|

市场调查报告书

商品编码

1444358

地震服务 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Seismic Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

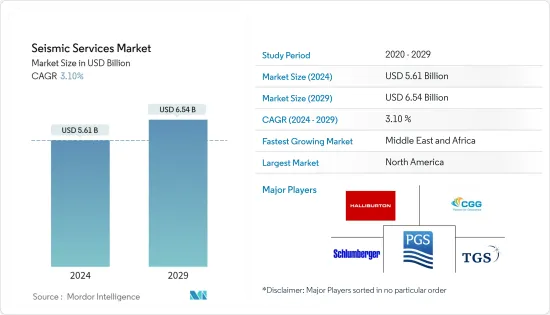

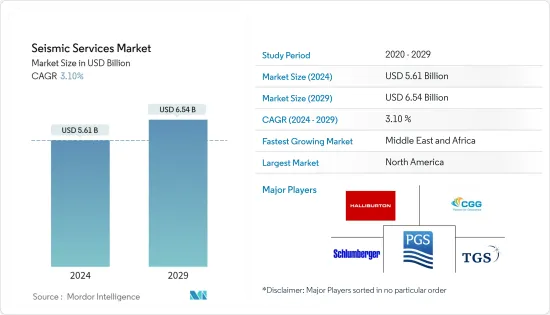

地震服务市场规模预计到 2024 年为 56.1 亿美元,预计到 2029 年将达到 65.4 亿美元,在预测期内(2024-2029 年)CAGR为 3.10%。

主要亮点

- 从中期来看,西非和墨西哥湾等近海地区勘探增加等因素,加上原油价格走强,使上游活动在经济上可行,可能会推动市场。

- 另一方面,许多国家正在转向再生能源并结束对原油的依赖,这可能会限制预测期内的市场成长。

- 然而,陆上和浅水油田已经成熟,这些地区几乎没有新油田发现的空间。因此,深水和超深水储量的开发预计将为未来地震服务市场创造重大机会。

地震服务市场趋势

海上石油和天然气产业的需求不断成长

- 海上部分占据地震服务市场的最大份额。由于多种有利条件,包括可重复且一致的震源、震源和接收器良好的耦合条件以及水作为介质的均匀特性等,海上地震资料的品质通常比陆上地震资料高得多。

- 根据贝克休斯的数据,2022年世界平均钻机总数为1,824个,高于2022年世界平均钻机数量1,747个。随着钻机数量的增加,勘探活动将会增加,进而预计将推动地震勘探活动。世界的服务需求。

- 2022 年 1 月,壳牌公司宣布在纳米比亚发现一口大型海上油气井。对勘探钻探的早期分析估计,新发现的油井可能含有 2.5 至 3 亿桶石油和天然气。这项发现之后,商业石油生产所需的油藏开发工作可能会推动市场。

- 此外,挪威石油管理局估计,大陆架上剩余资源的 47% 左右必须被发现。英国大陆棚 (UKCS) 约有 350 个未开发的发现,蕴藏着 32 亿桶石油当量 (bboe)。

- 因此,增加深水和超深水储量的勘探和生产(E&P)活动以及石油和天然气巨头加大力度开发未发现的资源预计将推动海上地震服务市场的发展。

中东和非洲可能会显着成长

- 海上地震勘测是绘製石油和天然气矿藏图的最便宜的方法。这种方法可以定位地下结构并记录折射和反射资料。由于调查需要多个来源,因此聘请了多个工作小组来收集资料。

- 中东和非洲的海上勘探不断增加,例如西非近海地区拥有广泛的未开发资源,为石油和天然气勘探公司创造了机会。因此,该地区的勘探可能会推动地震服务市场。

- 2022年1月,壳牌公司在纳米比亚近海Graff-1井获得重大油气发现,可能引发纳米比亚投资热潮。钻探结果显示,一层至少 60 公尺深的碳氢化合物,估计蕴藏着 2.5 亿至 3 亿桶石油和天然气当量。该油田开发完成后预计将于 2026 年投入生产,其中地震勘测预计将推动市场发展。

