|

市场调查报告书

商品编码

1444247

纸板包装 -市场占有率分析、产业趋势与统计、成长预测(2024-2029)Paperboard Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

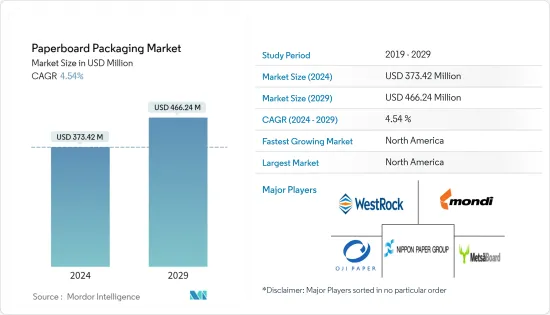

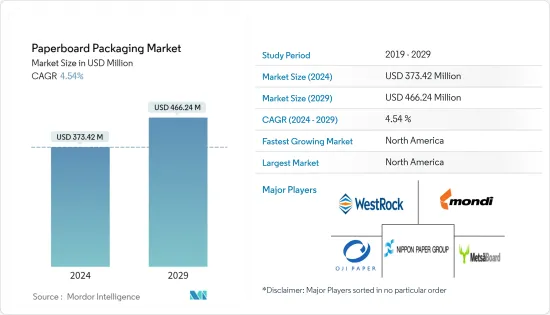

2024年纸板包装市场规模预计为3.7342亿美元,预计到2029年将达到4.6624亿美元,预测期内(2024-2029年)复合年增长率为4.54%。

预计在预测期内,该市场将受到电子商务以及化妆品和个人护理包装行业扩张的推动。由于医疗产业的扩张,对纸包装的需求预计将增加,医疗产业占非耐用产品的很大一部分。

主要亮点

- 纸板是一种常用于包装的厚纸基材料。以木浆为主要原料製成。大量纸板被回收利用,以减少森林砍伐和废弃物。纸板主要用于食品和饮料包装、医疗包装、耐用和非耐用包装、工业包装和化妆品包装。

- 目前,与可重复使用性相比,消费者更喜欢可回收性和生物分解性降解性作为重要的包装参数。这凸显了消费者对未来包装废弃物对环境影响的日益关注。美国60% 以上的社区收集并回收纸板包装。此外,企业也专注于推出可回收纸板产品。 连锁最近推出了由可回收纤维製成的纸板托盘。 SIG 也发现了利用消费后废弃物由回收聚合物製成的纸匣。

- 数位印刷纸板等先进技术正在吸引大量投资,产品经销商越来越多地采用该技术,并提供可提供吸引消费者註意力的互动和多彩设计的解决方案。此外,各国实施的政府法规也增加了对更永续和环保的包装解决方案(例如折迭纸盒)的需求。

- 此外,随着其在零售应用中作为 POS 显示器的发展以及小瓦楞和高品质图形纸板的持续发展趋势,瓦楞包装已成为关键的市场驱动力。这使得瓦楞纸箱能够与传统的折迭纸箱应用竞争。

- 然而,高性能替代品的可用性预计将阻碍市场成长。纸板包装是最常用的环保包装解决方案之一。与其他较大的包装选项相比,这种包装格式可以製造成各种尺寸,占地面积较小,几乎可以用于任何最终用户行业。

- 由于 COVID-19感染疾病,包装行业面临多项重大挑战,包括封锁的影响、公司从中国采购资源以及对包装所用材料的审查。儘管纸包装的供应面受到了显着影响,但由于某些应用领域的最终用户需求显着增加,纸包装的范围显着扩大。

纸板包装市场趋势

食品和饮料行业的需求不断增加

- 食品和饮料产业是纸板包装的最大终端用户,占全球市场占有率的一半以上。在食品和饮料行业,涂层、未漂白纸板用于饮料包装,瓦楞纸板用于水果、蔬菜和食品包装。随着冷冻食品的普及加速,对纸盒的需求也预计会增加。

- 另一方面,透过使用永续的加固工艺,纸张替代品可以实现与塑胶(例如水性涂料)相同的强度、防潮性和耐用性。塑胶吸管和刀叉餐具也正在逐步退出预包装食品产业,取而代之的是纸和木质替代品。

- 生活方式的改变和日益年轻化的人口正在增加对品牌和包装物质的需求。根据软包装协会的数据,美国饮料产业占包装市场的近 50%。超过 30% 的美国人每週点餐两次,预计未来几年这一比例将增加 3%。

