|

市场调查报告书

商品编码

1444276

热喷涂设备 -市场占有率分析、产业趋势与统计、成长预测(2024-2029)Thermal Spray Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

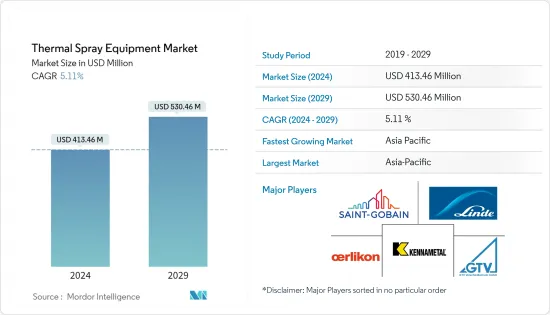

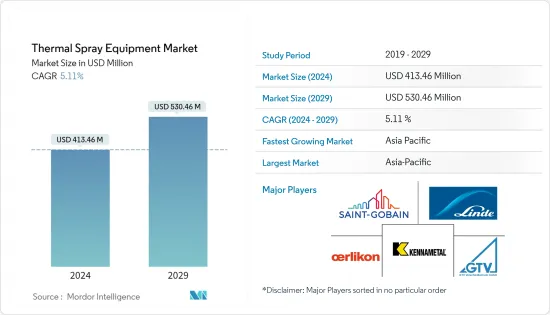

预计2024年热喷涂设备市场规模为4.1346亿美元,预计到2029年将达到5.3046亿美元,在预测期内(2024-2029年)增长5.11%,复合年增长率增长。

2020 年市场受到 COVID-19感染疾病的负面影响。全国范围内的封锁和严格的社交距离规定导致各个市场的供应链中断。然而,各行业的需求将在2021年恢復,预计未来几年将显着成长。

主要亮点

- 推动市场研究的主要因素是热喷涂陶瓷涂层的日益普及、热喷涂涂层在航太工业中的使用不断增加以及发电行业的发展。

- 另一方面,有关製程可靠性和一致性的问题正在阻碍所研究市场的成长。

- 目前金属陶瓷溶液前驱体等离子喷涂的进展、冷喷涂製程的进步、HVOF 涂层和系统的出现以及双丝电弧热喷涂系统的成长前景预计将为所研究市场的成长提供各种机会。

- 预计亚太地区将在预测期内主导全球市场。

热喷涂设备市场趋势

航太工业的应用不断增加

- 热喷涂设备用于喷射引擎零件的各种用途,例如曲轴、活塞环、汽缸和阀门。它也用于涂覆起落架以承受起飞和着陆时的力量。

- 热喷涂系统用于火箭燃烧室、压缩机空气密封件和高压喷嘴的涂层。涡轮空气密封、燃料喷嘴和涡轮叶片分别采用铬钴、氧化铝和碳化铬涂层。

- 波音公司引领航太业采用热喷涂设备取代众多结构部件上的硬铬镀层。根据波音公司《2022-2041年商业展望》,全球预测民用航空服务(包括航班业务、维护和工程、地面、车站、货运业务等)预计到2041年将达到3.615兆美元。

- 此外,根据国际航空运输协会(IATA)的数据,2020年全球商业航空公司收益为3730亿美元,预计与前一年同期比较增长26.7%。做过。此外,到 2022 年,收益预计将达到 6,580 亿美元。

- 飞机製造商正在寻找加快生产的方法,以填补积压订单。例如,波音公司《2022-2041 年商业展望》预计,到 2041 年,全球新飞机交付总量将达到 41,170 架。截至2019年,全球持有飞机数量达到约25,900架,持有数量有可能达到此水准。到 2041 年将达到 47,080 台。

- 总体而言,航太对热喷涂设备的需求在预测期内呈现出良好的成长动能。

中国将主导亚太地区

- 中国的热喷涂设备市场正在健康成长,反映出该国的航太和汽车製造业。

- 中国是最大的钢铁生产国之一,钢厂使用热喷涂涂层来保护。钢铁工业主要采用超音速火焰喷涂、热喷涂、等离子喷涂和等离子转移电弧堆焊来涂覆工作辊。

- 中国的航太政策是进入航太开发和生产顶级水准的最全面的尝试之一。中国拥有全球第二大国内航空市场。它还拥有世界上成长最快的国内航空业,旅客人数每年增长6.6%。

- 根据波音《2022-2041 年商业展望》,预计到 2041 年,中国将新增约 8,485 架交付交付,市场服务价值将达到 5,450 亿美元。

- 根据国际工业组织(OICA)统计,中国拥有全球最大的汽车生产基地,2021年汽车总产量达2,608万辆,比去年的2,523万辆成长3%。年。

- 2021年11月,配备电池插头的电动车较2020年同期成长106%。 2021年11月,该国电动车销量达到约413,094辆。此外,市场占有率增至19%。其中,15%是纯电动车,4%是插电混合动力汽车。

