|

市场调查报告书

商品编码

1444711

热喷涂 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Thermal Spray - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

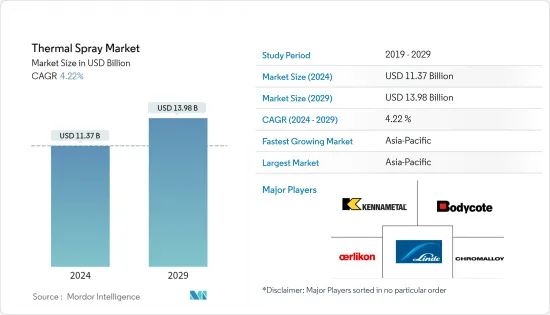

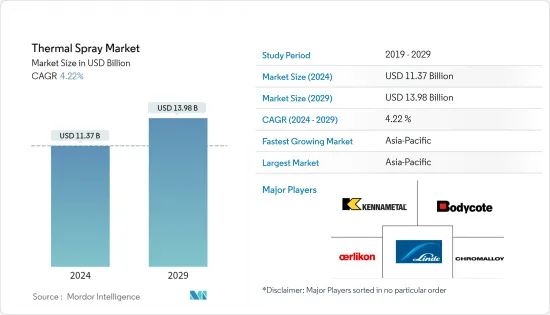

2024年热喷涂市场规模估计为113.7亿美元,预计到2029年将达到139.8亿美元,在预测期内(2024-2029年)CAGR为4.22%。

2020 年,市场受到 COVID-19 大流行的负面影响。封锁扰乱了製造活动和供应链,许多预定项目被更改或推迟。然而,自从限制解除以来,由于航空航太、涡轮机、汽车、电子、石油和天然气、医疗设备等各种最终用途行业的需求不断增长,该行业一直在復苏。

主要亮点

- 短期内,热喷涂涂层在医疗器材中的使用不断增加、热喷涂陶瓷涂层的日益普及、硬铬涂层的替代以及热喷涂涂层在航空航天工业中的使用不断增加是推动市场的一些因素要求。

- 然而,有关製程可靠性和一致性的问题以及近年来硬质三价铬涂层的出现可能会阻碍市场的成长。

- 喷涂技术(冷喷涂製程)的进步、热喷涂加工材料的回收以及石油和天然气行业不断增长的需求可能会在未来几年为市场创造利润丰厚的成长机会。

- 亚太地区预计将主导市场,并且在预测期内也可能出现最高的CAGR。

热喷涂市场趋势

增加在航太工业的使用

- 航空航太工业是热喷涂材料市场最大的最终用户。热喷涂涂层用于航空航天工业,以保护零件在飞行过程中免受极端温度和压力的影响。

- 除了提供高耐热性和长寿命外,它们还旨在保护引擎涡轮叶片和驱动系统。热喷涂主要用于喷射发动机部件,如曲轴、活塞环、气缸、阀门等。此外,它们还用于涂层起落架(起落架内的轴承和轴),以承受着陆和起飞时的力。

- 除了延长使用寿命外,热喷涂涂层还可以提高飞机和旋翼飞机引擎及相关零件的燃油效率、降低维护成本并提高速度。

- 根据日本飞机开发公司的资料,2021 年全球机队新增波音飞机数量为 340 架,而 2020 年为 157 架。

- 在亚太地区(不含中国),根据波音《2021-2040年商业展望》,到2040年可能将新增交付飞机约8,945架,市场服务价值达19,450亿美元。此外,到2040年,光是中国就可能新增交付约8,700架,市场服务价值达1.8兆美元。

- 此外,韩国是美国航空航太业最大的市场之一。韩国政府计划在 2025 年之前为 KF-X 项目投资 170 亿美元。2018 年 11 月,国内航空公司济州航空订购了 40 架 737 MAX 8 飞机,价值 44 亿美元。这些订单预计将于 2022 年至 2026 年期间完成。

- 根据美国联邦航空管理局 (FAA) 的数据,由于航空货运的成长,预计 2037 年美国商用飞机机队总数将达到 8,270 架。此外,由于现有机队老化,美国干线航空母舰机队预计将以每年 54 架飞机的速度成长。

