|

市场调查报告书

商品编码

1444104

PEMFC(固体聚合物燃料电池):市场占有率分析、产业趋势与统计、成长预测(2024-2029)Polymer Electrolyte Membrane Fuel Cells (PEMFCs) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

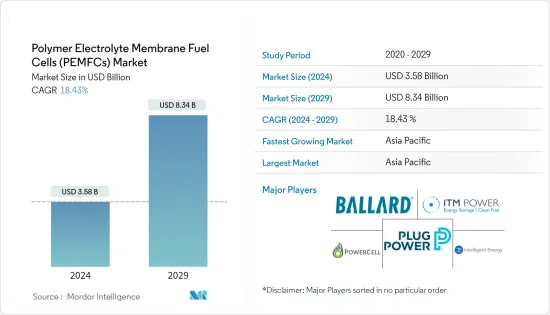

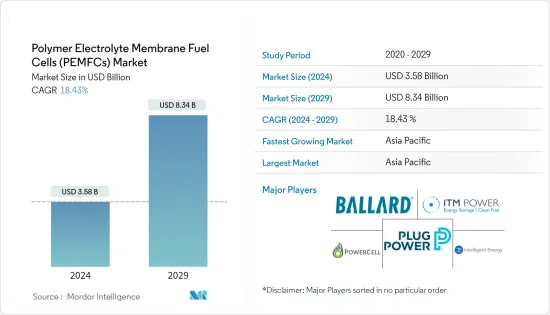

PEMFC(固体燃料电池)的市场规模预计到2024年为35.8亿美元,预计到2029年将达到83.4亿美元,预计在预测期内(2024-2029年)将增长。年内复合年增长率为18.43 %)。

儘管 COVID-19 对 2020 年市场产生了负面影响,但已达到疫情前的水平。

主要亮点

- 推动市场的主要因素是燃料电池领域不断增加的研发(R&D)活动,这带来了多种优势,如高功率密度、减少充电时间、延长储存寿命、延长使用寿命等,从而提供了技术优势。 PEMFC的循环优于锂离子电池等替代燃料电池。这正在推动配备 PEMFC 的车辆的采用,并预计将在预测期内推动市场发展。

- 然而,目前 PEMFC 技术的高成本以及市场上其他可行能源系统的可用性预计将阻碍预测期内的市场成长。

- PEMFC 的技术进步,例如减少燃料电池中铂的比例和降低最终成本,预计将在预测期内为市场创造一些机会。

- 2022年全球质子交换膜燃料电池市场将由亚太地区主导,其中中国占较大份额。这一增长的主要动力是中国和日本等政府推出的促进清洁能源使用的政策。

质子交换膜燃料电池市场趋势

政府措施和私人投资的增加预计将推动市场

- 过去两年,质子交换膜燃料电池市场出现了显着成长,这主要得益于政府在关键市场推出的措施以及私部门加强的投资支持。

- 加州能源委员会的替代和可再生燃料及车辆技术计划是 2013 年政府措施,该计划建立了长期授权,共同资助首批 100 个零售加氢站。这鼓励了私营部门对燃料电池市场的投资。

