|

市场调查报告书

商品编码

1444199

製造业数位转型:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Digital Transformation In Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

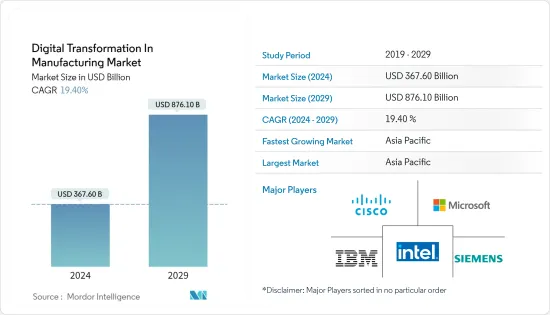

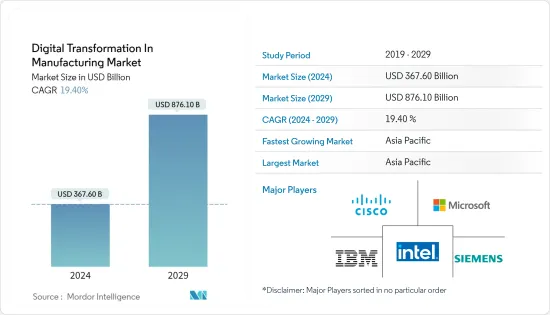

预计2024年製造业数位转型市场规模为3,676亿美元,预计2029年将达8,761亿美元,在预测期内(2024-2029年)成长19.40%,以复合年增长率成长。

主要亮点

- 製造业的数位化影响着业务和供应链的各个方面。它从设备设计开始,继续产品设计、生产流程开发,最后是最终用户体验监控和改进。数位转型正在彻底改变製造商透过跨境协作在云端沟通和维护产品和工程设计规范的方式。

- 此外,物联网 (IoT) 设备的普及正在改变工业流程并提高生产力。 IoT 设备可让您即时监控、收集和分析有关各种工业流程的资料。这可以实现预防性维护、减少能源消耗并提高整体生产力。

- 这些工具使相关人员、系统和机器能够更轻鬆地通讯和协作,从而简化流程并减少停机时间。透过整合物联网设备,製造商可以改善品管、即时管理库存并提高供应链可视性。

- 然而,数位化转型需要大量的领先成本。实施物联网设备和自动化系统等新技术通常需要在硬体、培训、软体和基础设施方面投入大量资金,这对某些公司来说在财务上面临挑战,并可能阻碍市场扩张。

- COVID-19的传播加速了製造业的数位转型。随着供应链和劳动力供应中断,公司寻求技术解决方案来降低风险并提高业务效率。自动化、远端监控和资料分析对于简化製造程序、管理库存和确保工人安全至关重要。面对即将到来的挑战,製造商已经实施了云端基础的平台、物联网小工具和人工智慧,同时增强了弹性和敏捷性,以促进即时资料分析、远端协作和预测性维护。这种快速的数位化也为更智慧、更整合的工厂在大流行后时期提高效率和创造力铺平了道路。

製造业数位转型的市场趋势

物联网 (IoT) 维持主要市场占有率

- 物联网是将实体设备和感测器连接到互联网以创建智慧互联繫统的数位转型的关键驱动力。这种连接可以实现即时资料收集和分析,从而提高业务效率、改善决策、建立新的经营模式并增强各行业的自动化。

- 製造业正在将物联网视为加强数位转型和提高业务效率的关键要素。它有助于即时资料的收集和分析,使组织能够做出明智的决策并优化製造和相关流程。

- 物联网透过创造新的投资机会、改善客户体验、提高生产力、降低营运成本和效率以及强化经营模式来影响组织的数位转型。由于其众多优势可以在未来几年成为竞争因素,它已成为医疗保健、政府和教育、安全和通讯行业的重要组成部分。

- 随着物联网技术在製造业的应用不断进步,市场正在稳步扩大。随着传统製造业数位转型,物联网正在推动智慧互联的下一次工业革命。为了提高生产力并最大限度地减少停机时间,企业正在改变处理日益复杂的系统和机器的方式。爱立信表示,物联网连接预计将以超过 18% 的复合年增长率成长,从 2022 年的 132 亿美元成长到 2028 年的 347 亿美元。

- 总体而言,製造商正在利用物联网技术来优化流程、提高生产力并降低成本。它是为了在快速参与全球製造业并推动製造业数位转型方面获得竞争优势。由于製造业的发展和物联网的引入,预计市场在预测期内将持续成长。

亚太地区成长最快

- 近年来,中国製造业经历了一场数位革命。中国政府正在积极支持传统製造流程中的数位技术,以提高生产、效率和创新。

- 中国正大力投资机器人、物联网、巨量资料分析、人工智慧和智慧製造云端运算技术等创新技术。借助这些技术,可以优化工业流程并实现预防性保养。这显着提高了生产力、降低了成本并增加了市场成长机会。