- 德国航空航太业包括全国 2,300 多家公司,其中德国北部的公司最集中。该国拥有许多飞机内饰部件和材料生产基地,主要集中在巴伐利亚州、不来梅州、巴登-符腾堡州和梅克伦堡-前波莫瑞州。

- 上述因素预计将在预测期内支持航空航太工业热喷涂的消费。

亚太地区将主导市场

- 在亚太地区,中国是GDP最大的经济体。中国和印度是世界上成长最快的经济体之一。

- 据中国民用航空局(CAAC)称,中国是最大的飞机製造商和国内航空旅客市场之一。此外,飞机零件及总装製造业发展迅速,小型飞机零件生产企业超过200家。此外,中国航空公司计划在未来20年内采购约7,690架新飞机,价值约1.2兆美元,预计将进一步提高热喷涂市场的市场需求。

- 中国是全球最大的电子产品生产基地。中国积极从事电子产品的製造,例如智慧型手机、电视、电线、电缆、便携式计算设备、游戏系统和其他个人电子设备。 2021年,中国电子产品出口额较上年增加近11.4%。由于国际市场需求持续稳定,主要厂商营收年增16.2%。

- 中国是全球最大的粗钢生产国。根据世界钢铁协会统计,2021年,中国产量占全球产量的50%以上。 2021年,受政策变动影响,全国粗钢年产能为10.328亿吨,较2020年的10.647亿吨下降3%。该国仍然是全球最大的钢铁生产国。

- 印度的汽车产业是印度经济表现的重要指标,因为该产业在技术进步和宏观经济扩张中发挥着至关重要的作用。根据 IBEF(印度品牌资产)的数据,2021 年印度乘用车市值为 327 亿美元,到 2027 年可能达到 548.4 亿美元,2022-2027 年CAGR将超过 9%基础)。

- 日本的电气和电子工业是世界领先的工业之一。该国在电脑、游戏机、手机和各种其他关键电脑零件的生产方面处于世界领先地位。消费性电子产品占日本经济产出的三分之一。日本电子资讯科技产业协会(JEITA)公布的资料显示,2021年,日本电子产业总产值约109,543.46亿日元,较上年增长近10%。

- 由于美国和加拿大这些终端用户产业的崛起,预计北美将在预测期内主导市场。

热喷涂产业概况

全球热喷涂市场本质上是分散的。市场上一些主要的参与者包括 OC Oerlikon Management AG、Linde plc、Chromalloy Gas Turbine LLC、Bodycote 和 Kennametal Inc. 等(排名不分先后)。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 热喷涂涂层在医疗器材中的使用不断增加

- 热喷涂陶瓷涂层越来越受欢迎

- 替代硬铬涂层

- 航太工业中热喷涂涂层的使用不断增加

- 限制

- 三价硬铬涂层的出现

- 有关过程可靠性和一致性的问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争程度

第 5 章:市场区隔(市场价值规模)

- 产品类别

- 涂料

- 材料

- 涂层材料

- 粉末

- 陶瓷

- 金属

- 聚合物和其他粉末

- 线材/棒材

- 其他涂料(液体)

- 补充资料(辅助资料)

- 热喷涂设备

- 热喷涂系统

- 除尘设备

- 喷枪和喷嘴

- 供料设备

- 备用零件

- 降噪外壳

- 其他热喷涂设备

- 热喷涂涂层和饰面

- 燃烧

- 电能

- 最终用户产业

- 航太

- 工业用燃气涡轮机

- 汽车

- 电子产品

- 油和气

- 医疗设备

- 能源与电力

- 炼钢

- 纺织品

- 印刷和造纸

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 东协国家

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)分析

- 领先企业采取的策略

- 公司简介

- Thermal Spray Material Companies

- Aisher APM LLC

- AMETEK Inc.

- Aimtek Inc.

- C&M Technologies GmbH

- Castolin Eutectic GmbH

- CENTERLINE (WINDSOR) LIMITED (Supersonic Spray Technologies)

- CRS Holdings LLC

- Global Tungsten & Powders Corp.

- HC Starck Inc.

- HAI Inc.

- Hoganas AB

- Hunter Chemical LLC

- Kennametal Inc.

- LSN Diffusion Limited

- Linde PLC

- Metallisation Limited

- Metallizing Equipment Co. Pvt. Ltd

- OC Oerlikon Management AG

- Polymet

- Powder Alloy Corporation

- Saint-Gobain

- Sandvik AB

- Fisher Barton

- Thermion

- Thermal Spray Coatings Companies

- APS Materials Inc.

