|

市场调查报告书

商品编码

1444042

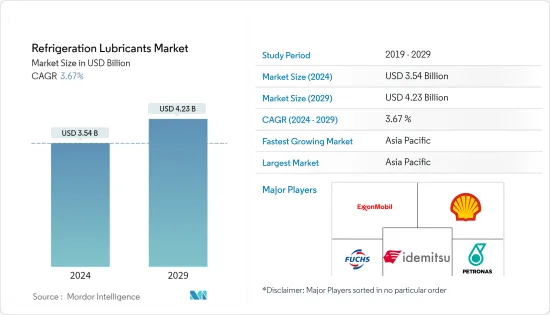

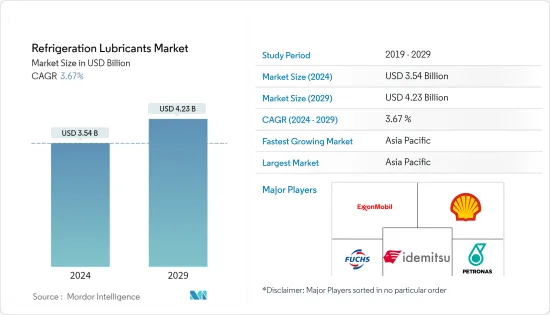

冷冻润滑剂:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Refrigeration Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

2024年冷冻润滑油市场规模预计为35.4亿美元,预计到2029年将达到42.3亿美元,在预测期内(2024-2029年)增长3.67%,复合年增长率为

由于 COVID-19 的爆发,全球范围内的国家封锁、製造活动和供应链中断以及生产停顿对所研究的市场产生了负面影响。然而,情况已于 2021 年开始復苏,预计市场成长轨迹将在预测期内恢復。

主要亮点

- 针对能源效率优化的新一代冷冻润滑油的出现、全球暖通空调冷气产业的成长动能以及汽车产业的復苏预计将推动冷冻润滑油市场的成长。

- 另一方面,由于不断的监管修订而逐步淘汰现有冷媒预计将阻碍市场成长。

- 奈米润滑剂技术的日益普及和对低温应用的需求不断增加预计将在所研究的市场中创造新的机会。

- 亚太地区主导全球市场,大部分消费来自印度和中国等国家。

冷冻润滑油市场趋势

全球暖通空调冷冻产业势头强劲

- 空调 (AC) 装置旨在调节封闭区域内的湿度和温度。空调的主要部件是压缩机、蒸发器、膨胀阀和冷凝器。润滑剂可减少管道腐蚀等副作用,并提高与常见冷冻气体的相容性。

- 冷冻润滑剂有多种用途,包括散热、润滑运动部件、充当密封剂以及冷却关键压缩机部件。

- 根据国际能源总署的数据,2021年,太空冷气需求在所有建筑最终用途中录得最高的年增长率,几乎占建筑业最终电力消耗量(约2,000太瓦时)的16%。预计这将使空调润滑油市场在预测期内受益。

- 2021 年 11 月,印度政府根据白色家电生产连结奖励计画(PLI) 计画选择了 26 个申请。这些项目将用于空调(AC) 製造,已承诺投资 389.8 亿印度卢比。这项措施可能会增加国内产量并对冷冻润滑油市场产生正面影响。

- 电动车的成长趋势可能会进一步支撑冷冻润滑油市场。 2021年,中国成为电动车的主要生产国。根据中国小客车协会(CPCA)的数据,2021年中国汽车销量超过330万辆,较2020年成长169%。

- 印度电动车市场主要由两轮车细分市场驱动,到 2021 年,两轮车市场占比将超过 48%。根据道路运输和公路部 (MoRTH) 的数据,印度电动车销量为 3,29,190 辆,较 2020 年销量成长 168%。

- 上述因素可能对冷冻润滑油市场产生正面影响。

预计亚太地区将主导市场

- 亚太地区是最大的冷冻润滑油市场。对冷冻润滑油的需求不断增长可归因于其在家用和工业空调系统中的使用量增加。

- 中国是世界上最大的汽车中心。根据OICA统计,2021年国内汽车总产量为26,082,220辆,较2020年成长3%。

- 中国主要电动车製造商包括特斯拉、比亚迪和蔚来汽车。该国对电动车的需求不断增长,正在推动汽车压缩机冷冻润滑油市场的发展。

- 根据OICA报告,2021年第一季至第三季欧洲生产了11,886,776辆汽车,而中国同期生产了18,242,588辆汽车。因此,汽车对空调的需求不断增加。

- 韩国汽车技术研究所 (KAII) 收集的资料显示,2021 年前 9 个月,韩国电动车销量成长 96%,达到 71,006 辆。由于欧洲、亚太和美洲进口国的需求增加,预计销售额将进一步增加。

