|

市场调查报告书

商品编码

1639393

电子货架标籤:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Electronic Shelf Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

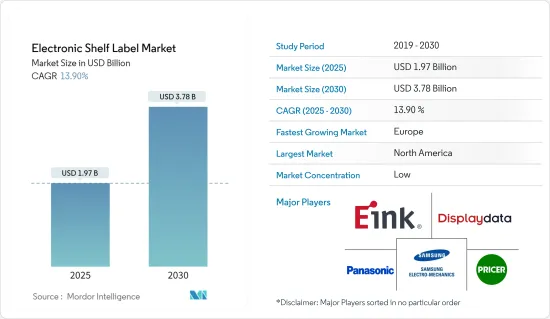

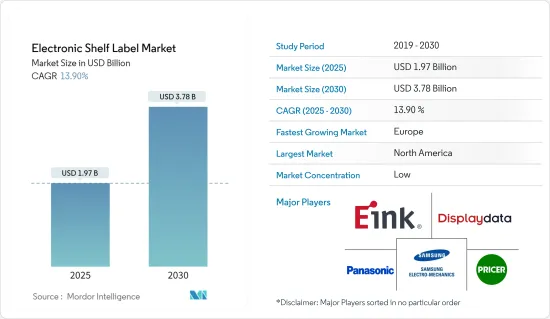

电子货架标籤市场规模预计在 2025 年为 19.7 亿美元,预计到 2030 年将达到 37.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.9%。

电子货架标籤 (ESL) 市场正在全球零售业中迅速普及,这主要得益于提高自动化程度、提高业务效率和改善客户体验的需求。 ESL技术为零售商提供了现代化的解决方案,透过电子价格标籤实现动态定价和即时产品资讯更新。作为零售自动化技术大趋势的一部分,ESL 系统简化了店内营运并改善了客户互动。大型超级市场和大卖场尤其专注于利用智慧零售解决方案来在数位化保持竞争力。

主要亮点

- 节能电子纸货架标籤正在彻底改变零售业:电子纸货架标籤因其低功耗和与零售环境中的物联网相容性而越来越受欢迎。无线货架标籤正在进一步改变零售商的库存管理和定价策略。这些技术取代了传统的、劳动密集的纸质标籤,并允许直接从集中管理系统更新电子价格显示。零售展示技术的采用对于智慧商店解决方案和物联网主导的零售业务至关重要。

- 智慧零售解决方案的策略重点:零售商正在采用 ESL 等智慧零售解决方案,作为提高业务效率和客户满意度的更大策略的一部分。这种转变与动态定价系统的日益采用相吻合,该系统允许零售商根据需求和竞争即时调整价格。但挑战依然存在,特别是对于面临前期投资和整合复杂性的小型零售商而言。儘管如此,ESL 技术的市场前景仍然看好,零售数位电子看板和其他智慧商店技术的需求不断增长推动着成长。

非接触式付款技术推动市场创新

主要亮点

- 透过 NFC 整合增强 ESL 功能:近距离场通讯(NFC) 技术是零售业采用 ESL 的主要驱动力。支援 NFC 的设备可以与 ESL 系统通讯,并透过智慧型手机向客户提供即时产品资讯和动态定价。这一趋势与零售业中物联网的兴起齐头并进,因为企业的目标是创造无缝、互联的购物体验。将电子价格显示系统与您的销售点 (POS) 基础架构结合可提高交易速度并提高整体客户满意度。

- NFC 技术促进非接触式付款:支援 NFC 的 ESL 系统允许消费者透过智慧型手机与数位价格标籤进行交互,从而提高购物便利性。随着 NFC 全球应用的成长,它为零售商提供了将价格更新、促销和其他零售自动化技术整合到一个有凝聚力的系统中的新机会。这种整合可以实现更快的结帐流程和即时价格调整,为您的客户提供更快捷的购物体验。

- 与 ESL 连结的动态定价系统:与支援 NFC 的 ESL 整合的动态定价系统正在彻底改变零售体验。这些系统可以根据供需波动即时改变价格,使零售商在快节奏的市场中占据竞争优势。随着越来越多的消费者采用支援 NFC 的行动付款系统,对 ESL 解决方案的需求预计将成长,从而推动未来几年的市场成长。

初期投资高是进入的障碍

主要亮点

- 高昂的前期成本限制了 ESL 的采用:儘管 ESL 技术具有长期优势,但采用该技术所带来的高昂前期成本仍然是中小型零售商面临的重大障碍。购买电子纸货架标籤、电池和通讯系统等硬体的费用以及整合到现有基础设施的成本是投资零售自动化技术的主要障碍。这种限制正在减缓 ESL 系统的采用,尤其是在新兴市场。