热喷涂设备产业概况

全球热喷涂设备市场本质上是部分一体化的。研究市场中的主要企业包括(排名不分先后)欧瑞康、林德、GTV Verschleibschutz GmbH、肯纳金属和圣戈班。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 航太工业的应用不断增加

- 热喷涂陶瓷涂层越来越受欢迎

- 发电领域的演变

- 抑制因素

- 製程可靠性和一致性问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

- 技术简介

第五章市场区隔(以金额为准的市场规模)

- 产品类别

- 热喷涂系统

- 除尘器

- 喷枪和喷嘴

- 送料装置

- 备用零件

- 降噪罩

- 其他产品类型

- 过程

- 燃烧

- 电能

- 最终用户产业

- 航太

- 工业用燃气涡轮机

- 车

- 电子产品

- 油和气

- 医疗设备

- 能源和电力

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 合併、收购、合资、合作和协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- Air Products and Chemicals Inc.

- Lincotek Equipment

- Arzell Inc.

- ASB Industries Inc.

- Bay State Surface Technologies Inc.(Aimtek)

- Camfil Air Pollution Control

- Castolin Eutectic

- Donaldson Company Inc.

- Flame Spray Technologies BV

- Thermion

- GTV Verschleibschutz GmbH

- HAI Inc.

- Imperial Systems Inc.

- Kennametal Inc.

- Linde

- CenterLine Holdings Inc.(Supersonic Spray Technologies)

- Metallisation Ltd

- Metallizing Equipment Co. Pvt. Ltd

- OC Oerlikon Management AG

- Plasma Powders &Systems Inc.

- Powder Feed Dynamics Inc.

- Progressive Surface

- Saint-Gobain

第七章市场机会与未来趋势

- 金属陶瓷溶液前驱体等离子喷涂的最新进展

- 冷喷涂製程的进步

- 介绍 HVOF 涂层和系统

- 双线拱形热喷涂系统的成长前景

The Thermal Spray Equipment Market size is estimated at USD 413.46 million in 2024, and is expected to reach USD 530.46 million by 2029, growing at a CAGR of 5.11% during the forecast period (2024-2029).

The market was negatively impacted in 2020 because of the COVID-19 pandemic. The nationwide lockdowns and stringent social distancing mandates caused supply chain disruptions across various markets. However, in 2021, the demand from various sectors recovered and is expected to grow at a significant rate in the coming years.

Key Highlights

- Major factors driving the market study are the rising popularity of thermal spray ceramic coatings, the increasing use of thermal spray coatings in the aerospace industry, and the evolution in the power generation sector.

- On the flip side, issues regarding process reliability and consistency hinder the growth of the market studied.

- Current progress in solution precursor plasma spraying of cermets, advancements in the cold spray process, the emergence of HVOF coatings and systems, and growth prospects for twin wire arc thermal spraying systems are expected to offer various opportunities for the growth of the market studied.

- The Asia-Pacific region is expected to dominate the global market during the forecast period.

Thermal Spray Equipment Market Trends

Rising Application in the Aerospace Industry

- Thermal spray equipment is employed for several purposes in jet engine components, such as crankshafts, piston rings, cylinders, valves, etc. In addition, it is also applied in the coating of landing gear to withstand the forces during landing and take-off.

- Thermal spray coatings systems are used for coating purposes in rocket combustion chambers, compressor air seals, and high-pressure nozzles. Coatings of chromium cobalt, aluminum oxide, and chromium carbide are employed in turbine air seals, fuel nozzles, and turbine vanes, respectively.

- Boeing led the aerospace industry to adapt and implement thermal spray equipment as an alternative for hard chromium plating on numerous structural components. According to the Boeing Commercial Outlook 2022-2041, the global forecast for commercial aviation services (which include flight operations, maintenance and engineering, ground, station, and cargo operations, and others) is expected to be USD 3,615 billion by 2041.

