|

市场调查报告书

商品编码

1635515

南美洲海洋地震探勘:市场占有率分析、产业趋势与成长预测(2025-2030)South America Offshore Seismic Survey - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

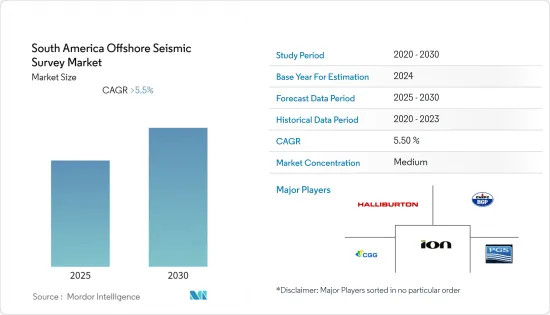

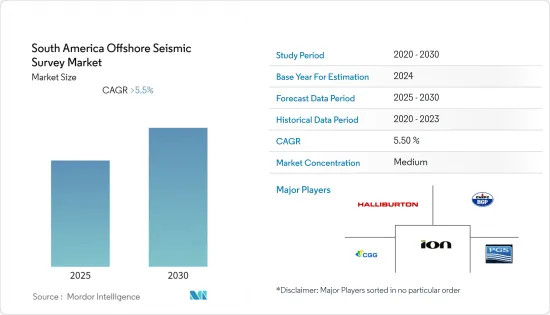

预计南美海上地震探勘市场在预测期内的复合年增长率将超过 5.5%。

2020 年,市场受到 COVID-19 大流行的负面影响。目前市场处于大流行前的水平。

主要亮点

- 从长远来看,海上石油生产对探勘技术的需求增加以及能源转型期间对离岸风力发电计划的需求增加等因素预计将推动预测期内的市场研究。

- 另一方面,由于地震探勘成本高而导致总探勘支出增加,预计将阻碍预测期内的市场成长。

- 地震探勘技术的不断进步预计将在不久的将来为南美海上地震探勘市场创造巨大的机会。

- 预计在预测期内,巴西南美海上地震探勘市场将出现显着成长。

南美洲海上地震探勘市场趋势

石油和天然气产业主导市场

- 海上地震探勘是石油和天然气探勘第一步的一部分。地震探勘是一种物理探勘技术,可创建地表下岩石的图像。此步骤至关重要,因为此次调查的图像将用于识别潜在的石油和天然气储量。巴西、阿根廷、哥伦比亚等国是该地区石油和天然气产业地震探勘的主要用户。

- 南美洲拥有世界上一些最大的已探明石油和天然气蕴藏量。截至2021年,该地区已探明原油蕴藏量约3,294.81亿桶。与 2017 年(3,292.83 亿桶)相比,增加了约 0.06%。委内瑞拉在这些石油蕴藏量中所占比例最大,超过 92%,约 3,034.68 亿桶。巴西和厄瓜多也是石油大国,石油蕴藏量分别为118.9亿桶和82.73亿桶。

- 巴西、阿根廷、委内瑞拉等国正在增加对石油和天然气探勘和生产的投资。例如,巴西国家石油公司计划在2022年至2026年间投资约680亿美元。在总投资中,84%将分配给石油和天然气勘探和生产(E&P)。勘探与生产总资本投资(570 亿美元)的约 67% 将分配给盐层下。这表明石油和天然气上游领域预计将有大量投资,特别是巴西的海上石油和天然气资产,从而增加预测期内对海上地震探勘市场的需求。

- 此外,在哥伦比亚,重点将放在皮埃蒙特地区陆上的新钻探宣传活动以及加勒比海上区块的探勘机会,哥伦比亚国家石油公司 Ecopetrol 正在优先考虑轻质石油和天然气。因此,预计未来三年仅上游计划就需要1,000万美元至120亿美元的投资。

- 此外,挪威海上地震资料采集公司 PGS 于 2021 年 12 月表示,计划于 2022 年第二季开始为巴西国家石油公司在巴西近海 Roncador 和 Albacora Leste 区块进行重大 4D 采集调查。此次收购预计将于2022年终完成。预计此类收购将在预测期内对海上地震探勘市场产生积极的需求。

