|

市场调查报告书

商品编码

1444408

发电汽轮机 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Steam Turbine For Power Generation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

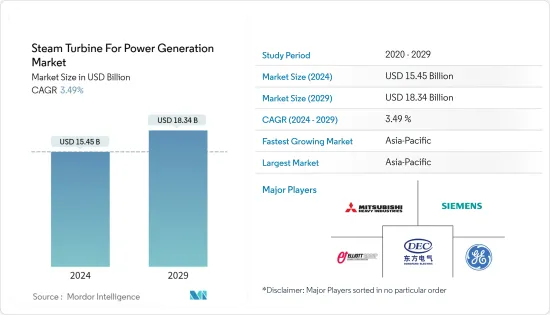

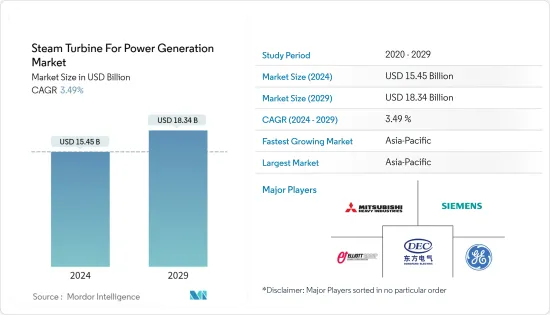

发电用汽轮机市场规模预计到 2024 年为 154.5 亿美元,预计到 2029 年将达到 183.4 亿美元,在预测期内(2024-2029 年)CAGR为 3.49%。

预计今年底,发电用汽轮机市场规模将达到149.3亿美元,预计未来五年将达到177.2亿美元,预测期内CAGR将超过3.49%。

主要亮点

- 从中期来看,即将建成的天然气联合循环电厂和热煤电厂以及对不间断电力供应的日益重视等因素预计将推动发电市场的汽轮机。

- 另一方面,再生能源发电的日益普及和对清洁能源的需求预计将阻碍预测期内的市场成长。

- 儘管如此,随着大部分需求来自北美和亚太地区,联合循环发电厂效率的提高可能会在预测期内为市场创造利润丰厚的成长机会。

- 由于能源需求不断增长,亚太地区是预测期内成长最快的市场。这一增长归因于对该地区国家(包括印度、中国和澳大利亚)投资的增加。

发电汽轮机市场趋势

天然气工厂将显着成长

- 燃气联合循环发电厂 (CCP) 结合使用燃气和蒸汽涡轮机,使用相同的燃料可比传统的简单循环发电厂多发电 50%。燃气涡轮机的废热被输送到附近的蒸汽涡轮机,从而产生额外的电力。

- 与燃煤发电厂相比,天然气联合循环发电厂产生的温室气体(例如二氧化碳(CO2))以及其他污染物(例如二氧化硫(SO2)和氮氧化物(NOx))的排放量显着降低。这使它们成为更清洁的发电选择,有助于改善空气品质并减少对环境的影响。

- 全球对再生能源的需求不断增长,提高了天然气发电厂的受欢迎程度。由于从煤炭转向天然气,天然气需求不断增加,特别是在亚太地区。例如,根据能源研究所《世界能源统计回顾》的数据,2022年,全球天然气消费总量约为39,413亿立方公尺。预计这将产生对天然气作为发电来源的巨大需求。

- 天然气联合循环发电厂提供营运弹性,使其能够快速回应电力需求的变化。它们可以相对快速地提高或降低功率输出,非常适合平衡太阳能和风能等再生能源的间歇性。

- 随着城市化进程的不断发展、能源需求的不断增长,以及政府推动工业化和基础设施发展活动的努力,全球对天然气联合动力循环的需求不断增加。大多数国家投资这些发电设施来满足不断增长的电力需求。

- 例如,在美国,截至 2021 年,约 32.3 吉瓦的新建天然气发电厂计划于 2025 年开始运营,并处于开发后期阶段。目前有 14.2 吉瓦正在建设中,3.4 吉瓦处于预建阶段,14.7 吉瓦正在提前获得许可。

