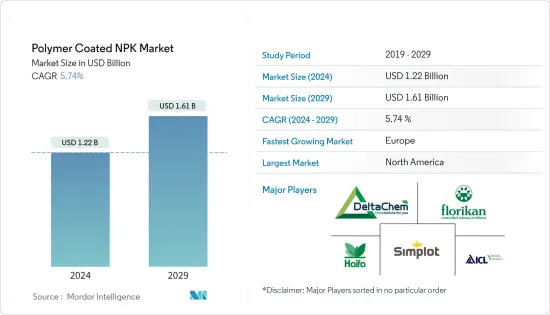

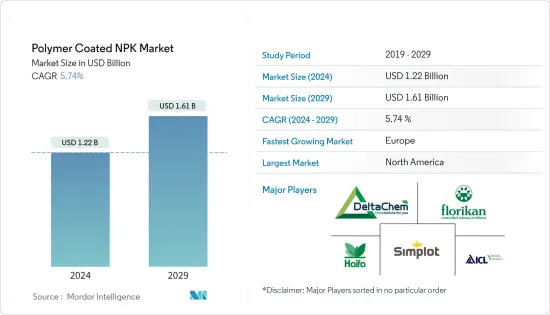

聚合物涂层 NPK 市场规模预计 2024 年为 12.2 亿美元,预计到 2029 年将达到 16.1 亿美元,预测期内(2024-2029 年)复合年增长率为 5.74%。

主要亮点

- 由于豆类面积下降面临巨大压力,因此对聚合物包膜 NPK 肥料的需求预计将增加,这需要高效的 NPK 肥料,以在整个生长季节保持一致的养分。此外,该品种能有效降低草莓、柑橘和蔬菜生产的长期成本,因为散布的有效期为6-9个月,只需施用一次,人们的需求正在增加。

- 预计未来几年,对粮食和农作物的需求增加以及全球人均肥沃土地份额的下降将增加对各种聚合物包膜肥料的需求。由于人口增长,对氮肥的需求预计会增加,以提高作物产量并确保粮食安全。土壤中缺乏养分和水分等现有挑战,以及日益增长的环境问题,正在为生物分解性的聚合物涂层肥料铺平道路,这种肥料具有根据植物需求同步释放养分的潜力,正在成为一种可行的解决方案。

- 越来越多地应用可生物分解性聚合物包膜肥料用于草坪、土壤品质、环境问题,以及不断增加对生物分解性肥料有效性的研究是聚合物包膜肥料市场的主要驱动力。另一方面,市场限制因素包括对常规肥料的高需求和聚合物包膜肥料的保质期短。

- 据国际化肥工业协会称,过去十年来,与农作物聚合物肥料相关的田间试验和试点计划增加了需求,主要来自柑橘、草莓、蔬菜和坚果生产商。在北美,对聚合物包膜肥料的需求预计将增加,因为日益减少的豆类种植面积面临巨大压力,需要高效的氮磷钾肥料在整个生长季节提供一致的养分。此外,该品种能有效降低草莓、柑橘和蔬菜生产的长期成本,因为散布的有效期为6-9个月,只需施用一次,人们的需求正在增加。

聚合物包膜氮磷钾肥料的市场趋势

农地减少和提高作物生产力的需要

在全球范围内,农业用地的比例在过去十年中持续下降。例如,根据世界银行的数据,农业用地比例从2018年的138975万公顷减少到2020年的1387172公顷。预计未来几年将进一步减少。农业用地的减少和全球粮食需求的增加预计将增加全球有效肥料(例如聚合物包膜肥料)的使用。这反过来又导致了研究市场的成长。

此外,随着收入的增加和都市化,公民正在积极地花更多的钱来维护他们的草坪。根据美国劳工统计局的一项研究,2020 年草坪维护的年度支出从 2018 年的 113.61 美元增加到 115.07 美元。因此,由于支出的增加和环保意识的增强,预计未来几年可生物分解性缓释性肥料的采用将会增加。

矿物肥料使用量的增加导致土壤中肥料累积过多。实证研究证明,可生物分解性的聚合物涂层有助于控制养分释放到土壤中,同时减少氨挥发等养分损失,并长期维持土壤肥力。

此外,人们对粮食安全的担忧也增加。美国、巴西、日本和中国等国家正致力于增加国内生产和提高自给自足,以满足对传统日本食品和西方食品的需求。食品需求的增加将推动市场成长。