- 因此,基于上述因素,预计石油和天然气产业将在预测期内主导南美海上地震探勘市场。

巴西,预计将出现显着成长

- 巴西原油产量约290万桶/日,到2021年将成为全球第十大石油生产国。根据美国能源资讯署(EIA)的数据,巴西90%以上的石油产量是从深海油田开采的。根据欧佩克2022年年度统计公报,巴西2021年探明原油蕴藏量约118.9亿桶,位居南美洲第二位,仅次于委内瑞拉。

- 截至2021年,巴西是南美洲石油和天然气支出最高的国家。巴西海上盐层下油田产量约占石油总产量的 50%,至 2021年终,这一比例将增加至 75% 左右。产量的增加和对海上天然气田的依赖增加是由于钻井技术的改进、海上石油和天然气行业专业知识的增加以及基础设施的扩大,这些都稳步降低了生产成本。

- 巴西国家石油公司和外国石油公司不断增加的投资预计将推动该国石油和天然气产业的发展,并在预测期内增加对地震探勘市场的需求。巴西拥有多个大型海上上游计划,预计2025年将贡献全球海上原油和冷凝油产量的20%以上。大部分产量将来自坎波斯盆地的 Pao de Acucar 和 Calcara 油田,预计 2022年终投产。随着这两个油田的投产,预计预测期内地震探勘的需求将大幅增加。

- 此外,法国 CGG 于 2022 年 4 月提交了一项计划,将在巴西海岸附近的圣埃斯皮里图盆地远洋区进行新的非排他性 3D 地震探勘。该探勘计画可能涵盖圣埃斯皮里图地区的大片区域,巴西能源巨头巴西国家石油公司、西班牙雷普索尔公司和中国海洋石油总公司等业者都在该地区拥有探勘区块。预计这些新兴市场的发展将在预测期内推动巴西地震探勘市场的积极需求。

- 因此,基于上述因素,巴西南美海上地震探勘市场预计在预测期内将出现巨大需求。

南美洲海上地震探勘产业概况

南美洲海上地震探勘市场因其性质而适度分割。市场主要企业包括(排名不分先后)Halliburton Company、BGP Inc.、CGG SA、Ion Geophysical Corporation 和 PGS SA。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按服务

- 资料采集

- 资料处理和解释

- 按行业分类

- 石油和天然气

- 风力

- 按地区

- 巴西

- 阿根廷

- 委内瑞拉

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Halliburton Company

- BGP Inc.

- CGG SA

- Fugro NV

- Ion Geophysical Corporation

- PGS SA

- Saexploration Holdings Inc.

- Schlumberger Ltd

- TGS ASA

- Shearwater Geoservices

第七章 市场机会及未来趋势

简介目录

Product Code: 92954

The South America Offshore Seismic Survey Market is expected to register a CAGR of greater than 5.5% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as increasing demand for seismic technology in offshore oil production and increasing demand for offshore wind projects in energy transition are expected to drive the market studied during the forecast period.

- On the flip side, increasing total expenditure on exploration due to high seismic survey costs is expected to hinder market growth during the forecast period.

- Increasing advancements in seismic survey technology are expected to create immense opportunities in the South American offshore seismic survey market soon.

- Brazil is expected to witness significant growth in the South American offshore seismic survey market during the forecast period.

South America Offshore Seismic Survey Market Trends

Oil and Gas Sector to Dominate the Market

- Offshore seismic surveys are a part of the first steps in oil and gas exploration. A seismic survey is a geophysical exploration technique that produces images of the rocks beneath the surface of the Earth. This step is crucial as the surveys' images are used to identify possible oil and gas accumulations. Countries such as Brazil, Argentina, and Colombia are a few leading seismic survey users in the oil and gas industry in the region.

- South America is home to some of the world's largest countries in terms of proven oil and gas reserves. The region, as of 2021, has proven crude oil reserves of around 329,481 million barrels. An increase of about 0.06% was observed compared to the 2017 value (329,283 million barrels). Venezuela has the largest share of more than 92% of these oil reserves, about 303,468 million barrels. Brazil and Ecuador are also leading countries with oil reserves of 11,890 million barrels and 8,273 million barrels, respectively.

