|

市场调查报告书

商品编码

1440388

电动车高压 DC-DC 转换器 - 市场份额分析、产业趋势与统计、成长预测(2024 - 2029 年)Electric Vehicle High-Voltage DC-DC Converter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

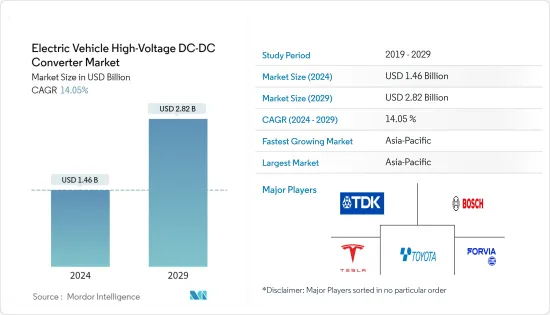

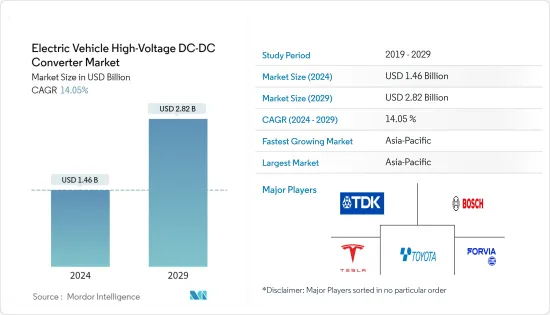

电动车高压DC-DC转换器市场规模预计到2024年为14.6亿美元,预计2029年将达到28.2亿美元,在预测期内(2024-2029年)CAGR为14.05%。

主要亮点

- COVID-19 大流行迫使多家车辆和零件製造工厂暂时关闭。这一因素阻碍了汽车工业的发展。然而,随着一些国家逐步取消车辆封锁,对车辆的需求略有增加,预计这将推动预测期内的市场成长。

- 随着消费者寻求价格实惠的产品,全球电动车市场正在经历转变。消费者偏好的这种潜在转变已转向二手车。自2020年以来,世界几乎每个地区对二手车的需求都在增加。二手车需求的增加可能会影响市场。

- 这场大流行影响了全球几乎所有产业;然而,由于每年电动车的持续需求和销售等因素,电动车DC-DC转换器市场的需求正在显着成长。例如,儘管受到疫情影响,亚太、欧洲等地区各国乘用车等电动车销售仍呈现正成长。

- 电动车销量的快速成长正在推动市场扩张,并为製造商提供收入机会。电动汽车中的电力电子系统用于转换和调节车辆电池的电源。

- 电池供电和混合动力电动车的日益普及,对DC-DC转换器的需求不断增加,因为需要DC-DC转换器将24V或48V电源转换为12V电源,以确保安全可靠的运行机载电子系统。

- 由于低排放交通需求的增长以及政府透过补贴支持公共汽车、卡车、皮卡和货车等电动商用车的零排放交通等原因,全球製造商都将注意力集中在电动商用车 (ECV) 上和退税。这将对预测期内的市场成长产生正面影响。

电动车高压直流-直流转换器市场趋势

全球电动车采用率增加

- 纯电动车 (BEV) 和插电式混合动力电动车 (PHEV) 销量的增加,以及由于材料进步和封装布置改进而导致动力总成零件成本降低,也推动了市场研究。此外,电池的高成本需要改进转换器和其他电力电子设备以及车辆的性能。

- 世界各国政府也推出了各种计画和政策,鼓励购买者选择电动车而不是传统汽车。鼓励购买电动车的一项倡议是加州零排放汽车 (ZEV) 计划,该计划的目标是到 2025 年让 150 万辆电动车上路。其他提供各种激励措施的国家包括印度、中国、英国、韩国、法国、德国、挪威和荷兰。

- COVID-19 爆发后,电动车的销量大幅成长。世界各国政府实施封锁,导致经济放缓,并对电动车和充电基础设施系统的销售产生负面影响。根据电动车製造商协会 (SMEV) 的数据,与 2020 财年相比,2021 财年印度电动车註册量下降了 20%。锂离子电池组和逆变器等其他零件的供应也受到影响。电源逆变器是电动车不可或缺的一部分。它将电池的能量转换为牵引电机,从而驱动车辆。