- 加州燃料电池合作伙伴计画的目标是到 2030 年建立一个由 1,000 个加氢站组成的网路和持有。

- 2022 年 2 月的计划表明,高温 PEMFC (HT-PEMFC) 凭藉其有效的散热性能,为重型车辆电动和其他大规模行动应用提供了极具吸引力的解决方案。

- 最普及的燃料电池类型是 PEM 类型。预计它将在欧洲燃料电池部署目标中发挥关键作用,并推动 PEMFC 市场的发展。

- 2022 年 2 月,洛斯阿拉莫斯国家实验室的科学家开发出一种可在更高温度下运作的新型聚合物燃料电池。

- 此外,全球对燃料电池汽车的需求正在增加。北韩和美国是燃料电池汽车保有量世界领先的国家。 2021年,北韩和美国分别占全球燃料电池汽车保有量的38%和24%。

- 因此,此类政府措施和投资可能会在预测期内推动市场发展。因此,由于上述因素,政府倡议和增加对质子交换膜燃料电池技术的私人投资预计将在预测期内推动市场发展。

预计亚太地区将主导市场

- 由于中国、日本和韩国等国家对清洁能源利用的优惠政策,亚太地区是 PEMFC 有前景的区域市场之一。

- 在中国,氢燃料电池产业的发展势头强劲,主要得益于国家和省级政府的优惠补贴以及地方政府旨在促进氢能汽车普及的激励计划,该产业被认为最具潜力。

- 除了中国拥有庞大的潜在市场外,国内生产质子交换膜燃料电池的公司也不少。因此,有国内需求,有国内供应,进一步推动了市场的成长。此外,中国企业希望在2022年将电解槽产能提高到1.5至2.5吉瓦,以供应国内和国际市场。

- 同时,中国计划在2025年每年生产10万至20万吨可再生氢,并拥有5万辆氢动力持有。中国目前是全球最大的燃料电池卡车和客车市场,也是第三大燃料电池市场。

- 近日,印度科学家透过高效能流程自主研发出一种用于燃料电池的铂基电催化剂。这种电催化剂表现出与市售电催化剂相当的性能,并且能够延长燃料电池堆性能的寿命。

- 因此,由于上述因素,亚太地区预计将在预测期内主导市场。

质子交换膜燃料电池产业概况

全球质子交换膜燃料电池市场的主要企业已经整合。市场上的主要企业包括(排名不分先后)Ballard Power Systems、Plug Power Inc.、ITM Power PLC、PowerCell Wednesday AB 和 Intelligence Energy Limited。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查范围

- 市场定义

- 调查先决条件

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2027 年之前的市场规模与需求预测(十亿美元)

- 最新趋势和发展

- 研发现状

- 政府政策法规

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争公司之间敌对的强度

第五章市场区隔

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- Cummins Inc.

- Bramble Energy

- Toshiba Corporation

- Ballard Power Systems

- Plug Power Inc.

- ITM Power PLC

- Powercell Sweden AB

- Intelligent Energy Limited

第七章市场机会与未来趋势

The Polymer Electrolyte Membrane Fuel Cells Market size is estimated at USD 3.58 billion in 2024, and is expected to reach USD 8.34 billion by 2029, growing at a CAGR of 18.43% during the forecast period (2024-2029).

Though COVID-19 negatively impacted the market in 2020, it has reached pre-pandemic levels.

Key Highlights

- Major factors driving the market are increasing research & development (R&D) activities in the field of fuel cells, which has led to several technological advantages, such as high power density, less time to refuel, more extended storage durability, and more number of life-cycles of polymer electrolyte membrane fuel cells over its alternatives, such as Li-ion battery. This has been driving the adoption of polymer electrolyte membrane fuel cell-powered vehicles and is thus expected to drive the market during the forecast period.

- However, the current high cost of polymer electrolyte membrane fuel cell technology and the availability of other viable energy systems in the market is expected to hinder the market growth during the forecast period.

- The technological advancements in PEMFCs, such as reducing the share of platinum in the fuel cell, which in turn decreases its final cost, are expected to create several opportunities in the market during the forecast period.

- The Asia-Pacific dominated the global polymer electrolyte membrane fuel cells market in 2022, with China holding a significant share. The major factors attributing to the growth are the policies initiated by various governments in countries such as China and Japan to drive the use of clean energy.

PEM Fuel Cells Market Trends

Government Initiatives and Growing Private Investments are Expected to Drive the Market

- The PEM fuel cell market witnessed significant growth in the last two years, mainly due to the introduction of government initiatives in key markets and increasing investment support from the private sector.

- The Californian Energy Commission's Alternative and Renewable Fuel and Vehicle Technology Program, a government initiative in 2013, established long-term authority to co-fund the first 100 retail hydrogen stations. This encouraged the private sector to invest in the fuel cell market.