- ASB Industries Inc.

- Bodycote

- Chromalloy Gas Turbine LLC

- FM Industries Inc.

- FW Gartner Thermal Spraying (Curtis-Wright)

- Fisher Barton (Thermal Spray Technologies)

- Thermion

- TOCALO Co. Ltd

- Lincotek Trento SpA

- Linde PLC (Praxair ST Technologies Inc.)

- OC Oerlikon Management AG

- Thermal Spray Equipment Companies

- Air Products and Chemicals Inc.

- Arzell Inc.

- ASB Industries Inc.

- Bay State Surface Technologies Inc. (Aimtek Inc.)

- Camfil Air Pollution Control (APC)

- Castolin Eutectic

- Centerline (Windsor) Ltd (SUPERSONIC SPRAY TECHNOLOGIES)

- Donaldson Company Inc.

- Flame Spray Technologies BV

- GTV Verschleibschutz GmbH

- HAI Inc.

- Imperial Systems Inc.

- Kennametal Inc.

- Lincotek Equipment SpA

- Linde PLC

- Metallisation Limited

- Metallizing Equipment Co. Pvt. Ltd

- OC Oerlikon Management AG

- Plasma Powders

- Powder Feed Dynamics Inc.

- Progressive Surface

- Saint-Gobain

- Thermion

- Thermal Spray Material Companies

第 7 章:市场机会与未来趋势

- 喷涂技术的进步(冷喷涂製程)

- 热喷涂加工材料的回收利用

- 石油和天然气产业的需求不断增加

The Thermal Spray Market size is estimated at USD 11.37 billion in 2024, and is expected to reach USD 13.98 billion by 2029, growing at a CAGR of 4.22% during the forecast period (2024-2029).

The market was negatively affected by the COVID-19 pandemic in 2020. The lockdown disrupted manufacturing activities and supply chains, and many scheduled projects were changed or postponed. However, the sector has been recovering since restrictions were lifted owing to the rising demand from various end-use industries, such as aerospace, turbines, automotive, electronics, oil and gas, medical devices, etc.

Key Highlights

- Over the short term, the increasing usage of thermal spray coatings in medical devices, the rising popularity of thermal spray ceramic coatings, the replacement of hard chrome coatings, and the rising use of thermal spray coatings in the aerospace industry are some factors driving the market demand.

- However, issues regarding process reliability and consistency and the emergence of hard trivalent chrome coatings in recent years may hinder the market's growth.

- Advancements in spraying technology (cold spray process), recycling of thermal spray processing materials, and increasing demand from the oil and gas industry will likely create lucrative growth opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Thermal Spray Market Trends

Increasing Usage in the Aerospace Industry

- The aerospace industry is the largest end-user of the thermal spray material market. Thermal spray coatings are used in the aerospace industry to protect components from extreme temperatures and pressures during flight.

- In addition to providing high thermal resistance and longevity, they are designed to protect engine turbine blades and actuation systems. Thermal sprays are primarily employed in jet engine components, such as crankshafts, piston rings, cylinders, valves, etc. Additionally, they are used in coating landing gear (bearings and axles inside landing gear) to withstand forces during landing and takeoff.

- Apart from enhanced service life, thermal spray coatings offer improved fuel efficiency, reduced maintenance cost, and higher speed in aircraft and rotorcraft engines and related components.

- As per the Japan Aircraft Development Corporation data, the number of Boeing aircraft added to the global aircraft fleet was 340 units in 2021, compared to 157 units in 2020.

- In the Asian-Pacific region (excluding China), according to the Boeing Commercial Outlook 2021-2040, around 8,945 new deliveries may be made by 2040, with a market service value of USD 1,945 billion. Moreover, around 8,700 new deliveries may be made in China alone by 2040, with a market service value of USD 1,800 billion.

- Additionally, South Korea is one of the largest markets for the US aerospace industry. The Korean government plans to invest USD 17 billion in the KF-X program until 2025. In November 2018, the domestic airline, Jeju Air, ordered forty 737 MAX 8 airplanes worth USD 4.4 billion. The orders are projected to be completed between 2022 and 2026.