- 消费者接受度一直是电动车製造商面临的主要挑战。儘管电动车具有许多优势,但由于缺乏充电基础设施以及电动车成本高昂(电动车的成本几乎与入门级豪华车相同)等因素,消费者一直不愿意使用。印度等国家已宣布计划改善充电基础设施,并在全国建立 50,000 多个充电站,但由于 COVID-19,不得不搁置其计划。

- 随着需求的增加,Rivian、福特、沃尔沃、通用汽车和特斯拉等企业预计将在未来几年扩大电动皮卡车的选择。例如,2022年8月,现代汽车公司表示,其XCIENT燃料电池重型卡车将出口到欧洲最大商用车市场德国。由于德国联邦数位和运输部对环保商用车的支持,七家德国物流、製造和零售组织将在其车队中使用 27 辆 XCIENT 燃料电池卡车。

- 2022 年 6 月,福特正式宣布推出一款全新电动商用车,该车将在俄亥俄州工厂为福特 Pro 客户生产,并将于本世纪中期首次亮相。该公司还披露了在其位于密西根州、俄亥俄州和密苏里州的工厂投资 37 亿美元并创造 6,200 多个工会製造业就业机会的计划。

- 世界各国政府也推出了各种计画和政策,鼓励买家选择电动车而不是传统汽车。加州 ZEV 计画的目标是到 2025 年在路上拥有 150 万辆电动车,就是一项促进电动车购买的倡议。

- 因此,随着电动车采用率的稳定上升,在长期预测期内,对 DC-DC 电源转换器的需求将同时成长。

亚太地区主导市场

- 亚太地区占据全球电动车市场的大部分份额。随着中国等国家引领电动车销售,预计市场在预测期内将大幅成长。

- 中国和日本都倾向于创新、技术和先进电动车的开发。此外,印尼等国家正在进行大型电动车计画。

- 中国是全球电动车产业的重要参与者。此外,中国政府正在鼓励人们采用电动车。中国计划在 2040 年完全转向电动车。中国电动乘用车市场也是全球最大的电动乘用车市场之一,并且在过去几年中增长迅速,预计在预测期内将增长得更高。也将对电动车高压DC-DC 转换器市场的需求产生正面影响。市场上的几个主要参与者正在与其他参与者合作开发电力电子元件。

- 例如,2021年11月,G-Pulse和Silicon Mobility宣布合作开发高压多相交错双向DC-DC转换器平台,用于新能源车(NEV),例如燃料电池电动车(FCEV)、纯电动车( BEV)、混合动力汽车电动车 (HEV) 和 PHEV。

- 2021年5月,TDK公司(TDK)宣布与宁德时代新能源科技有限公司(CATL)建立合作关係,以加强其电动汽车电气元件和DC-DC转换器等业务。 TDK将为宁德时代供应汽车电气元件和电源产品,用于汽车动力装置。

- 印度电动车市场正处于成长期。印度的汽车製造商,如 TATA、Mahindra、MG 等,正在采取措施提供价格实惠的电动驾驶选择。此外,政府也支持电动车,以减少该国温室气体的排放。

- 此外,印度的汽车製造商也在采取主动行动并投资于研发实践,以在印度提供价格实惠的电动车;例如,2021 年 2 月,现代汽车宣布斥资 1.2 亿美元开发新型经济型电动车。这些车辆将在当地製造,该公司正在与当地供应商洽谈零件采购事宜。现代汽车也可能寻求与其姊妹品牌起亚建立战略合作伙伴关係,因为它也计划将电动车添加到其在印度的产品组合中。该公司还致力于为印度开发一款面向大众市场、价格更实惠的电动车,预计 2024 年推出。

- 由于上述因素,车辆对DC-DC转换器的需求可能会增加。预计这将推动所研究市场在预测期内的成长。

电动车高压直流-直流变换器产业概况

电动车高压DC-DC转换器市场的主要参与者包括特斯拉公司、丰田工业公司、电装公司、罗伯特博世有限公司、大陆集团、英飞凌科技、海拉有限公司等。这些参与者在研发方面投入大量资金,以获得相对于其他参与者的竞争优势。

