|

市场调查报告书

商品编码

1441556

客车:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Bus - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

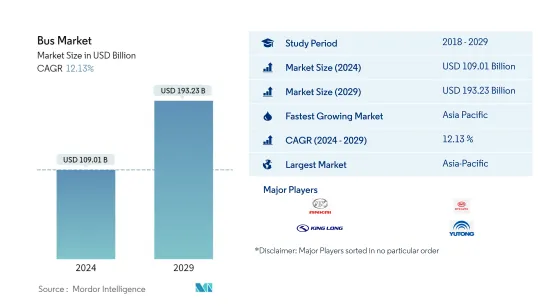

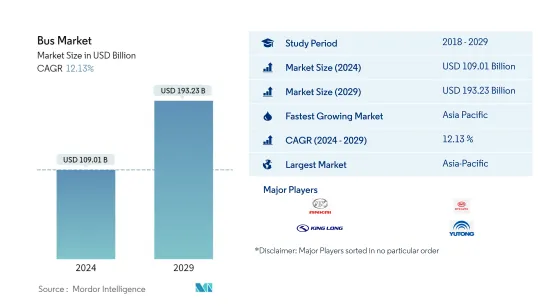

客车市场规模预计到 2024 年为 1,090.1 亿美元,预计到 2029 年将达到 1932.3 亿美元,在预测期内(2024-2029 年)复合年增长率为 12.13%。

客车市场是交通运输业一个充满活力且重要的部门,满足不同地区和应用的各种客运需求。巴士是城市内和城际旅行、学校交通、旅游等经济高效的交通途径。

随着城市和都市区的不断扩张,对高效、永续的大众交通工具系统的需求变得至关重要。公车在满足这一需求方面发挥关键作用,为公共交通提供了经济高效的解决方案。各国政府和城市当局正在投资扩大和现代化其公车车队,以改善大众交通工具基础设施并减少拥塞和排放气体。

对环境永续性和减少碳排放的日益关注正在推动向电动和混合公车的转变。利用电池技术的电动公车由于其零排放能力、降低的营运成本和提高的能源效率而变得越来越受欢迎。政府和大众交通工具营运商越来越多地采用电动和混合公车,推动了该领域的市场成长。

巴士产业正在经历重大技术进步,旨在提高乘客舒适度、安全性和营运效率。其中包括改进的座椅布置、先进的资讯娱乐系统、整合连接选项、驾驶员辅助系统和智慧车队管理解决方案等功能。技术创新透过改善乘客体验和优化营运效率来推动市场。

新兴国家不断增长的中产阶级人口正在推动对包括公共汽车在内的个人交通的需求。随着可支配收入的增加,越来越多的个人和家庭正在寻求负担得起的交通选择。公车是城镇内经济的通勤交通途径,对中产阶级消费者来说是个有吸引力的选择。

快速成长的经济体,特别是亚太和拉丁美洲地区,对客车的需求庞大。这些市场的特点是都市化加快、基础设施发展和可支配收入增加。这些地区的政府正在投资大众交通工具系统并扩大公车队,以满足不断增长的交通需求。

客车市场还包括丰富的售后市场部分,提供维修、维修和备件服务。售后服务在确保巴士车队的使用寿命和最佳性能方面发挥着重要作用。服务供应商和製造商专注于提供高效可靠的售后支持,以保持客户满意度和忠诚度。

总体而言,由于都市化、环境问题、技术进步和不断变化的消费者偏好等因素,客车市场正在经历稳定成长和转型。随着政府、交通当局和製造商继续投资改善大众交通工具基础设施和引入永续交通解决方案,该产业有望进一步扩张。

客车市场趋势

电动巴士的普及可能会推动目标市场的成长

燃油是车辆运作成本的重要组成部分。随着燃油价格上涨,从长远来看,使用电动巴士作为大众交通工具可以为您节省开支。与柴油公车相比,电动公车可节省 81-83% 的维护和营运成本。电动公车比汽油或柴油公车更适合乘客。与传统柴油公车不同,电动公车的 NVH 水平可以忽略不计,从而提高了乘客的舒适度。

电动公车製造商正在投资开发更好的产品,这可能会增加未来几年对公车的需求。例如,

- 2022 年 5 月,在北美最大的先进交通技术和清洁车队盛会——先进清洁交通 (ACT) 博览会上,蓝鸟公司推出了其独特且开创性的 5-6 级电动车平台。燃油成本占车辆寿命的很大一部分。营业费用。使用电动公车作为大众交通工具可以降低总拥有成本和其他初始成本。