- 日本是机器人和自动化的重要提供者,数位转型正在进一步加速其采用。先进的机器人用于各种製造过程,例如包装、组装和物料输送。自动化有助于提高效率、减少错误并提高职场安全性。

- 此外,日本最近在数位双胞胎技术的创建和应用方面已成为世界领先者。数位双胞胎是真实物件、系统或流程的虚拟表示,可用于分析、模拟和最佳化。加强产品设计,降低成本,提高製造效率。这项技术被用于日本的许多产业,包括製造业。

- 印度政府推出“印度製造”和“数位印度”,加速製造业数位转型。这些措施旨在提供法律支援和奖励,以促进营商便利,鼓励对基础设施和技术的投资,并促进数位技术在製造业中的使用。此外,印度製造业正在加速采用工业物联网。 IIoT 透过整合机器、感测器和设备来提供即时资料收集、远端监控和预测性维护。它帮助生产商简化业务、减少停机时间并提高整体设备性能。

- 在亚太地区,机器人和自动化技术正在製造业中迅速广泛采用。先进的机器人越来越多地用于组装、物料输送和其他重复性任务,以提高效率、生产率和产品品质。自动化使各行业能够降低人事费用并提高准确性,同时快速回应不断变化的市场需求。

製造业数位转型概述

由于许多解决方案供应商的出现以及行业技术的进步,数位转型的竞争变得更加激烈。特别是,公司经常调整定价方式以维持市场占有率并留住新的和现有的消费者,这给其他公司带来定价压力,使市场竞争更加激烈。此外,公司不断追求技术,例如以有竞争力的价格收购和生产新产品,从而加剧组织之间的竞争。市场上一些重要的参与者包括思科系统公司、微软公司、英特尔公司、IBM公司和西门子公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 产业价值链分析

- 技术简介

第五章市场动态

- 市场驱动因素

- 製造商倾向于采用具有成本效益的流程

- 物联网普及

- 市场限制因素

- 缺乏技术专长

第六章市场区隔

- 依技术

- 机器人技术

- IoT

- 3D列印与积层製造

- 网路安全

- 其他技术

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Cisco Systems Inc.

- Microsoft Corporation

- Intel Corporation

- IBM Corporation

- Siemens AG

- SAP SE

- Nortonlifelock Inc.

- Oracle Corporation

- Schneider Electric SE

- Mitsubishi Electric Corporation

- General Electric Company

- ABB Ltd

第八章投资分析

第9章市场的未来

The Digital Transformation In Manufacturing Market size is estimated at USD 367.60 billion in 2024, and is expected to reach USD 876.10 billion by 2029, growing at a CAGR of 19.40% during the forecast period (2024-2029).

Key Highlights

- The digitalization of the manufacturing sector impacts every aspect of operations and the supply chain. It begins with the design of the equipment and continues with the product design, production process development, and, finally, the monitoring and improvement of the end-user experience. Through cross-border collaboration, digital transformation is revolutionizing how manufacturers communicate and maintain product and engineering design specifications on the cloud.

- In addition, the widespread use of Internet of Things (IoT) devices is transforming industrial processes and increasing productivity. IoT devices enable real-time monitoring, gathering, and analyzing data on various industrial processes. It enables preventative maintenance, reduces energy use, and boosts overall productivity.

- With the help of these tools, stakeholders, systems, and machines can communicate and work together more easily, streamlining processes and decreasing downtime. By integrating IoT devices, manufacturers can improve quality control, manage inventories in real-time, and improve supply chain visibility.

- However, there are significant up-front expenses related to digital transformation. Implementing new technologies, including IoT gadgets and automation systems, frequently necessitates large expenditures in hardware, training, software, and infrastructure, which can be financially challenging for certain businesses, impeding market expansion.

- The COVID-19 outbreak expedited the manufacturing industry's digital transition. As supply chains and worker availability were disrupted, businesses sought technological solutions to reduce risks and improve operational effectiveness. Automation, remote monitoring, and data analytics were essential for streamlining manufacturing procedures, controlling inventory, and guaranteeing worker safety. Along with enhancing resilience and agility to facilitate real-time data analysis, remote collaboration, and predictive maintenance, manufacturers implemented cloud-based platforms, IoT gadgets, and artificial intelligence in the face of upcoming challenges. This rapid digitization also cleared the way for smarter, more integrated factories to boost efficiency and creativity in the post-pandemic period.

Digital Transformation in Manufacturing Market Trends

Internet-of-Things (IoT) to Hold Major Market Share

- The Internet of Things is a key driver of digital transformation that connects physical devices and sensors to the Internet, creating smart and connected systems. This connection enables real-time data collection and analysis, improving operational efficiency, better decision-making, new business models, and increased automation across various industries.

- Manufacturing businesses are concentrating on IoT as the critical enabler to augment digital transformation and unlock operational efficiencies. It facilitates the collection and analysis of real-time data, enabling organizations to make informed decisions and optimize manufacturing and related processes.