- 此外,广泛关注的迅速浪潮推动了环保包装选择的激增。据 Food Dive 称,全球 67% 的消费者认为他们购买的产品采用可回收包装很重要,54% 的消费者表示这是他们在购买时考虑的一个因素。此外,83% 的年轻买家愿意花更多钱购买永续包装的产品。

- 此外,行动消费也进一步加速了印度、中国和日本等国家的需求。中国和印度等国家对食品和饮料的需求一直很高,从而推动了纸板包装市场的发展。食品和饮料行业的这种积极增长预计将增加预测期内对纸板包装的需求。

- 此外,作为主要食品生产国之一的美国可能会看到纸板包装的成长。根据美国劳工统计局的数据,2021 年所有消费者单位的支出规模,家庭食品消费的年增率为 6.4%,家庭外食品消费的年增率为 27.6%。除五人及以上家庭外,所有消费单位的家庭食品支出均增加,无论规模大小。同时,所有消费领域的外带食品支出均增加。三人消费者单位中,家庭食品(+12.1%)及外食(+39.1%)的成长率最高。如前所述,只有 5 人或以上的消费者单位的家庭食品支出有所下降,儘管外出食品支出增幅第二大 (+31%) (-3%)。户外食品配送的快速成长可能为纸板包装公司提供更多的机会来提供永续和环保的包装配送。

北美将经历显着成长

- 由于有大量公司在北美经营,北美仍然是纸板包装产品的主要市场之一。美国对包装食品的需求不断增长以及消费者对食品和饮料产品偏好的转变预计将创造重大机会。

- 美国在北美地区的折迭纸盒包装市场中占据主导地位,食品预计将继续成为折迭纸盒的主要终端用户。例如,根据包装技术协会的数据,到 2022 年,美国食品业预计将以 2.9% 的复合年增长率稳定成长。

- 此外,根据ITC统计,2021年美国瓦楞纸和纸板进口额约为74,735,000美元,比去年2020年(约51,722,000美元)增加44.5%。进口量的大幅增加表明对纸板的需求增加。

- 此外,对塑胶使用的环境日益关注以及各个组织和政府对开发永续包装材料的关注也预计将在预测期内进一步推动目标市场的成长,这就是因素。

- 此外,市场上的公司正在透过增加併购活动和研发策略来增加对先进和客製化包装解决方案的投资。而且,市场上也出现了新的形势。例如,EdelmannUSA 最近成为 PPC 的成员。这显示这家欧洲公司正在更加重视拓展该市场。

纸板包装产业概况

全球纸板包装市场高度分散。市场上的主要企业正在专注于新产品创新和策略性收购,以加强其在市场上的地位。市场上营运的一些主要企业包括 Nippon Paper Industries、Mondi、Metsa Board、WestRock Company 和 ITC Limited。

- 2022 年 4 月:Burgo Group 同意将其位于义大利的里雅斯特的 Duino 工厂出售给 Mondi plc,总价为 4,000 万欧元(40,815,000 美元)。该工厂目前运作一台造纸机,生产薄涂布机械纸。 Mondi 将投资约 2 亿欧元(204,076,000 美元)改造造纸机,每年生产 42 万吨优质再生纸板。瓦楞纸板机械为公司提供供应保障,以改善瓦楞包装的后向整合并增强客户回应能力。

- 2022 年5 月:国际纸业的法国业务(法国西部的Societe Normande de Carton Ondule SA、SNCO 和Emballages Laurent SAS)将获得总计2,300 万欧元(24,191,000 美元)用于扩大产能。)将很快从投资中受益,以适应扩大电子商务行业并为客户提供更环保的包装选择。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争对手之间存在敌对威胁

- 评估 COVID-19感染疾病对市场的影响

第五章市场动态

- 市场驱动因素

- 电商产业需求旺盛

- 更多采用轻质材料和印刷创新范围推动电子和个人保健部门的成长

- 市场限制因素

- 森林砍伐对纸包装的影响

- 营运成本增加

- 纸箱板 EXIM 场景

- 纸板出口额及数量

- 按价值和数量进口纸板

第六章市场区隔

- 按年级

- 纸板纸

- 纸板原纸

- 其他等级

- 依产品类型

- 纸箱

- 瓦楞纸箱

- 其他类型

- 按最终用户产业

- 食品

- 饮料

- 卫生保健

- 个人护理

- 家务护理

- 电器

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- International Paper Company

- Mondi Plc

- Smurfit Kappa Group

- DS Smith Plc

- WestRock Company

- Packaging Corporation of America

- Cascades Inc.

- Oji Holdings Corporation

- Nippon Paper Industries Co., Ltd.