此外,电动公车的成本为 750,000 美元,而典型的柴油运输车辆的成本为 500,000 美元。电动公车的初始成本较高,但却是经济高效的替代方案。由于维护和燃料支出较低,因此营运成本较低,由于电价与石化燃料价格相比相对稳定,成本可预测性更高,从而可以在产品的使用寿命内显着节省成本。

有利的立法使电动公车在经济上可行。电动公车製造商声称这些车辆可节省 40 万美元的燃油和约 125,000 美元的维护费用,这可以抵消较高的初始成本。这些车辆具有更长的使用寿命、更低的维护成本和更高的舒适度,因为运行过程中的振动和移动机械部件被最小化。

虽然电动巴士生态系统的组成部分正在按照既定的政府法规实施,但安装和管理电动巴士充电站的紧迫挑战需要在规划、责任和营运方面的高度参与。

亚太地区是最大的区域市场

亚太地区作为客车市场的最大部分占有重要地位。有几个因素导致其在市场规模、需求和成长机会方面占据主导地位。

世界人口很大一部分集中在亚太地区,中国、印度等国人口众多。这些国家的快速都市化增加了对高效、可靠的大众交通工具系统的需求,以满足人口稠密城市的交通需求。公车在满足不断增长的城市人口的通勤需求方面发挥着重要作用。

亚太地区许多国家正在经历强劲的经济成长,导致生活水准提高和可支配收入增加。经济发展增加了对个人和大众交通工具的需求。该地区各国政府正在投资交通网络等基础设施发展,以支持经济成长,包括扩大和升级公车队。

亚太地区各国政府正积极推广大众交通工具,以此作为解决交通拥挤、减少污染和改善流动性的手段。正在实施各种政策和措施来支持大众交通工具系统的扩张,包括发展快速公车(BRT)网路、购买公车补贴以及基础设施投资。这些支持措施为客车市场的发展创造了良好的环境。

此外,亚太地区不断增长的中阶人口也是巴士市场的主要动力。随着收入的增加,越来越多的人正在寻求负担得起且便利的交通途径。公车为城市交通,尤其是城市内的日常通勤提供了一种经济高效的解决方案。中产阶级不断增长的购买力和对个人出行的渴望导致对公车的需求不断增长。

此外,亚太地区正在成为电动公车的主要市场。中国等国家正在寻求政府的大力支持和激励措施来鼓励使用电动车(包括公车),作为应对空气污染和减少对石化燃料依赖的努力的一部分。中国製造商在全球电动客车市场占据主导地位,其产能有助于该地区在该领域的领先地位。

- 例如,各国交通主管机关都在大力推动电动公车在大众交通工具中的引进。亚太地区的采用率正在上升。 UITP预计,2021年电动客车占全球客车总销量的份额将为10%,预计2022年将超过40%。 2021年,印度售出近1,245辆电动公车。

- 2022 年 8 月,印度政府核准了一项 100 亿美元的巨额预算,作为清洁能源计画有限公司 (CESL) 的一部分,促进到 2030 年采购 50,000 辆电动公车。为了配合这项渐进倡议,德里交通公司 (DTC) 宣布到 2025 年将拥有 8,000 辆电动公车。

此外,着名汽车製造商塔塔汽车公司在同月获得了一份巨额订单,根据 CESL 计划向西孟加拉邦运输公司 (WBTC) 供应 1,180 辆电动巴士。此举是增强该地区永续大众交通工具选择的重要一步。

亚太地区正在快速都市化,导致出现拥有数百万居民的特大城市。这些人口稠密的都市区需要高效且永续的交通解决方案,以应对与人口密度和拥塞相关的交通挑战。公共汽车是这些城市环境中必不可少的交通途径,因为它们可以运载大量乘客。

亚太地区在全球公车市场的主导地位是由其人口规模、经济成长、政府支持政策以及对高效城市交通解决方案的需求所推动的。

由于都市化的加快、可支配收入的增加以及环境永续性意识的增强,预计该地区对客车的需求将继续增长,这给客车行业的製造商、供应商和服务供应商带来了重大挑战,但同时也带来了市场机会。