- Furthermore, according to the International Air Transport Association (IATA), the global revenue for commercial airlines was valued at USD 373 billion in 2020 and was estimated at USD 472 billion in 2021, registering a growth rate of 26.7% Y-o-Y. Furthermore, the revenue was expected to reach USD 658 billion by 2022.

- Aircraft manufacturers are looking for ways to accelerate production to fill order backlogs. For instance, according to the Boeing Commercial Outlook 2022-2041, the total global deliveries of new airplanes are estimated to be 41,170 by 2041. The global airplane fleet amounted to around 25,900 units as of the year 2019 and the fleet number is likely to reach 47,080 units by 2041.

- Overall, there is a promising growth for the demand for thermal spray equipment in the aerospace industry over the forecast period.

China to Dominate the Asia-Pacific Region

- The thermal spray equipment market in China is experiencing healthy growth, mirroring the manufacturing section of the aerospace and automotive industry of the country.

- China is one of the largest steel producers, and steel mills use thermal spray coatings for protection. The steel industry mainly uses coatings of processing rolls by HVOF, spray fusing, plasma spraying, and plasma-transferred arc overlaying welding.

- The Chinese aerospace policy represents one of the most comprehensive attempts to enter the top levels of aerospace development and production. China has the second-largest domestic aviation market in the world. It also has the world's fastest-growing domestic aviation industry, with passenger traffic increasing at 6.6% per year.

- In China, according to the Boeing Commercial Outlook 2022-2041, around 8,485 new deliveries will be made by 2041 with a market service value of USD 545 billion.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), China has the largest automotive production base in the world, with a total vehicle production of 26.08 million units in 2021, registering an increase of 3% compared to 25.23 million units produced in last year.

- A growth of 106% in battery-plugged electric vehicles was witnessed in November 2021 compared to the same period in 2020. The country's sales of electric vehicles reached around 413,094 units in November 2021. In addition, the market share also increased to 19%, including 15% of all-electric and 4% of plug-in hybrid cars.

Thermal Spray Equipment Industry Overview

The global thermal spray equipment market is partially consolidated in nature. The major players in the market studied include (not in any particular order) Oerlikon, Linde, GTV Verschleibschutz GmbH, Kennametal, and Saint-Gobain, amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Application in Aerospace Industry

- 4.1.2 Rising Popularity of Thermal Spray Ceramic Coatings

- 4.1.3 Evolution in Power Generation Sector

- 4.2 Restraints

- 4.2.1 Issues Regarding Process Reliability and Consistency

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Thermal Spray Coating Systems

- 5.1.2 Dust Collection Equipment

- 5.1.3 Spray Guns and Nozzles

- 5.1.4 Feeder Equipment

- 5.1.5 Spare Parts

- 5.1.6 Noise-reducing Enclosures

- 5.1.7 Other Product Types

- 5.2 Process

- 5.2.1 Combustion

- 5.2.2 Electric Energy

- 5.3 End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Industrial Gas Turbines

- 5.3.3 Automotive

- 5.3.4 Electronics

- 5.3.5 Oil and Gas

- 5.3.6 Medical Devices

- 5.3.7 Energy and Power

- 5.3.8 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Products and Chemicals Inc.

- 6.4.2 Lincotek Equipment

- 6.4.3 Arzell Inc.

- 6.4.4 ASB Industries Inc.

- 6.4.5 Bay State Surface Technologies Inc. (Aimtek)

- 6.4.6 Camfil Air Pollution Control

- 6.4.7 Castolin Eutectic

- 6.4.8 Donaldson Company Inc.

- 6.4.9 Flame Spray Technologies BV

- 6.4.10 Thermion

- 6.4.11 GTV Verschleibschutz GmbH

- 6.4.12 HAI Inc.

- 6.4.13 Imperial Systems Inc.

- 6.4.14 Kennametal Inc.

- 6.4.15 Linde

- 6.4.16 CenterLine Holdings Inc. (Supersonic Spray Technologies)

- 6.4.17 Metallisation Ltd

- 6.4.18 Metallizing Equipment Co. Pvt. Ltd

- 6.4.19 OC Oerlikon Management AG

- 6.4.20 Plasma Powders & Systems Inc.

- 6.4.21 Powder Feed Dynamics Inc.

- 6.4.22 Progressive Surface

- 6.4.23 Saint-Gobain

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Current Progress in Solution Precursor Plasma Spraying of Cermets

- 7.2 Advancements in Cold Spray Process

- 7.3 Emergence of HVOF Coatings and Systems

- 7.4 Growth Prospects for Twin Wire Arch Thermal Spraying Systems