例如,2022 年 4 月,丰田自动织机公司宣布推出一款整合充电器和 DC/DC 转换器的紧凑型轻型模组。这是丰田首款用于电动车 (EV) 的 ESU(电力供应单元),它将作为 bZ4X 中处理充电和电力转换操作的核心单元。透过合併电动车运行所需的两个组件,与传统的单独组件安装相比,该公司的尺寸减小了 23%,重量减轻了 17%。

2022 年 3 月,TDK 宣布为广受欢迎的 CCG 系列隔离式 DC-DC 转换器推出更多型号。额定功率为 1.5W 和 3W 的零件在 -40 至 +85°C 的满载条件下以对流冷却方式运作。所有电压组合均配有用于表面贴装或通孔放置的端子。应用包括资料和电信、测试、测量、製程控制、广播和电池供电设备。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场驱动因素

- 电动车的普及率不断提高

- 其他的

- 市场限制

- 转换器在运作过程中产生的噪音可能会阻碍目标市场

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场区隔(市场规模价值 - 百万美元)

- 车辆类型

- 搭乘用车

- 商务车辆

- 推进类型

- 插电式混合动力汽车

- 纯电动车

- 燃料电池电动车

- 冷却方式

- 液冷

- 风冷

- 输入电压

- 200V - 450V

- 450V - 800V

- 800V - 1000V

- 输出电压

- 12V - 24V

- 24V - 48V

- 输出功率

- 小于2千瓦

- 2kW及以上

- 地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 挪威

- 波兰

- 俄罗斯

- 欧洲其他地区

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他国家

- 北美洲

第 6 章:竞争格局

- 供应商市占率

- 公司简介

- Continental AG

- Robert Bosch GmbH

- Valeo Group

- ABB Ltd.

- DENSO Corporation

- Hella GmbH & Co. KGaA

- Toyota Industries Corporation

- Infineon Technologies AG

- Texas Instruments

- STMicroelectronics

- TDK-Lambda Corporation

- Shinry Technologies

- Delta Electronics

- Vicor Corporation

- Hyundai Mobis Ltd.

第 7 章:市场机会与未来趋势

The Electric Vehicle High-Voltage DC-DC Converter Market size is estimated at USD 1.46 billion in 2024, and is expected to reach USD 2.82 billion by 2029, growing at a CAGR of 14.05% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic forced the temporary closure of several vehicle and component manufacturing facilities. This factor impeded the development of the automotive industry. However, with the gradual removal of vehicle lockdowns in several countries, demand for vehicles increased slightly, which was expected to propel the market growth during the forecast period.

- The electric vehicle markets across the world are experiencing a shift as consumers are seeking affordable products. This potential shift in consumer preferences has been diverted toward used vehicles. Since 2020, the demand for used vehicles has increased in almost every part of the world. The increase in demand for used cars is likely to affect the market.

- The pandemic affected almost every industry around the globe; however, the demand for the electric vehicle DC-DC converter market is growing significantly, owing to factors such as the continuous demand and sales of electric vehicles every year. For instance, despite the pandemic, the sales of electric vehicles, such as passenger cars, have shown positive growth in various countries in the regions, such as Asia-Pacific and Europe.

- The rapid rise in the sales of electric cars is driving market expansion and offering revenue possibilities for manufacturers. The power electronics system in an electric car is used to convert and regulate the power supply from the vehicle's battery.

- The growing popularity of battery-powered and hybrid electric vehicles has increased demand for DC-DC converters, as a DC-DC converter is required to convert a 24V or 48V power supply into a 12V power supply in order to ensure the safe and reliable operation of onboard electronic systems.

- Manufacturers are focused on Electric Commercial Vehicle (ECVs) across the globe attributed to reasons such as the rise in demand for low-emission transportation and government support of zero-emission transportation for electric commercial vehicles like buses, trucks, pickups, and vans through subsidies and tax refunds. This will positively impact the market growth during the forecast period.

