|

市场调查报告书

商品编码

1441574

汽车金属冲压 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Automotive Metal Stamping - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

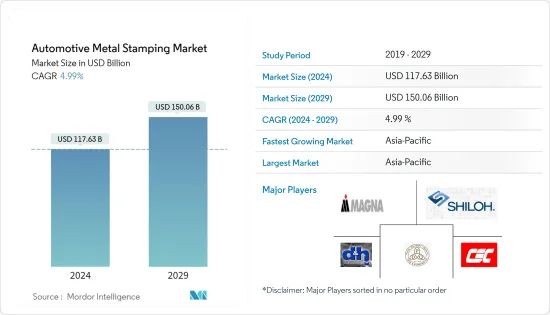

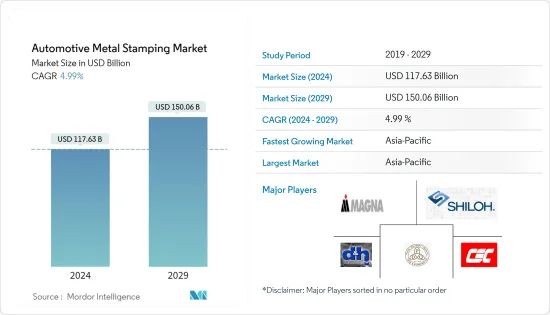

2024年汽车金属冲压市场规模预计为1176.3亿美元,预计到2029年将达到1500.6亿美元,在预测期内(2024-2029年)CAGR为4.99%。

全球汽车产量的增加和乘用车需求的增加可能会见证汽车金属冲压市场的大幅成长。然而,随着为了提高燃油效率和减轻车辆重量而缩小引擎尺寸的趋势不断增长,预计铝等轻质金属将在汽车金属冲压公司中出现巨大需求。这可能会见证汽车金属冲压市场的显着成长。

雷射金属冲压和液压金属冲压等不断发展的技术进步有助于降低製造成本,可能会推动汽车金属冲压市场的发展。製造业的快速扩张也推动了全球汽车金属冲压市场的发展。

金属广泛应用于汽车工业。重点整车厂与汽车冲压企业签订製造合同,是后者业务拓展的重要来源。因此,汽车生产趋势和针对汽车成分的政策框架对汽车金属冲压产业产生重大影响。

汽车金属冲压市场趋势

冲裁工艺领域将占据重要的市场份额 -

金属冲压在汽车行业中的使用日益广泛,见证了市场的大幅增长。冲裁製程可以执行长时间的生产,这需要对机械或基材进行微小的改变。主要汽车产业更喜欢将冲裁製程作为生产大批量零件的常用製程。对高效车辆不断增长的需求导致了创新和独特的外部车身结构的设计,并考虑了空气动力学效率。冲裁金属冲压提供了将金属製造成更小、更易于管理的零件的技术,以便更紧密地包装在车辆内部和周围。

一些参与者正在与原始设备製造商建立业务合作伙伴关係,这见证了金属冲压市场的重大成长。例如,

- 2023 年 2 月,Fischer 集团在其 Achern 总部推出了尖端的 TruLaser 8000 Coil Edition 下料,实现了与通快合作的里程碑。此创新系统可自主加工多达 25 吨的捲状金属板材,透过提高材料利用率和资源效率,彻底改变金属板材生产。该技术最初专注于汽车行业 Fischer 热成型产品的铝冲裁,标誌着重大飞跃。

雷射技术的进步,例如使用雷射冲裁技术支援的钣金冲压机,正在对市场产生积极影响。主要汽车零件製造中落料製程自动化程度的提升是落料製程的关键因素。由于这些因素,预计将在预测期内提振金属冲压市场。

亚太地区预计将主导目标市场 -

预计亚太地区将占据汽车冲压市场的大部分份额。该地区可支配收入的增加和全球国内生产总值的成长正在推动市场。汽车零件製造的便利性、汽车销售以及日益严格的政府法规改善了电动车的采用,以及该地区原始设备製造商和供应商为满足亚太地区汽车行业不断增长的需求而采取的强劲扩张,预计将创造正面的影响预测期内的市场成长前景。

从年销量和製造产量来看,中国仍然是全球最大的汽车市场,预计到2025年国内产量将达到3500万辆。根据中国汽车工业协会的资料,2022年汽车销量将超过2690万辆,较2021年成长3.46%。2022 年印度年销量为380 万台,较2021 年的370 万台成长超过25%。 2022年,印度乘用车产业经历了数个破纪录的年份。