客车业概况

客车市场整合程度较高,前五大企业占较大市场占有率。该市场的主要企业包括北汽集团、长安汽车集团、东风汽车集团、江铃汽车集团、上汽集团、厦门金龙汽车集团和宇通客车集团。例如,

- 2022年8月,派力肯宣布推出新款小型零排放车宇通E9。 E9长8.94米,宽2.42米。将较小的 E9 纳入我们的零排放系列是一项值得欢迎的发展。

- 宇通产品为消费者提供了真正的选择,拥有三种不同的单层尺寸和英国第一辆零排放客车。 E9 的尺寸和可操作性使其成为各种应用的理想选择。首批车辆目前正在生产中,并已收到订单,将于 2023 年 3 月交付。

- Switch EiV22 于 2022 年 8 月推出,是印度第一辆双层电动巴士,完全在印度设计和製造,以利用 Switch 在全球的电动巴士经验。它采用尖端技术和超现代设计,具有严格的安全要求和一流的舒适功能。

- 重新设计的着名双层巴士旨在透过创建城市公车的新标准来改变该国的大众交通工具。

- 2022 年 4 月:Proterra 推出新型 ZX5 电动公车,能源为 738 千瓦时。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 都市化进程和人口成长

- 其他的

- 市场限制因素

- 与其他交通途径的竞争

- 其他的

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 按类型

- 单层

- 双层

- 按用途

- 交通巴士

- 城际巴士/大型巴士

- 校车

- 其他用途

- 按燃料类型

- 柴油引擎

- 电池电动

- 插电式混合

- 燃料电池电力

- 其他燃料类型

- 按座位数

- 少于30个座位

- 31-50个座位

- 50个座位或以上

- 按长度

- 小于9米

- 9米至12米

- 12米以上

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Mercedes-benz Group Ag

- Ab Volvo

- Byd Motors Inc.

- Jiangling Motors Co. Group

- BAIC Group

- Xiamen King Long Motor Group

- Shanghai Automotive Industry Corporation

- Changan Automobile Group

- Dongfeng Motor Corp.

- Yutong Bus Group

第七章市场机会与未来趋势

The Bus Market size is estimated at USD 109.01 billion in 2024, and is expected to reach USD 193.23 billion by 2029, growing at a CAGR of 12.13% during the forecast period (2024-2029).

The bus market is a dynamic and vital sector of the transportation industry, catering to various passenger transportation needs across different regions and applications. Buses serve as a cost-effective and efficient mode of transportation for both urban and intercity travel, school transportation, tourism, and more.

As cities and urban areas continue to expand, the need for efficient and sustainable public transportation systems becomes crucial. Buses play a vital role in meeting this demand, offering a cost-effective solution for mass transit. Governments and city authorities are investing in bus fleet expansion and modernization to improve public transportation infrastructure and reduce congestion and emissions.

With the increasing focus on environmental sustainability and reducing carbon emissions, there has been a growing shift towards electric and hybrid buses. Electric buses, powered by battery technology, are gaining popularity due to their zero-emission capabilities, reduced operating costs, and improved energy efficiency. Governments and public transport operators are increasingly adopting electric and hybrid buses, driving market growth in this segment.

The bus industry is experiencing significant technological advancements aimed at enhancing passenger comfort, safety, and operational efficiency. These include features such as improved seating arrangements, advanced infotainment systems, integrated connectivity options, driver assistance systems, and intelligent fleet management solutions. Technological innovations are driving the market by offering enhanced passenger experiences and optimizing operational efficiencies.

The rising middle-class population in developing countries is contributing to the demand for personal transportation, including buses. As disposable incomes increase, more individuals and families are seeking affordable mobility options. Buses provide an economical mode of transportation for commuting within cities and towns, making them an attractive choice for middle-class consumers.

Rapidly growing economies, particularly in the Asia-Pacific and Latin American regions, are witnessing significant demand for buses. These markets are characterized by increasing urbanization, infrastructure development, and rising disposable incomes. Governments in these regions are investing in public transportation systems and expanding their bus fleets to cater to growing transportation needs.

The bus market also includes a substantial aftermarket segment, offering maintenance, repair, and spare parts services. Aftermarket services play a vital role in ensuring the longevity and optimal performance of bus fleets. Service providers and manufacturers are focusing on providing efficient and reliable aftermarket support to sustain customer satisfaction and loyalty.