- Countries such as Brazil, Argentina, Venezuela, etc., are investing more in the exploration and production of crude oil and natural gas. For instance, Petrobras plans to invest around USD 68 billion from 2022 to 2026. Of this total investment, 84% is allocated to oil and natural gas exploration and production (E&P). Of the total E&P CAPEX (USD 57 billion), around 67% will be allocated to pre-salt assets. This indicates that the upstream oil and gas sector, especially the offshore oil and gas assets in Brazil, is expected to witness significant investment, increasing the demand for the offshore seismic survey market during the forecast period.

- Furthermore, the exploration focus in Colombia will be on new drilling campaigns in the onshore Piedemonte region and opportunities in Caribbean offshore blocks, where Colombia's state-owned oil company Ecopetrol is prioritizing light oil and gas. Hence, upstream projects alone are expected to require investments of USD 10 million - USD 12 billion over the next three years.

- Also, Norwegian marine seismic data acquisition company PGS, in December 2021, stated that the company was scheduled to start a significant 4D acquisition survey for Petrobras over the Roncador and Albacora Leste fields offshore Brazil in Q2 2022. The acquisition is expected to be completed by the end of 2022. Such acquisitions are expected to create positive demand for the offshore seismic survey market during the forecast period.

- Therefore, based on the above-mentioned factors, the oil and gas sector is expected to dominate South America's offshore seismic survey market during the forecast period.

Brazil Expected to Witness Significant Growth

- Brazil accounts for about 2.9 million barrels per day of crude oil production and will be the tenth-largest oil-producing country in the world in 2021. According to the US Energy Information Administration (EIA), more than 90% of Brazil's oil production is extracted from deep-water oil fields offshore. According to OPEC Annual Statistical Bulletin 2022, Brazil accounted for about 11,890 million barrels of proven crude oil reserves in 2021, the second largest in South America after Venezuela.

- As of 2021, Brazil is the highest-spending country in South America regarding oil and gas. The country's offshore pre-salt oil fields pumped around 50% of the total oil output, and this share will increase to approximately 75% by the end of 2021. This increasing production and dependency on offshore oil and gas fields can be attributed to steadily decreasing production expenses due to improved drilling technology, growing expertise in the offshore oil and gas industry, and increased infrastructure.

- The increasing investments from Petrobras and foreign oil companies are expected to drive the oil and gas sector in the country, driving the demand for the seismic survey market during the forecast period. Brazil has several large-scale offshore upstream projects and is expected to contribute more than 20% of global offshore crude oil and condensate production by 2025. Most of the production is expected from the Pao de Acucar in the Campos basin and Carcara fields, which are expected to be initiated by the end of 2022. With the commencement of production from these two fields, the demand for seismic surveys is expected to increase significantly during the forecast period.

- Furthermore, in April 2022, France's CGG submitted plans to run a fresh non-proprietary 3D seismic survey in the deep-water section of the Espirito Santo basin offshore Brazil. The proposed campaign will likely encompass a large area in Espirito Santo where operators, including Brazilian energy giant Petrobras, Spain's Repsol, and China's National Offshore Oil Corporation, have exploration blocks. Such developments will likely create positive demand for the Brazilian seismic survey market during the forecast period.

- Therefore, based on the above-mentioned factors, Brazil is expected to witness significant demand in the South American offshore seismic survey market during the forecast period.

South America Offshore Seismic Survey Industry Overview

The South American offshore seismic survey market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Halliburton Company, BGP Inc., CGG SA, Ion Geophysical Corporation, and PGS SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Data Acquisition

- 5.1.2 Data Processing and Interpretation

- 5.2 By Sector

- 5.2.1 Oil and Gas

- 5.2.2 Wind

- 5.3 By Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Venezuela

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Halliburton Company

- 6.3.2 BGP Inc.

- 6.3.3 CGG SA

- 6.3.4 Fugro NV

- 6.3.5 Ion Geophysical Corporation

- 6.3.6 PGS SA

- 6.3.7 Saexploration Holdings Inc.

- 6.3.8 Schlumberger Ltd

- 6.3.9 TGS ASA

- 6.3.10 Shearwater Geoservices

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219