- According to the Federal Aviation Administration (FAA), the United States' total commercial aircraft fleet is expected to reach 8,270 in 2037 due to air cargo growth. Also, the United States mainliner carrier fleet is expected to grow at a rate of 54 aircraft per year due to the age of the existing fleet.

- The German aerospace industry includes more than 2,300 firms across the country, with northern Germany recording the highest concentration of firms. The country hosts many aircraft interior components and materials production bases, mainly in Bavaria, Bremen, Baden-Wurttemberg, and Mecklenburg-Vorpommern.

- The above factors are expected to support the consumption of thermal spray in the aerospace industry during the forecast period.

Asia-Pacific Region to Dominate the Market

- In the Asia-Pacific region, China is the largest economy in terms of GDP. China and India are among the fastest-growing economies in the world.

- According to the Civil Aviation Administration of China (CAAC), China is one of the largest aircraft manufacturers and markets for domestic air passengers. Moreover, the aircraft parts and assembly manufacturing sector has been growing rapidly, with over 200 small aircraft parts manufacturers. Moreover, Chinese airline companies are planning to purchase about 7,690 new aircraft in the next 20 years, valued at approximately USD 1.2 trillion, which is further expected to raise the market demand for the thermal spray market.

- China is the largest base for electronics production in the world. China is actively engaged in the manufacturing of electronic products, such as smartphones, TVs, wires, cables, portable computing devices, gaming systems, and other personal electronic devices. In 2021, an increment of nearly 11.4% was witnessed in the export value of Chinese electronics products with respect to the previous year. The revenues of major manufacturers expanded by 16.2% on a year-on-year basis due to the consistent demand from the international market.

- China is the largest producer of crude steel globally. According to the World Steel Association, in 2021, China accounted for more than 50% of global production. In 2021, the country's annual production capacity of crude steel stood at 1,032.8 million tons, declining by 3% compared to 1064.7 million tons produced in 2020 due to some policy changes. the country still reminas the largest steel producer globally.

- The automotive industry in India is an important indicator of how well the Indian economy is performing, as this sector plays a vital role in both technological advancements and macroeconomic expansion. In 2021, the Indian passenger car market was valued at USD 32.70 billion, and it is likely to reach a value of USD 54.84 billion by 2027, registering a CAGR of more than 9% between 2022-2027, according to IBEF (Indian Brand Equity Foundation).

- The electrical and electronics industry in Japan is one of the world's leading industries. The country is a world leader in terms of the production of computers, gaming stations, cell phones, and various other key computer components. Consumer electronics account for one-third of the Japanese economic output. According to the data released by the Japan Electronics and Information Technology Industries Association (JEITA), in 2021, the total production value of the electronics industry in Japan amounted to around JPY 10,954,346 million showcasing a rise of nearly 10% from the previous year.

- Owing to the rise of these end-user industries in the United States and Canada, North America is projected to dominate the market during the forecast period.

Thermal Spray Industry Overview

The global thermal spray market is fragmented in nature. Some of the major players in the market include OC Oerlikon Management AG, Linde plc, Chromalloy Gas Turbine LLC, Bodycote, and Kennametal Inc., among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage of Thermal Spray Coatings in Medical Devices

- 4.1.2 Rising Popularity of Thermal Spray Ceramic Coatings

- 4.1.3 Replacement of Hard Chrome Coating

- 4.1.4 Rising Use of Thermal Spray Coatings in the Aerospace Industry

- 4.2 Restraints

- 4.2.1 Emergence of Hard Trivalent Chrome Coatings

- 4.2.2 Issues Regarding Process Reliability and Consistency

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Coatings

- 5.1.2 Materials

- 5.1.2.1 Coating Material

- 5.1.2.1.1 Powders

- 5.1.2.1.1.1 Ceramics

- 5.1.2.1.1.2 Metal

- 5.1.2.1.1.3 Polymers and Other Powders

- 5.1.2.1.2 Wires/Rods

- 5.1.2.1.3 Other Coating Materials (Liquids)

- 5.1.2.2 Supplementary Materials (Auxiliary Material)

- 5.1.3 Thermal Spray Equipment

- 5.1.3.1 Thermal Spray Coating System

- 5.1.3.2 Dust Collection Equipment

- 5.1.3.3 Spray Gun and Nozzle

- 5.1.3.4 Feeder Equipment

- 5.1.3.5 Spare Parts

- 5.1.3.6 Noise-reducing Enclosures

- 5.1.3.7 Other Thermal Spray Equipment

- 5.2 Thermal Spray Coatings and Finishes

- 5.2.1 Combustion

- 5.2.2 Electric Energy

- 5.3 End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Industrial Gas Turbines