北美市场占据主导地位

北美在聚合物包膜氮磷钾肥料市场中占最大份额,其中美国在该地区贡献最大份额。据国际化肥工业协会称,过去十年来,与农作物聚合物肥料相关的田间试验和试点计划增加了需求,主要来自柑橘、草莓、蔬菜和坚果生产商。

此外,政府正在国内推广永续肥料的使用。美国环保署与美国农业部合作,通过了一项营养减少备忘录,以减少肥料的过度使用并提高效率。康提政府也提倡使用浓缩肥料,因为它们有助于防止氮淋滤和养分污染。例如,2022年9月,政府将聚合物包膜尿素加入加拿大农场气候行动基金(OFCAF)核准报销的高效能肥料产品清单中。此外,农民还获得财政支持,以根据国家 OFCAF倡议实施氮肥管理实践。

一项正在进行的甘蔗种植研究显示,甘蔗控制释放肥料的净利润为每公顷 2,839.0 美元,而传统 NPK 肥料为每公顷 2,173.0 美元。 Agrium 和 Koch Agronomic Services 等多家公司提供先进的聚合物涂层技术,可稳定释放该地区商业产品的 NPK 肥料。采用聚合物涂层的控制释放技术可以使水果有效率且持续地吸收 NPK 肥料。这将提高果实品质并减少落果,从而增加未来对果实的需求。

聚合物包膜氮磷钾肥料产业概况

聚合物包膜氮磷钾肥料市场适度整合,导致全球参与者主导市场。 Haifa Group、JRSimplot Company、ICL Specialty Fertilizers、DeltaChem GmbH、Florikan ESA LLC 和 Pursell Agritech 是市场上一些主要企业。控制释放肥企业主要采取合作伙伴策略进行研发、财务和行销支援。例如,Deltachem GmbH 与国际咨询委员会合作提供组织和销售支援。诺克斯肥料公司与BASF、拜耳和科迪华农业科技等顶级化学公司合作,为消费者带来活性成分。这些策略有助于公司扩大市场并扩大聚合物涂层 NPK 市场的客户群。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 作物类型

- 谷物和谷类

- 豆类和油籽

- 经济作物

- 水果和蔬菜

- 草坪和观赏植物

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 荷兰

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Haifa Group

- JRSimplot Company

- ICL Specialty Fertilizers

- DeltaChem GmbH

- Florikan ESA LLC

- Pursell Agritech

- Ekompany International BV

- Knox Fertilizer Company Inc.

- Compo Expert

第七章市场机会与未来趋势

The Polymer Coated NPK Market size is estimated at USD 1.22 billion in 2024, and is expected to reach USD 1.61 billion by 2029, growing at a CAGR of 5.74% during the forecast period (2024-2029).

Key Highlights

- The demand for polymer-coated NPK fertilizer is expected to increase as immense pressure lies on the declining pulse area that needs efficient NPK fertilizers for consistent nutrients throughout the growth phase. Moreover, the demand for this variety has emerged from the strawberry, citrus fruits, and vegetable growers, as the fertilizer has longevity of six to nine months and requires just one application, thus, proving effective in minimizing long-run costs.

- The increasing demand for food and crops and the reduced per capita share of fertile land globally will increase the demand for various polymer-coated fertilizers in upcoming years. The growing population is anticipated to increase demand for nitrogen fertilizers to enhance the yield of crops and ensure food security. The existing challenges, such as low nutrient and moisture present in the soils and the growing environmental concerns, are paving the way for biodegradable polymer-coated fertilizers, and they are emerging as a potential solution to synchronize nutrient release as per the requirement of plants.

- Growing application of biodegradable polymer-coated fertilizer on turf grass, soil quality, and environmental concerns, and growing research studies on the effectiveness of biodegradable fertilizers are the prime drivers of the polymer-coated fertilizer market. While some market restraints are the existing high demand for conventional fertilizers and the low shelf life of polymer-coated fertilizers.

- According to 'International Fertilizer Industry Association,' over the last decade, field experiments and trial projects related to polymer fertilizers in agriculture crops have increased the demand, primarily from citrus fruit, strawberry, vegetables, and nut growers. The demand for polymer-coated fertilizer in North America will increase as immense pressure lies on the declining pulse area that needs efficient NPK fertilizers for consistent nutrients throughout the growth phase. Moreover, the demand for this variety has emerged from the strawberry, citrus fruits, and vegetable growers, as the fertilizer has a longevity of six to nine months and requires just one application, thus, proving effective in minimizing long-run costs.