Overall, the bus market is experiencing steady growth and transformation driven by factors such as urbanization, environmental concerns, technological advancements, and evolving consumer preferences. The industry is poised for further expansion as governments, transport authorities, and manufacturers continue to invest in improving public transportation infrastructure and adopting sustainable mobility solutions.

Bus Market Trends

INCREASING ADOPTION OF ELECTRIC BUSES MAY PROPEL THE TARGET MARKET GROWTH

Fuel is a significant component of any vehicle's operational costs. With rising fuel prices, utilizing an electric bus for public transportation saves money in the long term. If we compare a diesel engine bus, electric buses save 81-83% on maintenance and operational costs. Electric buses are more comfortable for passengers than gasoline or diesel buses. Unlike traditional diesel buses, the NVH levels in electric buses are negligible, providing passengers with increased comfort.

Electric Bus manufacturing companies are making the investment to develop better product which might boost the demand for buses in upcoming years. For instance,

- In May 2022, at the advanced clean transportation (act) expo, North America's largest advanced transportation technology and clean fleet event, Blue Bird Corporation unveiled a unique pioneering class 5-6 electric vehicle platformThe cost of fuel makes up a sizable portion of any vehicle's operational expenses. Utilizing an electric bus for public transportation lowers the total cost of ownership and other upfront expenditures.

Additionally, in electric bus costs USD 750,000 compared to USD 500,000 for a typical diesel transit vehicle. Despite their higher initial costs, electric buses are a cost-effective alternative. They offer lower operating costs due to their lower maintenance and fuel expenditures, as well as greater cost predictability due to the relative stability of electricity prices compared to fossil fuel prices, resulting in significant savings over the course of their lifetime.

With favorable legislation, electric buses are more financially feasible. Manufacturers of electric buses assert that these vehicles make up for their higher initial cost, with fuel savings of USD 400,000 and maintenance savings of about USD 125,000. These vehicles have a prolonged life, low maintenance costs, and higher comfort due to the minimal vibrations and moving mechanical parts during operation.

Although the components of the e-bus ecosystem are being implemented in accordance with established government regulations, the immediate challenge of setting up and managing e-bus charging stations in terms of planning, the scope of responsibilities, and operation must be addressed on a high-priority basis.

Asia-Pacific is the largest segment by Region

The Asia-Pacific region holds a prominent position as the largest segment in the bus market. Several factors contribute to its dominance in terms of market size, demand, and growth opportunities.

The Asia-Pacific region is home to a significant portion of the world's population, with countries such as China and India having massive populations. As these countries continue to urbanize rapidly, there is a growing need for efficient and reliable public transportation systems to meet the transportation demands of densely populated cities. Buses play a crucial role in catering to the commuting needs of the expanding urban population.

Many countries in the Asia-Pacific region are experiencing robust economic growth, leading to improved living standards and increased disposable incomes. This economic progress has contributed to an increase in demand for personal transportation and public transportation systems. Governments in the region are investing in infrastructure development, including transportation networks, to support economic growth, which includes expanding and upgrading bus fleets.

Governments across the Asia-Pacific region are actively promoting public transportation as a means to address traffic congestion, reduce pollution, and improve mobility. Various policies and initiatives are being implemented to support the expansion of public transportation systems, including the development of bus rapid transit (BRT) networks, subsidies for purchasing buses, and investments in infrastructure. These supportive measures create a favorable environment for the growth of the bus market.

Additionally, the expanding middle-class population in the Asia-Pacific region is a key driver for the bus market. As incomes rise, more individuals are seeking affordable and convenient transportation options. Buses provide a cost-effective solution for urban mobility, particularly for daily commuting within cities. The middle-class population's increasing purchasing power and desire for personal mobility contribute to the growing demand for buses.

Moroever, the Asia-Pacific region has emerged as a leading market for electric buses. Countries such as China have witnessed significant government support and incentives to encourage the adoption of electric vehicles, including buses, as part of their efforts to combat air pollution and reduce dependence on fossil fuels. Chinese manufacturers dominate the electric bus market globally, and their production capabilities have contributed to the region's leadership in the segment.