- 许多天然气联合循环工厂可以在现有地点建造或改造,利用天然气供应和电力传输的基础设施。这有助于加快新发电能力的部署。

- 例如,2023年3月,亚洲开发银行宣布将在印度特里普拉邦兴建一座120兆瓦燃气联合循环发电厂。同样,同月,黑山政府与美国 Enerflex Energy Systems 和 Wethington Energy Innovation 等公司签署了一份谅解备忘录,内容涉及建造液化天然气 (LNG) 终端和燃气发电厂。 CCGP 发电厂的容量可能在 240 兆瓦至 440 兆瓦之间。

- 因此,天然气联合循环发电厂在效率、低排放、灵活性、可靠性和成本效益之间取得了平衡,使其成为发电的热门选择,从而增加了全球对蒸汽涡轮机的需求。

亚太地区预计将主导市场

- 亚太地区已经是蒸汽涡轮机最大的市场,预计未来几年将创造对蒸汽涡轮机的巨大需求。亚太地区火力发电占其发电量的50%以上。

- 根据中国电力企业联合会(CEC)的数据,2021年火力发电厂发电量约为5646.3太瓦时,核电发电量约为407.5太瓦时,占2021年发电量的约72.2%。类似的趋势在2021年也出现过。过去几年,预计未来几年也将出现类似的成长趋势。

- 截至 2023 年 1 月,该国拥有全球营运中燃煤火力发电厂数量最多的国家。截至2023年1月,中国已营运燃煤火电厂约3,092座,兴建中燃煤电厂499座,已公布的燃煤电厂112座。因此,这种趋势将推动未来几年的汽轮机市场。

- 根据中央电力局 (CEA) 的数据,印度拥有 205.2 吉瓦的煤炭、6.62 吉瓦的褐煤、24.8 吉瓦的天然气和 0.58 吉瓦的柴油火力发电厂。截至 2023 年 4 月,印度将拥有 6.7 吉瓦的核电和 172.5 吉瓦的再生能源发电厂。

- 据电力部称,印度有近28460兆瓦在建火力发电厂,预计在未来五年内併网。在所有在建项目中,约12830兆瓦可能由中央部会运营,而15630兆瓦预计将由国务院运营。因此,此类即将建成的火力发电厂将增加未来几年对汽轮机市场的需求。

- 根据永续能源政策研究所(ISEP)的数据,2022年,化石燃料占日本总发电量的72.4%,比前一年的71.7%略有上升。液化天然气(LNG)发电比例从去年的31.7%下降至29.9%,部分原因是价格上涨。

- 然而,日本的煤炭发电量却增加,从上年的26.5%上升至27.8%。相反,核电占发电量的4.8%,较前一年的5.9%下降。

- 因此,随着上述发展和即将建成的火力发电厂,亚太地区预计将在预测期内主导市场。

发电业汽轮机概述

发电用汽轮机市场处于半整合状态。该市场的一些主要参与者(排名不分先后)包括西门子能源公司、通用电气公司、东方汽轮机有限公司、巴拉特重型电气有限公司和三菱重工有限公司。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究范围

- 市场定义

- 研究假设

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场概览

- 介绍

- 2028 年之前的市场规模与美元需求预测

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 司机

- 需 24/7 不间断供电

- 提高天然气发电的渗透率

- 克制

- 燃煤电厂碳排放

- 增加再生能源在能源结构中的份额

- 司机

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争激烈程度

第 5 章:市场细分

- 植物类型

- 气体

- 煤炭

- 其他电厂类型(核电厂、热电联产电厂等)

- 容量

- 小于20兆瓦

- 20 - 40 兆瓦

- 40兆瓦以上

- 地理(区域市场分析{2028年之前的市场规模与需求预测(仅限区域)})

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 亚太

- 中国

- 印度

- 日本

- 亚太其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 欧洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 卡达

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第 6 章:竞争格局

- 併购、合资、合作与协议

- 领先企业采取的策略

- 公司简介

- Siemens Energy AG

- Mitsubishi Heavy Industries Limited

- Bharat Heavy Electricals Limited

- General Electric Company

- Dongfang Turbine Company Limited

- Toshiba Corporation

- Doosan Enerbility Co., Ltd.