- 2021年,印度2021年前第三季生产了3,289,683辆电动车,比2020年大幅成长53%。预计汽车产业的成长将在预测期内扩大市场。

- 印度拥有仅次于美国、俄罗斯和中国的世界第四大铁路网,轨道总长123,542公里,路线长度67,415公里,车站7,300多个。

- 这个世界第二人口大国的网路上定期运行 13,523 列客运列车和 9,146 列货运列车。 2020-21年铁路运输货物12.3亿吨。

- 由于上述所有因素,预计亚太地区将在未来几年占据市场主导地位。

冷冻润滑油产业概况

由于不同国家的多种排放法规,冷冻润滑油市场高度分散。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 推出具有优化能源效率的新一代冷冻润滑油

- 全球暖通空调冷冻产业势头强劲

- 汽车工业的復兴

- 抑制因素

- 由于不断的监管变化,逐步淘汰现有冷媒

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(收益市场规模)

- 按基油分

- 矿物油基润滑油

- 合成润滑油

- 按用途

- 空调

- 冷冻(家用、工业、低温)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- BASF SE

- BP PLC

- BVA Oil

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum &Chemical Corporation(SINOPEC Group)

- CPI Fluid Engineering

- ENEOS Corporation

- ExxonMobil Corporation

- Fuchs

- HP Lubricants

- Idemitsu Kosan Co. Ltd

- Isel

- Kluber Lubrication

- Kuwait Petroleum

- Matrix Specialty Lubricants BV

- Parker Hannfin Corp

- PETRONAS Lubricants International

- Shell plc

- Tazzetti SpA

- TotalEnergies

- Xaerus Performance Fluids International

第七章市场机会与未来趋势

The Refrigeration Lubricants Market size is estimated at USD 3.54 billion in 2024, and is expected to reach USD 4.23 billion by 2029, growing at a CAGR of 3.67% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market studied. However, the conditions started recovering in 2021, which is expected to restore the market's growth trajectory during the forecast period.

Key Highlights

- The emergence of new-generation refrigeration lubricants optimized for energy efficiency, increasing momentum in the global HVACR industry, and recovering automotive industry are expected to drive the growth of the refrigeration lubricants market.

- On the flip side, phasing out of existing refrigerants due to constant regulations amendments is expected to hinder the market's growth.

- Augmenting prominence for nano lubricant technology and a gain in demand for cryogenic applications are expected to unveil new opportunities for the market studied.

- Asia-Pacific dominated the global market, with the most significant consumption from the countries such as India and China.

Refrigeration Lubricants Market Trends

Increasing Momentum in the Global HVACR Industry

- Air conditioning (AC) units are designed to modify humidity and air temperature in an enclosed area. The primary components of an air conditioner are compressor, evaporator, expansion valve, and condenser. Lubricants reduce side effects, such as pipeline corrosion, and provide better compatibility with common refrigeration gases.

- Refrigeration lubricants have multiple purposes, such as removing heat, lubricating moving parts, acting as a sealant, and cooling the critical components of compressors.

- According to the International Energy Agency, space cooling demand experienced the highest annual growth among all buildings end uses in 2021 and accounted for nearly 16% of the buildings sector's final electricity consumption (about 2 000 TWh). This is expected to benefit the air conditioning lubricant market over the forecast period.

- The Government of India, in November 2021, selected 26 applications under the production-linked incentive (PLI) scheme for white goods. These are for air-conditioning (AC) manufacturing with a committed investment of INR 3,898 crore. This initiative is likely to boost production in the country and have a positive impact on the refrigeration lubricants market.

- The rising trends for electric vehicles are further likely to support the refrigeration lubricant market. China was the leading producer of electric vehicles in 2021. According to the China Passenger Car Association (CPCA), the country sold over 3.3 million units in 2021, which also accounted for an increase of 169% compared to 2020.

- The electric vehicles market in India is majorly driven by the two-wheeler segment that accounted for over 48% in 2021. According to the Ministry of Road Transport & Highways (MoRTH), 3,29,190 electric vehicles were sold in the country, representing an increase of 168% compared to the sales in 2020.

- The factors mentioned above are likely to impact the refrigeration lubricants market positively.

Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific region was the largest market for refrigeration lubricants. The rising demand for refrigeration lubricants can be attributed to the increasing usage of air conditioning systems for domestic and industrial applications.