- The Internet of Things impacts organizations' digital transformation by creating new investment opportunities, improving customer experience, increasing productivity, lowering operational costs and efficiency, and empowering business models. It became essential for industries, including healthcare, government and education, security, communication, and others, owing to numerous benefits that could act as a competitive factor in the coming years.

- The market is expanding positively as IoT technology is increasingly used in manufacturing. The Internet of Things (IoT) is driving the next industrial revolution of intelligent connectivity as the traditional manufacturing sector transforms digitally. It is transforming how businesses handle the increasingly complex systems and machines they use to increase productivity and minimize downtime. According to Ericsson, ioT connections are anticipated to increase from USD 13.20 billion in 2022 to USD 34.70 billion by 2028 at a CAGR of over 18%.

- Overall, manufacturers are optimizing processes, improving productivity, and reducing costs by leveraging IoT technologies. It is to gain a competitive edge in the rapidly involving manufacturing industry across the globe and driving digital transformation in the manufacturing sectors. The market's growth is likely to continue with the development of the manufacturing industry and the adoption of IoT over the forecast period.

Asia-Pacific to Register Fastest Growth

- China's manufacturing sector saw a digital revolution in recent years. The Chinese government actively supports digital technologies in traditional manufacturing processes to increase production, efficiency, and innovation.

- China invested significantly in innovative technologies like robotics, IoT, Big Data Analytics, AI, and cloud computing technologies for smart manufacturing. With the help of these technologies, industrial processes can become optimized, and preventative maintenance is made possible. It significantly boosts productivity and lowers costs, boosting the market's growth opportunities.

- Japan is a significant provider of robotics and automation, and digital transformation is further driving their adoption. Advanced robots are used in various manufacturing processes for packaging, assembly, and material handling tasks. Automation helps improve efficiency, reduce errors, and enhance workplace safety.

- Moreover, Japan became a global leader in digital twin technologies creation and application in recent years. Digital twins are virtual representations of actual things, systems, or procedures that can be used for analysis, simulation, and optimization. They can enhance product design, lower costs, and boost manufacturing effectiveness. This technique is used in many industries in Japan, including manufacturing.

- The Indian government introduced "Make in India" and "Digital India" to encourage the manufacturing sector's digital transformation. These initiatives seek to make doing business easier, promote infrastructure and technology investments, and offer legislative support and incentives to hasten the use of digital technologies in manufacturing. Also, IIoT adoption is accelerating in the Indian manufacturing sector. IIoT offers real-time data collection, remote monitoring, and predictive maintenance by integrating machines, sensors, and devices. It aids producers in streamlining operations, decreasing downtime, and enhancing overall equipment performance.

- In the Asia-Pacific region, robotics and automation technologies are rapidly being widely adopted in the manufacturing industry. Advanced robots are increasingly used in assembly lines, material handling, and other repetitive operations to increase efficiency, productivity, and product quality. Automation enables industries to respond rapidly to shifting market demands while lowering labor costs and improving precision.

Digital Transformation in Manufacturing Industry Overview

The competition in digital transformation is considerable due to the availability of many solution providers and technological improvements in the industry. Notably, firms often adjust their pricing methods to maintain market share and retain new and existing consumers, placing pricing pressure on other companies and boosting market competitiveness. Furthermore, firms are continually pursuing techniques such as acquisitions and the production of new goods at competitive prices, increasing competition among organizations. Some significant players in the market are Cisco Systems Inc., Microsoft Corporation, Intel Corporation, IBM Corporation, and Siemens AG.

- In March 2023, Mitsubishi Electric launched a free mobile application for iOS and Android platforms. It is for searching and comparing its factory automation products to make it easier to identify relevant products to aid digital manufacturers quickly.

- In February 2023, Oracle declared plans to open a third public cloud region, especially in Saudi Arabia, to fulfill the rapidly growing demand for its cloud services. Located in Riyadh, the new cloud region will be part of a planned USD 1.5 billion investment by Oracle to expand its overall cloud infrastructure capabilities in the Kingdom. Oracle Cloud delivers pioneering innovation in key technologies like Machine Learning, AI, and IoT. It will help fuel economic growth and digital transformation, an integral part of Saudi Vision 2030.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Inclination of Manufacturers Toward Cost-efficient Processes

- 5.1.2 Proliferation of IoT

- 5.2 Market Restraints

- 5.2.1 Lack of Technical Expertise

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Robotics

- 6.1.2 IoT

- 6.1.3 3D Printing and Additive Manufacturing

- 6.1.4 Cybersecurity

- 6.1.5 Other Technologies

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United kingdom

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Microsoft Corporation

- 7.1.3 Intel Corporation

- 7.1.4 IBM Corporation

- 7.1.5 Siemens AG

- 7.1.6 SAP SE

- 7.1.7 Nortonlifelock Inc.

- 7.1.8 Oracle Corporation

- 7.1.9 Schneider Electric SE

- 7.1.10 Mitsubishi Electric Corporation

- 7.1.11 General Electric Company

- 7.1.12 ABB Ltd