- Elliot Group

- WEG SA

- MAN Energy Solutions SE

第 7 章:市场机会与未来趋势

- 提高复合循环发电厂的效率

The Steam Turbine For Power Generation Market size is estimated at USD 15.45 billion in 2024, and is expected to reach USD 18.34 billion by 2029, growing at a CAGR of 3.49% during the forecast period (2024-2029).

The steam turbine for power generation market is estimated to be at USD 14.93 billion by the end of this year and is projected to reach USD 17.72 billion in the next five years, registering a CAGR of over 3.49% during the forecast period.

Key Highlights

- Over the medium term, factors such as upcoming natural gas combined cycle plants and thermal coal plants and growing emphasis on uninterrupted power supply are expected to drive the steam turbine for power generation market.

- On the other hand, the increasing adoption of renewable energy power generation and the demand for clean energy sources is expected to hinder the market growth during the forecast period.

- Nevertheless, increasing efficiency of combined cycle power plants with most of the demand coming from the North America and Asia Pacific region will likely create lucrative growth opportunities for the market during the forecast period.

- Asia-Pacific is the fastest-growing market during the forecast period due to the rising energy demand. This growth is attributed to increasing investments in the countries of this region, including India, China, and Australia.

Steam Turbine For Power Generation Market Trends

Natural Gas Plants to Witness Significant Growth

- A gas combined-cycle power plant (CCP) uses gas and a steam turbine together to produce up to 50% more electricity from the same fuel than a traditional simple-cycle plant. The waste heat from the gas turbine is routed to the nearby steam turbine, which generates extra power.

- Compared to coal-fired power plants, natural gas combined cycle plants produce significantly lower emissions of greenhouse gases, such as carbon dioxide (CO2), as well as other pollutants like sulfur dioxide (SO2) and nitrogen oxides (NOx). This makes them a cleaner option for electricity generation, contributing to improved air quality and reduced environmental impact.

- The rising global demand for renewable energy has increased the popularity of natural gas power plants. The demand for gas is increasing, especially in Asia-Pacific, due to the shift from coal to natural gas. For instance, according to the Energy Institute Statistical Review of World Energy statistics, in 2022, the total natural gas consumption recorded about 3941.3 billion cubic meters across the globe. This is expected to create significant demand for natural gas as a power generation source.

- Natural gas combined cycle plants offer operational flexibility, allowing them to respond quickly to changes in electricity demand. They can ramp up or down their power output relatively quickly, making them well-suited for balancing the intermittent nature of renewable energy sources like solar and wind.

- With growing urbanization, rising demand for energy, and government efforts to boost industrialization and infrastructure development activities, the need for a global gas-combined power cycle is increasing. Most countries invest in these generation facilities to meet the rising electricity demand.

- For instance, in the United States, as of 2021, approximately 32.3 GW of new natural gas-fired power plants are scheduled to begin operations in 2025 and are in advanced stages of development. 14.2 GW is currently under construction, 3.4 GW is in pre-construction, and 14.7 GW is in advanced permitting.

- Many natural gas combined cycle plants can be built or retrofitted at existing sites, leveraging the infrastructure for natural gas supply and electricity transmission. This can help to expedite the deployment of new power generation capacity.

- For instance, In March 2023, the Asian Development Bank announced that it would set up a 120 MW gas-fired combined cycle power plant in Tripura, India. Similarly, in the same month, the government of Montenegro signed an MoU with companies like Enerflex Energy Systems and Wethington Energy Innovation from the United States on the construction of a liquefied natural gas (LNG) terminal and a gas-fired power plant. The CCGP plant will likely have a capacity between 240 MW to 440 MW.