- 此外,2022 年 1 月,澳洲地球科学公司 Searcher 开始在南非西海岸进行地震勘测,以进行涵盖多个石油许可区块的多客户勘测专案。许可证面积约297,087平方米,许可证规定可以进行二维和三维推测地震勘探计画。这可能有助于该地区市场的成长。

- 因此,新石油和天然气的发现以及地震测试的批准等上述因素预计将在预测期内推动中东和非洲地区的地震服务市场。

地震服务业概况

地震服务市场高度集中。一些主要公司包括(排名不分先后)Schlumberger NV、CGG SA、PGS ASA、TGS ASA 和 Halliburton Company 等。

2022 年 8 月,斯伦贝谢和微软签署了一项多年期协议,旨在汇集联合专业知识,为能源产业建立开放、可扩展的云端原生资料产品。下一阶段将利用OSDU资料平台的开放性和敏捷性,开发第一个云端原生地震处理解决方案-DELFI地震处理。透过利用 OSDU 资料平台,合作伙伴为开发创新应用程式和工作流程以满足当前的地震需求提供了经济高效的基础。第三方开发人员将建构和增强地震处理解决方案,供其内部使用或提供给市场。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究范围

- 市场定义

- 研究假设

第 2 章:执行摘要

第 3 章:研究方法

第 4 章:市场概览

- 介绍

- 到 2028 年市场规模与需求预测(十亿美元)

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 司机

- 增加近海地区的勘探

- 原油价格走强,使上游活动在经济上可行

- 限制

- 转向再生能源

- 司机

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争激烈程度

第 5 章:市场细分

- 服务

- 数据采集

- 数据处理和解释

- 部署地点

- 陆上

- 离岸

- 地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 亚太

- 中国

- 印度

- 澳洲

- 亚太其他地区

- 欧洲

- 德国

- 俄罗斯

- 英国

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 伊朗

- 伊拉克

- 中东和非洲其他地区

- 北美洲

第 6 章:竞争格局

- 併购、合资、合作与协议

- 领先企业采取的策略

- 公司简介

- Halliburton Company

- Briscoe Group Limited

- CGG SA

- Fugro NV

- ION Geophysical Corporation

- PGS ASA

- Polarcus Ltd

- SAExploration Holdings Inc.

- Schlumberger NV

- SeaBird Exploration PLC

- Shearwater GeoServices Holding AS

- TGS ASA

- Magseis Fairfield ASA (WGP Group Ltd)

- China Oilfield Services Limited

第 7 章:市场机会与未来趋势

- 深水和超深水储量的可用性

The Seismic Services Market size is estimated at USD 5.61 billion in 2024, and is expected to reach USD 6.54 billion by 2029, growing at a CAGR of 3.10% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as increasing exploration in the offshore areas such as in West Africa and the Gulf of Mexico, coupled with the strengthening of crude oil prices, making the upstream activities economically feasible, are likely to drive the market.

- On the other hand, a lot of countries are shifting to renewable energy sources and ending their reliance on crude oil, which may restrain the market growth during the forecast period.

- Nevertheless, land-based and shallow-water oil fields have reached their maturity, and there is little scope for any new field discovery in these areas. Therefore, the development of deepwater and ultra-deepwater water reserves is expected to create significant opportunities for the seismic services market in the future.

Seismic Services Market Trends

Increasing Demand from the Offshore Oil and Gas Industry

- The offshore segment accounts for the largest share of the seismic services market. Offshore seismic data usually has much higher quality than onshore due to several favorable conditions, including repeatable and consistent sources, good conditions for coupling at sources and receivers, and the uniform property of water as the medium.

- According to Baker Hughes, the total world average rig count was 1,824 in 2022, more significant than the world average of 1,747 in 2022. With the increasing number of rigs, exploration activities will grow, which, in turn, is expected to drive the seismic services demand in the world.

- In January 2022, Shell PLC announced the discovery of a substantial offshore oil and gas well in Namibia. Early analysis of the exploratory drilling estimates that the newly discovered well could contain 250 to 300 million barrels of oil and gas. After this discovery, the reservoir development work necessary for commercial petroleum production will likely drive the market.