- Rengo Co. Ltd

- Graphic Packaging International

- Metsa Board Oyj

- Sonoco Products Company

- Visy Industries

- Seaboard Folding Box Company Inc.

第八章投资分析

第九章 市场未来展望

The Paperboard Packaging Market size is estimated at USD 373.42 million in 2024, and is expected to reach USD 466.24 million by 2029, growing at a CAGR of 4.54% during the forecast period (2024-2029).

The market is expected to be driven by the expansion of e-commerce and the cosmetic and personal care packaging sectors during the forecast period. The demand for paper packaging is predicted to rise as a result of the expansion of the medical industry also, which accounts for a significant portion of non-durable products.

Key Highlights

- Paperboard is a thick paper-based material that is commonly used in packaging. It is made from wood pulp as the primary material. A significant amount of paperboard is recycled to reduce deforestation and waste. Paperboards are primarily utilized in food and beverage packaging, medical packaging, durable and non-durable goods packaging, industrial packaging, and cosmetics packaging.

- Currently, consumers prefer recyclability and biodegradability as important packaging parameters over reusability. It underlines consumers' growing concerns about future packaging waste's environmental impact. More than 60% of all communities in the United States collect and recycle paperboard packaging. Furthermore, companies are also focusing on introducing recyclable paperboard products. The Cascades recently launched a cardboard tray made from recyclable fibers. SIG has also found cartons made from recycled polymers using post-consumer waste.

- With advanced technologies like digitally printed paperboard attracting high investments, the product distributors are increasingly adopting the technology due to the solution offering interactive and colorful designs for the consumers to notice. Furthermore, government regulations being enforced by various countries are also leading to the demand for more sustainable and eco-friendly packaging solutions, like folding cartons.

- Further, due to its development as a point-of-sale display in retail applications and ongoing development trends in small flutes and high-quality graphics boards, corrugated packaging has emerged as a crucial market driver. It has allowed corrugated boxes to compete with traditional folding carton applications.

- However, the availability of high-performance substitutes is expected to hinder the market's growth. Paperboard packaging is one of the most used eco-friendly packaging solutions. The ability of this packaging format to be produced in many sizes with a small footprint, compared to the other bulkier packaging options, makes it feasible for use in almost all end-user industries.

- The packaging industry witnessed some significant issues due to the COVID-19 pandemic, including the effects of the lockdown, companies moving to source away from China, and reconsidering materials used in packaging. Although the supply side of paper packaging has witnessed a significant impact, a drastic increase in the end-user demand in some applications has significantly expanded the scope of paper packaging.

Paperboard Packaging Market Trends

Increasing Demand from Food and Beverage Segment

- The food and beverage industry is the largest end-user of paperboard packaging and accounts for more than half of the global market share. The food and beverage industry utilizes coated, unbleached boards for packaging beverages and corrugated container boards for packaging fruits, vegetables, and food products. The acceleration of frozen foods will likely drive the demand for folding carton packaging.

- Meanwhile, using sustainable strengthening processes, paper substitutes can attain the same strength, moisture resistance, and durability as plastic (e.g., water-based coatings). Plastic straws and cutlery are also being phased out of the pre-packaged food industry in favor of paper/wooden alternatives.

- Changes in lifestyle and a growing young population lead to a higher demand for branded and packaged substances. According to the Flexible Packaging Association, the beverage sector in the United States accounted for nearly 50% of the packaging market. Over 30% of Americans order food twice a week, which is expected to grow by 3% in the coming years.

- Furthermore, the surge in ecological packaging options has been driven by a rapid wave of widespread interest. According to Food Dive, 67% of customers worldwide believe it is critical that the items they buy come in recyclable packaging, with 54% indicating it is a factor they consider when purchasing. Also, 83% of younger buyers are prepared to spend more on products that are packed sustainably.

- Moreover, on-the-go consumption in countries like India, China, and Japan further fuels the demand. In countries such as China and India, the food and beverage demand is always on the higher side, subsequently driving the paperboard packaging market. Such positive growth in the food and beverage industry is expected to increase the demand for paperboard packaging during the forecast period.

- Further, the United States, one of the significant food production countries, may witness growth in paperboard packaging. According to BLS, in 2021, spending by the size of all consumer units increased by an annual percent change of 6.4% for food consumed at home and 27.6% for food consumed away from home. For all consumer units, regardless of size, except those with five or more persons, spending on food at home increased. Meanwhile, expenditure on food away from home climbed for all consumer units. Spending on food at home (+12.1%) and food away from home (+39.1%) increased at the highest rates among consumer units with three individuals. As previously mentioned, only consumer units with five or more persons had a decline in spending on food at home (-3%) even though they witnessed the second-largest increase in spending on food away from home (+31%). The rapid growth in food away from home may increase the opportunities for paperboard packaging firms to serve sustainable, eco-friendly packaging delivery.