- Therefore, natural gas combined cycle power plants offer a balance between efficiency, lower emissions, flexibility, reliability, and cost-effectiveness, making them a popular choice for electricity generation and hence increasing the demand for steam turbines across the globe.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific is already the largest market for steam turbines and is expected to create significant demand for steam turbines over the coming years. Thermal power generation in the Asia-Pacific contributes to more than 50% of their electricity generation.

- As per the China Electricity Council (CEC), electricity generation from thermal power plants was around 5646.3 TWh, and nuclear was about 407.5 TWh in 2021, representing an electricity generation share of approximately 72.2% in 2021. Such a similar trend was witnessed during the past several years and is expected to have a similar growth trend during the upcoming years.

- As of January 2023, the country has the highest number of operating coal thermal power plants worldwide. Till January 2023, China has around 3092 units of operating coal thermal power plants, 499 under-construction coal power plants, and 112 announced coal power plants. Hence, such a trend would propel the steam turbine market in the upcoming years.

- As per the Central Electricity Authority (CEA), India has 205.2 GW of coal, 6.62 GW of lignite, 24.8 GW of natural gas, and 0.58 GW of diesel thermal power plants. Rest, 6.7 GW of nuclear and 172.5 GW of renewable power plants are present in India till April 2023.

- As per the Ministry of Power, there are nearly 28460 MW of under-construction thermal power plants in India, expected to come online during the next five years. Among all the under-construction, about 12830 MW is likely to be operated by the Central Ministry, while 15630 MW is expected to be operated by the State Ministry. Hence, such upcoming thermal power plants would increase demand for the steam turbine market in the forthcoming years.

- According to the Institute for Sustainable Energy Policies (ISEP), in 2022, fossil fuels constituted 72.4% of the overall electricity generation in Japan, marking a slight increase from the previous year's figure of 71.7%. The proportion of electricity generated from liquefied natural gas (LNG) decreased to 29.9%, down from 31.7% recorded in the previous year, partly influenced by price escalations.

- However, Japan's coal-based electricity generation saw an increase, rising to 27.8% compared to the previous year's 26.5%. Conversely, nuclear power contributed 4.8% to electricity generation, declining from the previous year's 5.9%.

- Thus, with the above developments and upcoming thermal power plants, the Asia-Pacific region is expected to dominate the market during the forecast period.

Steam Turbine For Power Generation Industry Overview

The steam turbine for power generation market is semi consolidated. Some of the major players in the market (in no particular order) include Siemens Energy AG, General Electric Company, Dongfang Turbine Company Limited, Bharat Heavy Electricals Limited, and Mitsubishi Heavy Industries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Need for Continuous 24/7 Supply of Electricity

- 4.5.1.2 Increasing Penetration of Natural Gas for Power Generation

- 4.5.2 Restraint

- 4.5.2.1 Coal Fired Power Plants Carbon Emissions

- 4.5.2.2 Increasing Share of Renewables in Energy Mix

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Plant Type

- 5.1.1 Gas

- 5.1.2 Coal

- 5.1.3 Other Plant Types (Nuclear, CHP, etc.)

- 5.2 Capacity

- 5.2.1 Less than 20 MW

- 5.2.2 20 - 40 MW

- 5.2.3 Above 40 MW

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Asia-Pacific

- 5.3.2.1 China

- 5.3.2.2 India

- 5.3.2.3 Japan

- 5.3.2.4 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 Middle-East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 South Africa

- 5.3.4.4 Qatar

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens Energy AG

- 6.3.2 Mitsubishi Heavy Industries Limited

- 6.3.3 Bharat Heavy Electricals Limited

- 6.3.4 General Electric Company

- 6.3.5 Dongfang Turbine Company Limited

- 6.3.6 Toshiba Corporation

- 6.3.7 Doosan Enerbility Co., Ltd.

- 6.3.8 Elliot Group

- 6.3.9 WEG S.A.

- 6.3.10 MAN Energy Solutions SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Efficiency of Combined Cycle Power Plants