|

市场调查报告书

商品编码

1443949

热喷涂材料 - 市场份额分析、行业趋势与统计、成长预测(2024 - 2029)Thermal Spray Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

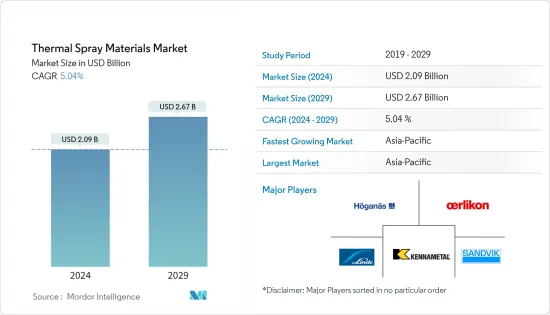

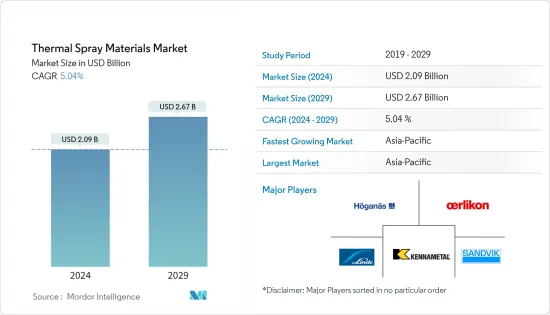

2024年热喷涂材料市场规模估计为20.9亿美元,预计到2029年将达到26.7亿美元,在预测期内(2024-2029年)CAGR为5.04%。

COVID-19 对 2020 年和 2021 年上半年的市场产生了负面影响。为了遏制病毒的传播,所有製造和其他活动都被暂停,从而对市场产生了负面影响。然而,由于製造业的增加和终端用户行业需求的恢復(这些行业已几乎全面投入营运),预计在疫情结束后,市场将稳步成长。

主要亮点

- 研究市场的重要因素包括热喷涂涂层在医疗器材製造中的使用不断增加、热喷涂陶瓷涂层的日益普及、防腐应用的广泛消费以及亚太地区风电行业的发展。

- 另一方面,替代替代品的出现预计将阻碍市场的成长。

- 金属陶瓷溶液前驱体等离子喷涂、热喷涂加工材料的回收利用、环境屏障涂层(EBC)热喷涂粉末的工业规模生产以及石油和天然气行业的增长前景方面的持续进展,预计将推动该领域的重大机会。未来的市场。

- 由于中国和印度等经济体的快速成长,预计亚太地区将在预测期内主导市场。

热喷涂材料市场趋势

航太将主导市场

- 热喷涂材料广泛应用于航太领域。它们用于製造涂层,应用于整架飞机的各个部件。这些涂层可延长零件的使用寿命,从而降低维护成本并提高燃油效率。

- 热喷涂材料,如氧化锆、铝青铜和钴钼,分别用于火箭燃烧室、压缩机空气密封件和高压喷嘴的涂层。

- 由于磨损、热腐蚀、微动、颗粒侵蚀等原因,飞机引擎有各种退化问题。当涉及高温时,这种降解会加速。热喷涂材料赋予延长引擎零件使用寿命所需的表面条件。

- 全球军事和航空航太製造市场包括波音、洛克希德和诺斯罗普·格鲁曼等主导企业。根据国际民航组织发布的报告,疫情后时期,由于经济开放,商业航空公司的收入大幅增加。 2021 年达到 4.72 亿美元,预计到 2022 年底将成长 39%,达到 6.58 亿美元。

- 由于航空航太基础设施建设和新项目投产的高支出,航空航太业的成长,特别是新兴经济体民航的成长,预计将推动市场的成长。例如,在印度,2021 年 3 月,政府向民航部 UDAN-RCS 提交了一份在 Ujjain 大坝开发水上机场专案的提案。

- 因此,由于热喷涂材料具有上述优点,其采用的增加预计将增加其在航空航太工业中的需求。

亚太地区将主导市场

- 热喷涂材料在航空航太工业中用作保护涂层。中国是最大的飞机製造国之一,也是国内航空客运最大的市场之一。

- 市场规模庞大、政府支持力度加大以及在线预订电动车的能力等因素可能会刺激该国对电动车的需求。

- 中国航空航太业在经历前几年的大幅下滑后,预计将于 2022 年恢復盈利。此外,中国民用航空局(CAAC)预计航空业国内运输量将恢復至疫情前水准的85%左右。

- 此外,中国航空公司计划在未来20年内采购约7,690架新飞机,价值约1.2兆美元,预计将带动热喷涂材料的需求。根据波音《2021-2040年商业展望》,到2040年,中国将新增交付飞机约8,700架,市场服务价值达1.8兆美元。

- 2021年12月,中国计画未来15年新建至少150座核反应堆,投资4,400亿美元。该国有 19 座反应炉在建,43 座反应炉等待许可,还有 166 座反应炉已宣布。这228座反应器的总容量为246GW。