Electric Vehicle High Voltage DC - DC Converter Market Trends

Increased Electric Vehicle Adoption Globally

- Increased sales of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), as well as lower costs of powertrain components due to advancements in materials and improved packaging arrangement, are also driving the market studied. Furthermore, the high cost of batteries has necessitated the improvement of converters and other power electronics, as well as the performance of vehicles.

- Governments all over the world have also launched various schemes and policies to encourage buyers to opt for electric vehicles over conventional vehicles. One such initiative that encourages the purchase of electric vehicles is the California zero-emission vehicle (ZEV) program, which aims to have 1.5 million electric vehicles on the road by 2025. Other countries offering various incentives include India, China, the United Kingdom, South Korea, France, Germany, Norway, and the Netherlands.

- The sales of electric vehicles were growing significantly post the outbreak of COVID-19. Governments across the world have imposed lockdowns, which resulted in an economic slowdown and negatively impacted the sales of electric vehicles and charging infrastructure systems. According to the Society of Electric Vehicle Manufacturers (SMEV), registration of electric vehicles in India declined by 20% in FY21 as compared to FY20. The supply of other components, such as lithium-ion battery packs and inverters, got impacted. A power inverter is an integral part of electric vehicles. It converts energy from batteries to a traction motor, which propels the vehicle.

- Consumer acceptance has been a major challenge for electric vehicle manufacturers. Despite the advantages that electric vehicles offer, there has been reluctance from consumers, owing to factors such as lack of charging infrastructure and the high cost of EVs (EVs' costs are almost the same as that of entry-level luxury cars). Countries, such as India, had announced their plan to improve the charging infrastructure and set up over 50,000 charging stations across the country but had to put their plans on hold back because of COVID-19.

- With an increase in demand, businesses like Rivian, Ford, Volvo, GM, and Tesla are anticipated to expand their selection of electric pickup trucks in the next years. For instance, in August 2022, Hyundai Motor Company stated that its XCIENT Fuel Cell heavy-duty trucks would be exported to Germany, Europe's largest commercial vehicle market. Seven German logistics, manufacturing, and retail organizations will use 27 XCIENT Fuel Cell trucks in their fleets, owing to support for environmentally friendly commercial vehicles from Germany's Federal Ministry for Digital and Transport.

- In June 2022, Ford officially announced a brand-new electric commercial vehicle that will be manufactured in its Ohio facility for Ford Pro customers and will make its debut in the middle of the decade. At its facilities in Michigan, Ohio, and Missouri, it has also disclosed plans to invest USD 3.7 billion and create more than 6,200 additional union manufacturing jobs.

- Governments around the world have also initiated various schemes and policies which encourage a buyer to choose electric vehicles over conventional vehicles. California ZEV program, which aims at having 1.5 million electric vehicles on the road by 2025, is one such initiative that promotes the purchase of electric vehicles.

- Therefore, with a steady rise in EV adoption, demand for DC-DC power converters shall simultaneously witness growth during the longer-term forecast period.

Asia-Pacific Dominating the Market

- Asia-Pacific holds the majority share in the global electric vehicle market. With countries like China leading the electric vehicle sales, the market is expected to grow significantly in the forecast period.

- China and Japan are inclined toward innovation, technology, and the development of advanced electric vehicles. Moreover, countries such as Indonesia are engaged in large electric mobility projects.

- China is a key player in the global electric vehicle industry. Moreover, the government of China is encouraging people to adopt electric vehicles. The country is planning to completely switch to electric mobility by 2040. The Chinese electric passenger car market is also one of the largest worldwide, and it has been growing rapidly over the last few years and is expected to grow higher in the forecast period, which is also going to have a positive impact on the demand for electric vehicle high voltage DC-DC Converter Market. Several key players in the market are partnering with other players to develop power electronics components.

- For instance, in November 2021, G-Pulse and Silicon Mobility announced a partnership to develop a high voltage multiphase interleaving bidirectional DC-DC converter platform for new energy vehicles (NEVs), such as fuel cell electric vehicles (FCEVs), BEVs, hybrid electric vehicles (HEVs), and PHEVs.