- China is the largest automotive hub in the world. According to OICA, the overall automotive production in the country in 2021 stood at 2,60,82,220, a 3% increase from 2020.

- China's leading electric car manufacturers include Tesla, BYD Co., and Nio Inc. The growing demand for electric vehicles in the country is driving the market for refrigeration lubricants for automotive compressors.

- As per the report by OICA, Europe produced 11,886,776 units from quarter 1 to quarter 3 of 2021, whereas China produced 18,242,588 vehicles in the same period. Therefore the demand for AC in automobiles continues to increase.

- South Korean sales of electric vehicles surged by 96% to 71,006 units in the first nine months of 2021, according to data collected by the Korea Automotive Technology Institute (KAII). The sales figure is further expected to increase with growing demand from the importing economies in Europe, Asia Pacific, and the Americas.

- In 2021, India produced 32,89,683 electric vehicles for the first three quarters of 2021, a massive increase of 53% from 2020. The growing automotive sector is expected to augment the market in the forecast period.

- India ranks fourth in the most extensive railway system in the world after the United States, Russia, and China, with 123,542 km of tracks, 67,415 km of route, and more than 7,300 stations.

- The second-largest populated country in the world runs 13,523 passenger trains and 9,146 freight trains regularly on its network. The railways carried 1.23 billion metric tons of freight in FY2020-FY2021.

- Due to all the factors above, Asia-Pacific is expected to dominate the market in the upcoming years.

Refrigeration Lubricants Industry Overview

The refrigeration lubricants market has a higher degree of fragmentation owing to multiple emission regulations in various countries. Key players (not in any particular order) in the market include ExxonMobil Corporation, Shell PLC, Fuchs, IdemitsuKosan Co. Ltd, and PETRONAS Lubricants International.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Emergence of New Generation Refrigeration Lubricants Optimized for Energy Efficiency

- 4.1.2 Increasing Momentum in the Global HVACR Industry

- 4.1.3 Recovering Automotive Industry

- 4.2 Restraints

- 4.2.1 Phasing out of Existing Refrigerants due to Constant Regulations Amendments

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Revenue)

- 5.1 By Base Oil

- 5.1.1 Mineral Oil Lubricant

- 5.1.1.1 Paraffinic Oil

- 5.1.1.2 Naphthenic Oil

- 5.1.1.3 Aromatic Oil

- 5.1.2 By Synthetic Lubricant

- 5.1.2.1 Synthetic Hydrocarbon

- 5.1.2.1.1 Polyalphaolefin (PAO)

- 5.1.2.1.2 Alkylated Aromatics

- 5.1.2.1.3 Polybutene

- 5.1.2.2 By Ester

- 5.1.2.2.1 Diester

- 5.1.2.2.2 Polyol Ester

- 5.1.2.2.3 Phosphate Ester

- 5.1.2.2.4 Polymer Ester

- 5.1.2.3 Polyalkylene Glycols (PAG)

- 5.1.2.4 Other Synthetic Lubricants

- 5.1.1 Mineral Oil Lubricant

- 5.2 By Application

- 5.2.1 Air Conditioning

- 5.2.1.1 Transportation

- 5.2.1.1.1 Automotive

- 5.2.1.1.2 Other Modes of Transportation (Rail Road, Airways, and Marine)

- 5.2.1.2 Other Air Conditioning Applications (Stationary Applications)

- 5.2.2 Refrigeration (Household, Industrial, and Cryogenics)

- 5.2.1 Air Conditioning

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 BP PLC

- 6.4.3 BVA Oil

- 6.4.4 Chevron Corporation

- 6.4.5 China National Petroleum Corporation

- 6.4.6 China Petroleum & Chemical Corporation (SINOPEC Group)

- 6.4.7 CPI Fluid Engineering

- 6.4.8 ENEOS Corporation

- 6.4.9 ExxonMobil Corporation

- 6.4.10 Fuchs

- 6.4.11 HP Lubricants

- 6.4.12 Idemitsu Kosan Co. Ltd

- 6.4.13 Isel

- 6.4.14 Kluber Lubrication

- 6.4.15 Kuwait Petroleum

- 6.4.16 Matrix Specialty Lubricants B.V.

- 6.4.17 Parker Hannfin Corp

- 6.4.18 PETRONAS Lubricants International

- 6.4.19 Shell plc

- 6.4.20 Tazzetti S.p.A

- 6.4.21 TotalEnergies

- 6.4.22 Xaerus Performance Fluids International

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Augmenting Prominence for Nano Lubricant Technology

- 7.2 Gain in Demand for Cryogenic Applications