该地区的几家製造商正在引入不同的业务策略来迎合金属冲压市场的需求。例如,在2023年1月,2023年汽配展上,海斯坦普宣布在印度兴建第四条热冲压生产线。这款新设备加入了印度浦那现有的烫印生产线。该公司强调,此举符合其印度和全球战略。它旨在拉近与客户的距离,并就製造商附近的解决方案进行协作。

由于上述因素,预计该行业将以合理的速度成长,从而增强预测期内汽车金属冲压市场的需求。

汽车金属冲压产业概况

汽车金属冲压市场有多家参与者,例如 Clow Stamping Company.、D&H Industries Inc.、Shiloh Industries Inc.、PDQ Tool & Stamping Co、Magna International Inc. 和 Integrity Manufacturing。一些公司正在利用新的创新技术扩大业务范围,以便比竞争对手更具优势。然而,市场分散,有多家本地企业在市场上运作。例如,

- 2023 年 2 月,Fischer 集团在其 Achern 总部推出了尖端的 TruLaser 8000 Coil Edition 下料,实现了与通快合作的里程碑。此创新系统可自主加工多达 25 吨的捲状金属板材,透过提高材料利用率和资源效率,彻底改变金属板材生产。该技术最初专注于汽车行业 Fischer 热成型产品的铝冲裁,标誌着重大飞跃。

- 2022 年 9 月,通用汽车宣布投资 4.91 亿美元,以提高其位于美国印第安纳州马里恩金属冲压工厂的钢和铝冲压件的产量,用于未来产品,包括电动车。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场驱动因素

- 预计汽车产量的增加将提振市场

- 市场限制

- 原物料价格波动可能会阻碍市场成长

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场区隔(以美元计的市场规模)

- 科技

- 消隐

- 压花

- 铸造

- 翻边

- 弯曲

- 其他技术

- 流程

- 滚压成型

- 烫金

- 钣金成型

- 金属加工

- 其他流程

- 车辆类型

- 搭乘用车

- 商务车辆

- 地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太

- 印度

- 中国

- 日本

- 韩国

- 亚太其他地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第 6 章:竞争格局

- 供应商市占率

- 公司简介

- Clow Stamping Company

- D&H Industries

- Magna International Inc.

- PDQ Tool & Stamping Co.

- Alcoa Inc.

- Shiloh Industries Inc.

- Manor Tool & Manufacturing Company

- Lindy Manufacturing

- American Industrial Company

- Tempco Manufacturing

- Wisconsin Metal Parts Inc.

- Goshen Stamping Co. Inc.

- Interplex Industries Inc.

第 7 章:市场机会与未来趋势

The Automotive Metal Stamping Market size is estimated at USD 117.63 billion in 2024, and is expected to reach USD 150.06 billion by 2029, growing at a CAGR of 4.99% during the forecast period (2024-2029).

Rising vehicle production and an increase in demand for passenger vehicle across the globe is likely to witness major growth in the automotive metal stamping market. However, with the growing trend toward engine downsizing in order to enhance fuel efficiency and lighter vehicles, lightweight metals such as aluminum are expected to witness huge demand among automotive metal stamping companies. This is likely to witness significant growth in the automotive metal stamping market.

Growing technology advancements such as laser metal stamping and hydraulic metal stamping, which help to reduce manufacturing cost, is likely to fuel the automotive metal stamping market. The rapid expansion of manufacturing industries is also fuelling the automotive metal stamping market across the globe.

Metals are widely used in the automotive industry. Key original equipment manufacturers have established manufacturing contracts with automotive stamping companies, which are an important source of business expansion for the latter. As a result, automotive production trends and policy frameworks aimed at automobile composition have a significant impact on the automotive metal stamping industry.

Automotive Metal Stamping Market Trends

Blanking Process Segment to Hold Significant Market Share -

The growing use of metal stamping in the automotive industry is witnessing major growth in the market. The blanking process can perform long production runs which require minor changes to the machinery or base material. Major automotive industries prefer the blanking process as the process commonly used to produce mass components. The rising demand for efficient vehicles has led to the design of innovative and unique outer body structures, with aerodynamic efficiency in consideration. Blanking metal stamping offers the technology to fabricate metal into smaller and more manageable pieces to be more tightly packaged in and around vehicles.