- 5.3.3 Automotive

- 5.3.4 Electronics

- 5.3.5 Oil and Gas

- 5.3.6 Medical Devices

- 5.3.7 Energy and Power

- 5.3.8 Steel Making

- 5.3.9 Textile

- 5.3.10 Printing and Paper

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of the Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Thermal Spray Material Companies

- 6.4.1.1 Aisher APM LLC

- 6.4.1.2 AMETEK Inc.

- 6.4.1.3 Aimtek Inc.

- 6.4.1.4 C&M Technologies GmbH

- 6.4.1.5 Castolin Eutectic GmbH

- 6.4.1.6 CENTERLINE (WINDSOR) LIMITED (Supersonic Spray Technologies)

- 6.4.1.7 CRS Holdings LLC

- 6.4.1.8 Global Tungsten & Powders Corp.

- 6.4.1.9 H.C. Starck Inc.

- 6.4.1.10 HAI Inc.

- 6.4.1.11 Hoganas AB

- 6.4.1.12 Hunter Chemical LLC

- 6.4.1.13 Kennametal Inc.

- 6.4.1.14 LSN Diffusion Limited

- 6.4.1.15 Linde PLC

- 6.4.1.16 Metallisation Limited

- 6.4.1.17 Metallizing Equipment Co. Pvt. Ltd

- 6.4.1.18 OC Oerlikon Management AG

- 6.4.1.19 Polymet

- 6.4.1.20 Powder Alloy Corporation

- 6.4.1.21 Saint-Gobain

- 6.4.1.22 Sandvik AB

- 6.4.1.23 Fisher Barton

- 6.4.1.24 Thermion

- 6.4.2 Thermal Spray Coatings Companies

- 6.4.2.1 APS Materials Inc.

- 6.4.2.2 ASB Industries Inc.

- 6.4.2.3 Bodycote

- 6.4.2.4 Chromalloy Gas Turbine LLC

- 6.4.2.5 FM Industries Inc.

- 6.4.2.6 FW Gartner Thermal Spraying (Curtis-Wright)

- 6.4.2.7 Fisher Barton (Thermal Spray Technologies)

- 6.4.2.8 Thermion

- 6.4.2.9 TOCALO Co. Ltd

- 6.4.2.10 Lincotek Trento SpA

- 6.4.2.11 Linde PLC (Praxair ST Technologies Inc.)

- 6.4.2.12 OC Oerlikon Management AG

- 6.4.3 Thermal Spray Equipment Companies

- 6.4.3.1 Air Products and Chemicals Inc.

- 6.4.3.2 Arzell Inc.

- 6.4.3.3 ASB Industries Inc.

- 6.4.3.4 Bay State Surface Technologies Inc. (Aimtek Inc.)

- 6.4.3.5 Camfil Air Pollution Control (APC)

- 6.4.3.6 Castolin Eutectic

- 6.4.3.7 Centerline (Windsor) Ltd (SUPERSONIC SPRAY TECHNOLOGIES)

- 6.4.3.8 Donaldson Company Inc.

- 6.4.3.9 Flame Spray Technologies BV

- 6.4.3.10 GTV Verschleibschutz GmbH

- 6.4.3.11 HAI Inc.

- 6.4.3.12 Imperial Systems Inc.

- 6.4.3.13 Kennametal Inc.

- 6.4.3.14 Lincotek Equipment SpA

- 6.4.3.15 Linde PLC

- 6.4.3.16 Metallisation Limited

- 6.4.3.17 Metallizing Equipment Co. Pvt. Ltd

- 6.4.3.18 OC Oerlikon Management AG

- 6.4.3.19 Plasma Powders

- 6.4.3.20 Powder Feed Dynamics Inc.

- 6.4.3.21 Progressive Surface

- 6.4.3.22 Saint-Gobain

- 6.4.3.23 Thermion

- 6.4.1 Thermal Spray Material Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Spraying Technology (Cold Spray Process)

- 7.2 Recycling of Thermal Spray Processing Materials

- 7.3 Increasing Demand Frome The Oil and Gas Industry