- The Californian Fuel Cell Partnership aims for a network of 1,000 hydrogen stations and a fuel cell vehicle population of up to 1,000,000 vehicles by 2030. The target reflects the input and consensus of more than 40 partners, including fuel cell technology companies, automakers, energy companies, government agencies and non-governmental organizations, and universities.

- In February 2022, a project showed that high-temperature polymer electrolyte membrane fuel cells (HT-PEMFCs) offer an attractive solution to electrify heavy-duty vehicles and other large-scale mobility applications due to effective heat rejection.

- Moreover, multiple institutions, including LANL (Katie Lim), Sandia National Labs (Cy Fujimoto), Korea Institute of Science and Technology (Jiyoon Jung), University of New Mexico (Ivana Gonzales), University of Connecticut (Jasna Jankovic), and Toyota Research Institute of North America (Zhendong Hu and Hongfei Jia) were involved in this project.

- Among fuel cells, the PEM type is the most popular one. It is expected to play a crucial role in Europe's target for fuel cell deployment and drive the PEM fuel cells market.

- In February 2022, scientists of the Los Alamos National Laboratory developed a new polymer fuel cell that operates at higher temperatures. The long-standing issue of overheating, one of the biggest technical obstacles to using medium- and heavy-duty fuel cells in vehicles, such as trucks and buses, was resolved by a new high-temperature polymer fuel cell that operates at 80-160 degrees Celsius and has a higher rated power density than cutting-edge fuel cells.

- Furthermore, there is a rise in fuel cell-based vehicle demand worldwide. North Korea and the United States are the leading countries in the world in terms of stock of fuel cell-based vehicles. In 2021, North Korea and the United States had 38% and 24% of world fuel cell-based vehicle stock, respectively.

- Hence, such government initiatives and investments are likely to propel the market during the forecast period. Therefore, owing to the abovementioned factors, government initiatives and growing private investments in PEMFC technology are expected to drive the market during the forecast period.

The Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific is one of the promising regional markets for polymer electrolyte membrane fuel cells due to favorable government policies for clean energy usage in countries such as China, Japan, and South Korea.

- China is considered to have the highest potential for PEMFC as the hydrogen fuel cell industry in the country has been gaining traction on the back of favorable national and provincial government subsidies and incentive programs from local authorities, mainly to encourage the uptake of hydrogen vehicles to cut pollution.

- Along with the potentially large market, China has numerous domestic enterprises that manufacture PEMFC. Hence, the country's demand and domestic supply are present, further bolstering the growth of the market. Moreover, Chinese companies seek to build their electrolyzer manufacturing capacity to 1.5-2.5 GW in 2022 to supply domestic and overseas markets.

- Meanwhile, China has plans to manufacture 100,000 to 200,000 tonnes of renewable hydrogen annually and have a fleet of 50,000 hydrogen-fueled vehicles by 2025. China is currently the world's largest market for fuel-cell trucks and buses and the third-largest for fuel-cell electric vehicles (FCEVs).

- Recently, Indian Scientists have indigenously developed platinum-based electrocatalysts for fuel cells through an efficient procedure. This electrocatalyst showed comparable properties to the commercially available electrocatalyst and could enhance the lifetime of the fuel cell stack performance.

- Therefore, owing to the abovementioned factors, the Asia-Pacific is expected to dominate the market during the forecast period.

PEM Fuel Cells Industry Overview

The key players in the global polymer electrolyte membrane fuel cells market are consolidated. Some of the major players in the market (in no particular order) are Ballard Power Systems, Plug Power Inc., ITM Power PLC, PowerCell Sweden AB, and Intelligent Energy Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, until 2027

- 4.3 Recent Trends and Developments

- 4.4 Research and Development Status

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Geography

- 5.1.1 North America

- 5.1.2 Europe

- 5.1.3 Asia-Pacific

- 5.1.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Cummins Inc.

- 6.3.2 Bramble Energy

- 6.3.3 Toshiba Corporation

- 6.3.4 Ballard Power Systems

- 6.3.5 Plug Power Inc.

- 6.3.6 ITM Power PLC

- 6.3.7 Powercell Sweden AB

- 6.3.8 Intelligent Energy Limited