|

市场调查报告书

商品编码

1444280

能源储存-市场占有率分析、产业趋势与统计、成长预测(2024-2029)Thermal Energy Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

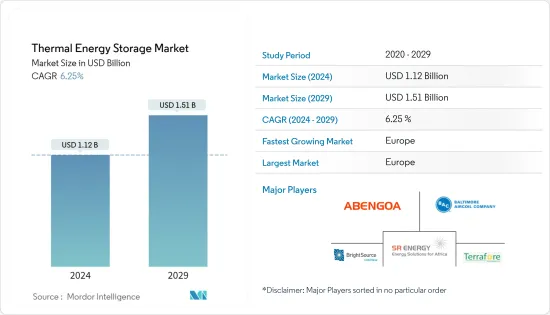

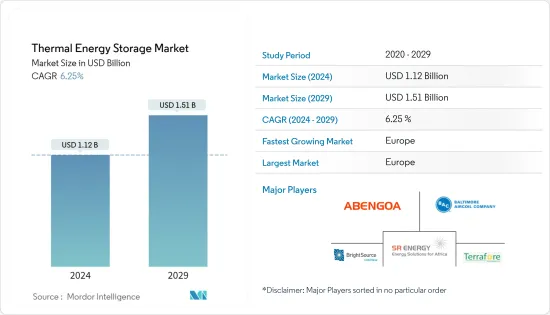

预计2024年能源储存市场规模为11.2亿美元,预计到2029年将达到15.1亿美元,预测期间(2024-2029年)复合年增长率为6.25%。

由于工业封锁和发电行业电力需求急剧下降,COVID-19 疫情对市场产生了负面影响。热能能源储存产业的企业出现了巨大的收益损失。 ABENGOA 2020 年销售额为 12.5 亿欧元,比 2019 年的 14.93 亿欧元下降 16%。由于工业领域大型企业对技术的需求不断增加,预计未来几年热能能源储存市场将快速成长。 -大规模暖气和冷气应用的选项以及节省尖峰时段能源的环保方式。然而,来自电池能源储存等其他能源储存替代方案的竞争预计将阻碍未来市场的成长。

主要亮点

- 由于越来越多地采用能源储存系统的聚光太阳能(CSP)技术,预计发电应用在预测期内将显着成长。

- 产业相关人员和政府机构正在努力透过研究和创新使技术范围多样化,从而在市场上创造充足的机会。最近,欧盟在「地平线 2020」计画下为能源储存技术进步拨款。

- 由于对季节性能源储存的高需求,欧洲在预测期内可能会成长更快。

热能能源储存市场趋势

发电量预计将大幅成长

- 世界对可再生能源发电和能源安全方法的采用正在加速对太阳能发电中的聚光太阳能发电(CSP)等技术的需求。这些技术在当前场景下经常被应用在能源储存系统中。

- 由于世界各地光热发电设备安装量的增加,光热发电电源的发电量正在显着增加。例如,根据 IRENA 的数据,2022 年 CSP 总装置容量约为 6.50 GW,而 2021 年为 6.37 GW。工业和商业领域的技术应用有所成长。太阳能 CSP 发电组合中将增加几个计划以及能源储存系统。

- 2022年1月,中国政府宣布计画在2024年兴建11个热能源储存光热发电计划。预计中国国有企业将在未来与其他产业相关人员联盟的计划中发挥主导作用。这些是千兆瓦级混合可再生能源计划,两年内还将增加更多项目。

- 2023年6月,Vast Solar Pty授予Worley一份澳洲VS1 CSP计划的重要工程合约。该计划涉及在南澳大利亚奥古斯塔港建设一座30兆瓦或288兆瓦时的光热电站。该设施采用Vast的模组化CSP塔v3.0技术,旨在利用超过8小时的热能来生产清洁、可输送、低成本的电力。

- 由于这些发展,发电行业预计将在预测期内占据最大的市场占有率。

预计欧洲将经历最高成长

- 欧洲在过去十年中一直在西班牙、奥地利、北欧和中欧等国家的都市区安装各种能源储存系统。这一战略步骤的主要推动力是冬季能源消费量的增加和寻找可再生的区域供暖方法。

- 该地区正在规划更多大型能源储存计划,以满足日益增长的季节性和短期能源储存需求,大多数设施采用熔盐技术和地下热水箱。我是。这些预计将成为未来区域供热和其他用途的多功能能源中心。

- 2022年8月,挪威京都集团与瓦楞纸板製造商Groma Papp签署了意向书(LoI),为京都提供基于熔盐的能源储存解决方案「HeatCube」。该系统计划于 2023 年投入运作。

- 2022年1月,欧盟和欧洲投资银行选择电网规模能源储存供应商马耳他公司在西班牙执行Sun2Store热能能源储存计划。这是一个 1,000 MWh/10 小时的能源储存系统,结合了举升技术和熔盐。该计划可能与阿法拉伐合作开发。

- 预计此类发展将显着推动欧洲能源储存市场。

热能源储存产业概况

热能源储存市场适度整合。一些主要企业(排名不分先后)包括 BrightSource Energy Inc.、Abengoa SA、Baltimore Aircoil Company、Terrafore Technologies LLC 和 SR Energy。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 调查先决条件

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2028 年之前的市场规模与需求预测(美元)

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 促进因素

- 工业领域对大规模暖气和冷气应用技术的需求不断增长

- 能源储存系统需求不断成长

- 抑制因素

- 与替代能源储存系统的竞争

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 类型

- 熔盐

- 热水

- 其他类型

- 目的

- 发电

- 加热

- 冷却

- 科技

- 显能源储存

- 潜热能能源储存

- 热化学能源储存

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东/非洲

- 北美洲

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- BrightSource Energy Inc.