- 印度政府计划在重工业部的生产相关奖励计画中向汽车和汽车零件产业提供 78 亿美元。因此,随着汽车产量的成长,汽车产业的扩张预计将在预测期内推动市场的成长。

- 由于这些发展,预计亚太地区将在预测期内主导市场。

热喷涂材料产业概况

热喷涂材料市场本质上是部分分散的。市场上一些主要的参与者(排名不分先后)包括 Hoganas AB、OC Oerlikon Management AG、Kennametal Inc.、Sandvik AB 和 Linde PLC。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 热喷涂在医疗器材製造上的使用不断增加

- 热喷涂陶瓷涂层的需求不断成长

- 防腐应用中的广泛消耗

- 亚太地区风电产业的演变

- 限制

- 替代品的出现

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场区隔(市场价值规模)

- 产品类别

- 涂层材料

- 粉末

- 陶瓷

- 陶瓷氧化物

- 氧化铝

- 二氧化钛

- 氧化锆

- 氧化铬和其他陶瓷氧化物

- 碳化物(包括金属陶瓷)

- 碳化铬

- 碳化钨

- 金属

- 纯金属和合金

- 贵金属

- MCrAlY

- 聚合物和其他涂层材料

- 线材/棒材

- 其他涂料(液体)

- 补充资料(辅助资料)

- 涂层材料

- 工艺类型

- 燃烧

- 电能

- 最终用户产业

- 航太

- 工业用燃气涡轮机

- 汽车

- 电子产品

- 油和气

- 医疗设备

- 能源与电力

- 其他最终用户产业

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 东协国家

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 领先企业采取的策略

- 公司简介

- Aisher APM LLC

- Ametek Inc.

- Aimtek Inc.

- C&M Technologies GmbH

- Castolin Eutectic

- CenterLine (Windsor) Limited

- CRS Holdings Inc.

- Fisher Barton

- Global Tungsten & Powders Corp.

- HAI Inc.

- HC Starck GmbH

- Hoganas AB

- Hunter Chemical LLC

- Kennametal Stellite

- Linde PLC

- LSN Diffusion Ltd

- Metallisation Limited

- Metallizing Equipment Co. Pvt. Ltd

- OC Oerlikon Management AG

- Polymet Corporation

- Powder Alloy Corporation

- Saint-Gobain

- Sandvik AB

- Thermion

第 7 章:市场机会与未来趋势

- 金属陶瓷溶液前驱体等离子喷涂研究进展

- 热喷涂加工材料的回收利用

- 环境屏障涂层 (EBC) 热喷涂粉末的工业规模生产

- 石油和天然气产业的成长前景

The Thermal Spray Materials Market size is estimated at USD 2.09 billion in 2024, and is expected to reach USD 2.67 billion by 2029, growing at a CAGR of 5.04% during the forecast period (2024-2029).

COVID-19 negatively impacted the market in 2020 and the first half of 2021. All the manufacturing and other activities were put on hold to curb the spreading of the virus, thereby negatively affecting the market. However, the market is projected to grow steadily post the retraction of the pandemic, owing to increased manufacturing and reinstating demand from the end-user industries, which have become operational at almost full scale.

Key Highlights

- The studied market's significant factors include the increasing usage of thermal spray coating in medical device manufacturing, the rising popularity of thermal spray ceramic coatings, extensive consumption in anti-corrosion applications, and evolution in the Asia-Pacific wind power sector.

- On the other hand, the emergence of alternate substitutes is expected to hinder the market's growth.

- The ongoing progress in solution precursor plasma spraying of cermets, recycling of thermal spray processing materials, industrial-scale production of environmental barrier coatings (EBC) thermal spray powders, and growth prospects in the oil and gas industry are the significant opportunities expected to drive the market in the future.

- Asia-Pacific region is expected to dominate the market in the forecast period because of vastly growing economies such as China and India.

Thermal Spray Materials Market Trends

Aerospace Industry to Dominate the Market

- Thermal spray materials are extensively used in the aerospace sector. They are used in manufacturing coatings, which are applied to various parts throughout the aircraft. These coatings offer component longevity, thus, reducing maintenance costs and increasing fuel efficiency.

- Thermal spray materials, such as zirconium oxide, aluminum bronze, and cobalt-molybdenum, are used for coating purposes in rocket combustion chambers, compressor air seals, and high-pressure nozzles, respectively.

- Various degradation problems exist in aircraft engines due to wear, hot corrosion, fretting, particle erosion, and many more. This degradation is accelerated when high temperatures are involved. Thermal spray material imparts the surface conditions required to increase engine components' service life.

- The global military and aerospace manufacturing market include dominant players such as Boeing, Lockheed, and Northrop Grumman. As per the report published by International Civil Aviation Organisation, commercial airlines' revenue grew significantly during the post-pandemic period because of the opening up of economies. It reached up to USD 472 million in 2021 and is forecasted to gain a whopping 39% standing at USD 658 million by the end of 2022.

- Growth in the aerospace sector, especially in civil aviation in emerging economies, on account of high expenditure on aerospace infrastructural construction and commissioning new projects, is expected to drive the market's growth. For instance, in India, in March 2021, the government submitted a proposal to develop a water aerodrome project at the Ujjain Dam under the Ministry of Civil Aviation's UDAN-RCS.