- 初始成本由长期节省所抵消:虽然 ESL 系统的前期投资很大,但它通常可以透过长期节省的人事费用和提高定价准确性来抵消。这减少了手动更新的需要并提高了自动化系统的效率,这对于大型零售连锁店来说是一项很好的投资。然而,小型零售商可能难以将 ESL 系统整合到其现有 POS 和库存管理平台中。

- 整合和维护挑战:维护和升级系统给小型零售企业带来了额外的挑战。将 ESL 系统与现有零售自动化技术结合所涉及的技术复杂性可能会造成资源紧张并减缓整体市场的成长。然而,大型零售连锁店继续采用 ESL 技术,因为它可以提高业务效率并实现即时价格更新。

电子货架标籤 (ESL) 市场趋势

NFC 行动付款有望推动市场成长

- NFC 整合彻底改变了 ESL:NFC 技术的整合正在重塑 ESL 市场,使消费者能够透过智慧型手机与数位价格标籤进行交互,并实现更快的行动付款。这项技术创新将透过提高交易速度和提供即时产品资讯来改善顾客的购物体验。

- 透过动态定价提高商店效率:连接到支援 NFC 的 ESL 的自动定价系统允许零售商根据需求、竞争和市场趋势即时调整价格。这种动态定价系统有助于商店保持竞争力,提供更有效率、更灵活的零售环境并增加销售。

- 电子纸技术提高了业务效率:凭藉极低的功耗和清晰的高解析度显示,电子纸货架标籤正在成为零售企业的首选。这些标籤可以远端更新,减少了手动更改价格的需要并提高了员工效率。作为零售业物联网趋势的一部分,ESL 有助于改善库存管理和商店营运。

- 对智慧零售解决方案的需求不断增长 对智慧商店解决方案的需求正在推动市场成长,其中支援 NFC 的 ESL 系统发挥核心作用。零售商正在投资 ESL 技术以提高客户参与和业务效率,从而促进零售自动化技术的持续扩展。

北美占据主要市场占有率

- 先进的零售基础设施推动 ESL 的采用:北美凭藉其先进的零售自动化技术基础设施引领 ESL 市场。在提高业务效率和客户体验的需求推动下,美国和加拿大的零售商在采用智慧商店解决方案方面处于领先地位。该地区大型零售连锁店的存在导致电子价格显示系统的采用范围更广。

- 物联网整合推动即时效率:北美零售商正在利用支援物联网的 ESL 系统来收集消费行为、存量基准和价格趋势的即时资料。这些资料使零售商能够做出更明智的决策,从而增强库存管理、定价策略和商店营运。

- 零售数位电子看板和电子纸标籤需求旺盛:竞争激烈的北美零售市场正在推动对数位电子看板位看板和电子纸货架标籤的需求。这些技术可以即时更新促销和定价,从而提高店内效率和客户体验。

- 良好的法规环境支援成长:在美国,政府对技术创新的支援正在加速采用 ESL 等零售自动化解决方案。由于零售商越来越关注以客户为中心的技术,例如无线货架标籤和动态定价系统,北美是 ESL 市场成长的关键地区。

电子货架标籤 (ESL) 产业概览

市场分散,参与者多元:ESL市场高度分散,大型公司和专业参与者都在争夺市场占有率。虽然三星马达和松下电器等大型跨国公司占据主导地位,但 Pricer AB 和 Displaydata Ltd 等公司也提供了创新的 ESL 解决方案,从而形成了多样化且竞争激烈的市场环境。

主要企业创新驱动力 E Ink Holdings Inc.、Displaydata Ltd. 和三星马达等公司以其先进的电子显示技术而闻名,对全球零售业产生了重大影响。这些公司透过提供全面的零售自动化解决方案在市场上站稳了脚跟。

技术进步将成为未来市场成功的关键:塑造 ESL 市场未来的主要趋势包括对即时定价更新和智慧零售解决方案的需求不断增长。为了持续的成功,公司需要专注于节能的 ESL 系统、与商店管理系统的无缝整合以及支援动态定价策略的能力。随着无线通讯技术的进步,能够容纳大量库存的公司将能够保持竞争力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 非接触式付款技术推动市场创新

- 市场限制

- 初期投资高是进入的障碍

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 技术简介

- 通讯技术(RF、NFC、IR 等)

- 组件(电池、显示器等)

第六章 市场细分

- 按产品

- LCD ESL

- 电子纸ESL

- 按商店类型

- 大卖场

- 超市场

- 专业和非食品零售商

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- E Ink Holdings Inc.