- For instance, Transit agencies across various countries have been significantly promoting the adoption of electric buses for public transportation. The adoption rate is climbing in the Asia Pacific. According to UITP, the global share of electric buses among the entire bus sale will be 10% in 2021 and is expected to cross 40% market share in 2022. Nearly 1245 electric buses were sold in India in the year 2021

- In August 2022, the Government of India sanctioned a substantial budget of USD 10 billion to facilitate the procurement of 50,000 electric buses by the year 2030 as part of the Clean Energy Scheme Limited (CESL). In line with this progressive initiative, the Delhi Transport Corporation (DTC) has declared its commitment to introduce 8,000 electric buses into its fleet by the year 2025.

Additionally, Tata Motors Ltd., a renowned automotive manufacturer, secured a significant order in the same month to supply 1,180 electric buses to the West Bengal Transport Corporation (WBTC) under the CESL program. This move represents a significant stride towards enhancing eco-friendly and sustainable public transportation options in the region.

The Asia-Pacific region is witnessing rapid urbanization, leading to the emergence of megacities with millions of inhabitants. These densely populated urban areas require efficient and sustainable transportation solutions to address the mobility challenges associated with population density and congestion. Buses, with their ability to carry a large number of passengers, provide an essential transportation mode in these urban environments.

The Asia-Pacific region's dominance in the global bus market is driven by its population size, economic growth, supportive government policies, and the need for efficient urban transportation solutions.

With ongoing urbanization, rising disposable incomes, and increasing awareness of environmental sustainability, the demand for buses is expected to continue growing in this region, presenting significant market opportunities for manufacturers, suppliers, and service providers in the bus industry.

Bus Industry Overview

Bus market is fairly consolidated, with the top five companies occupying significant market share. The major players in this market are BAIC Group, Changan Automobile Group, Dongfeng Motor Corp., Jiangling Motors Co. Group, Shanghai Automotive Industry Corporation, Xiamen King Long Motor Group, and Yutong Bus Group. For Instance,

- In August 2022, Pelican announced in August the debut of the Yutong E9, a new, smaller zero-emission car. The E9 measures 8.94 meters in length and 2.42 meters in width. The inclusion of the smaller E9 in our zero-emission offering is a welcome development.

- The Yutong product gives consumers true choice, with three distinct single deck sizes and the first zero-emission coach in the United Kingdom. The E9's size and maneuverability make it perfect for a variety of applications. The first car is now being built, and orders have already been placed for delivery in March 2023.

- In August 2022, The Switch EiV22 is India's first electric double-decker bus, designed, and manufactured completely in India to leverage Switch's global electric bus experience. It has cutting-edge technology and an ultra-modern design that includes stringent safety requirements as well as best-in-class comfort features.

- The redesigned famous double-decker bus is intended to change public transportation in the country by creating new intra-city bus norms.

- April 2022: Proterra introduced the new ZX5 electric bus with 738 kilowatt hours of energy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Urbanization And Population Growth

- 4.1.2 Others

- 4.2 Market Restraints

- 4.2.1 Competition From Other Modes Of Transportation

- 4.2.2 Others

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Single Deck

- 5.1.2 Double Deck

- 5.2 By Application

- 5.2.1 Transit Bus

- 5.2.2 Intercity Bus/Motorcoaches

- 5.2.3 School Bus

- 5.2.4 Other Applications

- 5.3 By Fuel Type

- 5.3.1 Diesel

- 5.3.2 Battery Electric

- 5.3.3 Plug-in Hybrid

- 5.3.4 Fuel Cell Electric

- 5.3.5 Other Fuel Type

- 5.4 By Seating Capacity

- 5.4.1 Up to 30 Seats

- 5.4.2 31 - 50 Seats

- 5.4.3 More Than 50 Seats

- 5.5 By length

- 5.5.1 Up to 9 Meters

- 5.5.2 9 Meters - 12 Meters

- 5.5.3 More Than 12 Meters

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Rest of the world

- 5.6.4.1 South America

- 5.6.4.2 Middle-East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share**

- 6.2 Company Profiles*

- 6.2.1 Mercedes-benz Group Ag

- 6.2.2 Ab Volvo

- 6.2.3 Byd Motors Inc.

- 6.2.4 Jiangling Motors Co. Group

- 6.2.5 BAIC Group

- 6.2.6 Xiamen King Long Motor Group

- 6.2.7 Shanghai Automotive Industry Corporation

- 6.2.8 Changan Automobile Group

- 6.2.9 Dongfeng Motor Corp.

- 6.2.10 Yutong Bus Group