Several players are introducing business partnerships with the original equipment manufacturers which is witnessing major growth in the metal stamping market. For instance,

- In February 2023, Fischer Group achieved a milestone in its partnership with TRUMPF by introducing the cutting-edge TruLaser 8000 Coil Edition blanking at its Achern headquarters. This innovative system autonomously processes up to 25 tons of coiled sheet metal, revolutionizing sheet metal production with enhanced material utilization and resource efficiency. Initially focused on aluminum blanking for Fischer's hot-forming products in the automotive industry, this technology marks a significant leap forward.

Advancements in laser technology, such as the usage of laser blanking technology supported sheet metal stamping machines, are positively affecting the market. The rise in automation in the blanking process in major automotive component manufacturing is a key factor for the blanking process. Owing to such factors is anticipated to boost the metal stamping market over the forecast period.

Asia-Pacific Region is Expected to Dominate the Target Market -

The Asia-Pacific region is expected to have a majority share in the automotive stamping market. Rising disposable income and an increase in global domestic product in the region are driving the market. Ease of manufacturing auto parts, vehicle sales, and growing government regulations improving electric vehicles adoption and robust expansion adopted by original equipment manufacturers and suppliers in the region to accommodate rising demand from the automotive industry across the Asia-Pacific region is expected to create a positive outlook for market growth during the forecast period.

China continues to be the world's largest automobile vehicle market by both annual sales and manufacturing output, with domestic production expected to reach 35 million vehicles by 2025. Based on data from the China Association of Automobile Manufacturers, over 26.9 million vehicles were sold in 2022, an increase of 3.46% from 2021. India finished 2022 with annual sales of 3.8 million units, up more than 25% from 2021's 3.7 million units. The passenger vehicle industry in India experienced several record-breaking years in 2022.

Several manufacturers in the region are introducing different business strategies to cater to the metal stamping market offerings. For instance, In January 2023, Auto Expo 2023- Components, Gestamp announced its fourth hot stamping production line in India. This new addition joins the existing hot stamping lines in Pune, India. The company emphasizes that this move aligns with its strategy for India and worldwide. It aims to foster proximity to customers and collaborate on solutions near manufacturers.

Owing to these aforementioned factors, the sector is expected to grow at a reasonable rate, enhancing the demand in the automotive metal stamping market during the forecast period.

Automotive Metal Stamping Industry Overview

The automotive metal stamping market has the presence of several players, such as Clow Stamping Company., D&H Industries Inc., Shiloh Industries Inc., PDQ Tool & Stamping Co., Magna International Inc., and Integrity Manufacturing. Several companies are expanding their footprints with new innovative technologies so that they can have an edge over their competitors. However, the market is fragmented with several local players operating in the market. For instance,

- In February 2023, Fischer Group achieved a milestone in its partnership with TRUMPF by introducing the cutting-edge TruLaser 8000 Coil Edition blanking at its Achern headquarters. This innovative system autonomously processes up to 25 tons of coiled sheet metal, revolutionizing sheet metal production with enhanced material utilization and resource efficiency. Initially focused on aluminum blanking for Fischer's hot-forming products in the automotive industry, this technology marks a significant leap forward.

- In September 2022, General Motors Co. announced an investment of USD 491 million to boost the production of steel and aluminum stamped parts for future products, including electric vehicles, at its Marion metal stamping facility in Indiana, United States.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Automobile Production is Anticipated to Boosts the Market

- 4.2 Market Restraints

- 4.2.1 Fluctuating Raw Material Prices May Hinder the Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD)

- 5.1 Technology

- 5.1.1 Blanking

- 5.1.2 Embossing

- 5.1.3 Coining

- 5.1.4 Flanging

- 5.1.5 Bending

- 5.1.6 Other Technologies

- 5.2 Process

- 5.2.1 Roll Forming

- 5.2.2 Hot Stamping

- 5.2.3 Sheet Metal Forming

- 5.2.4 Metal Fabrication

- 5.2.5 Other Processes

- 5.3 Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Clow Stamping Company

- 6.2.2 D&H Industries

- 6.2.3 Magna International Inc.

- 6.2.4 PDQ Tool & Stamping Co.

- 6.2.5 Alcoa Inc.

- 6.2.6 Shiloh Industries Inc.

- 6.2.7 Manor Tool & Manufacturing Company

- 6.2.8 Lindy Manufacturing

- 6.2.9 American Industrial Company

- 6.2.10 Tempco Manufacturing

- 6.2.11 Wisconsin Metal Parts Inc.

- 6.2.12 Goshen Stamping Co. Inc.

- 6.2.13 Interplex Industries Inc.