- Displaydata Ltd

- Samsung Electro-Mechanics Co. Ltd

- Pricer AB

- Panasonic Corporation

- Altierre Corporation

- Diebold Nixdorf

- LG Corporation

- M2 Communication Inc.

- SES-imagotag

- Wincor Nixdorf AG

- AdvanTech Inc.

第八章投资分析

第九章 市场机会与未来趋势

The Electronic Shelf Label Market size is estimated at USD 1.97 billion in 2025, and is expected to reach USD 3.78 billion by 2030, at a CAGR of 13.9% during the forecast period (2025-2030).

The electronic shelf label (ESL) market has seen rising adoption across the global retail sector, driven by the need for enhanced automation, operational efficiency, and improved customer experiences. ESL technology provides a modern solution for retailers, allowing dynamic pricing and real-time product information updates through electronic price tags. As part of the larger trend toward retail automation technology, ESL systems streamline in-store operations while improving customer interactions. Large supermarkets and hypermarkets are especially keen on leveraging smart retail solutions to remain competitive in an increasingly digital landscape.

Key Highlights

- Energy-Efficient E-Paper Shelf Labels Revolutionize Retail Pricing: E-paper shelf labels are gaining popularity due to their low energy consumption and compatibility with IoT in retail environments. Wireless shelf labels have further transformed inventory management and pricing strategies for retailers. These technologies enable electronic price display updates directly from centralized management systems, replacing the traditional, labor-intensive paper tags. The adoption of retail display technology is critical for smart store solutions and IoT-driven retail operations.

- Strategic Focus on Smart Retail Solutions: Retailers are increasingly integrating smart retail solutions, like ESLs, as part of larger strategies to improve operational efficiency and customer satisfaction. This shift aligns with the growing adoption of dynamic pricing systems, allowing retailers to adjust prices in real-time based on demand and competition. However, challenges remain, especially for small retailers facing high initial investments and integration complexities. Nevertheless, the market outlook for ESL technology remains promising, with increasing demand for retail digital signage and other smart store technologies driving growth.

Contactless Payment Technologies Driving Market Innovation

Key Highlights

- NFC Integration Enhances ESL Capabilities: Near-field communication (NFC) technology has become a significant driver of ESL adoption in retail. NFC-enabled devices can communicate with ESL systems, offering customers real-time product information and dynamic pricing through smartphones. This trend is closely connected to the rise of IoT in retail, as businesses aim to create seamless, connected shopping experiences. Integrating electronic price display systems with point-of-sale (POS) infrastructure enhances transaction speeds and improves overall customer satisfaction.

- NFC Technology Facilitates Contactless Payments: NFC-enabled ESL systems enhance shopping convenience by allowing consumers to interact with digital price tags through their smartphones. As NFC penetration increases worldwide, retailers are presented with new opportunities to integrate price updates, promotions, and other retail automation technologies into a cohesive system. This convergence allows for faster checkout processes and immediate price adjustments, offering customers a highly responsive shopping experience.

- Dynamic Pricing Systems Linked to ESLs: Dynamic pricing systems integrated with NFC-enabled ESLs are revolutionizing the retail experience. These systems allow for immediate price changes based on fluctuating demand and supply, giving retailers a competitive edge in a fast-paced market. As more consumers adopt NFC-enabled mobile payment systems, the demand for ESL solutions is expected to rise, driving market growth in the coming years.

High Initial Investments Present a Barrier to Entry

Key Highlights

- Significant Upfront Costs Limit ESL Adoption: Despite the long-term benefits of ESL technology, the high initial costs associated with its implementation remain a major obstacle for smaller retailers. The expenses of purchasing hardware such as E-paper shelf labels, batteries, and communication systems, along with integration into existing infrastructure, deter some businesses from investing in this retail automation technology. This limitation slows down the adoption of ESL systems, particularly in emerging markets.

- Initial Costs Offset by Long-Term Savings: While the upfront investments in ESL systems are considerable, they are often offset by long-term savings in labor costs and increased pricing accuracy. The need for fewer manual updates and the improved efficiency of automated systems provide a strong return on investment for large retail chains. However, smaller retailers may struggle with the complexities of integrating ESL systems into existing POS and inventory management platforms.

- Challenges in Integration and Maintenance: For small retailers, maintaining and upgrading these systems presents additional challenges. The technical complexities of integrating ESL systems with existing retail automation technology can strain resources, slowing the market's overall growth. Nonetheless, larger retail chains continue to adopt ESL technology, driven by the promise of operational efficiency and real-time pricing updates.