North America to Witness Significant Growth Rate

- North America continues to be one of the leading markets for paperboard packaging products, owing to the presence of a large number of players operating in the country. Rising demand for packaged food in the U.S. and shifting consumer preference towards food & beverage products are expected to create significant opportunities.

- The United States dominates the folding carton packaging market in the North American region, where food is expected to continue as the primary end-user of folding cartons. For instance, according to the Association for Packaging and Processing Technologies, the United States food industry is expected to proliferate at a steady rate of 2.9% CAGR through 2022.

- Further, According to ITC statistics, the United States, in 2021, imported corrugated paper and paperboard valued at around USD 74.735 million, a 44.5% increase in imports from the previous year, 2020, which was reported at about USD 51.722 million. Such a significant rise in imports indicates the increase in demand for paperboard.

- In addition, increasing environmental concerns regarding the use of plastics and various organizations and governments' focus on the development of sustainable packaging materials are other factors expected to further fuel the growth of the target market over the forecast period.

- Furthermore, players in the market are increasingly investing in advanced and customized packaging solutions through increased M&A activities or R&D strategies. Moreover, the market is also witnessing new players entering the landscape. For instance, EdelmannUSA recently became a member of the PPC. This is indicative of the increased focus of the Europe-based company to expand in this market.

Paperboard Packaging Industry Overview

The global paperboard packaging market is highly fragmented. The major players operating in the market are focusing on innovating new products and entering into strategic acquisitions to strengthen their market presence. Some of the major players operating in the market include Nippon Paper Industries Co. Ltd, Mondi, Metsa Board, WestRock Company, and ITC Limited, among others.

- April 2022: The Burgo Group has agreed to sell the Duino mill in Trieste (Italy) to Mondi plc for a total price of EUR 40 million (USD 40.815 million). The mill now runs a single paper machine that produces thin-coated mechanical paper. Mondi intends to invest around EUR 200 million (USD 204.076 million) in this paper machine's conversion to produce 420,000 tonnes of high-quality recycled containerboard annually. The containerboard machine will improve backward integration in Corrugated Packaging and give the company supply security to better cater to its clients.

- May 2022: The French businesses owned by International Paper (Societe Normande de Carton Ondule SA, SNCO, and Emballages Laurent SAS, located in Western France) will profit from investments totaling nearly EUR 23 million (USD 24.191 million) to expand their capacity for production in response to the expansion of the e-commerce industry and provide customers with even more environmentally friendly packaging options.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Threat of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong demand from the e-commerce sector

- 5.1.2 Growing adoption of light weighting materials and scope for printing innovations propelling growth in the electronics & personal care segment

- 5.2 Market Restraints

- 5.2.1 Effects of Deforestation on Paper Packaging

- 5.2.2 Increasing Operational Costs

- 5.3 Cartonboard EXIM Scenario

- 5.3.1 Cartonboard Exports By Value and Volume

- 5.3.2 Cartonboard Import By Value and Volume

6 MARKET SEGMENTATION

- 6.1 By Grade

- 6.1.1 Cartonboard

- 6.1.2 Containerboard

- 6.1.3 Other Grades

- 6.2 By Product Type

- 6.2.1 Folding Cartons

- 6.2.2 Corrugated Boxes

- 6.2.3 Other Types

- 6.3 By End-User Industry

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Healthcare

- 6.3.4 Personal Care

- 6.3.5 Household Care

- 6.3.6 Electrical Products

- 6.3.7 Other End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 Italy

- 6.4.2.4 France

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 Saudi Arabia

- 6.4.5.2 South Africa

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Paper Company

- 7.1.2 Mondi Plc

- 7.1.3 Smurfit Kappa Group

- 7.1.4 DS Smith Plc

- 7.1.5 WestRock Company

- 7.1.6 Packaging Corporation of America

- 7.1.7 Cascades Inc.

- 7.1.8 Oji Holdings Corporation

- 7.1.9 Nippon Paper Industries Co., Ltd.

- 7.1.10 Rengo Co. Ltd

- 7.1.11 Graphic Packaging International

- 7.1.12 Metsa Board Oyj

- 7.1.13 Sonoco Products Company

- 7.1.14 Visy Industries

- 7.1.15 Seaboard Folding Box Company Inc.