- Thus, increasing the adoption of thermal spray material due to its advantages mentioned above is expected to boost its demand in the aerospace industry.

Asia-Pacific to Dominate the Market

- Thermal spray materials are used in the aerospace industry as protective coating. China is one of the largest aircraft manufacturers and one of the largest markets for domestic air passengers.

- Factors such as large market size, increasing government support, and the ability to book electric vehicles online are likely to fuel the demand for electric vehicles in the country.

- China's aerospace industry is projected to return to profitability in 2022 after facing a significant decline in the previous years. In addition, the Civil Aviation Administration of China (CAAC) has estimated the aviation sector to recover domestic traffic to around 85% of pre-pandemic levels.

- Moreover, Chinese airline companies are planning to purchase about 7,690 new aircraft in the next 20 years, valued at approximately USD 1.2 trillion, expected to drive the demand for thermal spray materials. According to the Boeing Commercial Outlook 2021-2040, around 8,700 new deliveries will be made in China by 2040, with a market service value of USD 1,800 billion.

- In December 2021, China planned to build at least 150 new nuclear reactors in the next 15 years with an investment of USD 440 billion. The country has 19 reactors under construction, 43 reactors awaiting permits, and a massive 166 reactors that have been announced. The combined capacity of these 228 reactors is 246GW.

- The Government of India has planned to give USD 7.8 billion to the automobile and auto components sector in production-linked incentive schemes under the Department of Heavy Industries. Thus, the expansion of the automotive sector with the growing production of automobiles is anticipated to drive the market's growth over the forecast period.

- Owing to these developments, Asia-Pacific is expected to dominate the market over the forecast period.

Thermal Spray Materials Industry Overview

The thermal spray materials market is partially fragmented in nature. Some of the major players in the market (in no particular order) include Hoganas AB, OC Oerlikon Management AG, Kennametal Inc., Sandvik AB, and Linde PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage of Thermal Spray Coating in Medical Device Manufacturing

- 4.1.2 Rising Demand of Thermal Spray Ceramic Coatings

- 4.1.3 Extensive Consumption in Anti-corrosion Applications

- 4.1.4 Evolution in the Asia-Pacific Wind Power Sector

- 4.2 Restraints

- 4.2.1 Emergence of Alternate Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Coating Materials

- 5.1.1.1 Powders

- 5.1.1.1.1 Ceramics

- 5.1.1.1.1.1 Ceramic Oxides

- 5.1.1.1.1.1.1 Alumina

- 5.1.1.1.1.1.2 Titania

- 5.1.1.1.1.1.3 Zirconia

- 5.1.1.1.1.1.4 Chromia and Other Ceramic Oxides

- 5.1.1.1.1.2 Carbides (including Cermets)

- 5.1.1.1.1.2.1 Chromium Carbides

- 5.1.1.1.1.2.2 Tungsten Carbides

- 5.1.1.1.2 Metals

- 5.1.1.1.2.1 Pure Metal and Alloys

- 5.1.1.1.2.2 Precious Metals

- 5.1.1.1.2.3 MCrAlY

- 5.1.1.1.3 Polymer and Other Coating Materials

- 5.1.1.2 Wires/Rods

- 5.1.1.3 Other Coating Materials (Liquid)

- 5.1.2 Supplementary Materials (Auxiliary Materials)

- 5.1.1 Coating Materials

- 5.2 Process Type

- 5.2.1 Combustion

- 5.2.2 Electric Energy

- 5.3 End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Industrial Gas Turbines

- 5.3.3 Automotive

- 5.3.4 Electronics

- 5.3.5 Oil and Gas

- 5.3.6 Medical Devices

- 5.3.7 Energy and Power

- 5.3.8 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aisher APM LLC

- 6.4.2 Ametek Inc.

- 6.4.3 Aimtek Inc.

- 6.4.4 C&M Technologies GmbH

- 6.4.5 Castolin Eutectic

- 6.4.6 CenterLine (Windsor) Limited

- 6.4.7 CRS Holdings Inc.

- 6.4.8 Fisher Barton

- 6.4.9 Global Tungsten & Powders Corp.

- 6.4.10 HAI Inc.

- 6.4.11 HC Starck GmbH

- 6.4.12 Hoganas AB

- 6.4.13 Hunter Chemical LLC

- 6.4.14 Kennametal Stellite

- 6.4.15 Linde PLC

- 6.4.16 LSN Diffusion Ltd

- 6.4.17 Metallisation Limited

- 6.4.18 Metallizing Equipment Co. Pvt. Ltd

- 6.4.19 OC Oerlikon Management AG

- 6.4.20 Polymet Corporation

- 6.4.21 Powder Alloy Corporation

- 6.4.22 Saint-Gobain

- 6.4.23 Sandvik AB

- 6.4.24 Thermion

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Current Progress in Solution Precursor Plasma Spraying of Cermets

- 7.2 Recycling of Thermal Spray Processing Materials

- 7.3 Industrial Scale Production of Environmental Barrier Coatings (EBC) Thermal Spray Powders

- 7.4 Growth Prospects in the Oil and Gas Industry