Electronic Shelf Label (ESL) Market Trends

NFC Mobile Payment is expected to boost market growth

- NFC Integration Revolutionizes ESL: The integration of NFC technology is reshaping the ESL market, allowing consumers to interact with digital price tags via smartphones for faster mobile payments. This innovation enhances transaction speeds and offers real-time product information, elevating the customer shopping experience.

- Dynamic Pricing Improves Store Efficiency: Automated pricing systems connected to NFC-enabled ESLs allow retailers to adjust prices immediately based on demand, competition, and market trends. This dynamic pricing system helps stores stay competitive and offers a more efficient and responsive retail environment, boosting sales.

- E-Paper Technology Improves Operational Efficiency: E-paper shelf labels, which consume minimal energy and offer clear, high-resolution displays, are becoming a preferred choice in retail. These labels can be updated remotely, reducing the need for manual price changes and increasing staff efficiency. As part of the IoT trend in retail, ESLs contribute to better inventory management and store operations.

- Demand for Smart Retail Solutions Grows: The demand for smart store solutions is driving market growth, with NFC-enabled ESL systems playing a central role. Retailers are investing in ESL technology to enhance customer engagement and operational efficiency, contributing to the expansion of retail automation technologies worldwide.

North America to Hold a Major Market Share

- Advanced Retail Infrastructure Fuels ESL Adoption: North America leads the ESL market due to its advanced retail automation technology infrastructure. U.S. and Canadian retailers are at the forefront of adopting smart store solutions, driven by the need for operational efficiency and improved customer experiences. The presence of major retail chains in the region further drives the implementation of electronic price display systems.

- IoT Integration Boosts Real-Time Efficiency: North American retailers are leveraging IoT-enabled ESL systems to collect real-time data on consumer behavior, inventory levels, and pricing trends. This data allows retailers to make more informed decisions, enhancing inventory management, pricing strategies, and store operations.

- High Demand for Retail Digital Signage and E-Paper Labels: The competitive nature of the North American retail market is driving demand for retail digital signage and e-paper shelf labels. These technologies enable real-time updates on promotions and pricing, improving in-store efficiency and customer experiences.

- Favorable Regulatory Environment Supports Growth: Government support for technological innovation in the U.S. accelerates the adoption of retail automation solutions like ESLs. Retailers are increasingly focusing on customer-centric technologies such as wireless shelf labels and dynamic pricing systems, positioning North America as a key region for ESL market growth.

Electronic Shelf Label (ESL) Industry Overview

Fragmented Market with Diverse Players: The ESL market is highly fragmented, with both large corporations and specialized companies competing for market share. Major global players like Samsung Electro-Mechanics and Panasonic Corporation dominate, while firms such as Pricer AB and Displaydata Ltd offer innovative ESL solutions, contributing to a diverse and competitive market landscape.

Key Leaders Driving Innovation: Companies like E Ink Holdings Inc., Displaydata Ltd, and Samsung Electro-Mechanics are known for their advanced electronic display technologies and significant influence in the global retail sector. These companies have solidified their market positions by delivering comprehensive retail automation solutions.

Future Market Success Tied to Technological Advancements: Key trends shaping the future of the ESL market include the growing demand for real-time pricing updates and smart retail solutions. For continued success, companies must focus on energy-efficient ESL systems, seamless integration with store management systems, and the capacity to support dynamic pricing strategies. As wireless communication technologies advance, businesses capable of handling large-scale inventories will maintain a competitive edge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Contactless Payment Technologies Driving Market Innovation

- 4.3 Market Restraints

- 4.3.1 High Initial Investments Present a Barrier to Entry

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

- 5.1 Communication Technology (RF, NFC, IR etc.)

- 5.2 Components (Batteries, Display etc.)

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 LCD ESLs

- 6.1.2 E-paper ESLs

- 6.2 By Store Type

- 6.2.1 Hyper Markets

- 6.2.2 Super Markets

- 6.2.3 Specialty Stores and Non-food Retail Stores

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 E Ink Holdings Inc.

- 7.1.2 Displaydata Ltd

- 7.1.3 Samsung Electro-Mechanics Co. Ltd

- 7.1.4 Pricer AB

- 7.1.5 Panasonic Corporation

- 7.1.6 Altierre Corporation

- 7.1.7 Diebold Nixdorf

- 7.1.8 LG Corporation

- 7.1.9 M2 Communication Inc.

- 7.1.10 SES-imagotag

- 7.1.11 Wincor Nixdorf AG

- 7.1.12 AdvanTech Inc.