Polymer Coated NPK Fertilizers Market Trends

Declining Agricultural Land and The Need For Increased Crop Productivity

Globally, the percentage of agricultural land has been decreasing continually over the past decade. For instance, according to World Bank, the share of agricultural land decreased from 1,389,750 thousand hectares in 2018 to 1,387,172 by 2020. It is projected to decrease further in the coming years. With this decline in agricultural land, coupled with the increasing food demand worldwide, the usage of effective fertilizers such as polymer-coated fertilizers is projected to increase globally. This, in turn, is leading to the growth of the market studied.

Moreover, due to the increasing incomes and urbanization, the people in the country are willing to spend more on the maintenance of turf grasses in the lawns. According to a study by the Bureau of labor statistics, in 2020, the annual spending on the maintenance of lawns increased from USD 113.61 in 2018 to USD 115.07. Thus, with increasing spending and rising environmental conscience, adopting biodegradable controlled-release fertilizers is anticipated to grow in the coming years.

The increasing usage of mineral fertilizers led to the over-accumulation of fertilizers in the soil. Empirical studies have proven that biodegradable polymer coatings are helpful in the controlled release of nutrients into the soil while reducing nutrient losses, such as ammonia volatilization, and conserving soil fertility in the long run.

Furthermore, food security has become an increasing concern. Countries like the United States, Brazil, Japan, China, etc., are focusing on increasing the self-sufficiency ratio by increasing domestic production to meet the demand for both traditional Japanese and western food types. This increasing demand for food drives the market growth.

North America Dominates the Market

North America occupied the largest share of the market for polymer-coated NPK fertilizers, with the United States contributing to the largest share in the region. According to 'International Fertilizer Industry Association', over the last decade, field experiments and trial projects related to polymer fertilizers in agriculture crops have increased the demand, primarily from citrus fruit, strawberry, vegetables, and nut growers.

Furthermore, the government is promoting the use of sustainable fertilizers in the country. The US Environmental Protection Agency adopted the Nutrient Reduction Memorandum, in which the agency works with the US Department of Agriculture to reduce excess fertilizer usage and increase efficiency. Attributed to its benefits in fighting nitrogen leaching and nutrient pollution, the Candian government is also promoting the use of enhanced fertilizers. For instance, in September 2022, the government added polymer-coated urea to the list of enhanced efficiency fertilizer products approved for reimbursement from its On-Farm Climate Action Fund (OFCAF) in Canada. Furthermore, farmers get financial support for implementing nitrogen fertilizer management practices under the OFCAF initiative in the country.

The ongoing research on sugarcane cultivation research reveals that the net return from controlled-released fertilizers for sugarcane is USD 2,839.0 per hectare, whereas, for traditional NPK fertilizers, it is USD 2,173.0 per hectare. Several companies, like Agrium and Koch Agronomic Services, provide advanced polymer coating technology for a consistent release of NPK fertilizers for commercial products in the region. The controlled-release technology through polymer coating provides fruits with efficient and consistent consumption of NPK fertilizer. This, in turn, improves the quality of the fruits and fewer fruit drops, thereby, driving the demand for the same in the future.

Polymer Coated NPK Fertilizers Industry Overview

The market for polymer-coated NPK fertilizers is moderately consolidated, resulting in the dominance of the global players over the market. Haifa Group, J.R.Simplot Company, ICL Specialty Fertilizers, DeltaChem GmbH, Florikan ESA LLC, and Pursell Agritech are some of the major players in the market. Controlled-release fertilizer companies primarily adopted partnership strategies for R&D, financial, and marketing support. For instance, Deltachem GmbH partnered with the International Advisory Board for institutional and sales support. Knox Fertilizer Company partnered with some top chemical companies like BASF, Bayer, and Corteva AgriScience to bring some active ingredients to consumers. These strategies have been helping expand the market outreach as well as the customer base for the companies in the polymer-coated NPK market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Crop Type

- 5.1.1 Grains and Cereals

- 5.1.2 Pulses and Oilseeds

- 5.1.3 Commercial Crops

- 5.1.4 Fruits and Vegetables

- 5.1.5 Turf and Ornamentals

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Netherlands

- 5.2.2.5 Russia

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 Australia

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Haifa Group

- 6.3.2 J.R.Simplot Company

- 6.3.3 ICL Specialty Fertilizers

- 6.3.4 DeltaChem GmbH

- 6.3.5 Florikan ESA LLC

- 6.3.6 Pursell Agritech

- 6.3.7 Ekompany International BV

- 6.3.8 Knox Fertilizer Company Inc.

- 6.3.9 Compo Expert