- Furthermore, the Norwegian Petroleum Directorate has estimated that around 47% of all the remaining resources on the shelf must be discovered. Around 350 undeveloped discoveries in the United Kingdom Continental Shelf (UKCS) contain 3.2 billion barrels of oil equivalent (bboe).

- Therefore, increasing exploration and production (E&P) activities in the deepwater and ultra-deepwater reserves and increasing efforts by the oil and gas majors to tap into the undiscovered resources are expected to drive the offshore seismic services market.

Middle-East and Africa is Likely to Experience Significant Growth

- The Offshore Seismic Survey is the least expensive method of mapping oil and gas deposits. This approach locates subsurface structures and records data on refraction and reflection. Because the survey requires more than one source, several WGs are employed to collect data.

- Middle-East and Africa is witnessing increasing offshore exploration in regions such as offshore West Africa, which has widespread untapped resources, creating opportunities for the oil and gas exploration companies. Thus, explorations in this region are likely to drive the seismic services market.

- In January 2022, Shell PLC made a significant oil and gas discovery in the Graff-1 well in offshore Namibia, which can spark a wave of investment in Namibia. The drilling results have shown one layer of at least 60 meters deep of hydrocarbons, holding an estimated 250 to 300 million barrels of oil and gas equivalent. The field expects to go into production by 2026 after its development, including seismic surveys, which are expected to drive the market.

- Furthermore, in January 2022, the Australian geoscience company Searcher started its seismic survey off the West Coast of South Africa for a multi-client survey program that covers a number of petroleum license blocks. The permit area is approximately 297,087 m2, and the permit provides for the undertaking of a two-dimensional and three-dimensional speculative seismic survey program. This is likely to aid the growth of the market in the region.

- Therefore, the above-mentioned factors, such as new oil and gas discoveries and approvals for seismic testing, are expected to drive the seismic services market in the Middle-East and Africa region over the forecast period.

Seismic Services Industry Overview

The seismic services market is highly concentrated. Some of the major companies include (not in a particular order ) Schlumberger NV, CGG SA, PGS ASA, TGS ASA, and Halliburton Company, among others.

In August 2022, Schlumberger and Microsoft have signed a multi-year agreement to pool joint expertise and build open and extensible cloud-native data products for the energy industry. The next phase will use the openness and agility of the OSDU Data Platform to develop the first cloud-native seismic processing solution - DELFI Seismic Processing. By leveraging the OSDU Data Platform, the partners are providing a cost-effective foundation for developing innovative applications and workflows to address current seismic needs. Third-party developers will build and augment seismic processing solutions, either for their internal use or to offer to the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Exploration in Offshore Areas

- 4.5.1.2 The Strengthening of Crude Oil Prices, Making the Upstream Activities Economically Feasible

- 4.5.2 Restraints

- 4.5.2.1 Shifting to Renewable Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service

- 5.1.1 Data Acquisition

- 5.1.2 Data Processing and Interpretation

- 5.2 Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States of America

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Asia-Pacific

- 5.3.2.1 China

- 5.3.2.2 India

- 5.3.2.3 Australia

- 5.3.2.4 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 Russia

- 5.3.3.3 United Kingdom

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of the South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Iran

- 5.3.5.4 Iraq

- 5.3.5.5 Rest of the Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Halliburton Company

- 6.3.2 Briscoe Group Limited

- 6.3.3 CGG SA

- 6.3.4 Fugro NV

- 6.3.5 ION Geophysical Corporation

- 6.3.6 PGS ASA

- 6.3.7 Polarcus Ltd

- 6.3.8 SAExploration Holdings Inc.

- 6.3.9 Schlumberger NV

- 6.3.10 SeaBird Exploration PLC

- 6.3.11 Shearwater GeoServices Holding AS

- 6.3.12 TGS ASA

- 6.3.13 Magseis Fairfield ASA (WGP Group Ltd)

- 6.3.14 China Oilfield Services Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Availability of Deepwater and Ultra-Deepwater Water Reserves