- Aalborg CSP AS

- Abengoa SA

- Baltimore Aircoil Company

- Burns &McDonnell

- SaltX Technology Holding AB

- Terrafore Technologies LLC

- Trane Technologies PLC

- SR Energy

- Vantaa Energy

第七章市场机会与未来趋势

- 研究和创新的兴起使技术范围多样化

The Thermal Energy Storage Market size is estimated at USD 1.12 billion in 2024, and is expected to reach USD 1.51 billion by 2029, growing at a CAGR of 6.25% during the forecast period (2024-2029).

The COVID-19 outbreak negatively impacted the market due to the industrial lockdowns and plummeted power demand in the power generation industry. The thermal energy storage industry players witnessed huge losses in their revenues. The ABENGOA company recorded a revenue of EUR 1,250 million for 2020, a 16% decline from EUR1,493 million in 2019. The thermal energy storage market is likely to boom in the future due to the increased demand for technology in the industrial sector for large-scale heating and cooling applications and the option for an eco-friendly method of saving energy for power generation during peak hours. However, the competition from other energy storage alternatives like battery energy storage is expected to hamper the market's growth in the future.

Key Highlights

- The power generation application is expected to witness significant growth during the forecast period due to the growing adoption of concentrated solar power (CSP) technology with thermal energy storage systems.

- The research and innovation endeavors to diversify the scope of the technology by the industry players and government organizations create ample opportunities for the market. Very recently, the European Union allotted funds for the technological advancement of thermal energy storage under the Horizon 2020 program.

- Europe is likely to grow faster during the forecast period due to the high demand for seasonal energy storage.

Thermal Energy Storage Market Trends

Power Generation Expected to Witness Significant Growth

- The global installation of renewable power generation and energy security methods has accelerated the need for technologies like concentrated solar power (CSP) in solar power generation. These technologies are often used with thermal energy storage systems in the current scenario.

- The power generation through CSP sources is increasing significantly due to the increasing installation of CSP capacities globally. For instance, in 2022, the total installed CSP capacity was around 6.50 GW, which was 6.37 GW in 2021, as per IRENA. The growth in the technology application was witnessed in the industrial and commercial sectors. Several projects will be added to the solar CSP power generation portfolio, along with thermal energy storage systems.

- In January 2022, the Chinese government announced plans to build 11 CSP projects with thermal energy storage by 2024. The country's state-owned firms are expected to play a leading role in the upcoming projects in consortium with other industry players. They are gigawatt-scale mixed renewable energy projects to be added within two years.

- In June 2023, Vast Solar Pty awarded crucial engineering contracts for the VS1 CSP project in Australia to Worley. The project involves the construction of a 30 MW or 288 MWh CSP plant in Port Augusta, South Australia. This facility will utilize modular CSP tower v3.0 technology of Vast, intending to generate clean, dispatchable, and low-cost power with more than 8 hours of thermal energy.

- Due to these developments, the power generation segment is expected to occupy the largest market share during the forecast period.

Europe Expected to Witness the Highest Growth

- Europe has been installing various thermal energy storage systems for a decade in the urban districts of countries like Spain, Austria, and Northern and Central Europe. The major driver of such a strategic step is the high energy consumption during winters and exploring renewable ways of district heating.

- The region has planned even more large-scale thermal storage projects to meet the ever-growing seasonal and short-term storage demand, with most installations with molten salt technology and underground hot water tanks. They are expected to serve as multifunctional energy hubs for future district heating sources and other applications.

- In August 2022, Kyoto Group in Norway signed a letter of intent (LoI) with Glomma Papp, a cardboard manufacturer, to enter a supply agreement for Kyoto's thermal energy storage molten-salt-based solution, Heatcube. This system is expected to be commissioned in 2023.

- In January 2022, the European Union and the European Investment Bank chose Malta Inc., the grid-scale thermal energy storage provider, to execute the Sun2Store thermal energy storage project in Spain. It is a 1,000-MWh/ten-hour energy storage system combining pumped heat technology with molten salt. The project will likely be developed in partnership with Alfa Laval.

- Such developments are expected to boost the European thermal energy storage market significantly.

Thermal Energy Storage Industry Overview

The thermal energy storage market is moderately consolidated. Some of the key players (not in particular order) are BrightSource Energy Inc., Abengoa SA, Baltimore Aircoil Company, Terrafore Technologies LLC, and SR Energy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Technology in the Industrial Sector for Large-scale Heating and Cooling Applications

- 4.5.1.2 Risising Demand for Energy Storage Systems

- 4.5.2 Restraints

- 4.5.2.1 Competition from Alternative Energy Storage Systems

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Molten Salt

- 5.1.2 Hot water

- 5.1.3 Other Types

- 5.2 Application

- 5.2.1 Power Generation

- 5.2.2 Heating

- 5.2.3 Cooling

- 5.3 Technology

- 5.3.1 Sensible Heat Storage

- 5.3.2 Latent Heat Storage

- 5.3.3 Thermochemical Heat Storage

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BrightSource Energy Inc.

- 6.3.2 Aalborg CSP AS

- 6.3.3 Abengoa SA

- 6.3.4 Baltimore Aircoil Company

- 6.3.5 Burns & McDonnell

- 6.3.6 SaltX Technology Holding AB

- 6.3.7 Terrafore Technologies LLC

- 6.3.8 Trane Technologies PLC

- 6.3.9 SR Energy

- 6.3.10 Vantaa Energy

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Risisng Research and Innovation Endeavors to Diversify the Scope of the Technology