- In May 2021, TDK Corporation (TDK) announced it entered a partnership with Contemporary AmperexTechnology Co., Limited (CATL) to strengthen its businesses, such as electric components for electric vehicles and DC-DC converters. TDK will supply automotive electrical components and power supply products to CATL for automotive power units.

- The Indian electric vehicle market is in its growing stage. Automobile manufacturers in India, such as TATA, Mahindra, MG, etc., are taking initiatives to provide affordable electric driving options. Moreover, the government is also supporting electric mobility to reduce the exhaust emissions of greenhouse gases in the country.

- Additionally, automobile manufacturers in India are also taking initiatives and investing in R&D practices to provide affordable electric cars in India; for instance, in February 2021, Hyundai announced spending USD 0.12 Billion on the development of new affordable EVs. The vehicles would be manufactured locally, and the company is in talks with local vendors to source the components. Hyundai may also seek a strategic partnership with its sister brand, Kia, as it also has plans to add EVs to its portfolio in India. The company is also working on a mass-market, more affordable electric car for India that is expected to debut by 2024.

- Due to the aforementioned factors, the demand for DC-DC converters in vehicles is likely to witness an increase. This is expected to propel the growth of the studied market over the forecast period.

Electric Vehicle High Voltage DC - DC Converter Industry Overview

The key players in the electric vehicle high-voltage DC-DC converter market include Tesla Inc., Toyota Industries Corporation, Denso Corporation, Robert Bosch GmbH, Continental AG, Infineon Technologies, Hella GmbH, and others. These players are investing heavily in R&D in order to gain a competitive edge over other players.

For instance, in April 2022, Toyota Industries Corporation announced the launch of a single compact and lightweight module with an integrated charger and DC/DC converter. This is Toyota's first ESU (Electricity Supply Unit) for usage in electric cars (EVs), and it will be placed as the core unit that handles charging and power conversion operations in the bZ4X. By merging the two components required for EV operation, the business was able to achieve a 23% decrease in size and a 17% reduction in weight when compared to the traditional installation of separate components.

In March 2022, TDK Corporation announced the introduction of additional models to the popular CCG series of isolated DC-DC converters. The 1.5W and 3W rated parts operate convection cooled at full load from -40 to +85°C. All voltage combinations are available with terminations for either surface-mount or through-hole placement. Applications include data and telecommunications, test, measurement, process control, broadcast, and battery-powered equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Adoption of Electric Vehicles

- 4.1.2 Others

- 4.2 Market Restraints

- 4.2.1 Converters Generate Noise During Operation May Hinder the Target Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD Million)

- 5.1 Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Plug-in Hybrid Vehicle

- 5.2.2 Battery Electric Vehicle

- 5.2.3 Fuel Cell Electric Vehicle

- 5.3 Cooling Method

- 5.3.1 Liquid Cooled

- 5.3.2 Air Cooled

- 5.4 Input Voltage

- 5.4.1 200V - 450V

- 5.4.2 450V - 800V

- 5.4.3 800V - 1000V

- 5.5 Output Voltage

- 5.5.1 12V - 24V

- 5.5.2 24V - 48V

- 5.6 Output Power

- 5.6.1 Less Than 2 kW

- 5.6.2 2kW and Above

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Norway

- 5.7.2.7 Poland

- 5.7.2.8 Russia

- 5.7.2.9 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Chile

- 5.7.4.4 Rest of South America

- 5.7.5 Middle-East and Africa

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 South Africa

- 5.7.5.4 Other Countries

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Continental AG

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Valeo Group

- 6.2.4 ABB Ltd.

- 6.2.5 DENSO Corporation

- 6.2.6 Hella GmbH & Co. KGaA

- 6.2.7 Toyota Industries Corporation

- 6.2.8 Infineon Technologies AG

- 6.2.9 Texas Instruments

- 6.2.10 STMicroelectronics

- 6.2.11 TDK-Lambda Corporation

- 6.2.12 Shinry Technologies

- 6.2.13 Delta Electronics

- 6.2.14 Vicor Corporation

- 6.2.15 Hyundai Mobis Ltd.